We are about to enter a period of bad news. New cases of coronavirus will continue to go up along with unemployment (in the short term).

If I would have told you three months ago that the Stock Market would rally today – if we get an initial Jobless Claims number of less than 750,000 – you would have thought I was out of my mind…

I have no idea what the number will be today and neither does the Street – as I have seen estimates between 1-4M. My guess is it will be highest ever by far (~700,000 was the record in 1982)…

So that is the bad news. The good news is that the Stock Market has already discounted a ton of short term economic pain. That said, just because we have a two day rally does not mean it’s time to get your party suit on.

If you’ve been following me for some time, you know I’m a Country Music fan. In coming weeks, you might take comfort in Country Star Luke Comb’s words of wisdom, “Beer Never Broke My Heart” as the daily headlines are going to get worse before they get better:

It takes one hand to count the things I can count on

No, there ain’t much, man, that ain’t ever let me downLong-neck ice-cold beer never broke my heart

So how are we dealing with this environment?

On Tuesday afternoon I was on Fox Business and I talked about buying the highest quality companies, selectively, over time, adding on down days and sitting on our hands during up days. Here are the names I discussed:

I think the key takeaway you should have after watching the segment is that you have to take the long view (1-3 year outlook). For example, if you bought in October/November 2008, by March 2009 you looked silly because the market dropped further (over 10-20% more depending where you added), BUT BY JUNE 2009 YOU LOOKED LIKE A GENIUS as the market rallied ~43% and put you deeply in the green from your “white knuckle” buys in late 2008. That is the key reason you don’t want to add everything all at once…

As Warren Buffett says, “If you wait for the robins to start singing (good news), it’s already Spring (and you missed it).” Nibble when it’s darkest!

Later on Tuesday night I went on CGTN America to discuss the details of the stimulus package and how it will expand to almost 1/3 of our annual GDP – if needed in coming months. I go on to say however that the key will be the “Case Curve.” If we can mimic China, South Korea, Singapore, etc. that stimulus could have a profound impact on a late 2020 recovery. But the key is the new case curve – then everything else is in place:

What are some milestones/catalysts we are watching moving forward?

- $2T stimulus package (make workers and business whole until back to office). Passed in Senate this morning.

- Up to $4T of loans to businesses. Forgivable if they retain employees on payroll. Passed in Senate this morning.

- Fed: Has backstopped almost all asset classes at this point (unlimited). They are putting their money where their mouth is (see balance sheet below).

- Positive test results from 10,000 dose test in NY: Hydroxychloroquine and azithromycin (would be game changer and get folks back to work quickly if it works). Anecdotal evidence promising so far. Day by day…

- New cases peak in the US.

- OPEC+ reverses their decision and cuts production (either voluntarily because it’s in their interest OR with pressure/sanctions from US). This would stabilize credit markets quickly (and naturally without significant further intervention).

- Vaccine needed ideally by Fall/Winter.

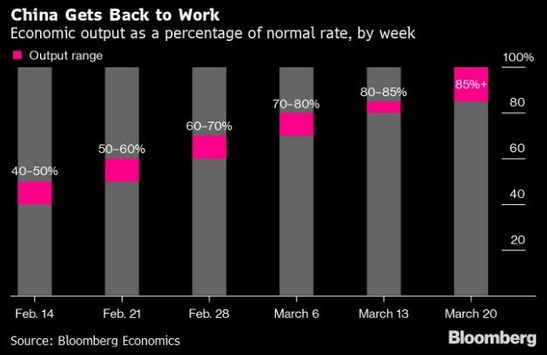

The name of the game is the “Case Curve.” If we can come close to the China curve, here’s what we have to look forward to:

- Disney re-opening Shanghai Park

- Starbucks re-opened stores

- Apple re-opened stores

- Yum China opening 95% of restaurants.

Source: James Wong (LinkedIn)

There is a light at the end of the tunnel. We just hope that it’s a short tunnel…

Now onto the shorter term view for the General Market:

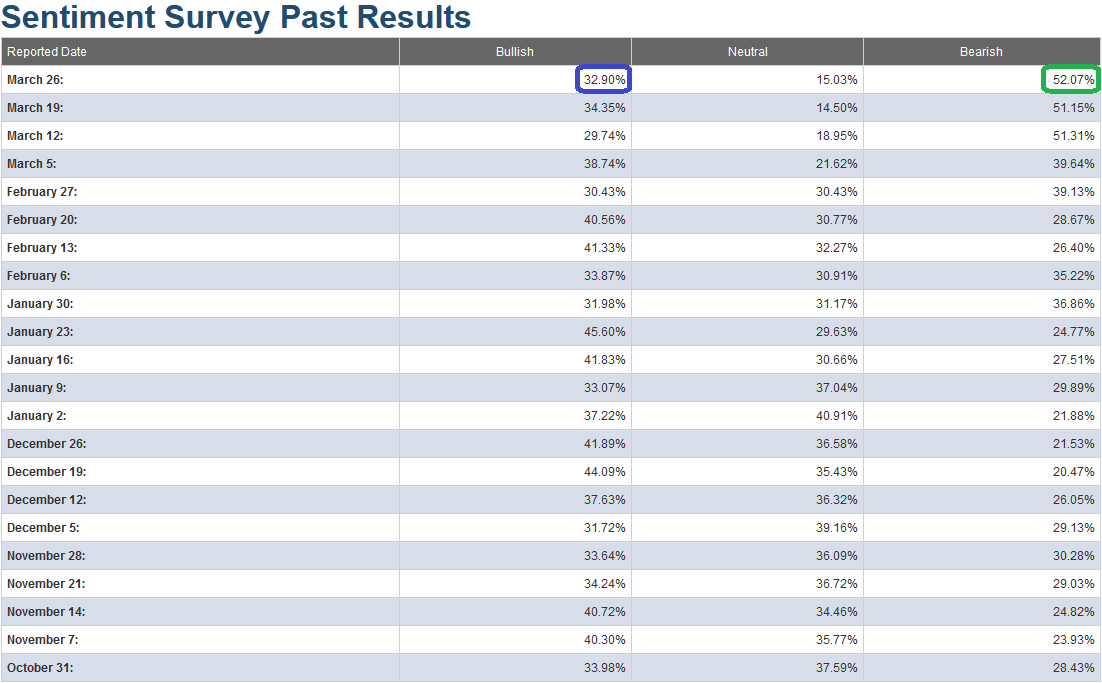

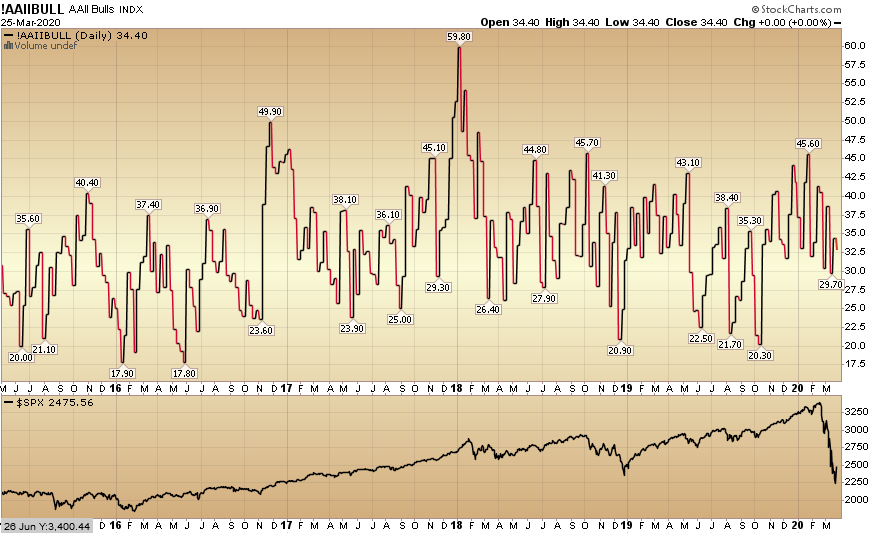

This week’s AAII Sentiment Survey result (Video Explanation) Bullish Percent ticked down to 32.90% from 34.35% last week. Bearish Percent ticked up to 52.07% from 51.15% last week. What is sitting in the back of my mind is the fact that while Bearish Percent is at/near an extreme level, the Bulls never got washed out in this crash.

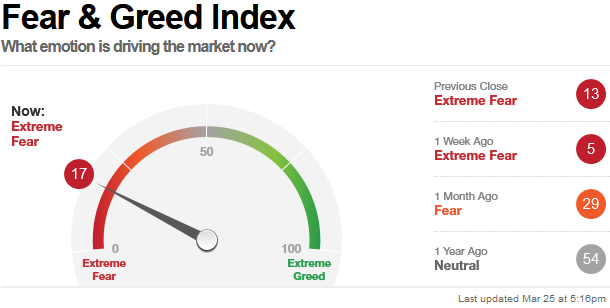

The CNN “Fear and Greed” Index rose from 5 last week to 17 this week. The fear is slowly thawing and will move in fits and starts in coming weeks. You can learn how this indicator is calculated and how it works here: (Video Explanation)

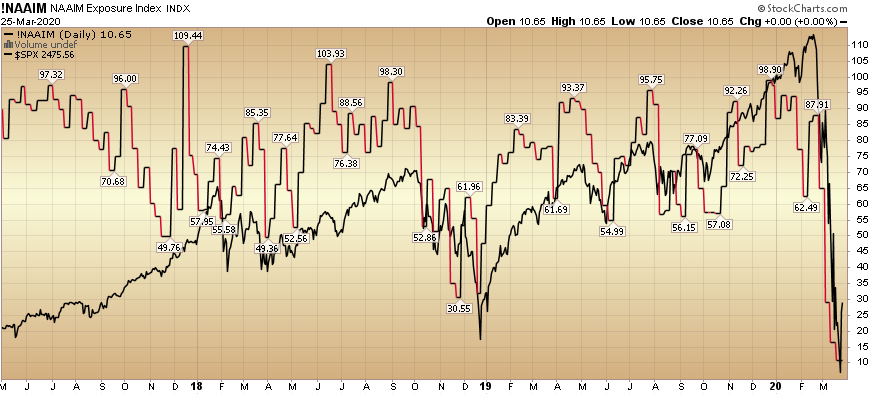

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation Here) dropped from 16.59% equity exposure last week, to 10.65% this week. Active managers will have to regain exposure in coming weeks as the worst of the news starts to move into the rear view mirror. We are not there yet. The worst news is still ahead but it will get better. It always does…

Our message for this week is similar to last week:

We are selectively and slowly adding to those stocks/sectors which are nearing valuation levels that we would define as “pricing in at/near the worst case scenario.”

Most stocks do not yet meet this measure (as the “worst case” is unlikely to materialize), but for those that do we are adding and will continue to do so as opportunity presents itself in coming days and weeks.

But for now, it’s day by day and opportunistic execution…