Data Source: Factset

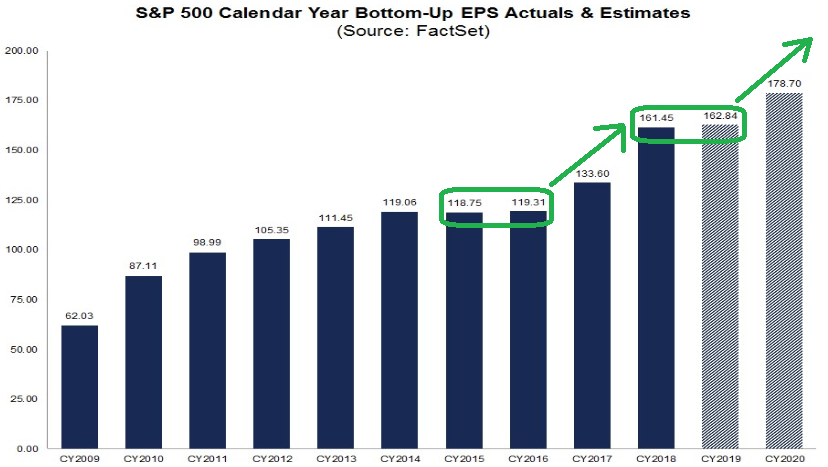

While 2020 Earnings estimates for the S&P 500 held steady at $178.70 this week, the growth rate actually improved to 9.9% from 9.7% – due to a modest take down in 2019 results.

As we have previously covered, this will be the first time we experience earnings growth since 2016-2017. In anticipation of the 2017 11% earnings jump (which was also preceded by 2 years of flat earnings and stock prices), the market started to rise in Q4 2016 and didn’t stop for 15 months – booking a 37.8% gain.

As we pointed out in our article over the weekend, the 3 worst performing sectors of 2019 are expected to have the highest earnings growth in 2020 (Energy, Industrials, and Materials):

For Q3 2019, we picked up another 10bps of improvement, coming in at -2.2% (versus -4.8% expectations a couple weeks into the reporting period). 20 companies are still left to report for Q3.