Yogi Berra was not only a great baseball player, but a good humorist to boot. One of his most popular “Yogiisms” was, “When you come to a fork in the road, take it.”

We’ve spent the last few months building positions in Banks, Defense Stocks and Energy. If you’ve listened to or watched any of the podcasts/VideoCasts since this summer, it’s been a broken record (and an unpopular one at that). Until now… (Opinion Follows Trend)

I was extremely confident about the fundamental set-up and outcome, but could not have predicted this additional development (blue wave) as a secondary catalyst to the (election and vaccine) which we anticipated as the first catalysts in past notes/podcasts.

In last week’s note I said, “So with everyone looking for a knee-capping after the New Year, I think it’s more likely that the market pushes higher and forces a bunch of reluctant money (that sold the March lows and have been waiting for their “big correction” that never came) to get in.

The more likely scenario is a crisis “fake-out” (or delayed result) from the Jan 5-6 “downside catalysts” – in which the put buyers think they have scored – only to find a final push higher forcing the final reluctant longs in before the trap door is finally opened (best guess February time-frame, but who knows).”

The Kenny Chesney “Happy Does” Stock Market (and Sentiment Results)…

This proved to be accurate, however, I did not anticipate a Senate flip as the catalyst. I only looked at the fundamental setup/valuations/sentiment and positioning to make a probabilistic bet on a significant change. You can never truly know the catalyst.

On Monday, we got the “fake out” I was looking for where the “tail risk” buyers I explained in last week’s section “SKEW” would feel like they won – only to have Lucy pull the football away from Charlie Brown – yet again. Remember, insurers will never sell that much premium at the tails (even at high prices) if they expect to have to pay you. Everyone bought the same policy, the sellers made bank…

On Monday, I was on with Liz Claman on Fox Business (The Claman Countdown) with the Dow at its lows (down ~500pts) and stated, “Is it a Shake Out or a Fake Out? I think it’s a Fake Out and here’s why…”

Thanks to Liz and Jacqueline D’Ambrosi Scales for having me on. I also re-emphasized our continued focus on banks, energy and defense stocks as well as put out our “top 4 stock picks for 2021.” You can watch it here:

What’s interesting about this segment is the set-up and outcome was perfect, but the catalyst was unexpected. This ties in with Yogi’s maxim, “when you come to the fork in the road, take it!”

You can never really know what the catalyst will be, but understanding the set-up, fundamental backdrop, positioning and sentiment goes a long way to being positioned to win regardless of which “fork” catalyzes the move.

“The Last Shall Be First”

In the segment with Liz Claman above I mentioned this will be a year of “The Last Shall Be First.” The implication being those stocks and sectors that were left behind in the first half of 2020 (re-opening trade/cyclicals/value) would continue the post-election/vaccine trend of relative outperformance to those groups that led the first half of 2020 (stay at home trade/tech/growth).

The quote from the book of Matthew reads as follows, “So the last shall be first, and the first last: for many be called, but few chosen.” Even Jesus understood the importance of Sector Rotation!

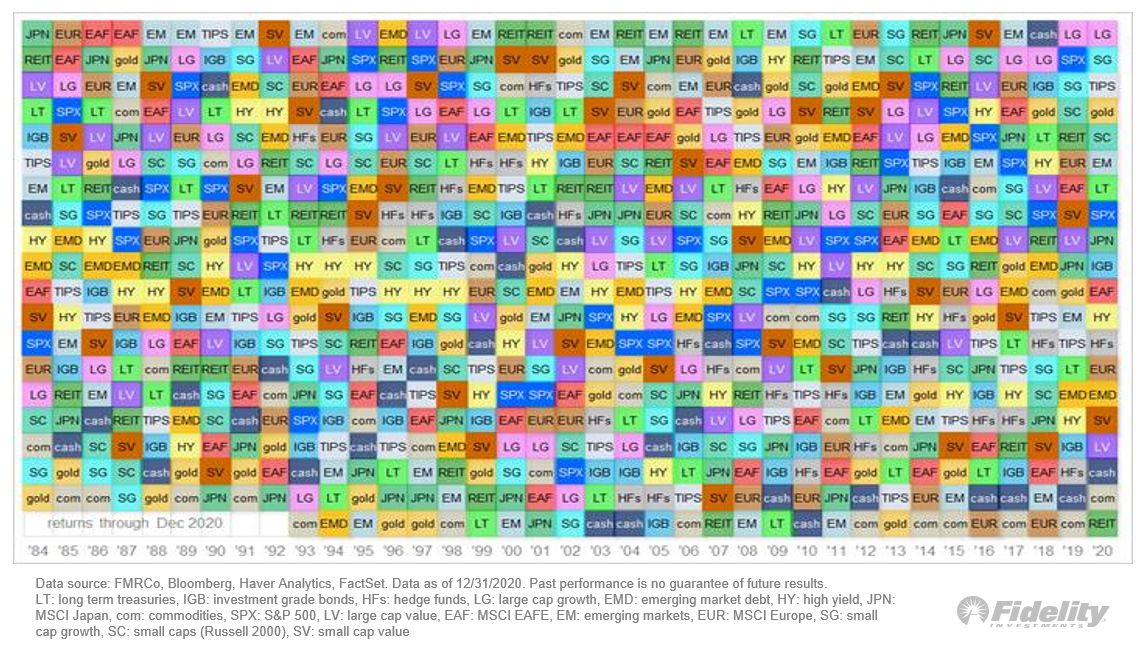

I’ve always been a fan of these instrument performance tables – as they show patterns over time. Jurrien Timmer of Fidelity Investments posted this data recently:

As a mean-reversion player I like to look and see how asset classes move from “out of favor” back to “in favor” over time. Rarely can one class hold the top seat for more than a couple of years.

In the late 80’s to early 90’s EM (Emerging Markets) held the top (performance) spot for a number of years only to drop to the bottom over the next couple of years.

The REITS had their run in the early 2000’s only to plummet to the bottom spot in 2007.

And lately (the last 4 years) Large Cap Growth (i.e. FAANGM) has held the number 1 or 2 spots. I would not be surprised to see LG (Large Cap Growth) hit the bottom spot(s) in one of the next 3 years. Time will tell…

On the flip side, Japanese Equities were second to last in performance in ’96 and ’97 only to hit the #2 performance spot the very next year.

REITS were near the bottom in ’97 and ’98 only to take the top spot in ’99 and ’00.

Cash was the second worst performer in 2016 and 2017 only to be the “best performing asset class” in 2018!

And now we see Large Cap Value and Small Cap Value near the bottom (along with REITS). Value is picking up steam already, and we may see REITS rise from the dead in coming quarters as well.

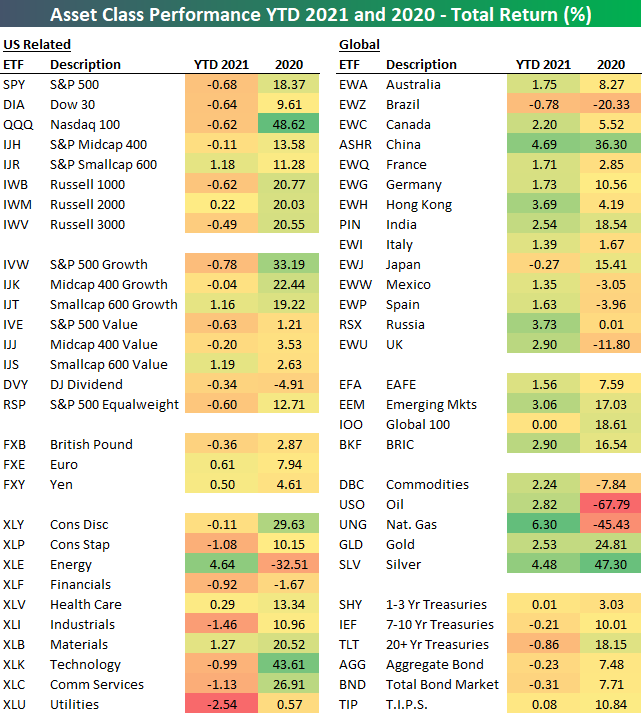

Bespoke group (@BespokeInvest) put out the total returns for global asset classes recently. Keep your eye on the underperformers in 2020 becoming the outperformers in 2021 and 2022:

Natural Gas, Oil, Energy (Sector), UK and Brazil stand out as the “Last” or worst performers. They are already starting to turn hard. Can they move to the top of the list in coming years? I wouldn’t count them out…

Santa Came to Town

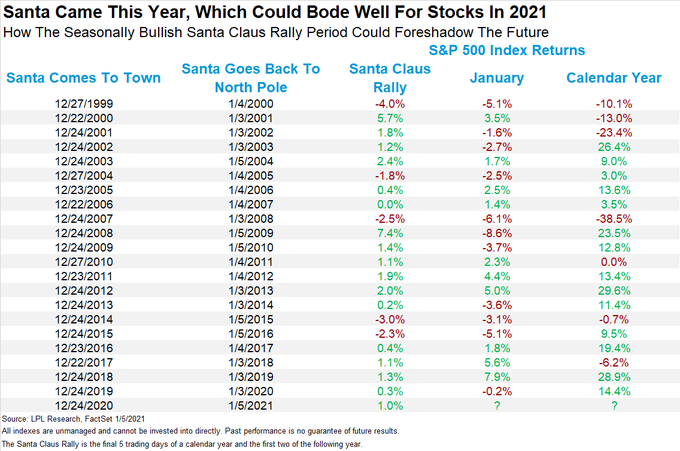

As anticipated, Santa pulled through after the Monday “scare” and delivered a seasonal return (from Christmas Eve thru the 2nd trading day of the New Year) of ~1%.

Ryan Detrick at LPL Financial crunched the numbers, and here’s what that has presaged in recent history:

Riding the “Blue” Wave

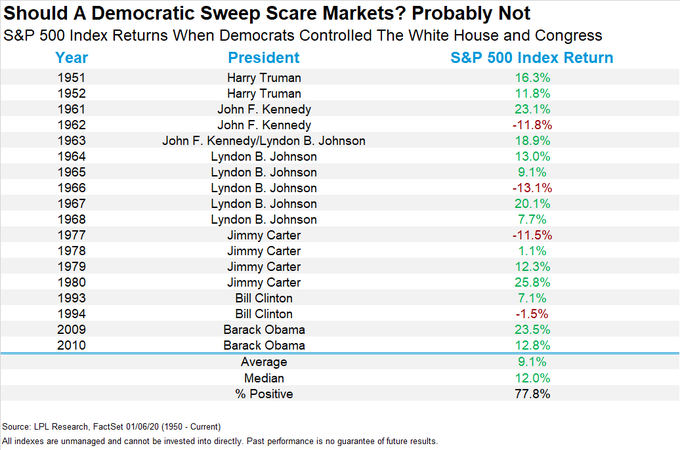

LPL Financial (Detrick) also crunched the numbers on a Full Blue Sweep (President, Senate, House), and while not as positive as a mixed Congress/Gridlock, nothing to fear (but fear itself) – said a Famous Democrat many years ago…

We’re long overdue for some roads, bridges, airports and long-term investment that will keep America competitive for generations to come…

It’s FINALLY coming.

Cobra Kai Returns

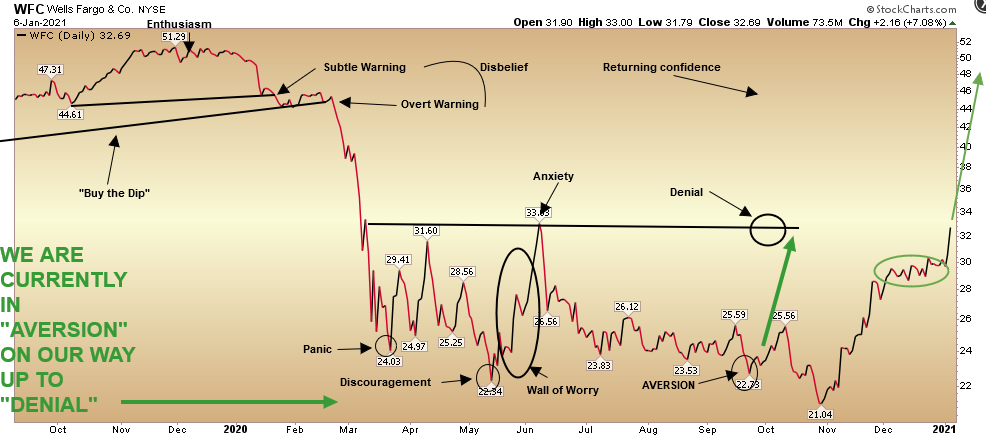

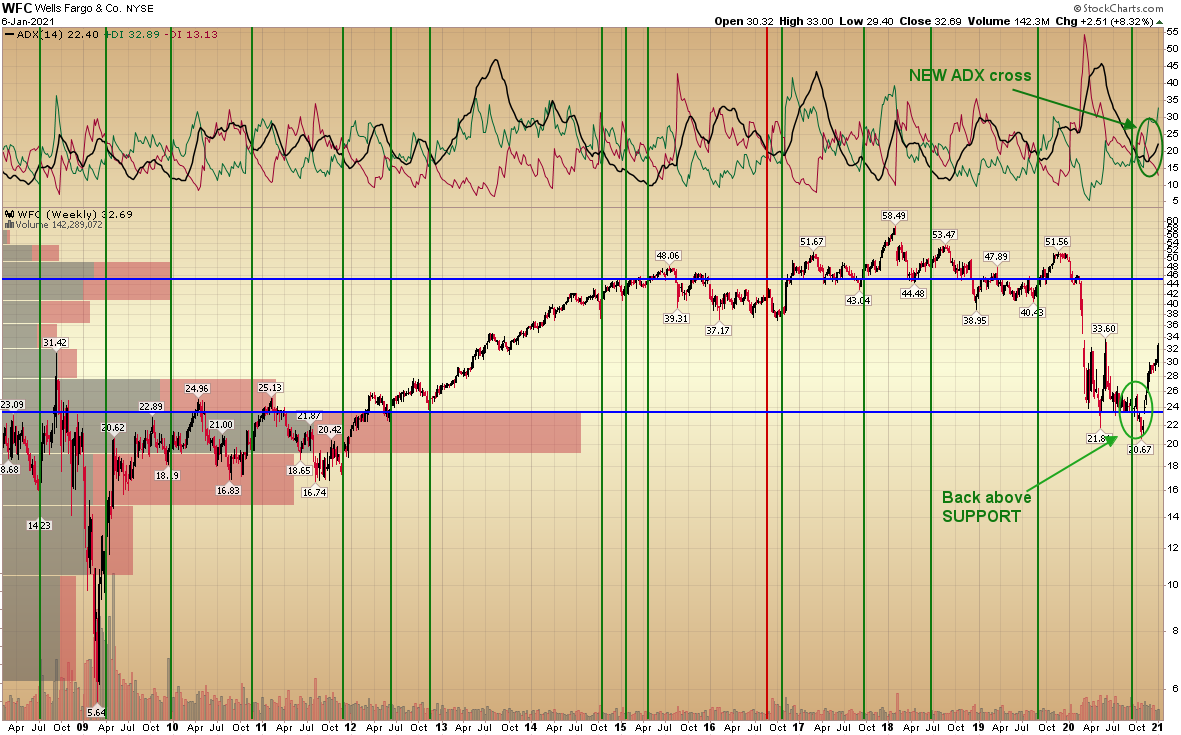

With the premiere of “Cobra Kai” (Season 3) on Netflix, it is only fitting we update the progress of Wells Fargo since our article on September 24:

The Cobra Kai “Sweep The Leg” Stock Market (and Sentiment Results)…

At the time, Wells Fargo was trading at $22.83 per share. Here’s what has happened since:

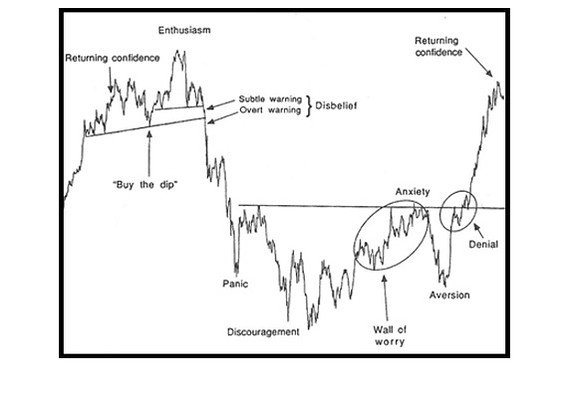

We have finally broken through “Denial” and are on our way to “Returning Confidence”:

Now onto the shorter term view for the General Market:

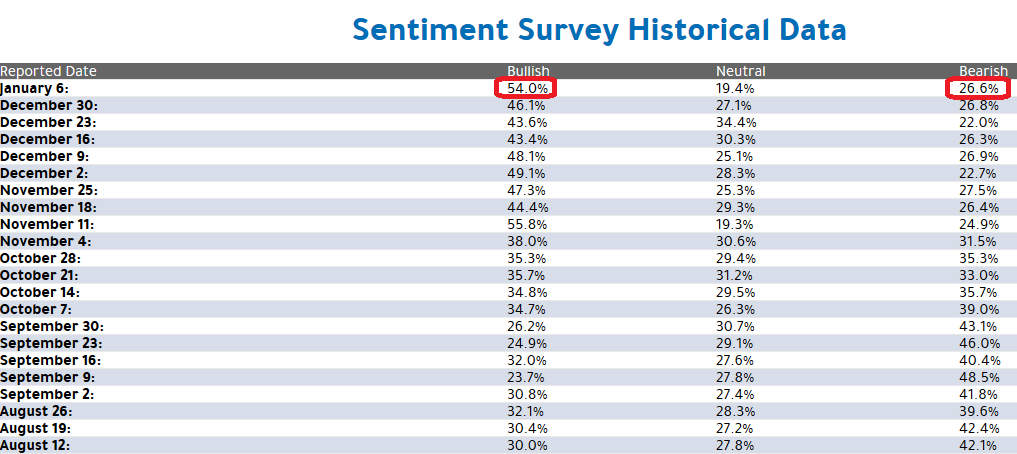

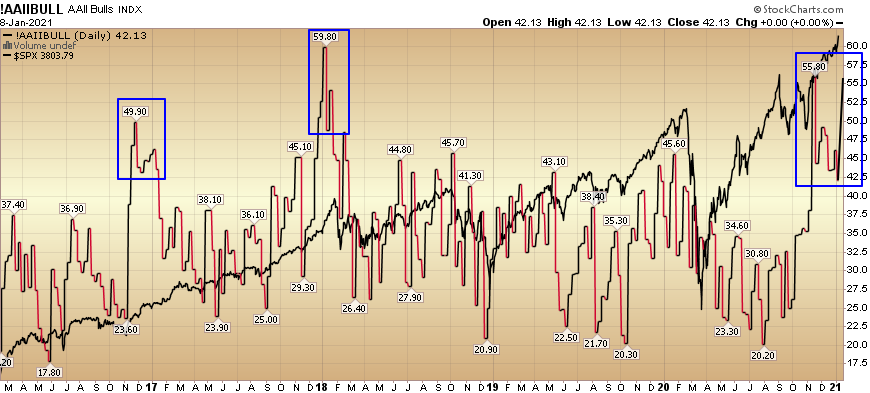

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 54% from 46.08% last week. Bearish Percent flat-lined at 326.6% from 26.80% last week. We are still at an extreme in sentiment for retail investors.

Just like the last few weeks – while this is still an extreme in short-term sentiment and should be heeded in the short-term – it is important to note in the chart below, that while similar levels presaged a short term top in early 2018, they occurred near the beginning of a longer term uptrend at the end of 2016-2017 (right after the last Presidential election).

We noted the similarities between the pre-election stock-market in 2016 versus 2020 in our October 29, 2020 note. It has played out exactly according to script ever since, which is why I am inclined to give this extreme level in sentiment the same “benefit of the doubt” as late 2016.

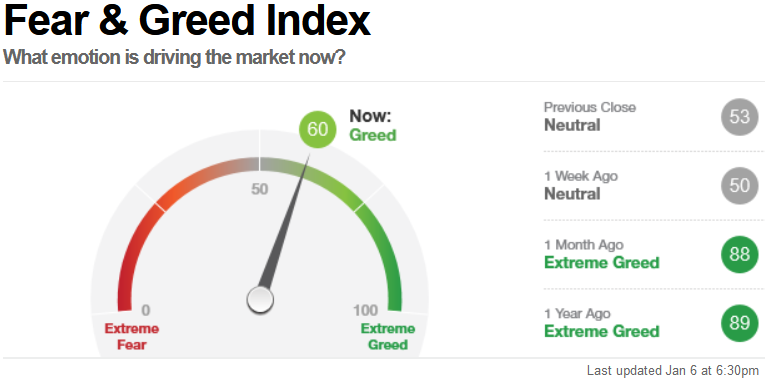

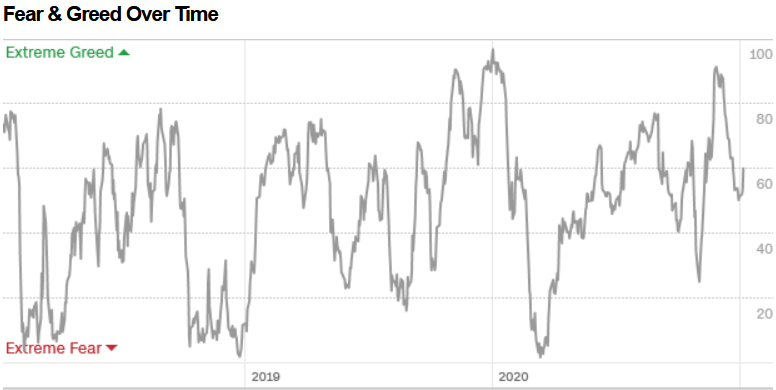

The CNN “Fear and Greed” Index rose from 50 last week to 60 this week. This is still a relatively neutral read. You can learn how this indicator is calculated and how it works here: (Video Explanation)

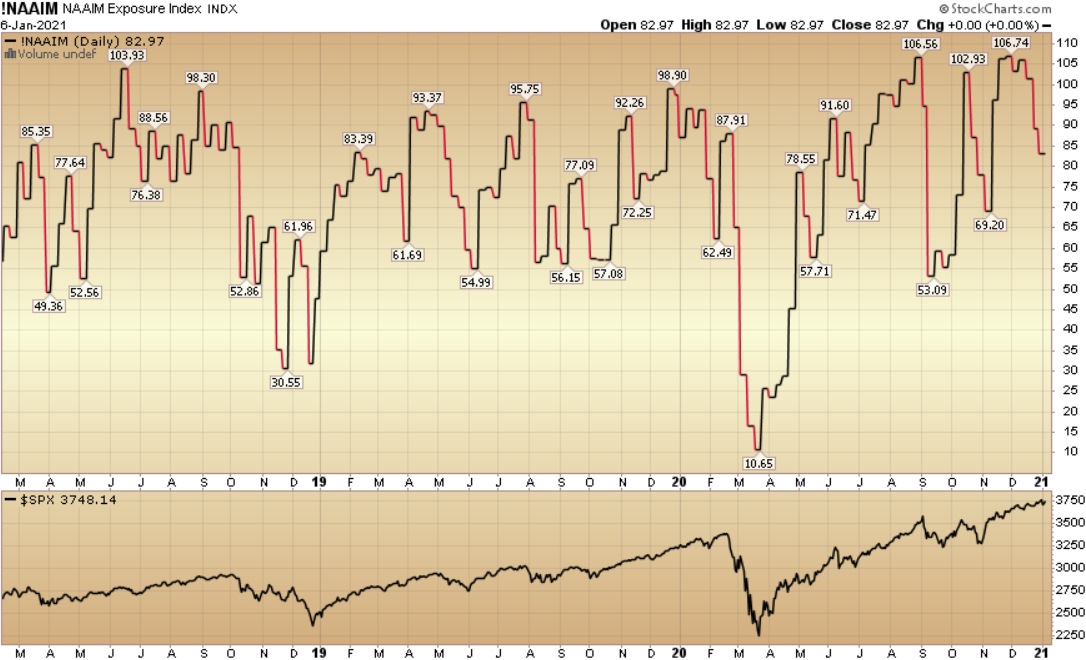

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) came down to 82.97% this week from 89.11% equity exposure last week.

Our message for this week:

Last week I said:

“While many worry that institutional managers – and retail investors alike – are overly confident, it just may be the case that we’ll get the anticipated correction when everyone has forgotten about the “euphoria” narrative.

While everyone’s looking for NOW, I think the odds favor a mid Q1 pullback – after most managers have given up on a correction and followed the chase. Only when everyone’s IN can they open the trap door…”

So far it is playing according to script. Yesterday forced new money into the market. This should have some more gas in the tank before stalling out and Wile E Coyote realizing (too late) that he has run too far. At that point we’ll get the healthy correction that many have been calling for since early December.

It did not pay to play the short term moves in 2010 and 2011 – as you may very well have missed out on a decade long run. That long cycle ended with the 2019 yield curve inversion, and the 2020 ~35% correction plus 1H 2020 recession (2 quarters of negative GDP growth). The recession ended with positive GDP growth in Q3 2020 (33.4% annualized) and began the new business cycle we are experiencing today.

We’ll be using any weakness that potentially comes our way in Q1 to add more value/cyclical names to hold for the next 3-5 years…