On September 25, a man named Nathan Apodaca – from Idaho Falls, ID – posted a TikTok video of himself lip-syncing Fleetwood Mac’s legendary song, “Dreams” (while riding on a skateboard and drinking Cranberry Juice).

This set off a viral internet sensation – garnering well over 38M views in its first week:

When I looked up the meaning of the song, I found this explanation on rare.us:

“Frontwoman Stevie Nicks and guitarist Lindsey Buckingham were breaking up after being together for just shy of a decade. On a day when she wasn’t needed in the studio, she went to another room, into Sly Stone’s studio, and wrote the track. The song was an attempt to philosophically process her separation from Lindsey. Nicks says that she tried to portray a silver lining of hope in the song.”

So what are the salient lyrics as they relate to the Stock Market this week? What first came to mind was the relationship between Speaker Pelosi and President Trump in their “on again, off again” negotiation of a stimulus package:

Now here you go again

You say you want your freedom

Well, who am I to keep you down?

It’s only right that you should

Play the way you feel it

But listen carefully to the sound

Of your loneliness

Like a heartbeat… drives you mad

In the stillness of remembering what you had

And what you lost…

And what you had…

And what you lost

Thunder only happens when it’s raining

Players only love you when they’re playing…

Will we get a comprehensive Stimulus Package to bridge us to a full treatment or vaccine? Will it be a “carve out” deal to tide us over until the Election? If it completely breaks down, will President Trump rely on 200 years for Presidential precedent to re-allocate over $300B that was already approved by Congress in the CARES Act, but not yet spent? (Duke Law)

On Tuesday, I was live on Fox Business “The Claman Countdown” minutes after President Trump sent this tweet:

Nancy Pelosi is asking for $2.4 Trillion Dollars to bailout poorly run, high crime, Democrat States, money that is in no way related to COVID-19. We made a very generous offer of $1.6 Trillion Dollars and, as usual, she is not negotiating in good faith. I am rejecting their…

— Donald J. Trump (@realDonaldTrump) October 6, 2020

Thanks to Liz Claman and Ellie Terrett for having me on. Here’s what I had to say about the stimulus and how it might play out in real time (as the market was dropping fast):

Later on that night I joined Rachelle Akuffo on CGTN Global Business to elaborate on the prospects for Stimulus, Powell’s plea for Fiscal accommodation, IMF predictions, the recovery, the economy, and the outlook for 2021. Thanks to Rachelle Akuffo and Delal Pektas for having me on:

On Monday, I was on “Closing Bell” for CNBC Indonesia talking COVID treatments, President Trump’s recovery, the implications of different Election outcomes, stimulus, Emerging Markets outlook, Commodity Cycle and Asia recovery data. Thanks to Maria Katarina and Yoliawan Hariana for inviting me on:

Generational Opportunity

This week a reporter from Bloomberg reached out with the following question:

“Have you invested throughout Covid? If so, what have you been buying/selling (stocks, rates, any asset class) and where are the opportunities into 2021?”

I will post the full article when it goes to press, but for now, I want to discuss the historic opportunity that is sitting in our laps right now. Here was my response:

We have been investing aggressively through COVID. This is a generational opportunity for some of the laggard sectors that have been left behind during the “Stay at Home” period of COVID. Now that we are beginning the “Re-Opening” period of the COVID crisis, opportunities to position ahead of continued treatment improvements and vaccines abound…

For the month of September, Cyclicals have outperformed Tech – implying the “re-opening trade” is starting. In September; Industrials, Materials, Transports and Financials have all outperformed Technology. We have been adding Cyclicals in recent months and lightening up on “over-owned” pockets of tech.

This rotation is consistent with 2021 Earnings Estimates for the S&P 500. Most cyclical sectors will grow earnings at a FASTER pace than the S&P 500, while Tech will grow earnings at HALF the pace of the S&P 500:

Sectors that will grow 2021 earnings FASTER than S&P 500 (25.7%): Energy, Industrials (87.1%), Consumer Disc. (74.1%), Materials (29.5%), Financials (29.3%).

Sectors that will grow 2021 earnings SLOWER than S&P 500 (25.7%): Comm. Services (20.2%), Health Care (13.6), Tech (13.5%), Real Estate (7%), Cons. Staples (6.7%), Utilities (5.9%).

|

Re-Opening Trade |

Stay at Home Trade |

| Cyclicals/Value Outperform | Growth/Tech Outperform |

| Managers have ABUNDANCE of choice to buy EARNINGS GROWTH. They can pay lower multiples for same growth rate. | Managers have SCARCITY of choice to buy EARNINGS GROWTH. They have to pay higher multiples for same growth rate. |

| VACCINE = Catalyst | Shut Downs/Lock Downs = Catalyst |

| Perform in HIGH economic growth environment (Early Cycle) > 5% GDP Growth environment (which we will have in 2021) | Perform in LOW economic growth environment (Late Cycle) < 2% GDP Growth environment |

| Examples: Financials, Industrials, Materials, Energy, Transports, etc. | Examples: Tech, Healthcare, Biotech, etc. |

2008-2009 was the only recovery of the last 14 that was not lead by Housing. This recovery will be lead by housing/cyclicals (as 85M millenials are at the age of housing formation and COVID has accelerated the pace). On top of that, low rates are helping with financing and urban exodus is accelerating the trend. This trend is just beginning…

In March and April we were buying homebuilders. In recent months we have been aggressively buying banks. You cannot have a sustainable recovery without credit expansion. Here’s why we are buying US Banks:

- Banks are Over-Reserved. When Banks made their estimates of expected credit losses in Q2 2020, economists were estimating GDP would contract as much as -12% in 2020 and unemployment could balloon over 20%. The opposite has happened: Unemployment is at 7.9% and 2020 GDP is expected to contract by only -3.5%. Banks have not yet changed their credit reserves to reflect this improvement.

- In Q2, banks had to comply with a new accounting standard called CECL (Current Expected Credit Loss). What this means is that for the first time ever, they had to account for the “worst case scenario” of credit losses ALL UP-FRONT versus reviewing and adjusting on a quarter by quarter basis. What does in mean in terms of reporting? Because of this artificial accounting change, the big four banks (JPM, BAC, C, WFC) earned just $5 billion in second-quarter pretax income, compared with roughly $34 billion in the second quarter of 2019. Due to CECL, the top four banks’ loan loss provisions in Q2 2020 were $33B versus less than $5B in Q2 2019. The ECONOMY was not responsible for the majority of these extra provisions, it was exclusively the accounting change. IF THE ACCOUNTING RULE STAYED THE SAME (and you were comparing apples to apples), the “big 4” would have had earnings of $28B pre-tax. While this is not as high as the $34B they earned in Q2 2019, a $6B swing is reasonable considering the world was shut down for 2-3 months. So banks (many trading at a discount to book value) are reflecting an apocalyptic economic scenario that has not played out. Instead, it is likely that these reserves will be reversed in upcoming quarters and come back as INCOME/EPS. This is NOT priced into the stocks, and we believe patient and astute investors will be rewarded.

- Our top pick and position is Wells Fargo. It is trading a ~38% discount to book value. It has only done this two times in history (2009 and in the early 90’s). It recovered back to book within months (not years) in both instances (this would imply ~65% increase from current levels). Keep in mind, banks like Wells Fargo traded as high as 1.75x book – just a few years ago – which would imply significant upside from its current discount to book (over time).

- Jamie Diamond (CEO JPM), John Shrewsberry (outgoing CFO WFC) and Brian Moynihan (CEO BAC) have all indicated – in recent weeks – that some of these credit reserves may be excessive and reversed in coming quarters.

So while many investors fear new credit loss provisions, the reality is that the opposite may be true. The big banks are likely over-reserved and investors who are positioned now will benefit from their over-caution in Q2 – as they release these reserves in coming quarters. It may require some patience and bearing short-term volatility, but these dislocations, valuations and opportunities only come around a few times in a long career.

Another point to consider is what I covered in my segment with Liz Claman this week. If in fact there was another stimulus check issued (in a package, carve out, or Executive Order), it would amount to ~$300B. According to a study done by NBER on the first stimulus checks, only 40% of the money was spent by recipients. The remaining 60% was used to pay down debt or add to savings.

A second stimulus check would dramatically accelerate the pace at which banks could begin to release reserves and book those releases as income/eps. We estimate the “Big 4” banks are over-reserved by ~$23B. These reserves will be future earnings that are not priced in to these stocks at present.

Update on the “Most Hated” Stock in the S&P 500

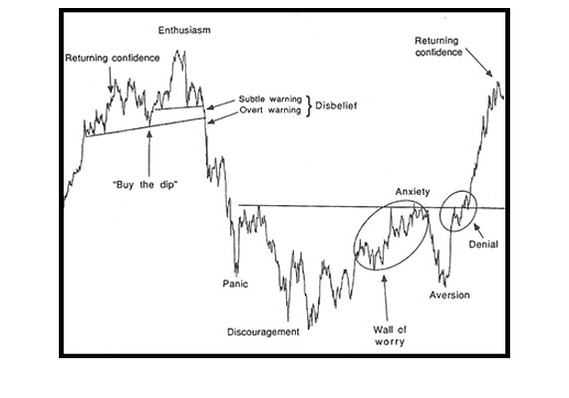

Last week, after discussing the fundamental thesis for Wells Fargo (see here for previous note’s context), we presented this timeless roadmap for Sentiment (as it relates to a stock, sector or the general market):

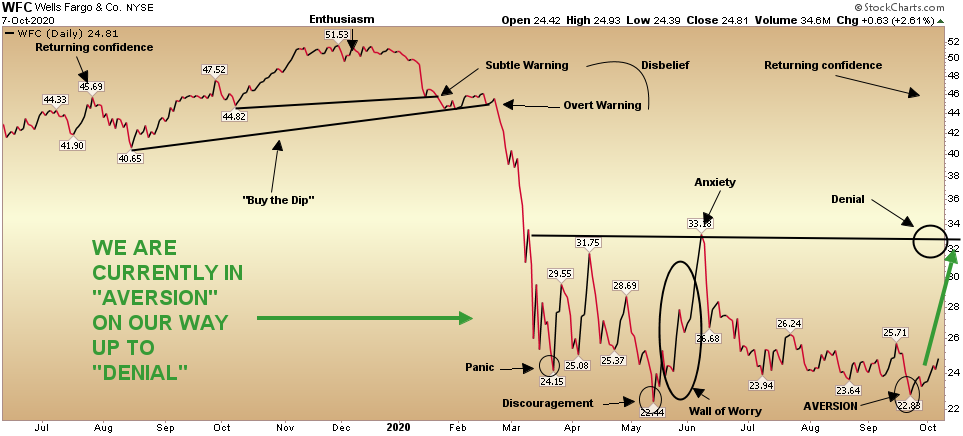

This week’s updates show that the “Most Hated” stock in the S&P 500 is following the path back to redemption:

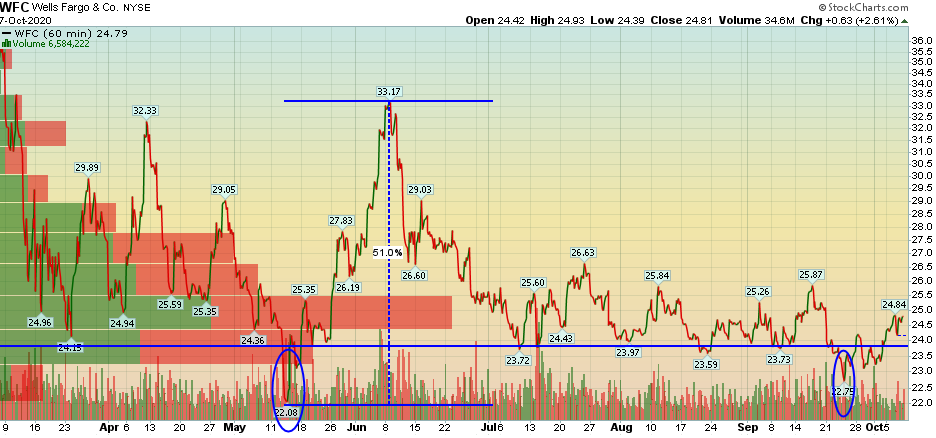

The Cobra Kai “Leg Sweep” has proved to be the short term bottom (up 8.96% off the “leg sweep” low):

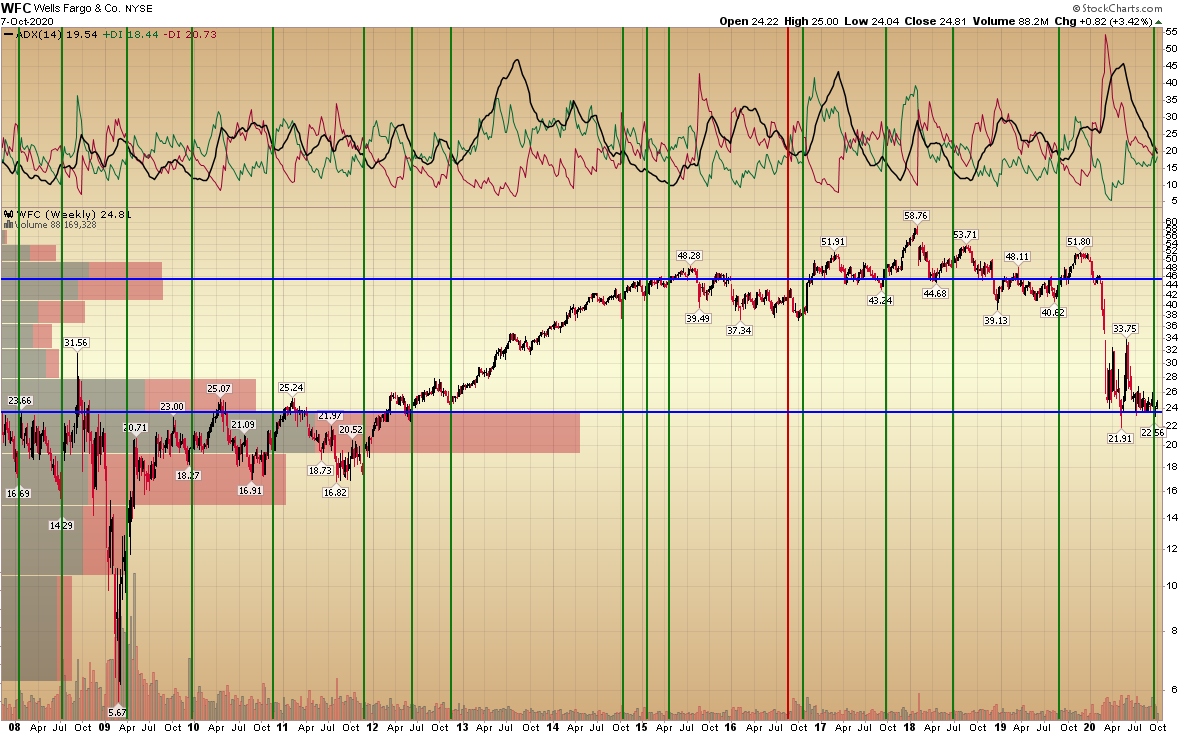

The 15 of 16x ADX crossover statistic is still holding in place on a long-term basis:

Now onto the shorter term view for the General Market:

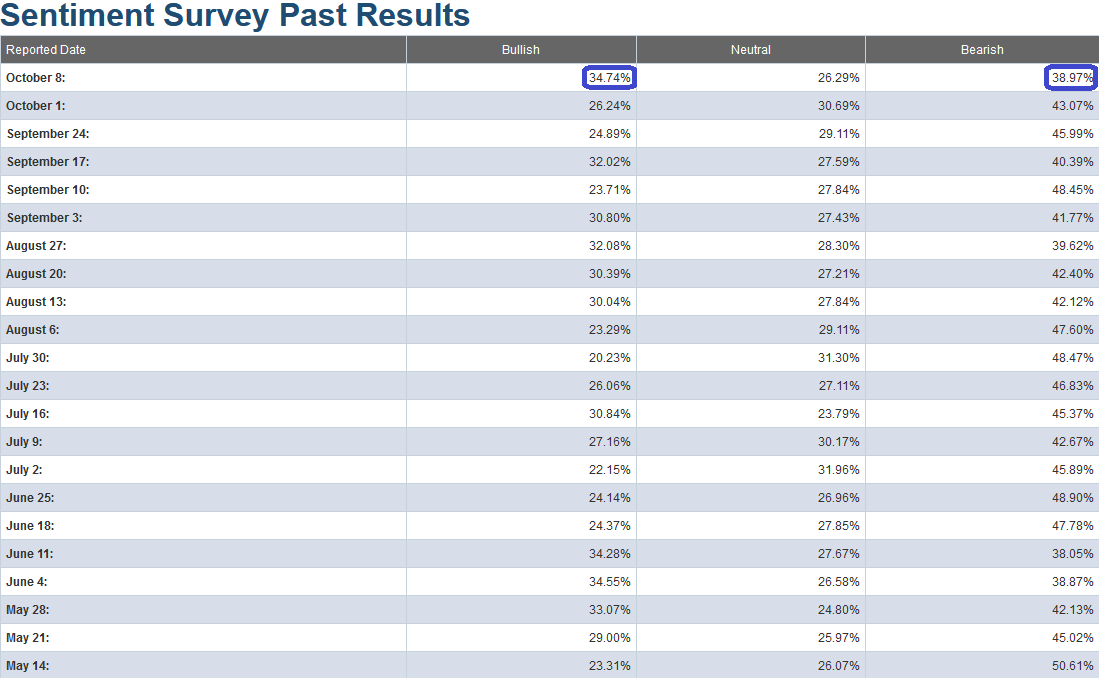

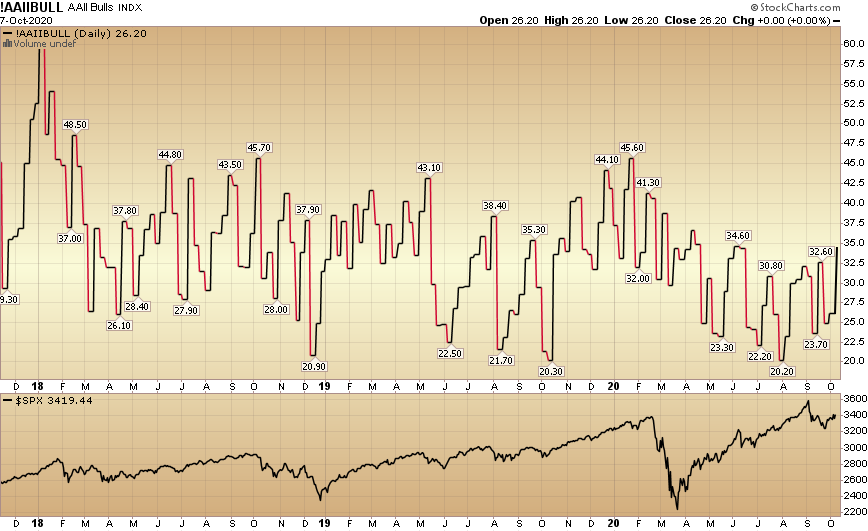

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 34.74% from 26.24% last week. Bearish Percent fell to 38.97% from 43.07% last week. Enthusiasm is now present, but we have some rock to climb before hitting euphoria.

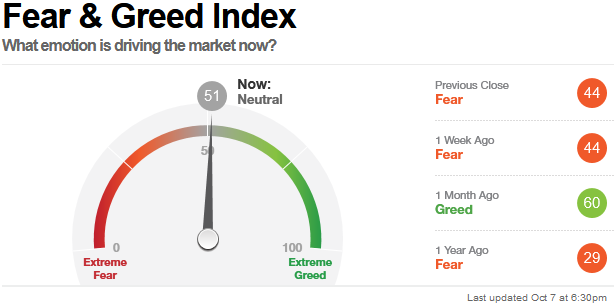

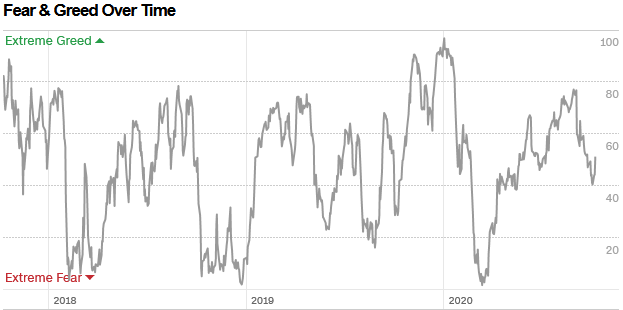

The CNN “Fear and Greed” Index ticked up from 45 last week to 51 this week. This indicator is still in the middle of the range. You can learn how this indicator is calculated and how it works here: (Video Explanation)

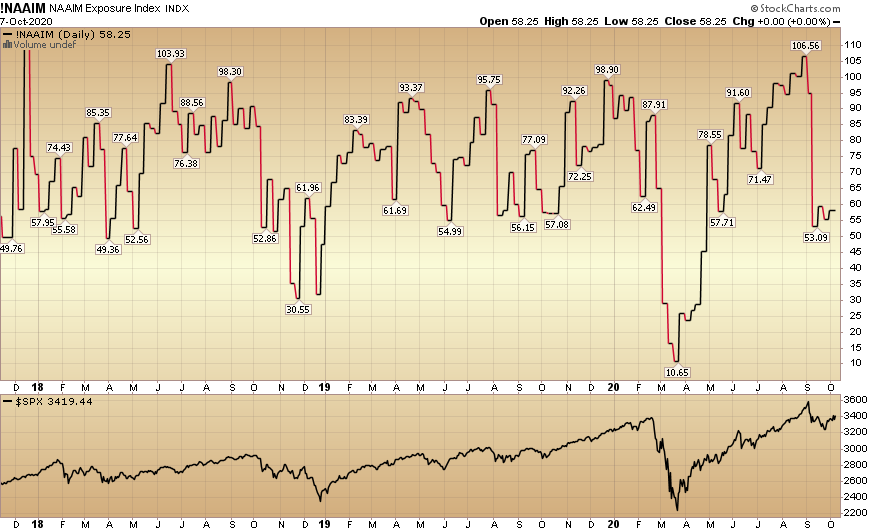

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) inched up from 55.3% equity exposure last week, to 58.25% this week.

Our message for this week:

As I have repeated for a few weeks, the catalyst for change (a continuation of the move into Cyclicals) will likely come from science at this point. Don’t bet against science.

Not only do we have 4 vaccines in Phase 3, but we are seeing major progress on treatments as well. The Regeneron drug we highlighted in the last two weeks’ notes has played a pivotal role in President Trump’s quick recovery. It may prove to be as (if not more) important than the vaccine when all is said and done:

A MESSAGE FROM THE PRESIDENT! pic.twitter.com/uhLIcknAjT

— Donald J. Trump (@realDonaldTrump) October 7, 2020

The market is starting to ease into the “re-opening” trade (Cyclicals) – in anticipation of the imminent vaccine approval. We saw this with Industrials, Materials, Transports and Financials all outperforming Tech in September.

Given the legacy overweight to tech, my sense is there is still some more to work out in the coming week(s) for some of the overvalued pockets of tech/saas, etc. The anti-trust risk that we covered ~5 weeks ago in our podcast is now gaining momentum:

House Lawmakers Condemn Big Tech’s ‘Monopoly Power’ and Urge Their Breakups (New York Times)

That said, there’s enough money ($4.4T cash on the sidelines) that has yet to broaden their exposure and get positioned for the “re-opening” trade move into cyclicals/value.

These economically sensitive names outperform in the early/high economic growth stages of a new cycle – which we have started in Q3. We will continue to take advantage on any short-term weakness – as when the re-opening trade flips on in earnest – it will be abrupt and meaningful for those who are correctly positioned…

But for now, keep on alert for some unilateral action by President Trump. There is well over $300B (approved by Congress and unspent from the first CARES Act) that he may very well release to businesses and individuals in coming days.

The Administration has finally got the message that the “dream” of a reasonably compromised stimulus bill was being slow-walked. We covered that two weeks ago. Now they will do what needs to be done…