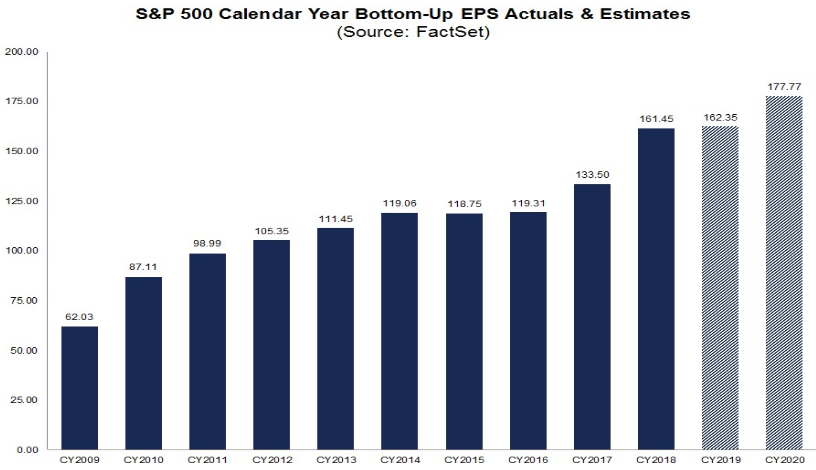

Data Source: Factset

S&P 500 Earnings:

This week, 2020 EPS estimates came down from 178.24 to 177.77. While this is a drop of 26bps, the 2020 Earnings Growth rate stayed up at 9.6% due to a slight down-tick in 2019 estimated results. Q4 2019 Estimates have dropped 10bps (from -1.4% to -1.5% since 12/20).

Of the 15 companies in the S&P 500 that have already reported Q4 results, 88% have beat on earnings and 75% have beat on revenue. The average earnings recovery rate during a quarter is 3.6% – which implies +2.1% EPS growth for Q4 2019 over Q4 2018. This would break us out of a 3 quarter earnings recession (negative earnings growth), which has not be seen since 2016.

The last “earnings recession” (3 quarters of negative yoy earnings growth) in 2016 was followed by a 37.8% rally in the S&P 500. We have already rallied 14% off the October lows in the S&P 500, but provided we get reasonable guidance in the coming weeks and months of earnings season, we could have further room to run in 2020. We discussed CEO/CFO guidance/sentiment in our note yesterday – which can be found here:

The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)

Guidance:

So far, a smaller number of companies have lowered guidance for Q4 2019 than normal. 67% took guidance down (72 of 107) which is less than the five year average of 70% at this time in the season.

S&P Consensus Target Price:

The consensus 12-month target price for the S&P 500 is 3441.44. This is just 5.6% above the closing price of 3257.85. This implies a multiple contraction – as estimated earnings growth is 9.6%. If guidance comes in at a reasonable level in coming weeks, this consensus price target may be too conservative (especially considering the discount rate has come down 75bps in recent months).

Worst to First?

The worst 3 sectors of 2019 are still expected to have the highest three earnings growth rates of 2020. This is led by Energy at 21.5%, Industrials at 14.7% and Materials at 13.3%.

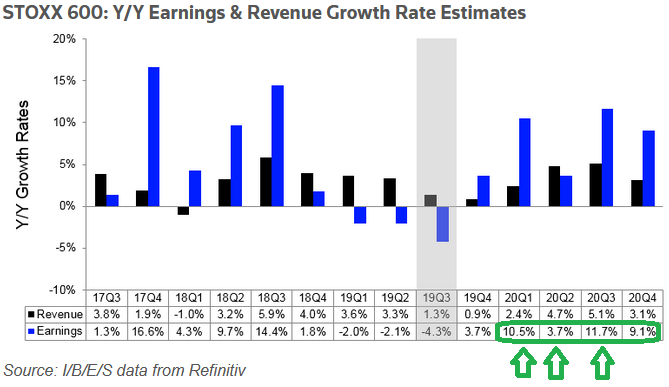

Euro STOXX 600 Earnings:

While the U.S. retained its 9.6% EPS growth rate for 2020, Europe’s STOXX 600 actually went UP. Q1, Q2, and Q3 2020 estimates ROSE by 110bps cumulatively (since 12/20) and Q4 remained the same. Data Source: Refinitiv