Data Source: FactSet

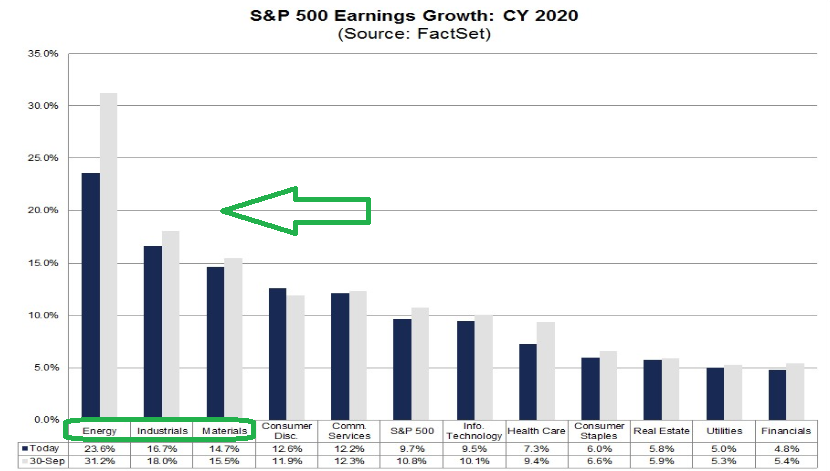

This week, 2020 earnings estimates (for the S&P 500) held pretty steady at $178.87, or 9.7% EPS growth for 2020.

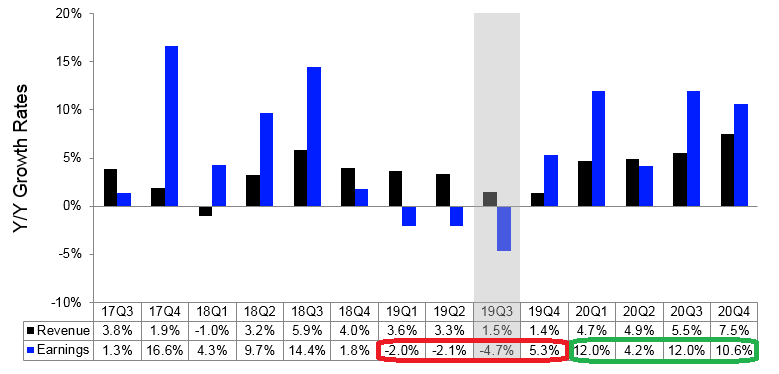

As for Q3 readings we have had 250bps of improvement since the trough – when EPS was estimated to come in at -4.8% for the quarter. We are now are at -2.3% with 8% left of the S&P 500 companies left to report for Q3.

So now that we have yesterday’s news out of the way, let’s be like Gretzky and focus on where the puck is going. If we look at forward estimates by sector, we come away with the feeling, “the last shall be first.”

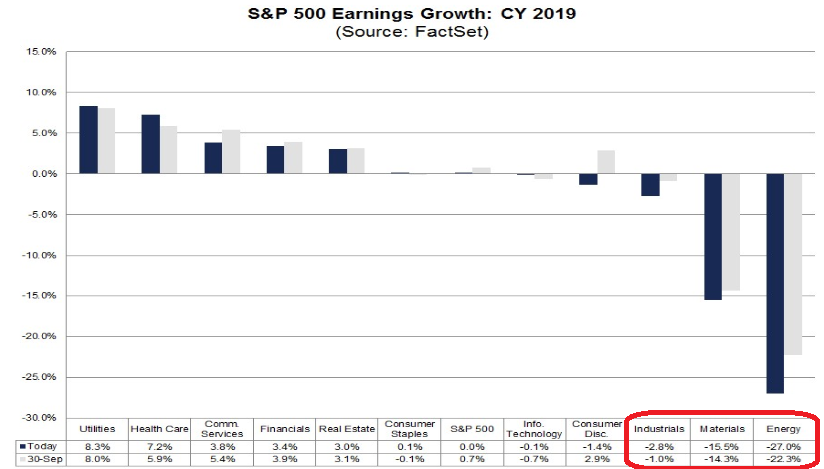

The top three sectors for anticipated earnings growth in 2020 are 1) Energy 2) Industrials and 3) Materials – with growth of 23.6%, 16,7% and 14.7% respectively (see featured table above). This is a stark difference from their performance in 2019:

Additionally, Energy has the largest price gap between Friday’s closing prices and the consensus 12 month target prices for the components of the sector – trading at a 17.1% discount.

European Stoxx 600 Earnings Estimates for 2020 are also holding up this week ~9.7% estimated growth (coming off 3 consecutive quarters of negative earnings growth):

So both the US (S&P 500) and the EU (Stoxx 600) are finishing up 3 consecutive quarters of negative earnings growth. Is that good news or bad news? Review our note from September 20 to find out: