~224 Managers overseeing ~$600B AUM responded to this month’s BofA survey.

OUTLOOK:

Theme: “October Fund Manager Survey (FMS) said the recession is over, reduce cash, pause cyclical rotation, and price in contested election. Cyclical rotation via banks/energy to resume in Q4.”

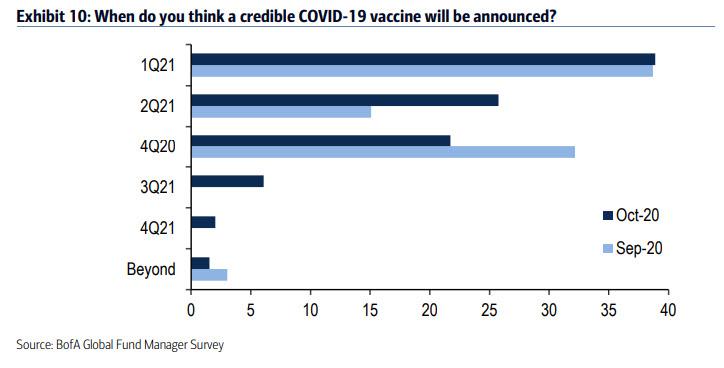

-A net 39% of investors expect a credible Covid-19 vaccine to be announced in the first quarter.

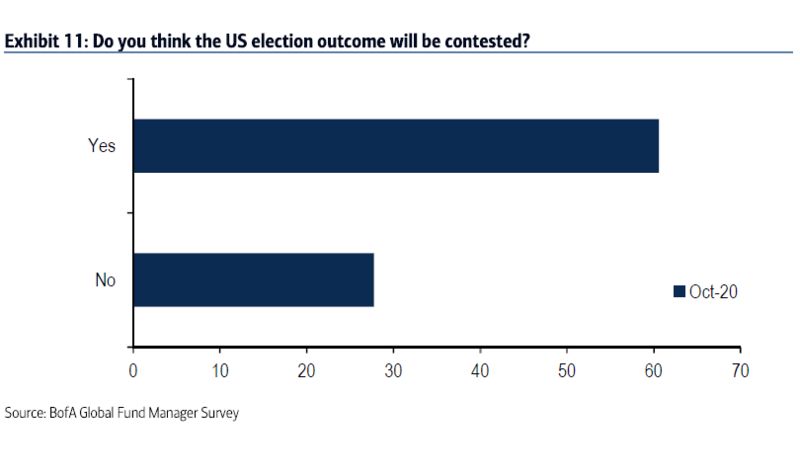

-61% OF POLLED INVESTORS BELIEVE U.S. ELECTION RESULT WILL BE CONTESTED.

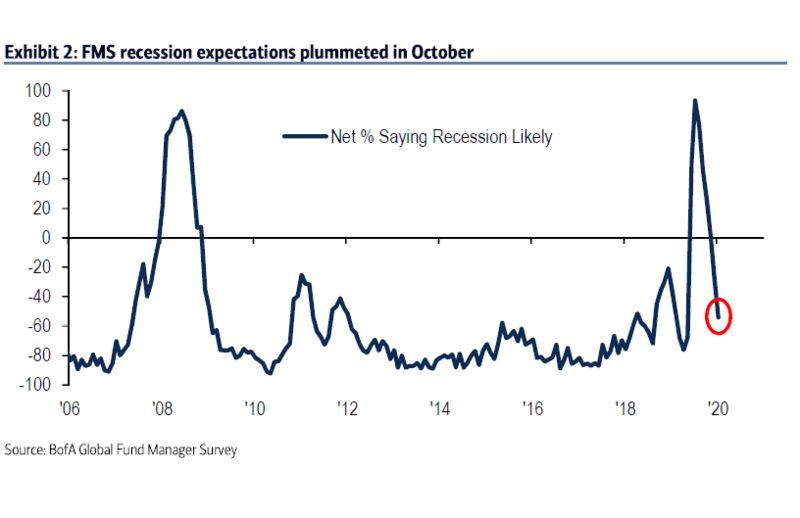

-RECESSION EXPECTATIONS IN NEXT 12 MONTHS COLLAPSED.

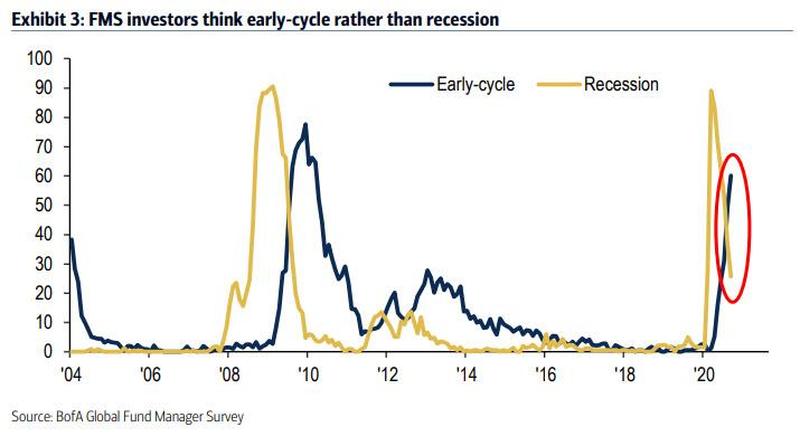

-60% SAY THE GLOBAL ECONOMY IN EARLY-CYCLE PHASE VS 26% IN RECESSION.

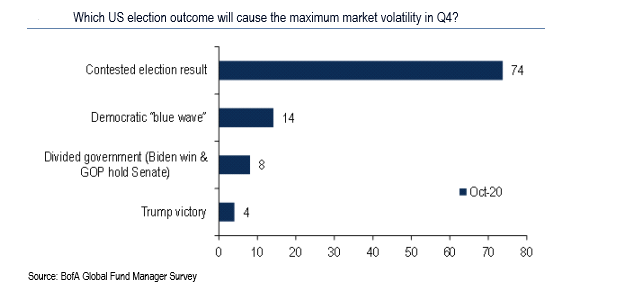

-Nearly three quarters of investors surveyed by Bank of America (BofA) expect a surge in financial market volatility in the fourth quarter.

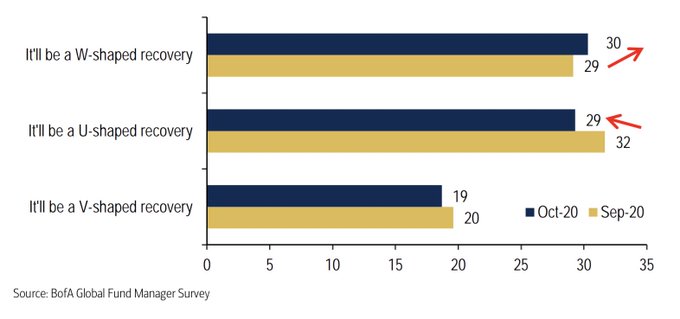

-Investors continue to expect a bumpy or a slow recovery, with -Majority (59%) expect either a W- or U-shaped recovery. Just 19% say V shaped despite US fiscal policy.

SENTIMENT:

-RECESSION EXPECTATIONS IN NEXT 12 MONTHS COLLAPSED; 60% SAY GLOBAL ECONOMY IN EARLY-CYCLE PHASE VS 26% IN RECESSION.

-Max Conviction: Tech.

-Rising Conviction: Healthcare.

-Max Despair: Energy and Banks.

-BofA Bull Bear Indicator at 3.8, indicates final capitulation into risk ahead in Q4.

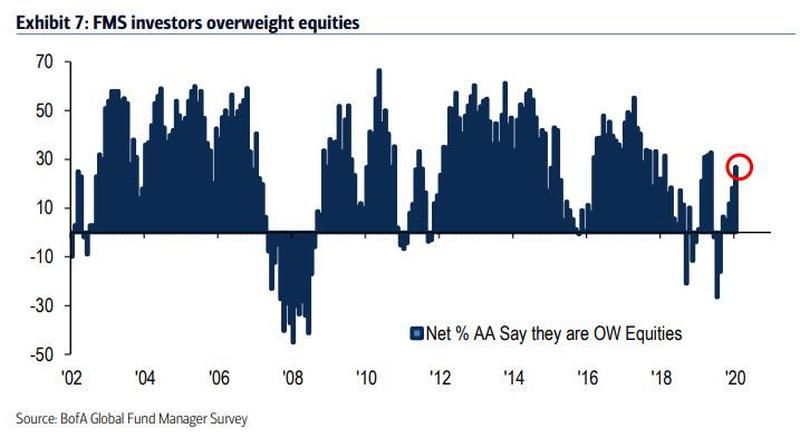

-27% of survey participants saying they are overweight stocks. According to BofA, this level shows they are optimistic on equities, but not “dangerously.”

POSITIONING:

-BofA: Michael Hartnett said they expect the cyclical equity rotation into banks and energy to resume in the fourth quarter.

-FMS investor optimism on stocks higher (net 27% OW) but not yet extremely bullish

-TECH LEADERSHIP IN EQUITIES IN 2021: 50% SAY YES, 43% SAY NO

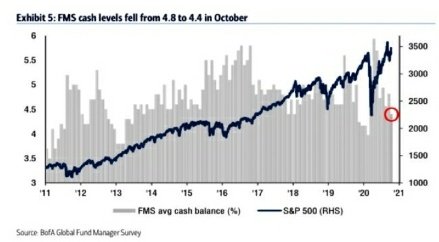

-Investors lowered their cash levels from 4.8% to 4.4%. When cash levels are above 5%, it indicates “fear” and when levels are below 4%, it indicates “greed.”

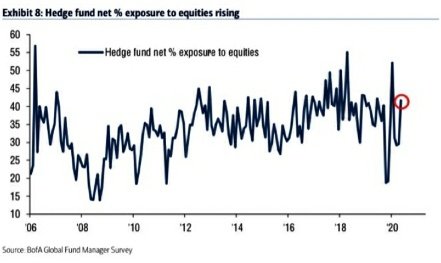

-Hedge funds increased net equity exposure to 42% from 30%, the highest level since June 2020.

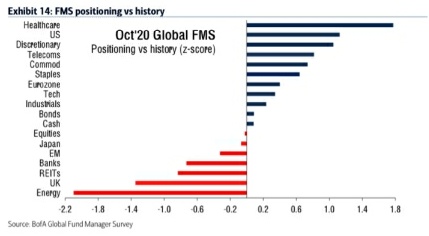

-Most underweight energy since April. (2.1 SD underweight)

-Most Overweight Healthcare since May (1.8 SD overweight)

-Managers are moving into Value over Growth and Small Caps over Large Caps.

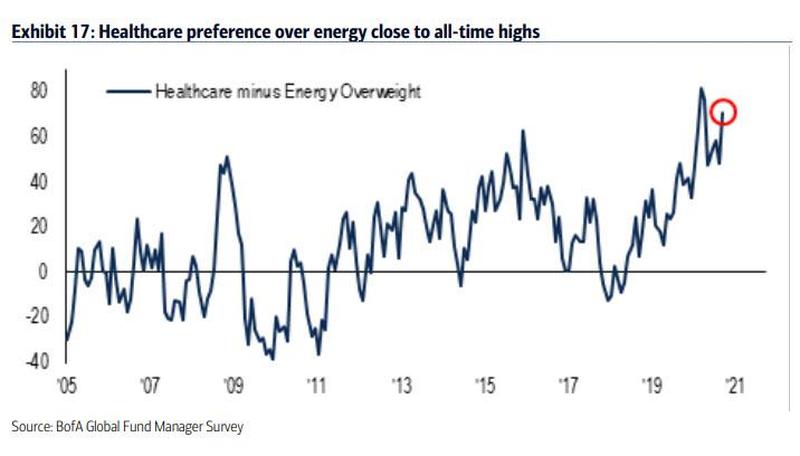

-Fund managers paused the rotation into cyclicals, selling energy and banking stocks along with bonds while buying healthcare, staples and Japanese shares.

-Allocation to Euro-zone stocks increased 4 percentage points to a net 26% overweight, to remain the region with the highest overweight globally.

-Allocation to U.S. equities rose 1 percentage points to a net 19% overweight.

-Investors remain deeply net underweight U.K. stocks at 33% even after slightly increasing allocation.

-Exposure to Japanese stocks increased the most of any region in October to a net 4% overweight.

-Sellers Strike: Tech

-Buyers Strike: Banks, Energy

-Healthcare over Energy is close to all-time highs (high was Apr’20). The spread was net +41% overweight for Healthcare and -30% underweight for Energy.

-Extremes: Largest short in energy in 20 years. Healthcare OW surges to #1.

-Retail funds (i.e. mutual funds) reduced elevated cash levels this month to 4.3% while Institutional funds (i.e. pension, insurance) reduced cash levels to 3.6%.

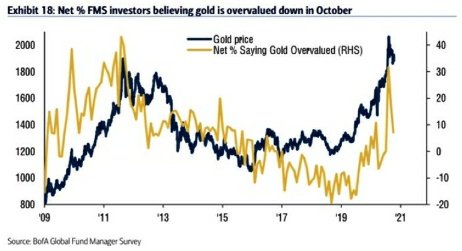

-Sentiment on Gold valuation:

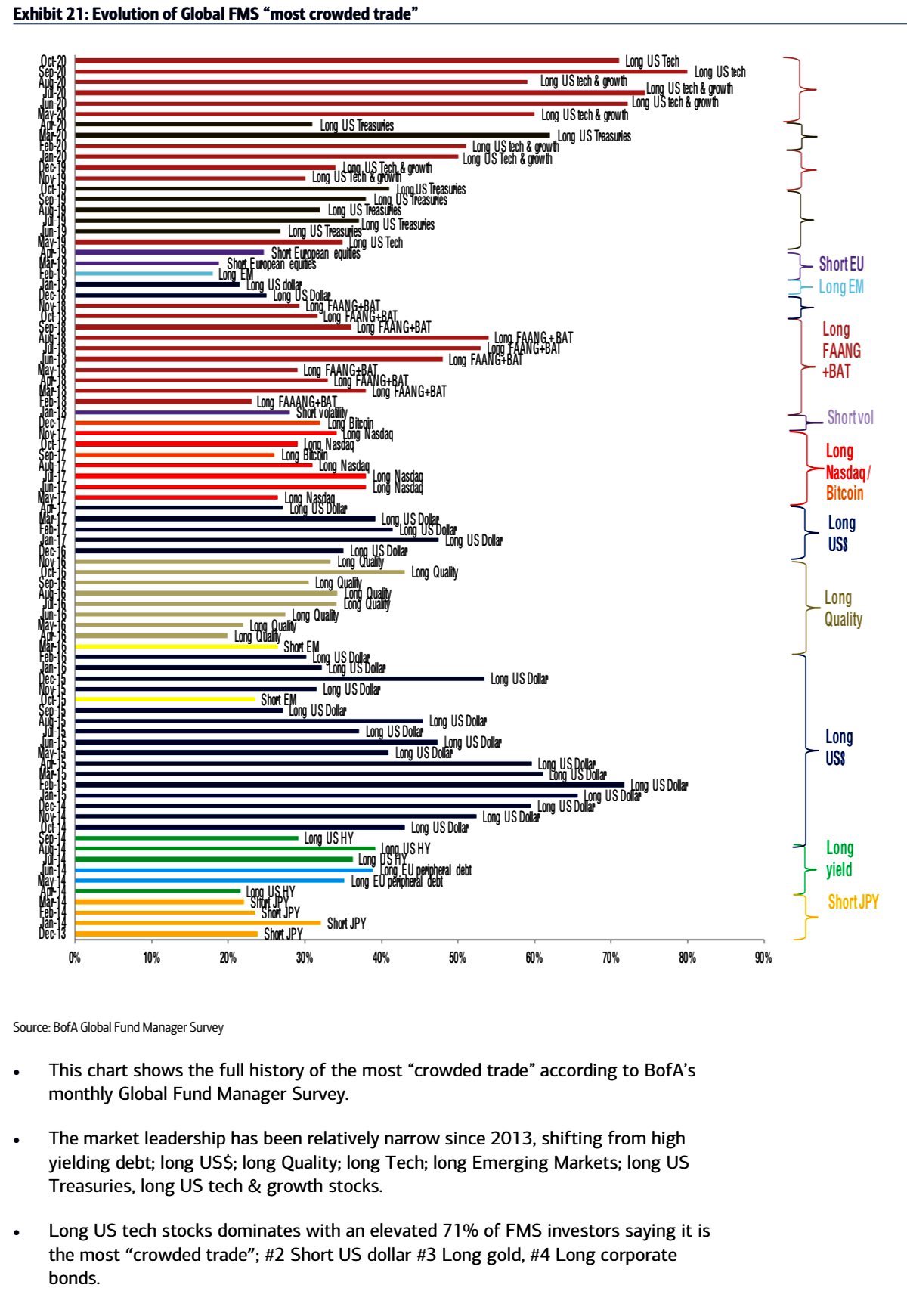

MOST CROWDED TRADE:

-#1 LONG U.S. TECH “MOST CROWDED TRADE” FOR THE SIXTH STRAIGHT MONTH

-#2 short U.S. dollar

-#3 long gold trades

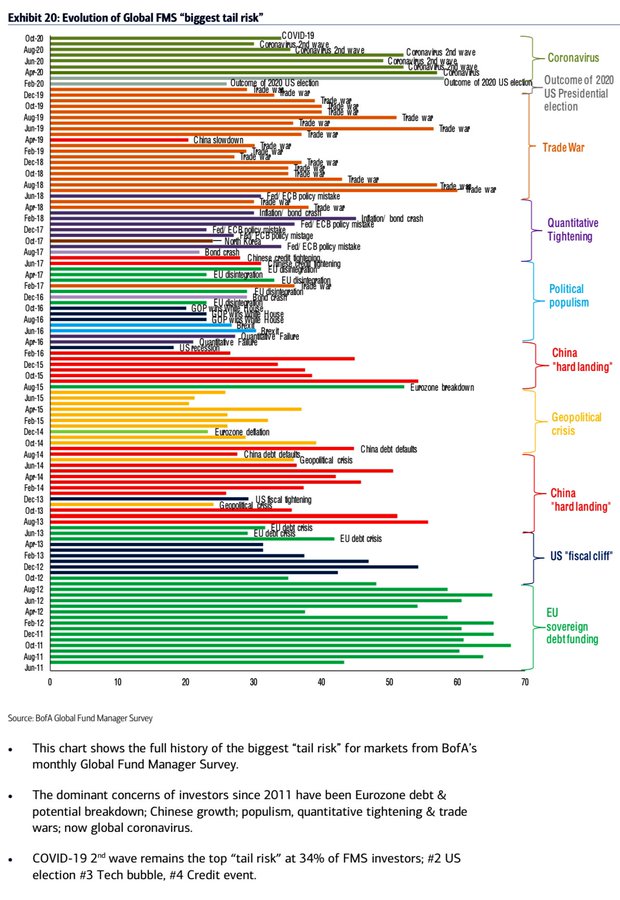

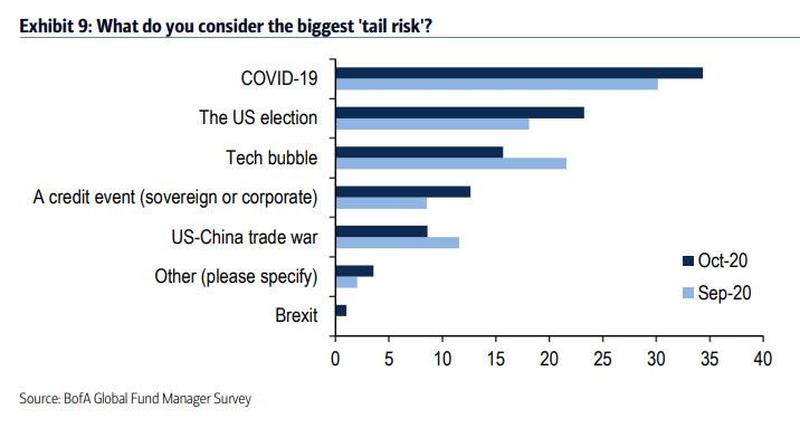

BIGGEST TAIL RISKS:

-COVID-19 (35%)

-Contested U.S. election (23%)

-Tech bubble (16%).