Skip to content

China Boosts Index Investments in Latest Bid to Revive Market (bloomberg )

Building-Products Distributor QXO Launching Hostile Bid for Beacon (wsj )

Why America is in an alcohol recession (thehustle )

Chinese AI applications now have bigger aims — they’re looking beyond chatbots (cnbc )

China’s central bank conducts 14-day reverse repos ‘to inject liquidity into the market and boost confidence’ (globaltimes )

Tom Brady and His Watch Are Both Modern Sports Icons (gq )

Lamborghini Revuelto vs. McLaren 750S: Which Supercar Is Best? — Performance Car of the Year 2025 (roadandtrack )

The BoJ’s Dangerous Confidence (gavekal )

Bryson DeChambeau’s LIV Golf wealth fueling ‘mega-project’ (golf )

‘I got better at life’: Why Joel Dahmen trained with a Navy Seal (golf )

Diageo Doesn’t Intend to Sell Guinness, Moet Hennessy Stake (bloomberg )

Trump vs Powell: Who will drive the stock market as the Fed holds its first meeting of the year? (marketwatch )

This Wegovy user spent $5,000 on a new wardrobe after losing 80 pounds — and she’s not alone (marketwatch )

This Trend Could Spell Trouble for Bank Stocks (barrons )

Germany’s Economic Model Is Broken, and No One Has a Plan B (wsj )

So Much for Tariffs? Businesses Could Avoid Paying $250 Billion in Levies, Goldman Sachs Says. (barrons )

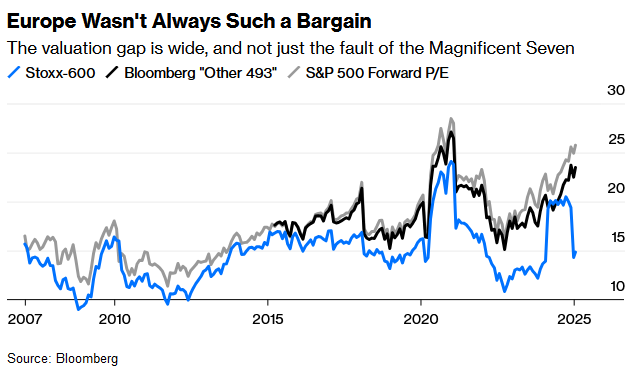

Investors Bet Trump Will Make Europe Investable Again (wsj )

Trump Tries to Forge ‘Golden Age’ Economy of Self-Reliance and Defiance (wsj )

Business elites truly believe Trump could be on the verge of solving one of the world’s most difficult problems: The Ukraine War (com )

The podcast bros who helped put Trump back in the White House (ft )

‘Leveraged to the hilt’: PE-backed firms hit by wave of bankruptcies (ft )

How Canada Goose went from making Antarctic outerwear to selling luxury status symbols, and where it goes from here (businessinsider )

10 Best Cheap Stocks to Buy Under $10 (morningstar )

The Cheat Sheet on Trump’s First Week (nytimes )

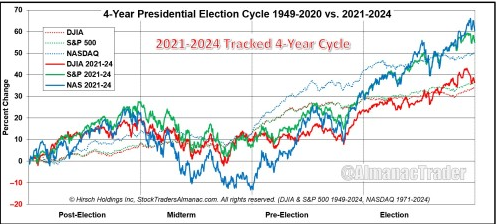

2021-2024 Textbook 4-Year Cycle in The Books (jeffhirsch )

Javier Milei’s free-market shock therapy to transform Argentina’s economy gets huge endorsement as sudden growth rebound seen (fortune )

How (un)popular is China’s Communist Party? (economist )

The 18 Best New Supercars of 2025 (robbreport )

Dollar falls after Trump hints at softer stance on China tariffs (ft )

Dollar Posts Worst Week in 14 Months as Tariff Risks Subside (boomberg )

Diageo Weighs Options for Guinness in Portfolio Review (bloomberg )

Will the Chinese Consumer Finally Start Spending? (bloomberg )

Beacon Roofing Seeks Potential Rivals to QXO Takeover Bid (bloomberg )

Dollar Posts Worst Week in 14 Months as Tariff Risks Subside

Home Sales Had Their Worst Year Since 1995. There May Be a Silver Lining. (barrons )

American Express Earnings Show Its Card Members Keep Spending. Why the Stock Is Falling. (barrons )

Mid-Cap Stocks Have Been in the Shadows. Why 2025 Could Be Their Year. (barrons )

Why Donald Trump Is Racing So Fast to Remake America (wsj )

Beijing Signals Readiness to Talk to Trump’s Team, Even Old Foes (wsj )

Burberry Sees Positive Signs as Turnaround Plan Continues (wsj )

Trump Unleashes Surprise Global Rally by Backing Off Key Promise (bloomberg )

China Welcomes Back Hollywood Films in Bid to Boost Spending (bloomberg )

AI-Driven Power Boom Will Drive Demand 38% Higher on Top US Grid (bloomberg )

AI, Stargate and China Were the Talk of Davos (bloomberg )

Why the Stock Market Might Be at Peak Concentration Risk (bloomberg )

AmEx CFO says spending picked up at year-end, thanks to millennials and Gen Z (cnbc )

Stock Investors Like Trump 2.0 (wsj )

US stocks at most expensive relative to bonds since dotcom era (ft )

Beijing tells insurers to buy more Chinese stocks (ft )

Why Boeing’s stock isn’t tumbling, even after an ‘eye-watering’ loss warning (marketwatch )

China’s New Rules to Add $138 Billion Into Market, Analysts Say (bloomberg )

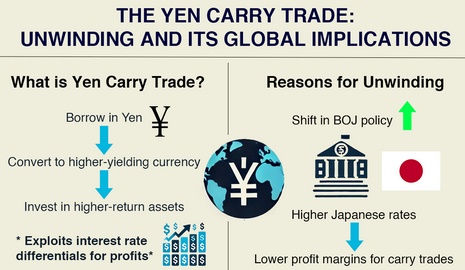

Japan Raises Interest Rates to Highest Level Since 2008 (nytimes )

Japan core inflation climbs to a 16-month high, boosting case for rate hikes (cnbc )

Trump Says He Would ‘Rather Not’ Have to Impose Tariffs on China (bloomberg )

Boeing Preannounced Earnings. They Were Dreadful—but That’s OK. (barrons )

Boeing pre-reported losses ‘not that bad’, says Jefferies’ Kahyaoglu (cnbc )

Yuan Gains as Trump Dials Back Tariff Threats (bloomberg )

Europe’s Stoxx 600 Hits Record High on Trump Tariff Relief (bloomberg )

Trump Says He’ll Demand Interest Rates Drop, Urges OPEC to Cut Oil Prices in Davos Speech (barrons )

Trump Can Capture the Fed. Here’s How. (barrons )

TikTok’s Possible Buyers, From Elon Musk to MrBeast (bloomberg )

Disney Raises Iger’s Pay by 30%, Reflecting Turnaround in Profit (bloomberg )

Trump Says He Knows Interest Rates Better Than Fed Chief Powell (bloomberg )

Trump Looks to China to Help Press Putin Into a Deal to End War (bloomberg )

Mortgage Rates in US Drop for First Time in More Than a Month (bloomberg )

Trump piles pressure on Fed chair Jay Powell to cut interest rates (ft )

Beijing tells insurers to buy more Chinese stocks (ft )

Hong Kong stocks rise on Trump’s China optimism and Wall Street rally (scmp )

Like a Good Neighbor, Chinese Insurance Companies Are There To Buy Stocks (chinalastnight )

China’s Flattening Yield Curve Is Putting PBOC in Focus (bloomberg )

China Guides Mutual Funds, Insurers to Invest More in Stocks (bloomberg )

China urges state-backed funds to buy more stocks amid market slump (cnbc )

Saudi Leader Offers $600 Billion Investment Pledge in Trump Call (bloomberg )

One by One, World Leaders in Davos Fall in Line in Trump Era (bloomberg )

As Trump Lobs Tariff Threats, White House Maps Trade Overhaul (bloomberg )

Cheap, Not Trump, Is Why European Stocks Are Spiking (bloomberg )

Stock-Market Bulls Are Staring Down Positioning for Rally Clues (bloomberg )

Trump Maps Pivot From Quick Wins to Harder, ‘Solvable’ Problems (bloomberg )

Musk Pours Cold Water on Trump-Backed Stargate AI Project (wsj )

Why Markets Love the Latest Raft of Earnings (barrons )

BofA Says Benign Trump Policies to Spark Rally in Stock Laggards (bloomberg )

China’s Social Security Fund Told To Buy Stocks (chinalastnight )

China Eases Rules for Long-Term Funds to Boost Stock Market (bloomberg )

How Javier Milei’s Tough Remake of Argentina Made Him a MAGA Hero (wsj )

Putin and Xi Stick Together in Video Call After Trump’s Inauguration (wsj )

20 value stocks primed for rapid revenue growth (marketwatch )

Trump’s dream TikTok deal could set a blueprint for doing business with China (nypost )

Here’s the key date to watch for Trump’s tariff policies, one analyst says (marketwatch )

Trump’s Day 1 executive orders target EVs, inflation, immigration. Here’s what could come next. (marketwatch )

Opinion: Trump’s first 100 days: What he must do on trade, immigration and tax cuts (marketwatch )

Opinion: Faster growth can fix many of America’s problems. Here’s how Trump can succeed. (marketwatch )

Is it time to shift to a value-focused investment strategy? (yahoo )

Jamie Dimon says US stock market ‘kind of inflated,’ critics need to ‘get over’ Trump tariffs (nypost )

Americans flocked to this southern US state in droves in 2024 (nypost )

Trump Threatens 10% Tariff on China, Cites Trade Deficit With EU (bloomberg )

US Mortgage Rates Drop to 7.02%, First Decline in Six Weeks (bloomberg )

Einhorn says the market is at the fartcoin stage of the cycle. His fund bought Peloton and made these moves. (marketwatch )

New Tariffs Didn’t Come on Trump’s Day One. A Trade War May Not Be in the Wings. (barrons )

Trump ‘Uncertainty’ Claims a Victim. Ford Stock Catches a Downgrade. (barrons )

Davos Reaction to Trump 2.0: Buckled Up and Ready for His New Term (wsj )

Musk Pours Cold Water on Trump-Backed Stargate AI Project (wsj )

The Alcohol Industry Is Hooked on Its Heaviest Drinkers (wsj )

Five Things to Know About Trump’s Energy Orders (wsj )

A List of Trump’s Key Executive Orders—So Far (wsj )

Trump Keeps China Guessing on Tariff Threats (wsj )

An Anxious Federal Workforce Bids Goodbye to Job Stability and Remote Work (wsj )

Trump to Spur US Tech Deals Boom, Qatar’s $510 Billion Fund Says (bloomberg )

Why Trump Is Pledging to Refill the US Oil Reserve (bloomberg )

TikTok Saga Shows Americans Can’t Be Bothered to Take On China (bloomberg )

Trump Says He’s Open to Elon Musk or Larry Ellison Purchasing TikTok (bloomberg )

Jamie Dimon says Trump’s tariff policy is positive for national security so people should ‘get over it’ (cnbc )

A Chinese startup just showed every American tech company how quickly it’s catching up in AI (businessinsider )

S. investors liked the Stargate AI news. Asian investors loved it. (marketwatch )

All Federal DEI Offices To Be Closed By Wednesday EOD, Workers Placed On Paid Leave: White House (zerohedge )

Extremes Become More Extreme, Then Revert To The Mean (zerohedge )

Trump highlights partnership investing $500 billion in AI (apnews )

China directs funds to stabilise stock market amid Trump tariff threats (scmp )

China’s consumer sector, long plagued by a property slump that has slowed the economy and dampened sentiment, could be nearing a “tipping point”, as consumers save less and spend more following last September’s stimulus blitz, analysts said. (scmp )

Intel’s Potential Buyers Speculated Ahead of Trump’s Inauguration: A Quick Round-up (trendforce )

Trump Holds Off on Immediate China Tariffs, Calls for Study (bloomberg )

Xi Calls for Proactive Macro Policies to Keep China Momentum (bloomberg )

Hartnett suggests being long on international stocks like Europe, China and emerging markets amid policy easing in those regions. He also recommends buying rate-sensitive stocks like homebuilders, utilities, financials and REITs as the 30-year Treasury yield has peaked below 5%. (bloomberg )

Analysts Agree These 8 Warren Buffett Stocks Will Soar In 2025 (investors )

Trump’s Inflation-Cutting Push Suggests Regulatory Cuts Are Coming (barrons )

Trump Signs Order Freezing Government Hiring, Mandates Workers Return to Office (barrons )

Tariffs on Mexico, Canada Could Come as Soon as Feb. 1, Trump Says (barrons )

Trump’s Day 1 orders target EVs, inflation, immigration. Here’s what could come next. (marketwatch )

Trump Signs Executive Orders Focused on the Border, Energy (wsj )

China Signals It Is Open to a Deal Keeping TikTok in U.S. (wsj )

Big Pharma, Beaten Down Under Biden, Hopes for New Chapter Under Trump (wsj )

Trump’s Tariff Shifts Are a Warning for Corporate America to Expect Whiplash (bloomberg )

Trump Signs Executive Order to Cancel Federal DEI Requirements (bloomberg )

Trump Again Calls for EU to Buy More US Energy to Avoid Tariffs (bloomberg )

Trump Lifts Biden’s Freeze On Liquefied Natural Gas Exports (bloomberg )

Treasuries Rally on First Trading Day Under Trump Presidency (bloomberg )

Trump May Be a Net Positive for the Jobs Market, Randstad Says (bloomberg )

Japanese Stocks Drop After Trump Talks About Tariff Plan (bloomberg )

Trump Says He Will Stop Leasing Federal Land for Wind Farms (bloomberg )

Trump Says He’ll Fill US Strategic Oil Reserve ‘Right to the Top’ (bloomberg )

Trump to Sign Orders Defining Sexes, Ending DEI in Agencies (bloomberg )

Jefferies downgrades Apple to rare underperform rating (cnbc )

Stanley Druckenmiller says ‘animal spirits’ are back in markets because of Trump (cnbc )

Trump trade memorandum doesn’t impose tariffs, but he says some could be coming (cnbc )

As WEF gets underway, the list of world leaders not attending Davos speaks volumes (cnbc )

Should you sell Apple’s stock? This analyst makes the case with 3 reasons. (marketwatch )

These are the 2 most important questions for 2025, according to BofA (streetinsider )

Stuart Varney: Patriotism has made a comeback (foxbusiness )

Tech war: China creates US$8.2 billion AI investment fund amid tightened US trade controls (scmp )

Chinese regulators express support for capital markets ahead of Trump’s inauguration (scmp )

Hong Kong stocks rise on positive talks between Trump and Xi (scmp )

Guggenheim expects Fed to cut rates about every quarter in 2025 (reuters )

It’s a Tough Time for Builders. D.R. Horton’s Outlook Could Be a Bright Spot. (barrons )

Is Elon Musk About to Buy Intel (INTC)? (247wallst )

Dollar Eases as Trump’s Second Term Approaches (tradingeconomics )

China Stocks Climb After Xi-Trump Call (tradingeconomics )

TikTok Restores US Service, Credits Trump (zerohedge )

Hartnett: Historic Rout In Treasuries Ending As “Trump Can’t Allow Bigger Debt And Deficits” (zerohedge )

Trump wants to visit China, strengthen relationship: Report (yahoo )

The truth behind your $12 dress: Inside the Chinese factories fuelling Shein’s success (bbc )

Don Julio (Diageo Owned) Debuts ‘Year Of The Snake’ 1942 Añejo Tequila (maxim )

Pagani Utopia Has Vision-Blurring Performance (roadandtrack )

China ready to work with US for steady growth of ties: Chinese VP (globaltimes )

Trump Says He’ll Give TikTok a 90-Day Reprieve. The App Threatens to Shut Down at Midnight. (barrons )

How Buffett and Munger helped Americans become savvy investors (nypost )

Voters Want MAGA Lite From Trump, WSJ Poll Finds (wsj )

Trump Told Advisers He Wants to Visit China as President (wsj )

Bank of Japan Is Set to Raise Interest Rates, Trump Permitting (bloomberg )

Perplexity Said to Submit Bid to Merge With TikTok’s US Unit (bloomberg )

Trump Says He’ll Likely Visit California Next Week, NBC Says (bloomberg )

Walgreens CEO Admits That Locking Merchandise Away From Shoplifters Makes Regular People Not Buy It (futurism )

The Single Biggest Individual Financier In The World. The Richest Woman In America: Hetty Green (founders )

Your Guide to Trump’s Day-One Agenda — From Taxes to Tariffs (bloomberg )

Traders Pile into Bullish China ETF Wagers After Trump-Xi Call (bloomberg )

What Trump is planning for day one — and what could matter most for investors (yahoo )

Trump, China’s Xi Discuss Trade, TikTok Before Inauguration (bloomberg )

Why Trump’s Plan to Escalate Tariffs Has So Many Haters (bloomberg )

S&P 500 Has Its Best Week Since November Election (bloomberg )

Can an EV Ever Really Be a Muscle Car? (bloomberg )

Sources Say Intel Is An Acquisition Target (semiaccurate )

SLB Stock Jumps on Earnings. AI Is the ‘X Factor’ for Energy-Tech Industry. (barrons )

Chinese Stocks in Hong Kong Cap Best Week in Three Months (bloomberg )

This Gorgeous Lamborghini Miura Is Up For Grabs (maxim )