- Tesla Stock Waffles On Earnings, Another Executive Departure (Investor’s Business Daily)

- Intel Slumps as Wall Street Scrutinizes New CEO Swan’s Pedigree (Bloomberg)

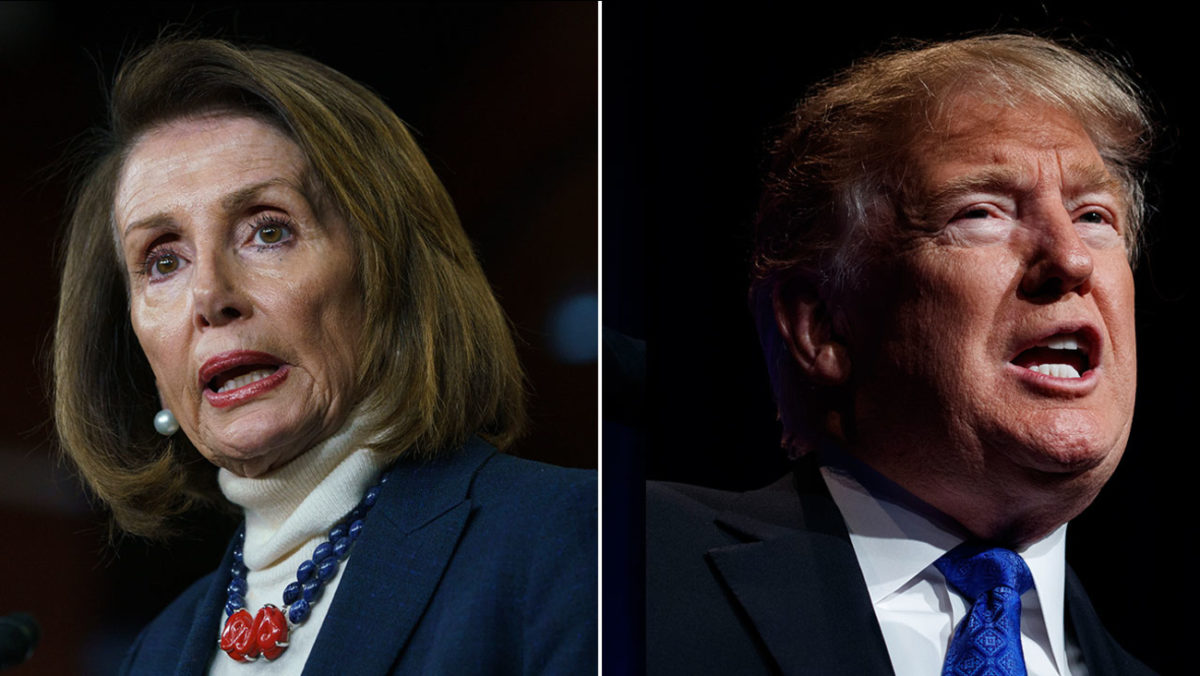

- Pelosi: ‘There’s Not Going to Be Any Wall Money’ (CNS News)

- Trump Today: President conditions China trade deal on opening up markets to U.S. farm, manufactured goods (Market Watch)

- The Threat of a Eurozone Recession (Project Syndicate)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.