Data Source: Factset

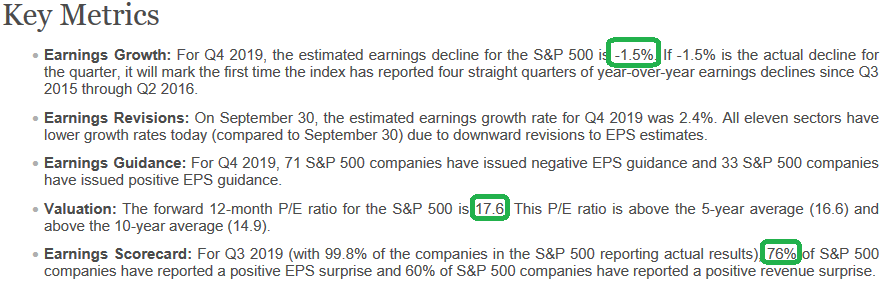

Q4 2019 earnings estimates are currently at -1.5%. Given the average improvement over a quarter at 3.7% – it is likely that the streak of negative year on year earnings growth of the last three quarters will be put to bed. As we have laid out repeatedly over the last few months, that’s a good thing:

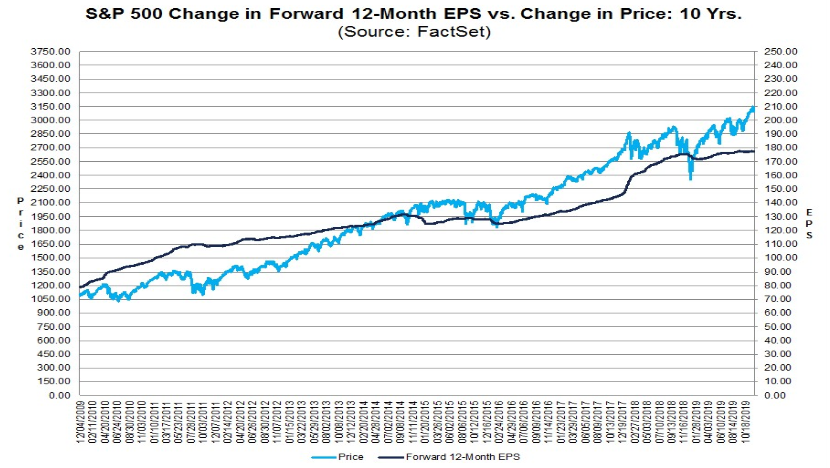

Looking ahead to 2020, earnings estimates are holding in strong at just shy of double digit earnings growth (9.8%/$178.57). This will be the first time we have a material jump in growth since 2016-2017 when the market rallied mid-30’s% over 15 months (Q4 2016-Q1 2018).

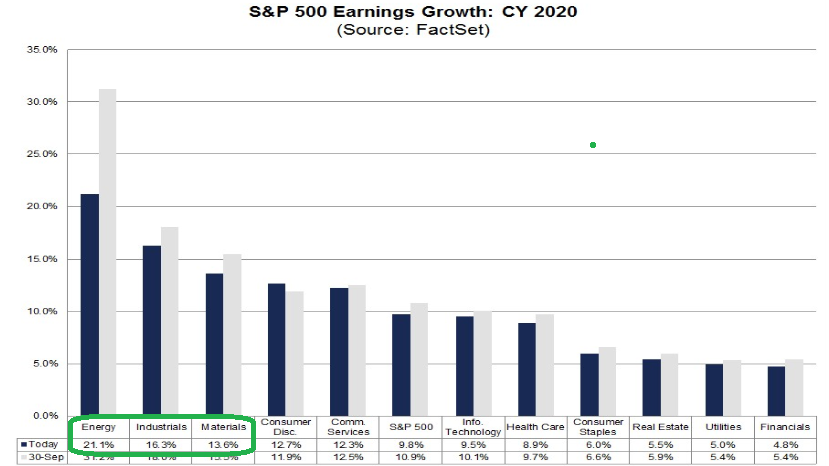

In our recent article, “The Last Shall Be First” we pointed out that the worst performing sectors of 2019 (Energy, Industrials, Materials) are expected to have the highest earnings growth in 2020. This growth will be led by energy at 21.1% growth in 2020.

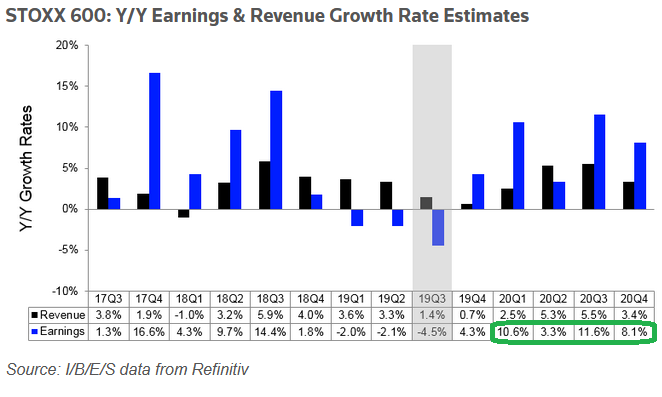

Euro STOXX 600 Earnings Estimates for 2020 also held in strong this week with 3 of 4 quarters hovering around double-digit earnings growth: