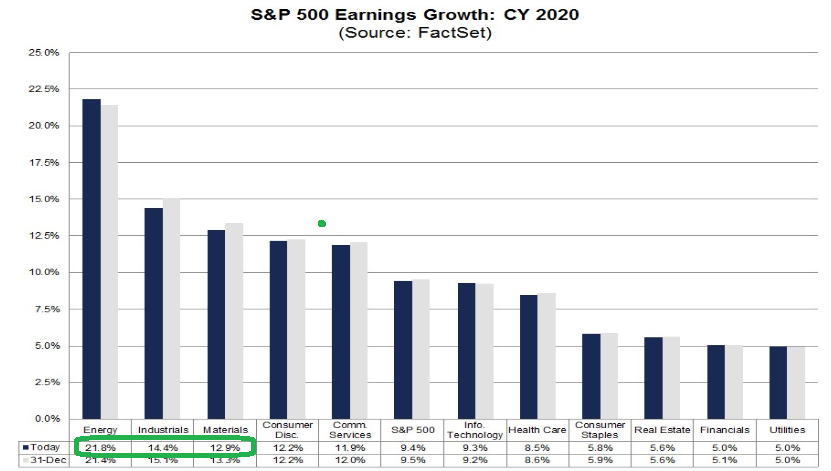

Data Source: Factset

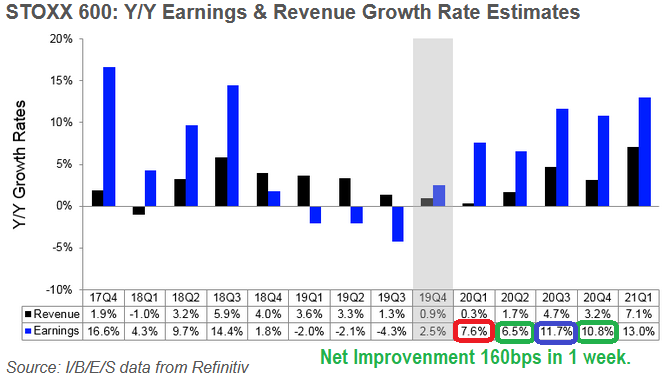

2020 Earnings Estimates for the S&P 500 trimmed from 177.77 to 177.64 in the past week. Conversely, the Earnings Estimates for the Euro Stoxx 600 increased by 160bps for 2020 in the past week.

So far for Q4 2019 Earnings reports, of the 20 S&P companies that have already reported, 84% have beat on earnings and 74% have beat on revenues. This is above the 5 year average.

S&P 500 Target Price

The bottom-up consensus 12-month target price for the S&P 500 is 3474.50. This is 6.1% above yesterday’s closing price of 3274.70.

The implication of having earnings growth of 9.4% and price appreciation of 6.1% is that either: 1) Earnings will be less than expected, or 2) there will be multiple contraction.

While the former is possible, the latter is unlikely – with the discount rate having come down by 75bps in the last few months. I think it is more likely that this target price is conservative and likely to be topped at some point before the end of the year.

Of note is the fact that the worst three sectors (Energy, Industrials, Materials) of 2019 are projected to have the highest earnings growth rates in 2020 – led by Energy.

Not only is Energy 2020’s earnings growth leader, but in the last 10 days the growth rate has increased 40bps (from 21.40% to 21.80%).

Next week, 24 S&P 500 components will report Earnings for Q4 2019 (including 3 DOW components).