It has been a whirlwind 48 hours. Since there is so much to discuss regarding the election and its implications, the stock market outlook, and the initial knee-jerk reaction of the stock market, I thought it would be more helpful to put the majority of this week’s article in video than print (so I could cover more ground in a shorter period of time).

In this first segment with CNBC Indonesia (from late Tuesday night) I was asked to talk about:

- Gold

- Emerging Markets

- Bonds

- Political Polarization

- Gridlock Outcome and tax/stimulus implications

- Sectors favored by each candidate

- Core political Issues

- Indonesia

Thanks to Daniel Wiguna and Yoliawan Hariana for inviting me on:

Yesterday, I was on Yahoo! Finance with Alexis Christoforous. Thanks to Sarah Smith for inviting me on. In this segment I covered:

- Having your Cake and Eating it too.

- All taste and no calories.

- Dodging a bullet with Gridlock decimating the corporate tax rate increase.

- Impact on Stimulus.

- 4 Pillars to take the market to the next level.

Last night, Indu Choudhary of IIFL asked me to record a video for the largest publicly traded stock brokerage in India (5paisa). They have over 5M app downloads. Later this week she will be showing it to all of their clients. She asked me to cover the following subjects:

- Election outcome and implications for the Stock Market.

- Analysis of FAANG stocks (knee jerk or sustainable trend?) and general market trends.

Now onto the shorter term view for the General Market:

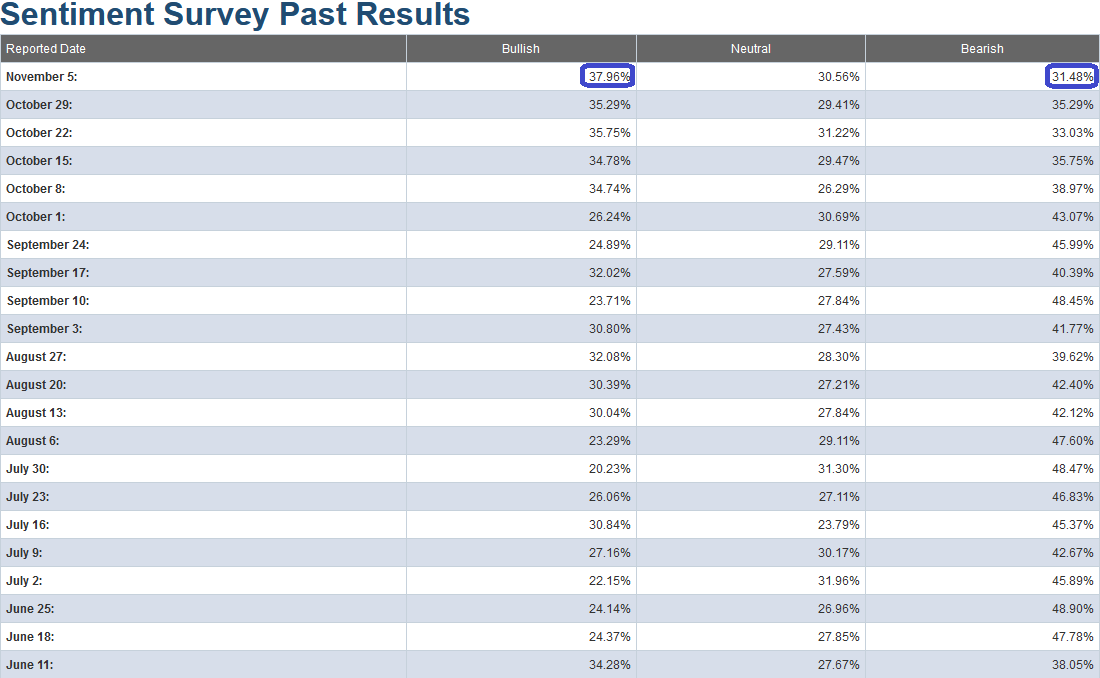

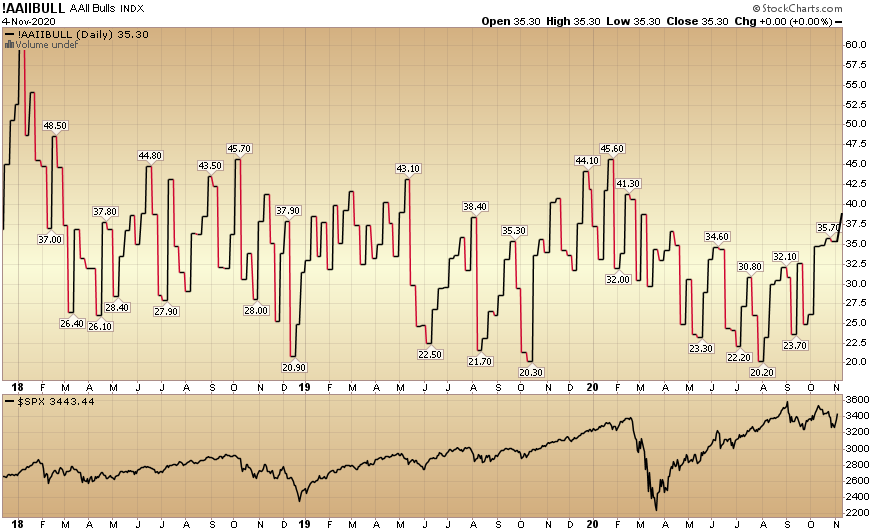

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 37.96% from 35.29% last week. Bearish Percent fell to 31.48% from 35.29% last week. We are nearing extremes in sentiment, but not there yet…

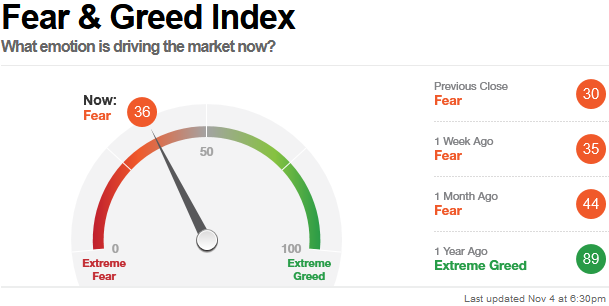

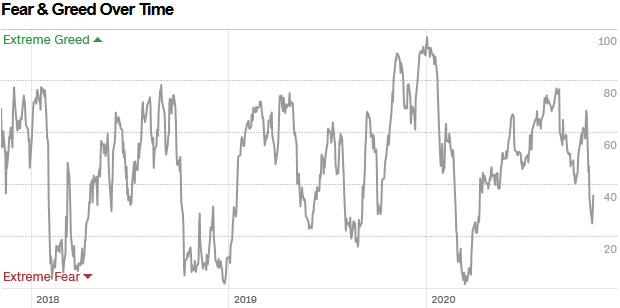

The CNN “Fear and Greed” Index flat-lined from 37 last week to 36 this week. This is surprisingly low given the recent market action. The implication is we can climb this “wall of worry” higher. You can learn how this indicator is calculated and how it works here: (Video Explanation)

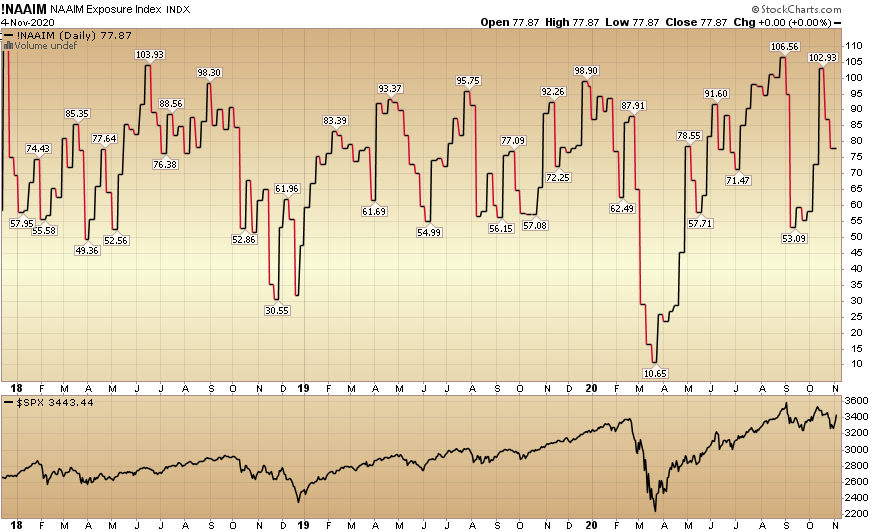

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 77.87% this week from 87.07% equity exposure last week. Fear has continued to persist among active managers, but they will have to chase up into year end.

Our message for this week:

As I have emphasized for over a month, the catalyst for change (a continuation of the move into Cyclicals) will likely come from science at this point. Don’t bet against science. Every day that passes we are closer to waking up to an approved vaccine or new treatment.

While the knee jerk reaction to the election was a panic into FAANG stocks and a replay of the Obama Administration’s “greatest hits” album, this is not the time to give up on the cyclical trade. The expectation for slower economic growth – due to the expected election outcome – may be short lived. There is simply too much money in the system now and the stage is set for a new Act (business cycle)…