- PayPal Reports Strong First-Quarter Earnings. Turnaround Strategy is Working, CEO Says. (barrons)

- PayPal Profit Gauge Tops Estimates in Sign of Turnaround Success (bloomberg)

- Venmo revenue grows 20%, with debit card payment volume soaring (cnbc)

- Alibaba launches new Qwen LLMs in China’s latest open-source AI breakthrough (cnbc)

- Alibaba Rolls Out Latest Flagship AI Model in Post-DeepSeek Race (bloomberg)

- China Offers Olive Branch to U.S. Firms After Boeing Delivery Halt (wsj)

- Bessent Says China Must Take Lead on Tariffs Talks, Hints at India Deal (barrons)

- The Best Chinese Stocks to Buy (morningstar)

- China’s E-Commerce Giants Are Putting Up a Fight (bloomberg)

- What’s the De Minimis Tariff Loophole Trump Is Closing? (bloomberg)

- Huawei Races To Replace Nvidia: New Ascend 910D AI Chip Will Begin Testing Next Month In China (zerohedge)

- Nvidia’s Chip Market Problems Aren’t Just in China (wsj)

- Trump to Soften Blow of Automotive Tariffs (wsj)

- Boeing Removed From Credit Watch by S&P in Turnaround Boost (bloomberg)

- India Plans to Highlight Boeing Order Pipeline in US Trade Talks (bloomberg)

- Why Restarting a Power Grid After Massive Collapse Is So Hard (bloomberg)

- Housing on Federal Lands Aims to Ease Affordability Crisis (nytimes)

- How to Invest Like Warren Buffett (morningstar)

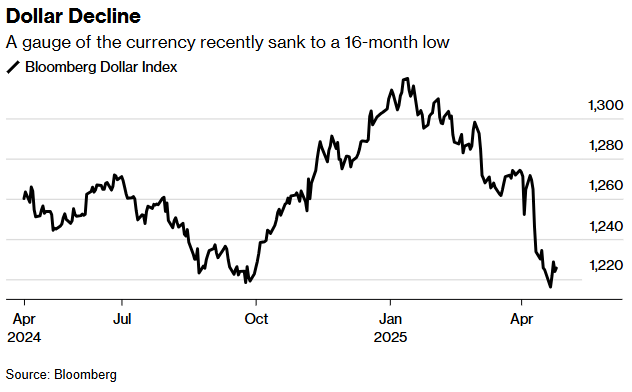

- Dollar on track for biggest two-month fall in more than two decades (streetinsider)

- Has sentiment bottomed out? (ft)

- Buyback Blackout Period Ends: Record Stock Repurchases On Deck (zerohedge)

- Woodside Energy Approves $17.5 Billion Louisiana LNG Development (wsj)

- GM Beats Earnings Estimates, Delays Conference Call. It’s Waiting for Trump Tariff Changes. (barrons)

- Royal Caribbean raises annual profit forecast on strong cruise demand (reuters)

- American Tower beats quarterly revenue estimate on strong telecom infrastructure leasing demand (reuters)

- Starbucks Is Reinventing Itself. Earnings Will Show the Progress. (barrons)

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Tips (PCN) – Position Completion Notification

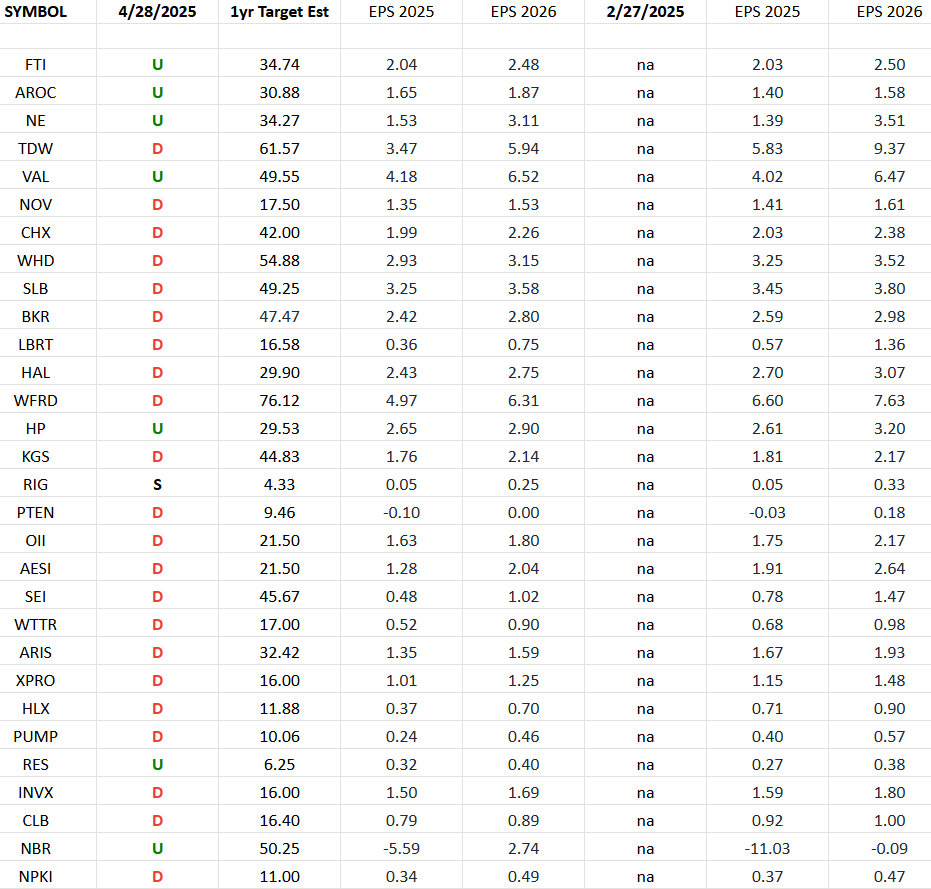

Oil & Gas Equipment & Services Earnings Estimates and Revisions

In the spreadsheet above I have tracked the earnings estimates for the Oil & Gas Equipment & Services ETF (XES) top 30 weighted stocks. Continue reading “Oil & Gas Equipment & Services Earnings Estimates and Revisions”

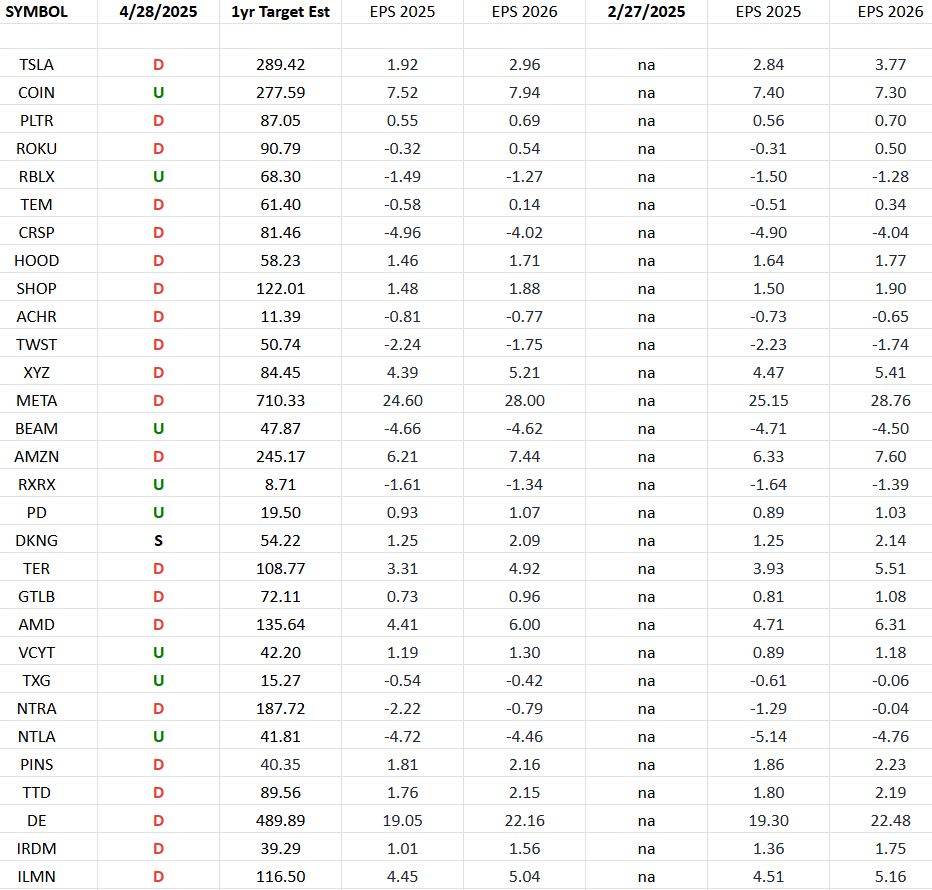

ARKK Innovation Fund Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Ark Innovation Fund (ARKK) top weighted stocks.

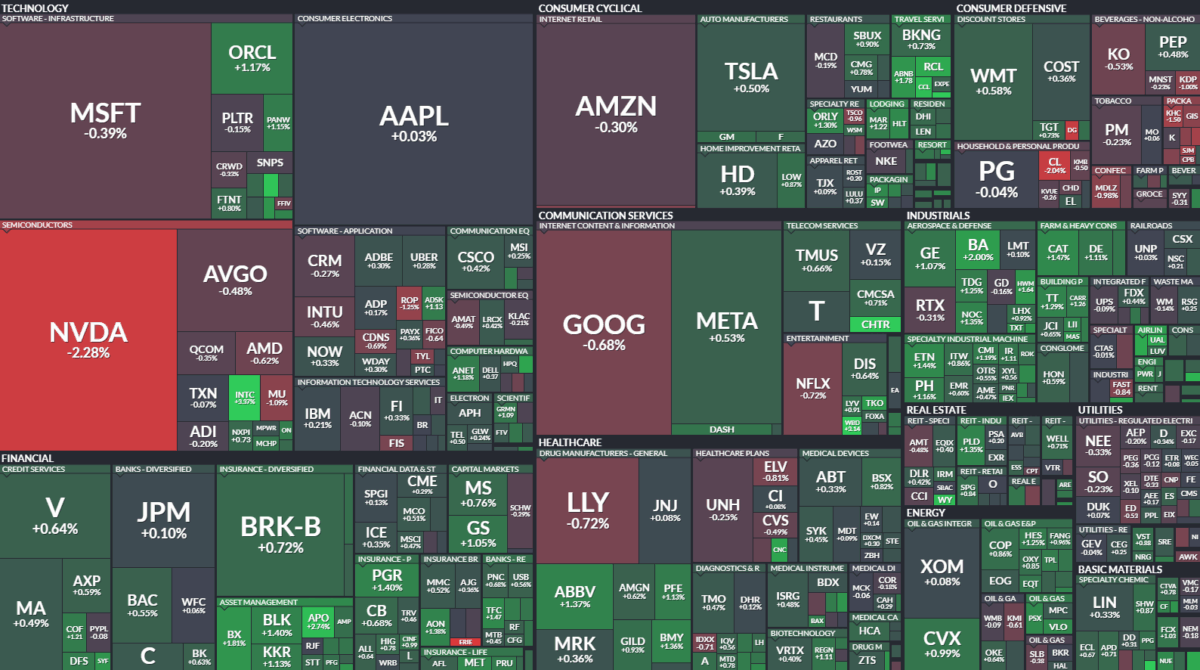

Where is money flowing today?

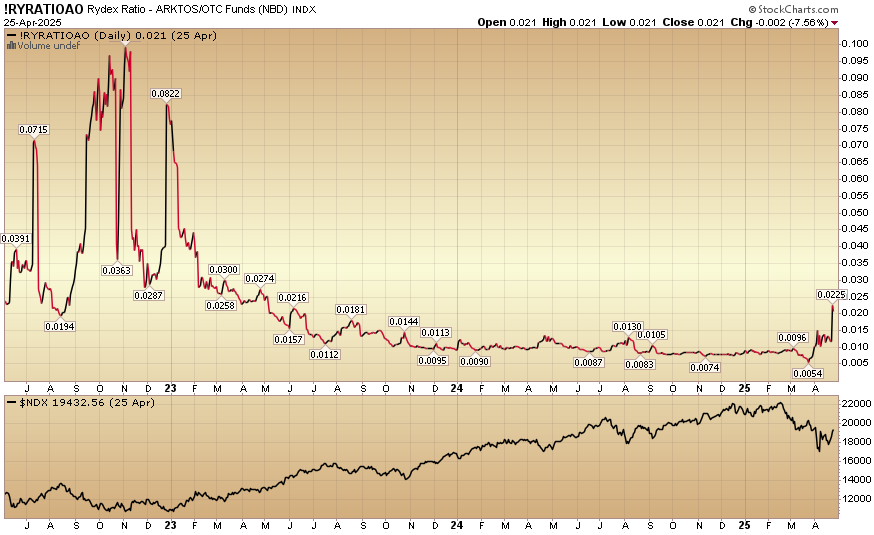

Indicator of the Day (video): Rydex Ratio – ARKTOS/OTC Funds

Quote of the Day…

Be in the know. 16 key reads for Monday…

- Unhedged and Burned, Stock Investors Brace for More Dollar Pain (bloomberg)

- The Dollar’s Weakness Creates an Opportunity for the Euro. Can It Last? (nytimes)

- Morgan Stanley’s Wilson Says Weak Dollar Will Buoy US Stocks (bloomberg)

- China moves to protect economy from trade war, vows to hit 5% growth target (scmp)

- China rolls out employment support and hints at more stimulus as U.S. tensions escalate (cnbc)

- Goldman says China funds to buy US$110 billion of Hong Kong-listed stocks (scmp)

- China’s Huawei Develops New AI Chip, Seeking to Match Nvidia (wsj)

- Goldman Sachs Offers Advice on Tariffs to Countries Scrambling to Please Trump (wsj)

- Philippines Aims to Lower US Tariff to Zero During Talks (bloomberg)

- Emerging-Market Stocks Extend Rally Amid Earnings Optimism (bloomberg)

- Riyadh Air willing to buy Boeing planes from cancelled Chinese orders, CEO says (reuters)

- Bernstein raises Boeing stock rating, price target to $218 (investing)

- Boeing Stock Is Rising for Two Reasons (barrons)

- Inflation Fear Is Making Some People Spend More—and Others Less (wsj)

- Home prices starting to crack: Here’s why (youtube)

- The 7-year car loan is here. Do you really want to be paying off your car in 2032? (usatoday)