The song that best describes this abbreviated Holiday Week’s Stock Market mood is, “Home Sweet Home” by Mötley Crüe:

I’m on my way

Home sweet home…”

The Nasdaq has already made new highs. It has been a “long and winding road” back and there’s still more field to plow, but we’re making progress.

This Sunday (pre-recorded) I was on NJNN with Larry Mendte (who has scored 27 Emmys in his illustrious career), and we discussed the road to recovery. You can review it here:

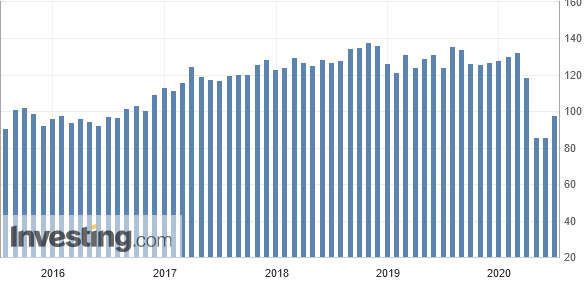

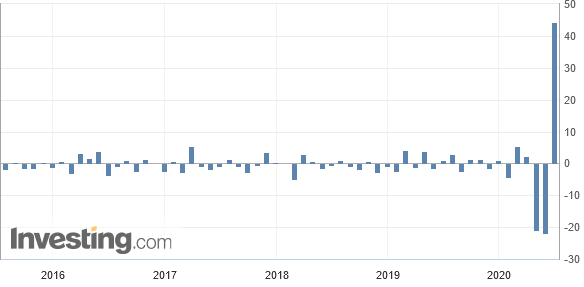

Knocked it out of the park on Monday. The National Association of Realtors measures the change in the number of homes under contract to be sold but still awaiting the closing transaction, excluding new construction.

It was expected to be up 18.9% after falling -21.8% last month, but instead crushed expectations at +44.3%.

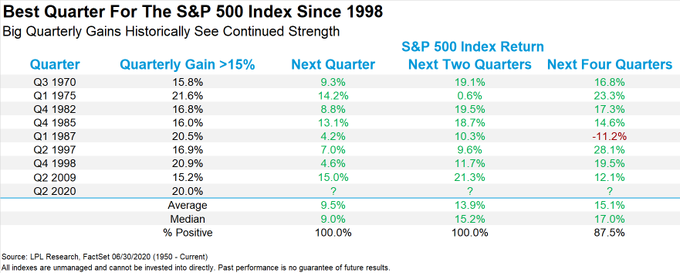

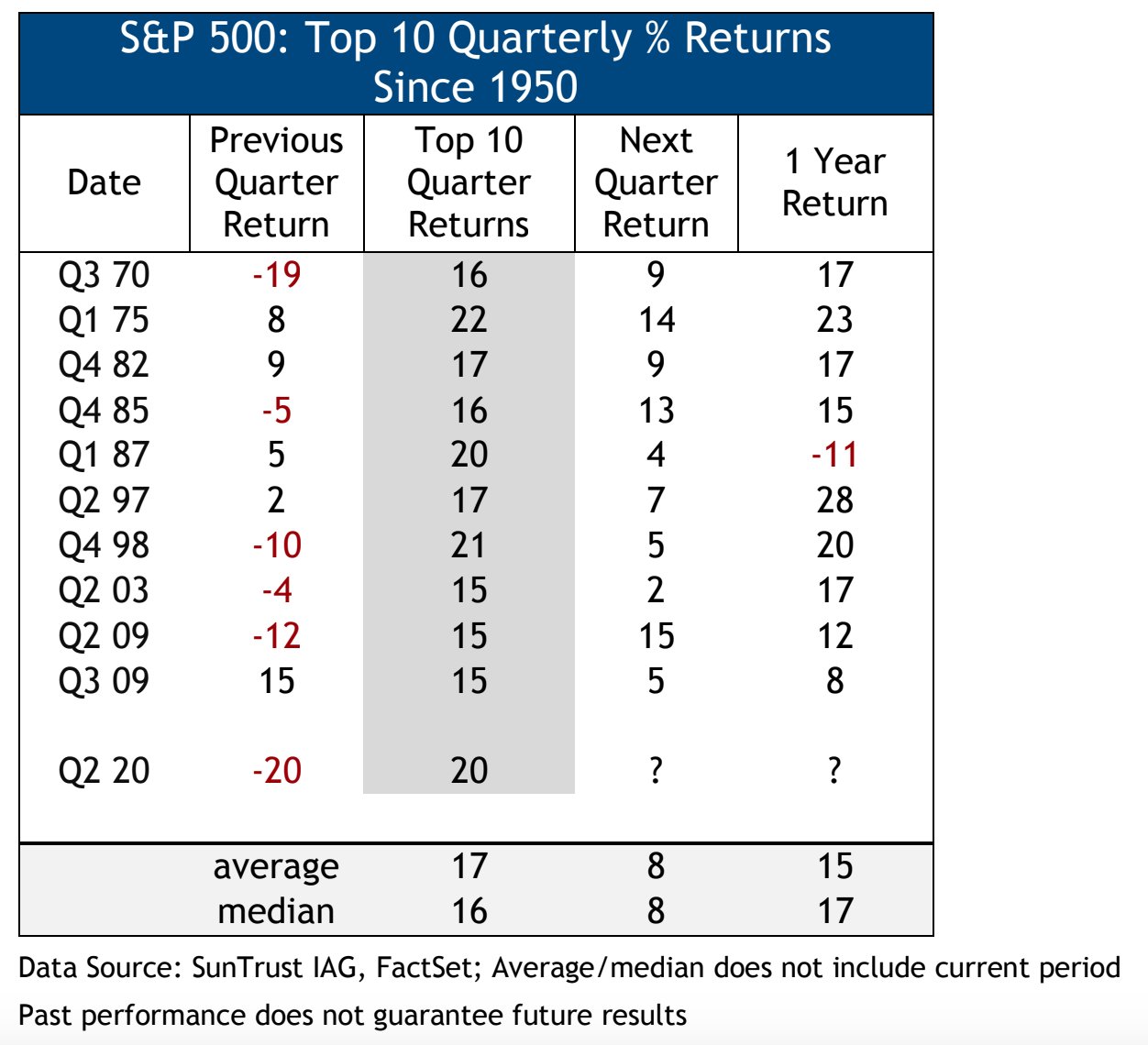

Source Above: Keith Lerner SunTrust

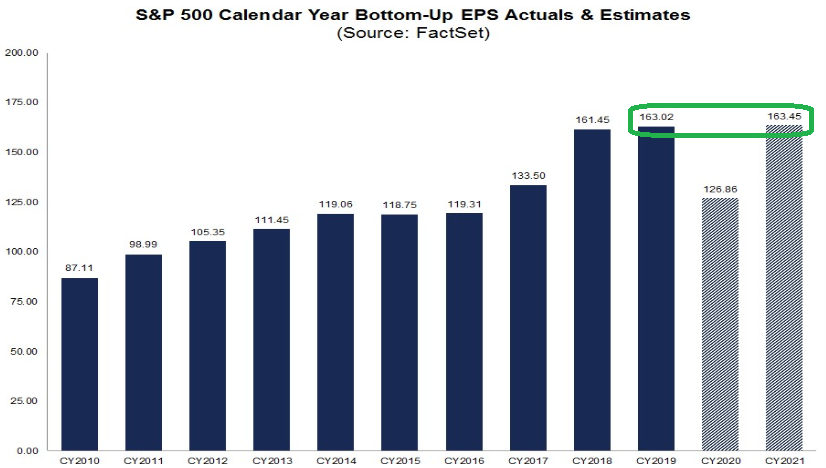

After the best ten quarters since the end of WWII, the index has climbed every single subsequent quarter – with an average gain of ~8-9%. That does not guarantee it will repeat again, but the psychology, positioning and data supports a similar outcome. This would meet our expectation of reaching “Home Sweet Home” (new highs) in the S&P 500 before year end.

This expectation would be impossible if not for the unprecedented intervention by the Fed, Treasury, Administration and other global policy makers. Under normal circumstances one to three years to get back to new highs would have been a more realistic expectation (as in 1918 and 1987 scenarios).

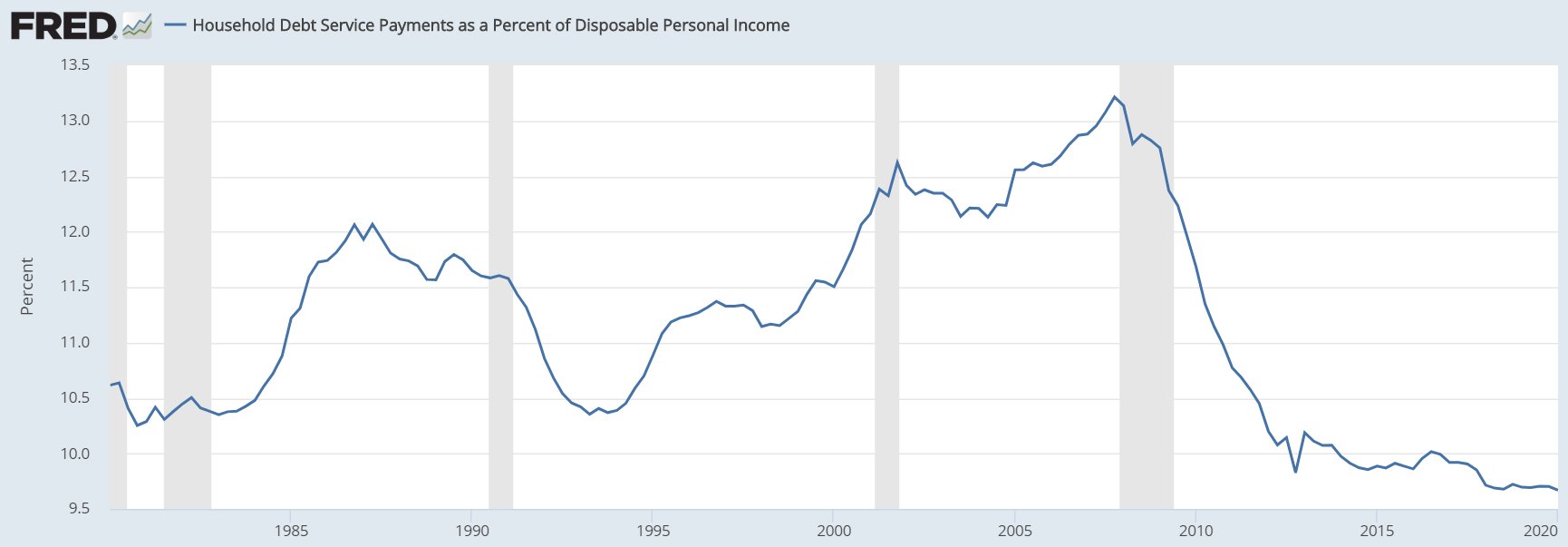

Household debt service as a percentage of disposable personal income is at multi-decade lows. While the government balance sheet has expanded post “Great Financial Crisis,” the consumer’s balance sheet has cleaned up and deleveraged considerably.

If you couple that with high cash balances and savings rates, we have the fuel to start a massive recovery as the virus gets contained.

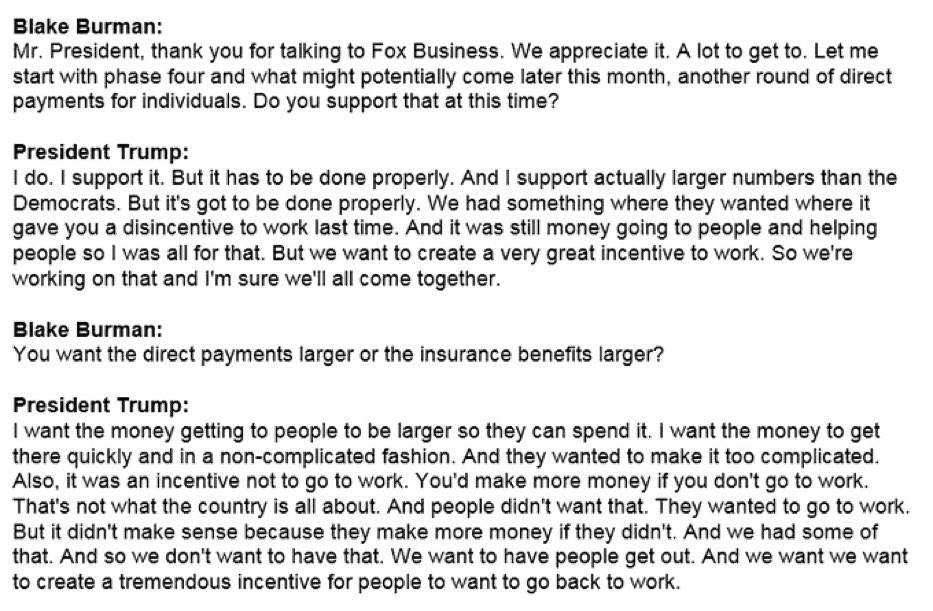

Just today, President Trump signaled an earnestness to provide more direct stimulus to consumers and also hinted at doing something to improve minimum wages. Here is the Fox Business interview of Brett Burman (via Greta Wall/twitter) that took place on “The Claman Countdown” Wednesday:

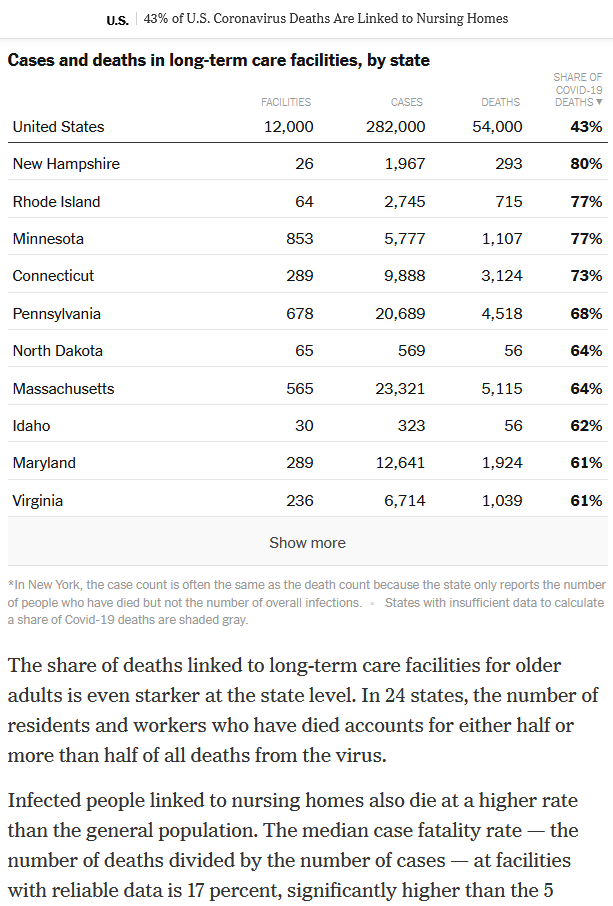

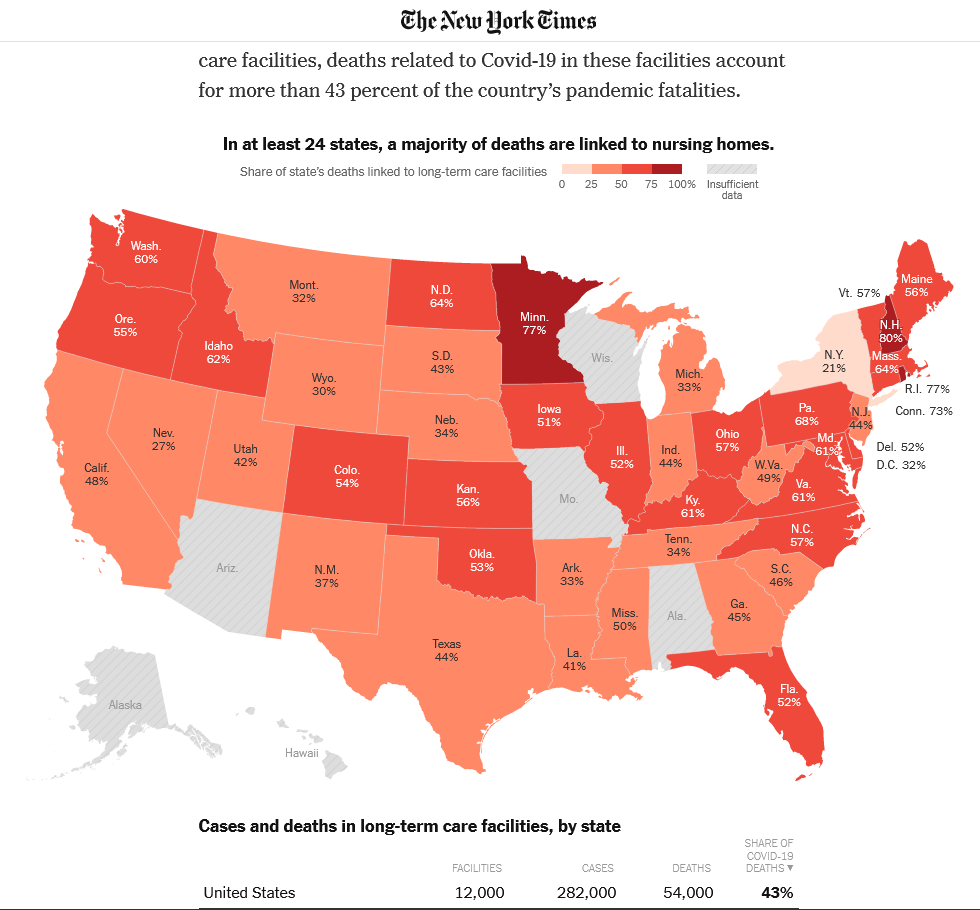

The big focus has been on ~125k people dying from COVID. There was an article in the New York Times this week that added some helpful granularity to this number.

43% of the deaths were from nursing homes nationwide. In most states it was greater than 50%. So while cases have recently gone up, deaths continue to go down due to the age of the “infected” falling from the mid-60s to the mid-30’s.

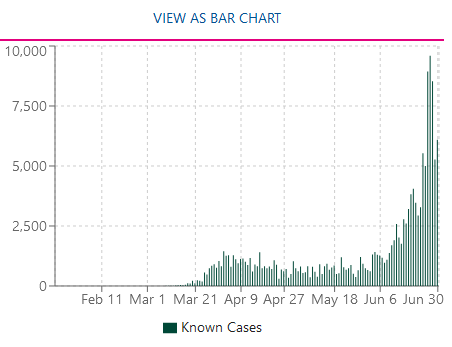

Many of these infections are preventable by wearing masks in public spaces where people congregate indoors. This was put into place quickly here in the tri-state area after our cases spiked. Since implementing these practices, cases have plummeted in our region. The same thing will happen in the sunbelt and we are starting to see signs of this in the hardest hit states:

In Florida, cases were 9,592 on June 27. They have dropped to 6,093 on June 30:

source: usafacts.org

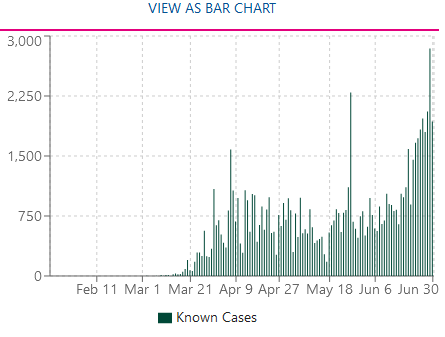

In Georgia, cases were 2,843 on June 29. They have dropped to 1,932 on June 30:

Texas, California and Arizona still have some work to do, but will eventually fall into line as we did in the Northeast. None of us wore masks until people around us started getting sick or dying. Then we took it seriously and cases collapsed. It’s a simple process that each region has to go through.

On the flip side, when you back out the nursing home deaths/long term care facility deaths you’re right around 70,000 – which is equivalent to a severe flu season. That said, we still need to take it seriously or the economic damage can cascade. We are back on the uptred but we must “starve the beast” by wearing masks in public crowded spaces.

Viruses cannot multiply if there are no hosts. Our mask is currently the best weapon to crush the invisible enemy. Soon we will have “tanks and missles” (treatments and vaccines) to slay the invisible enemy, but for now, you can be a battle warrior by wearing your mask and starving this beast.

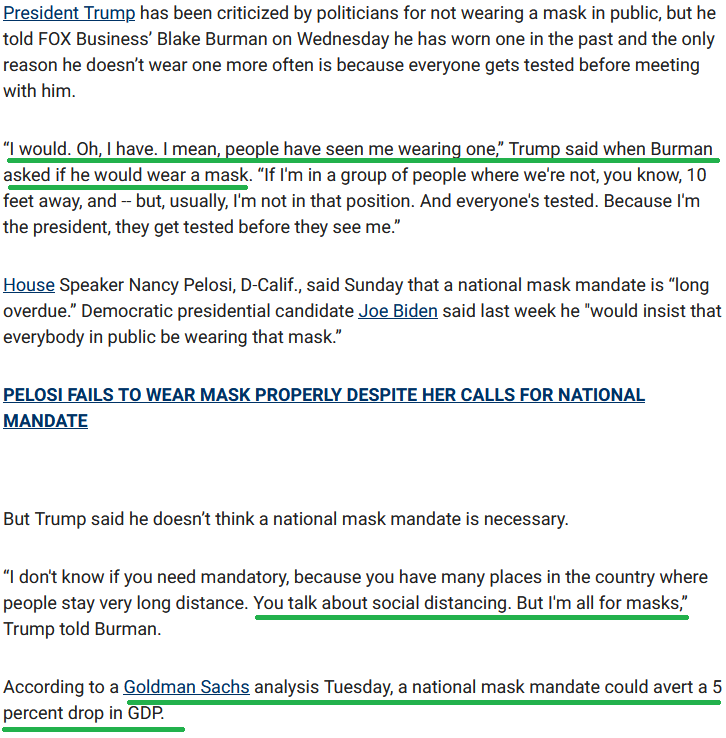

Both Vice President Pence and President Trump have shown support for people choosing to wear masks in public when they cannot socially distance. More from President Trump’s interview on the “Claman Countdown:”

I, like everyone else, value freedom – but until we slay the enemy there are continued limitations on that freedom (restaurants, travel, concerts, sports, businesses). So the argument I am making above is a short term sacrifice of wearing a mask in public – in order to starve the virus for the intermediate term benefit of getting 100% of our freedoms back and growing the economy very rapidly. Millions will go back to work quickly, the economy will boom like never before with > $10T of Stimuls, Aid and Liquidity in the pipes.

Sacrifice a couple months, benefit a couple of decades! It worked in the Northeast. It will work everywhere else as well.

There has been a lot of talk about the Fed implementing “Yield Curve Control” in recent weeks (as well as in the Fed notes yesterday). This was done post WWII when debt/GDP levels ballooned to 120% as they may soon approach (also due to a war-like scenario we are in fighting COVID). So far, talk has centered around holding the shorter end of the curve yields down (3yr and 5 yr Treasuries). This would have the effect of steepening the curve and pouring profits into banks – as incentives to extend credit and fuel the recovery would abound as Net Interest Margin increased.

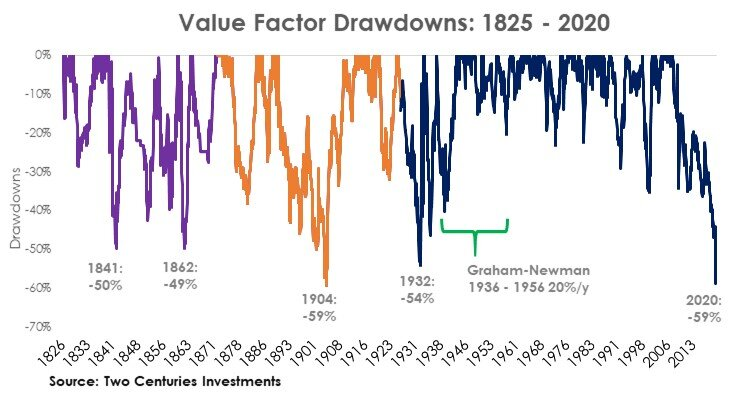

This would further be in line with historic precedent that we have discussed in recent weeks – that cyclicals outperform immediately coming out of recessions. I came across this chart that identified the spread between growth and value over time. We are at an extreme that has not existed since Benjamin Graham began his career and compounded his fund at >20% per year over two decades:

Buffett began working for Graham during this period and carried the principles through his entire career. That was a once in a generation opportunity that seems to be setting up again for the first time in decades.

While banks (and many other cyclicals) look like “the plague” at present, keep in mind the last time things were so grim for banks (and what happened next):

Now onto the shorter term view for the General Market:

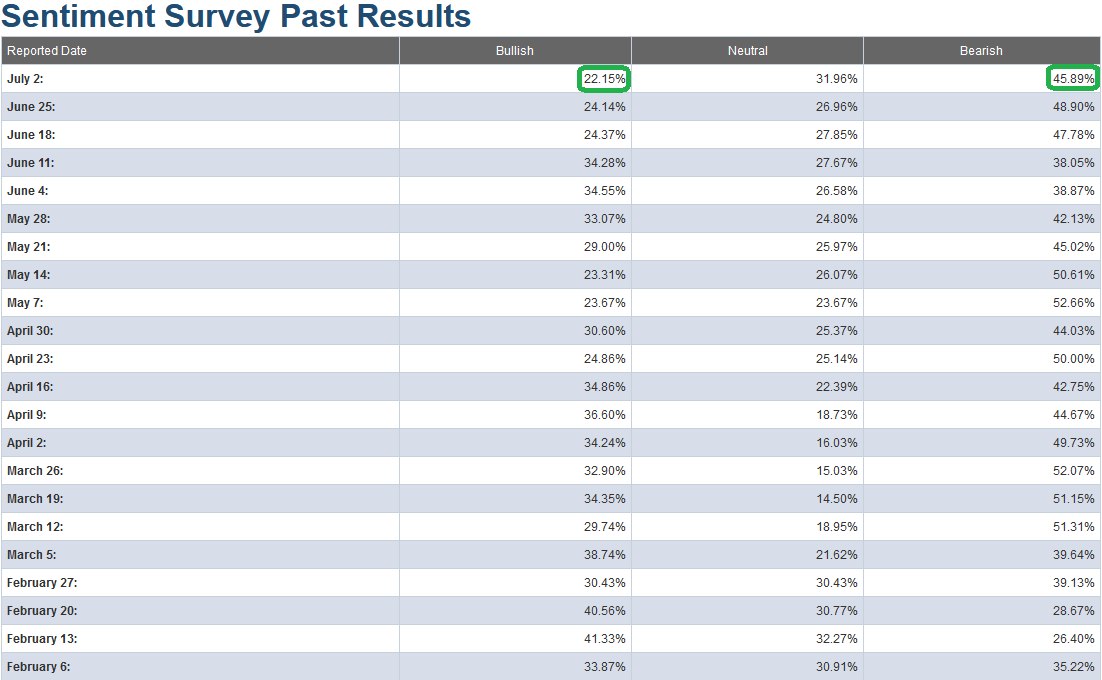

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) slid to 22.15% from 24.14% last week. Bearish Percent moderated a bit to 45.89% from 48.90% last week. These are levels that historically favor being a buyer versus a seller. In the chart below I have annotated what the S&P 500 did after the “bullish percent” dropped below 25 (which is at/near an extreme level in pessimism).

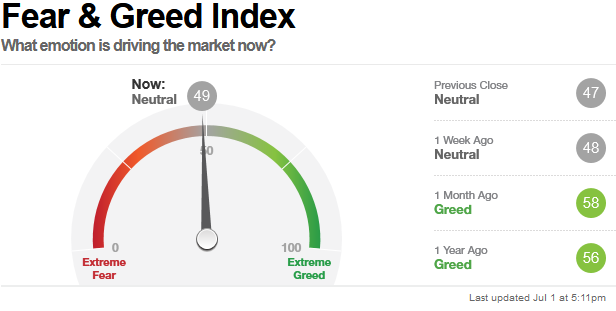

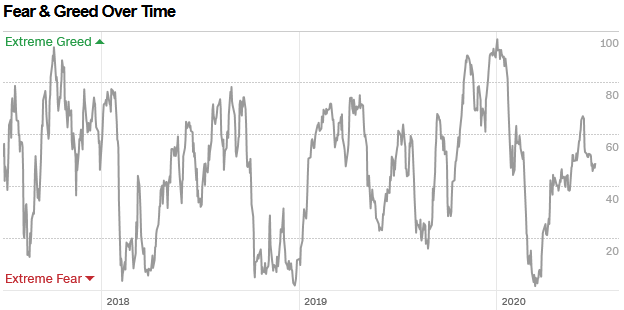

The CNN “Fear and Greed” Index flatlined from 51 last week to 49 this week. Despite the market moving up ~40+% off the lows, we have still not hit anywhere near an extreme/euphoric level (>80/90) yet. You can learn how this indicator is calculated and how it works here: (Video Explanation)

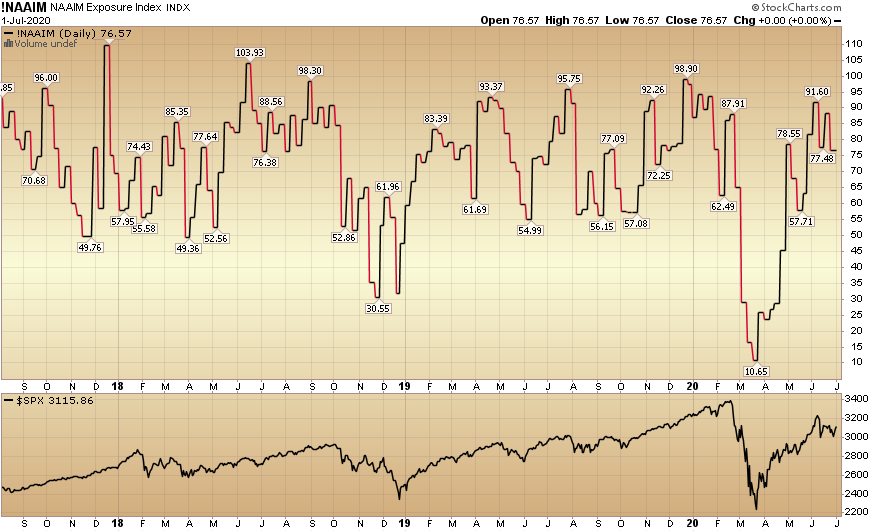

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) slid from 77.48% equity exposure last week, to 76.57% this week.

Our message for this week:

We remain very constructive in the intermediate term and will take advantage of any additional buying opportunities in laggard/cyclical names – should they arise over the summer. In the interim we will hold what we have and shave only in the event we DO hit levels of euphoria that we have not seen since February.

As Vince Neill so eloquently stated:

I’m on my way

Home sweet home…”