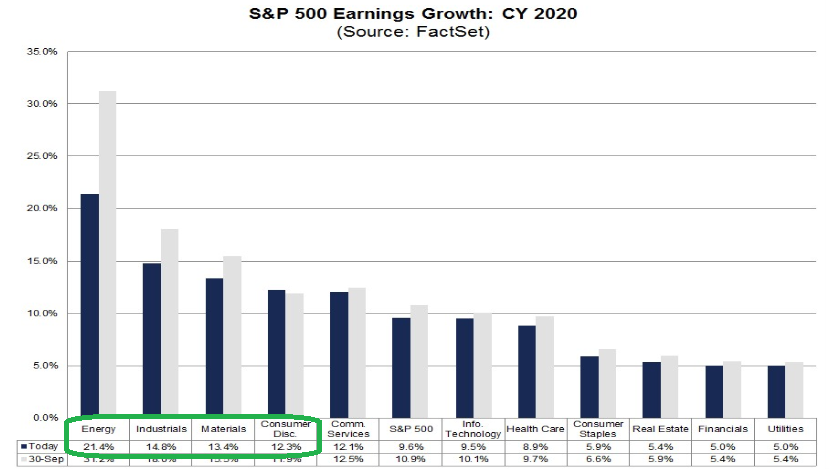

Data Source: FactSet

This week 2020 Earnings Estimates for the S&P 500 ticked down modestly from $178.47 to $178.24. This puts the 2020 EPS growth rate at 9.6% for 2020.

The worst three sectors of 2019 are projected to have the highest earnings growth in 2020. Energy is expected to grow 21.4% followed by Industrials at 14.8% and Materials at 13.4%.

Q4 2019 earnings dropped 10bps (from -1.3% last week to -1.4% this week). Given the average quarterly improvement rate of 3.7% it is probable that Q4 2019 earnings will be the first quarter of positive earnings growth following 3 consecutive quarters of negative growth.

With the Fed reversing course (from tightening to loosening) just 4 months ago, we are in the “lull” period until that enhanced liquidity starts to impact the underlying economy.

Just as it took two consecutive years of tightening to cause negative earnings growth this year, it will take a few months for the economy to feel the effect of the medicine and start to hum (as reflected in what could become UPWARD revisions moving forward). This is outside the realm of consensus.

While increased liquidity and the completion of “phase one” with China were expected to stabilize growth/estimates, no one is looking for or calling for upward revisions moving forward. I think it is a distinct possibility – as we get a few more weeks/months down the road – that companies start to issue more constructive guidance. This comes in the form of further visibility/stability from “Phase One” and the lagged effect of an accommodative fed. It also does not consider the possibility of a weakening dollar – which if persistent – would be a bonus tailwind.

S&P Target Price:

The bottom-up consensus target price for the S&P 500 is 3430.28.

This is 7.0% above the closing price of 3205.37.

Highest and Lowest Sector Price Targets:

The Energy sector is expected to see the largest price increase at +14.2%.

Energy has the largest upside difference between the bottom-up consensus target price and the closing price.

The Financials sector is expected to see the smallest price increase at +3.2%.

Financials have the smallest upside difference between the bottom-up consensus target price and the closing price for this sector.

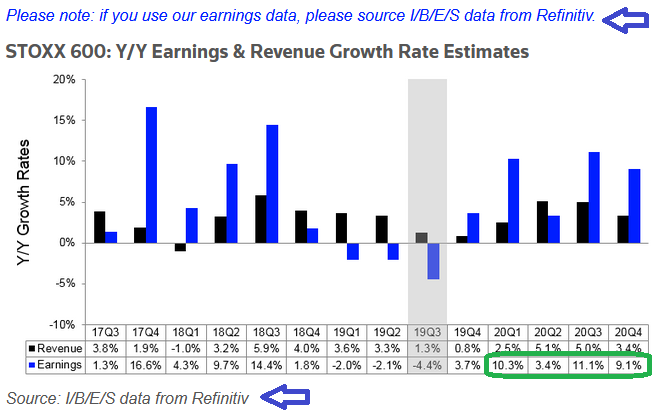

Euro STOXX 600:

European estimates confirmed the strength in the U.S. this week:

While Q3 2020 was revised down by 70bps, Q4 2020 was revised up by 70bps in the last week (for a net no-change).