Per Factset:

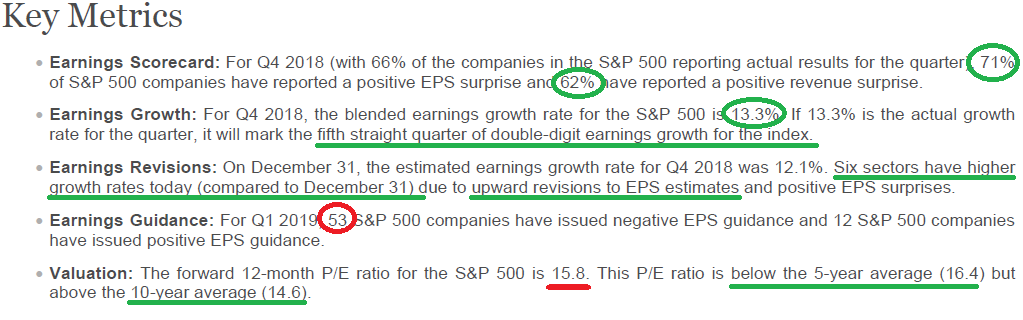

EPS and revenues continue to beat by 71% and 62% respectively (after 66% of S&P 500 companies have reported). The earnings growth rate has increased to 13.3% for Q4 2018 from 12.4% last week (and 12.1% on 12/31). Guidance is a bit light with negative guidance at a 53:12 ratio neg:pos revisions. With the forward P/E at 15.8x this morning we are ABOVE the 10 yr. avg. of 14.6x and below the 5yr. avg. of 16.4 (keep in mind the discount rate has gone UP in the last 12 months so multiple should naturally be coming in). 2019 earnings estimates remain ~$170 per share (5% eps growth yoy and 5.1% revenue growth yoy).

So for the S&P 500 to go UP in price, we need either:

1) Multiple Expansion, or 2) Earnings Revised UP from here.

Catalysts for Earnings/Multiple growth:

- Real China Deal (earliest end of February).

- New Brexit Referendum (Brits vote to stay in EU) – month(s) off (lower probability).

- US Dollar weakens: ($USD was ~5% stronger against the Euro yoy Q4. This hurt US earnings and helped EU earnings)

- Post-Earnings buybacks will help some, but earnings catalysts now largely in the rear view mirror.

As we have stated in multiple recent posts, we continue to believe the market will consolidate/digest (partially pullback) January’s gains in the coming weeks. If estimates can remain strong through this period, there may be some light at the end of the tunnel (the data is still solid). We will continue to watch earnings/revisions/guidance on a daily basis and make adjustments as the data comes in.

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.