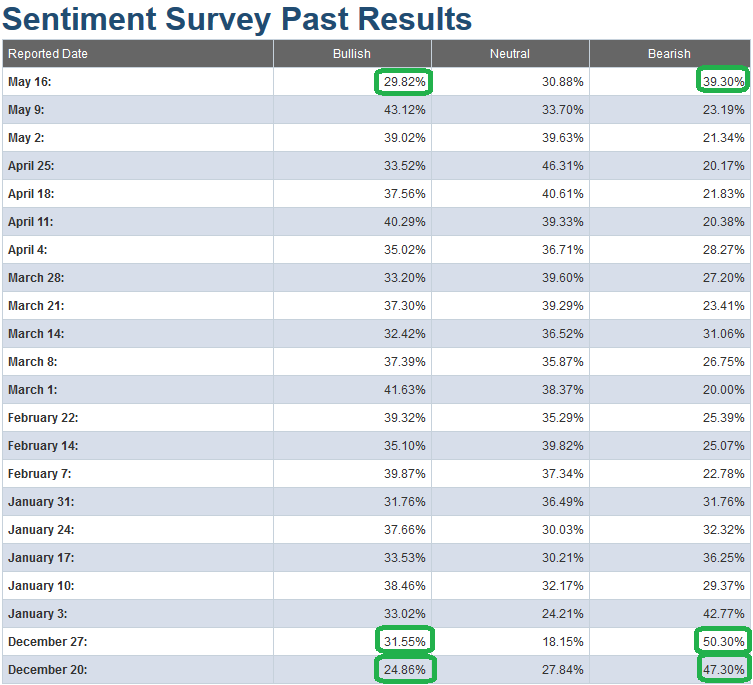

Waking up today I had fully expected the “bullish percent” to move well above 30 and the “bearish percent” to drop since last week. This would have caused us to look for places to lighten up, and if there was a euphoric read, start to look for a few shorts… Continue reading “AAII: As Pessimism Persists, The Wall of Worry (to climb) Remains Intact.”

Category: Sentiment

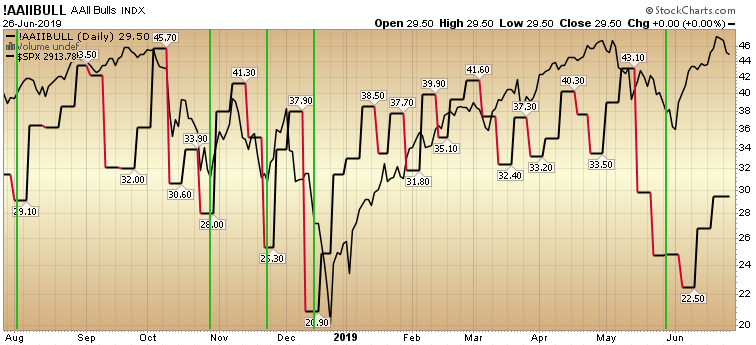

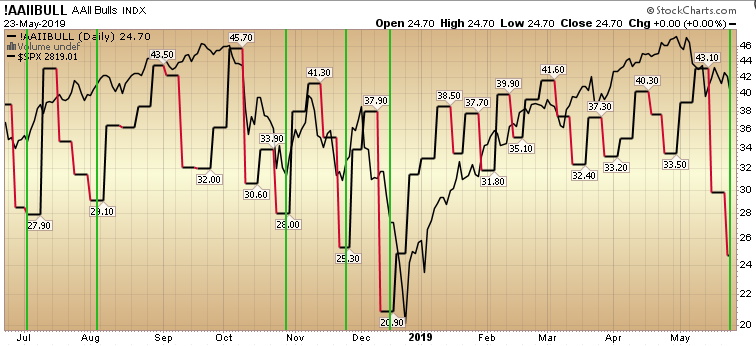

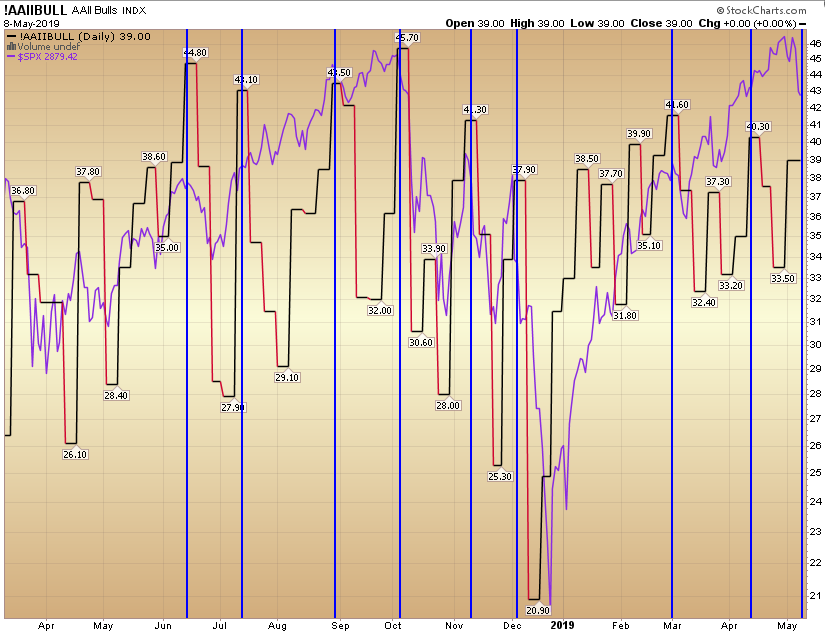

Updated Sentiment Chart

Data Source: AAII

This updated chart gives a nice visual of the data we presented yesterday. As you can see above, it has not paid to get short below the high 30’s (bullish percent), but it has paid to get long below 30 (when pessimism was still high). The print from yesterday was 29.51%. There is still a wall of worry to climb. Continue reading “Updated Sentiment Chart”

AAII Sentiment: Pessimism Thawing, but Skeptics Still Abound

In the last few weeks – as pessimism prevailed in the AAII Sentiment Survey Results – we made the case to get long: Continue reading “AAII Sentiment: Pessimism Thawing, but Skeptics Still Abound”

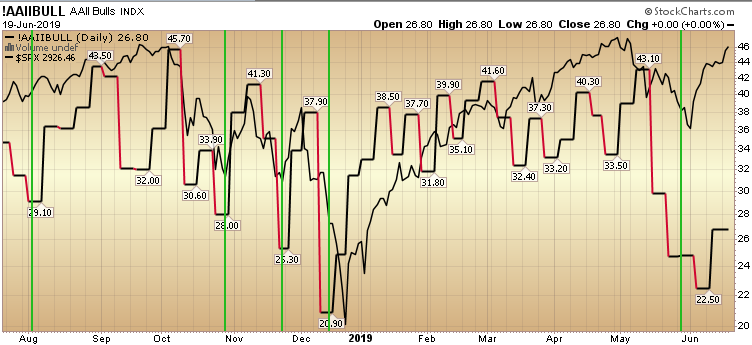

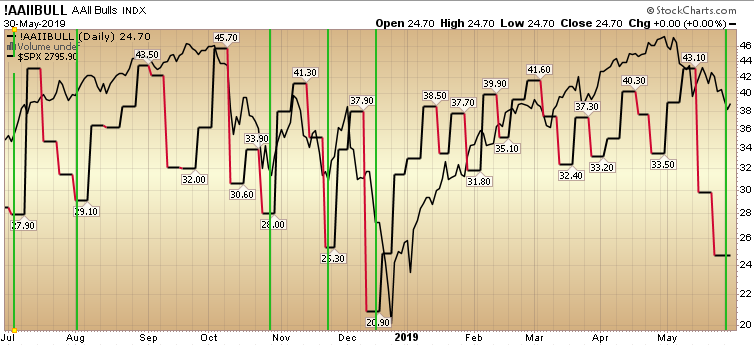

Updated Sentiment Chart

Data Source: AAII

This updated chart gives a nice visual of the data we presented yesterday. As you can see above, it has not paid to get short below the high 30’s (bullish percent), but it has paid to get long below 30 (when pessimism was still high). The print from yesterday was 26.84%. There is still a wall of worry to climb. Continue reading “Updated Sentiment Chart”

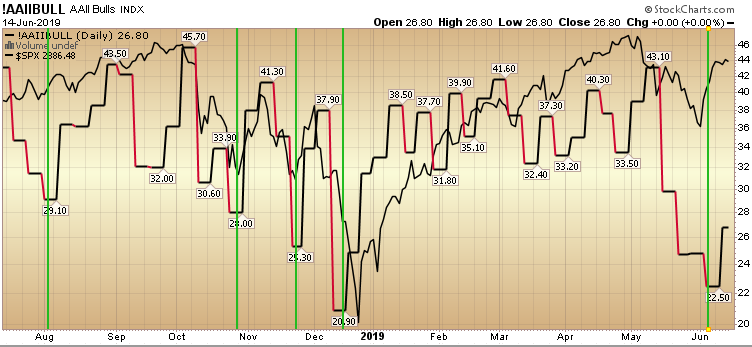

AAII Sentiment Survey Results Still Favor Bulls (Even After Bounce)

In the last 2 weeks we talked about fading pessimism and buying stocks. Even after the big bounce we got in the market following the extreme pessimism, there is still skepticism in the market. This bodes well for continued gains in coming weeks as the market can climb the wall of worry. Continue reading “AAII Sentiment Survey Results Still Favor Bulls (Even After Bounce)”

AAII Sentiment Survey Results. Even Better Than Last Week…

Last week we said, “the probabilities favor “fading pessimism” and getting selectively long”: Continue reading “AAII Sentiment Survey Results. Even Better Than Last Week…”

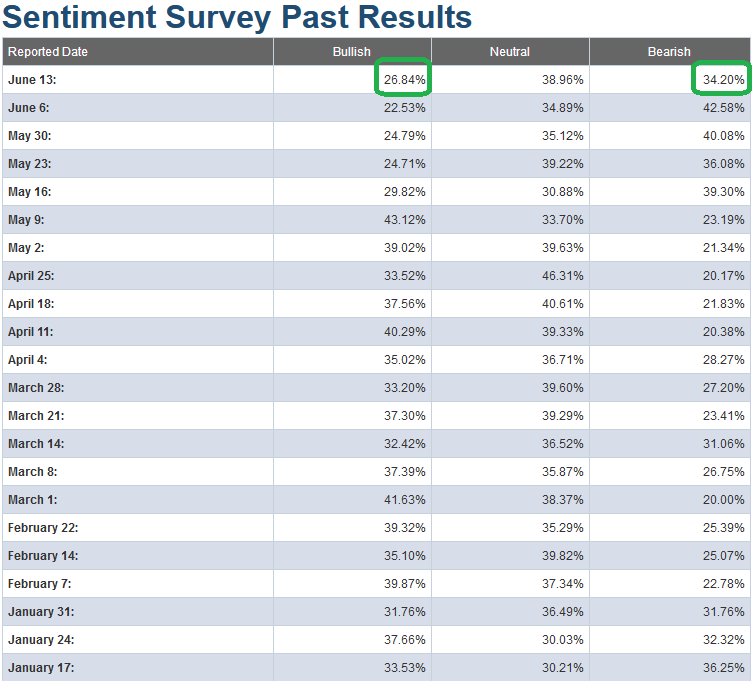

AAII Sentiment Survey Results – Pessimism Reigns. What to do about it?

The only things that have changed between last week and this week’s AAII sentiment survey report are:

- We have built a sentiment base below 30 read for “bullish sentiment.”

- Bearishness hit an extreme above 40.

- The market has been basically flat for 11 trading sessions (we are around same levels as May 13 on the SPX).

Continue reading “AAII Sentiment Survey Results – Pessimism Reigns. What to do about it?”

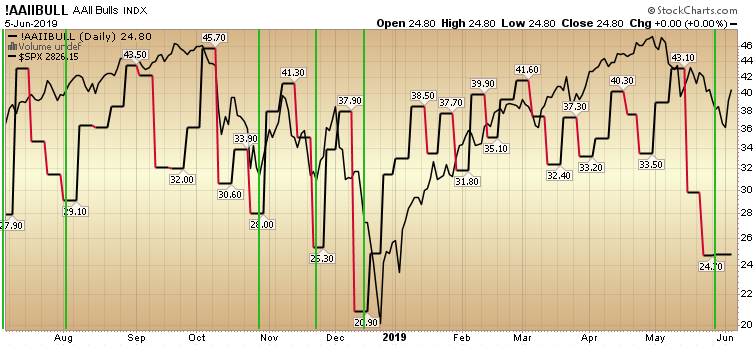

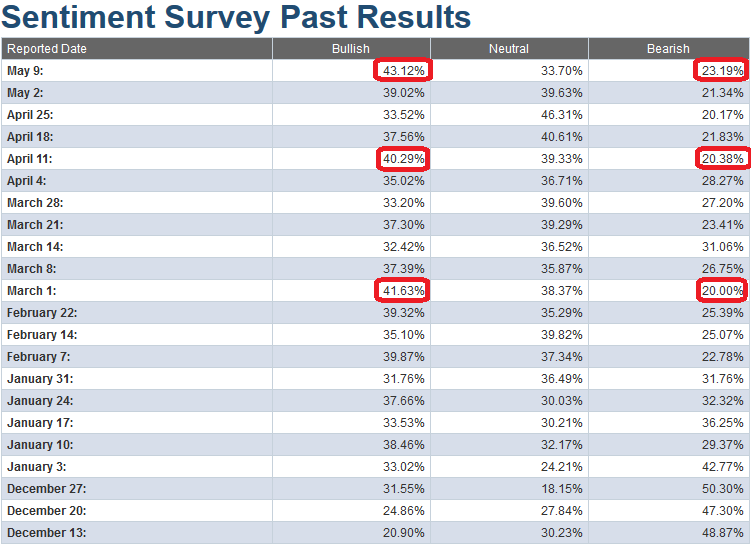

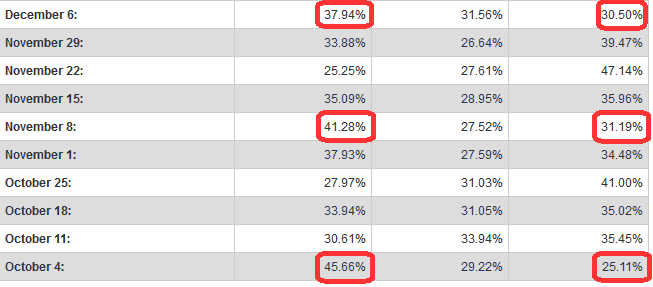

AAII Results: Bulls on the Run, Time to Buy?

Today’s AAII Sentiment Survey results had the bulls running for the hills! When you look at the chart above, the red and black line represents the bullish percent number from the weekly survey. The black line in the background represents the S&P 500. Continue reading “AAII Results: Bulls on the Run, Time to Buy?”

AAII Sentiment Survey Results: Complete FLIP. What’s next?

Last week we pointed out the extreme in bullishness was not good for the bulls and we subsequently got a swift pullback on Friday and Monday.

AAII Sentiment Survey Results: Back at Extreme. What’s next?

Continue reading “AAII Sentiment Survey Results: Complete FLIP. What’s next?”

AAII Sentiment Survey Results: Back at Extreme. What’s next?

If you had asked me last night where the AAII sentiment Survey results would come in this morning I would have said, “35-37% bullish percent.” Instead we got an extreme read to 43.12%. Bearishness is still near historic lows at 23.19%. This is not the type of read bulls want to see. Continue reading “AAII Sentiment Survey Results: Back at Extreme. What’s next?”