With the market as elevated as it is, the song we chose to embody this week’s sentiment is U2’s “Elevation:”

You make me feel like I can fly

So high, elevation

Elevation

Elevation

Elevation

The key question everyone is asking is, “are we going to get a correction now?” In my media appearances this week I laid out the “set-up” and what we expect moving forward. I’ve presented the segments in chronological order (most recent first), starting with yesterday’s interview on Yahoo! Finance.

Thanks to Seana Smith, Adam Shapiro, Sarah Smith, and Bridgette Webb for having me on Yahoo! Finance yesterday to discuss the Stock Market, Energy, OPEC, Banks (CECL), the Economy and our favorite stock holding:

And finally, on Monday morning I was on Cheddar TV with Jill Wagner. Thanks to Jill and Francesca Conti for having me on – as well as Taylor Craig coordinating all aspects.

In this segment, we were able to cover a lot of ground related to GDP, Money Supply, GDP Output Gap (and what happened the last 2x it was this wide), Consumer Savings, Inventories, and why the rotation into cyclicals is real and will last:

- There will be no Grinch! Santa Claus is coming to town.

- Last 25 years, market rallies 90% of the time between Thanksgiving and Christmas.

- Since WWII, when the S&P 500 is up 10-15% through November, December closes positive 100% of the time (source: Fundstrat).

- The U.S. economy just came off an amazing quarter (GDP), at an annualized rate of 33.1%, the strongest ever in records going back to 1948.

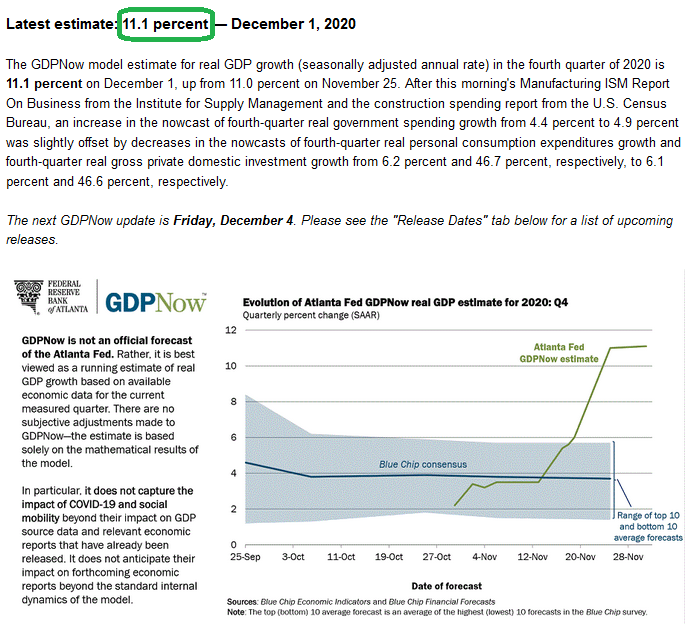

- The Atlanta Fed now has GDP estimates for Q4 at 11.1% (well above consensus):

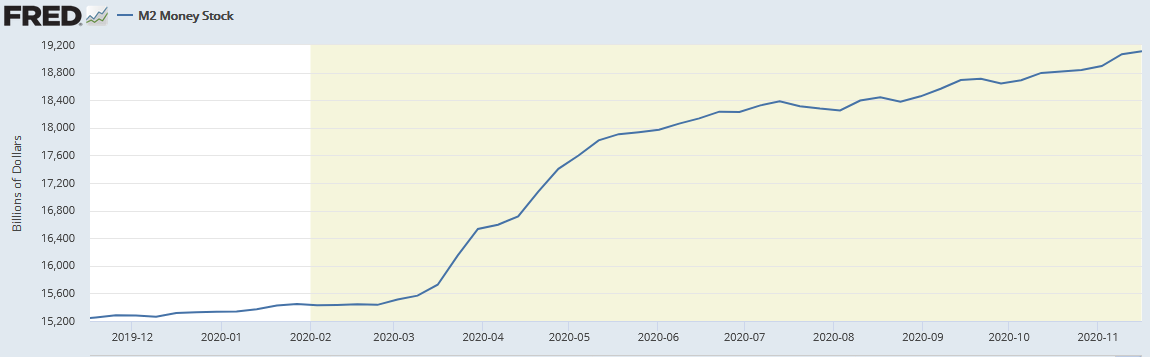

- With M2 money supply growth of ~+25% yoy, GDP should grow 5-6% in 2021.

Consumer Savings/Pent-Up Demand/Inventories

- Consumers have $2.5T of savings and massive pent-up demand. Add the beginning of vaccinations in the next couple of weeks and consumer confidence will start to be unleashed.

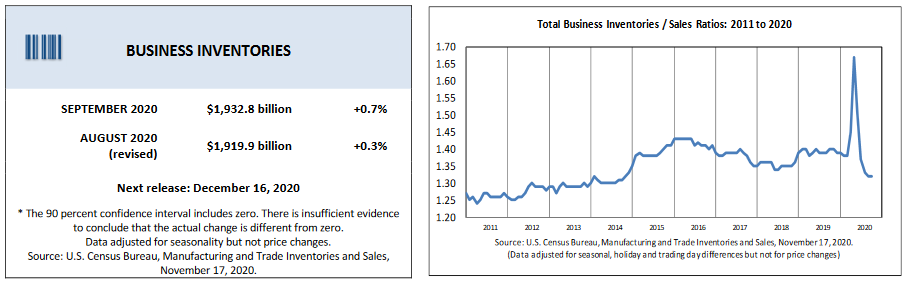

- When consumers up their spending, factories will have to increase production rapidly, because the shelves are almost empty.

- Relative to the level of economic activity, U.S. inventories are near the leanest levels in history.

Fiscal/Monetary Policy Lag

- Lagged (6-9 months) impact of $12T global fiscal stimulus and $7.5T of global monetary policy/liquidity implemented in Spring and Summer is just starting to kick in.

- $20T to solve a -$3.66T problem (-4.4% global GDP contraction in 2020).

Output Gap:

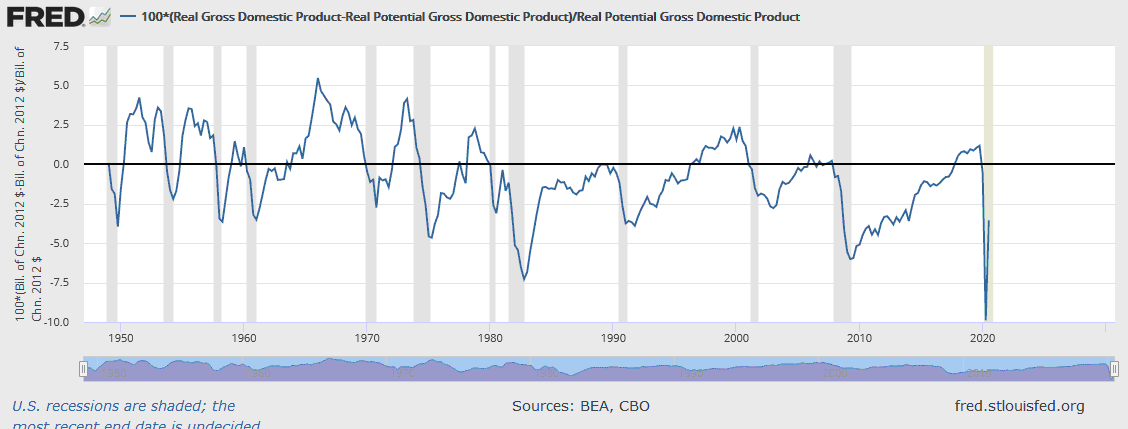

- The output gap is the difference between where actual GDP is from what it potentially could be if you had fully employed all the resources at normal productivity – it fell to near negative double digits in Q2.

- It is now back to -3.5%, but the last 2x it hit and recovered from levels anywhere near this were Q4 1982 and Q2 2009. Both marked the beginning of historic multi-year bull markets.

- As we are seeing play out, the groups that performed the best in the early stages following this level of output gap were: cyclicals/value and small caps.

Cyclicals

The rotation is real, and it is persisting with the additional catalyst of vaccine announcements.

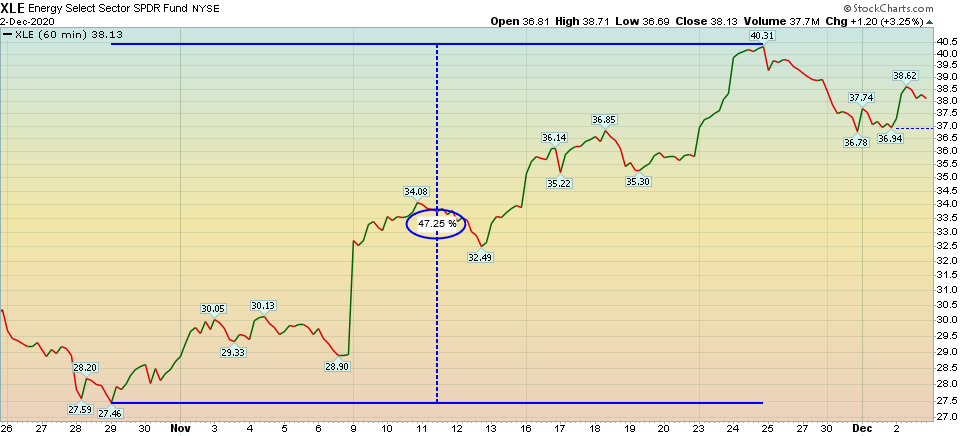

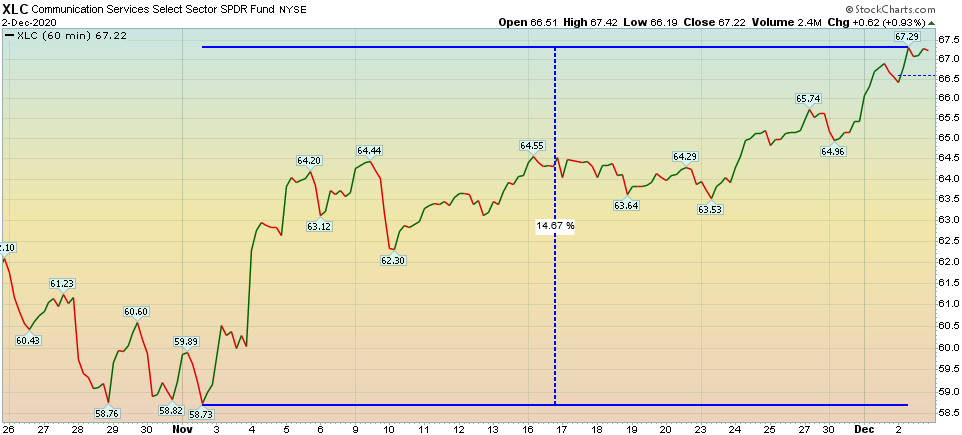

Energy ~47.25% move…

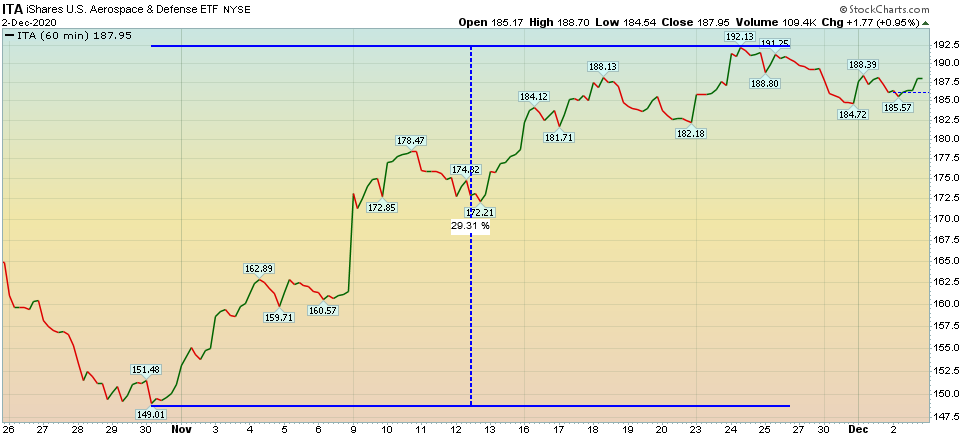

Defense and Aerospace ~29.31% move…

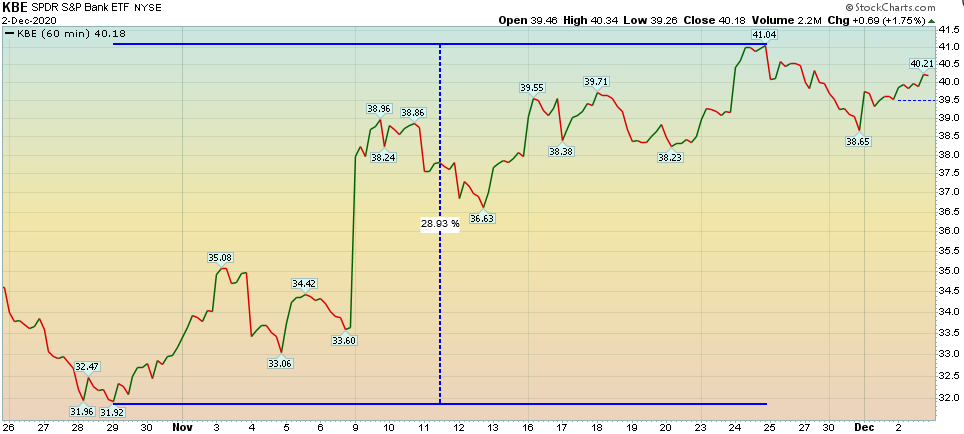

Banks ~28.93% move…

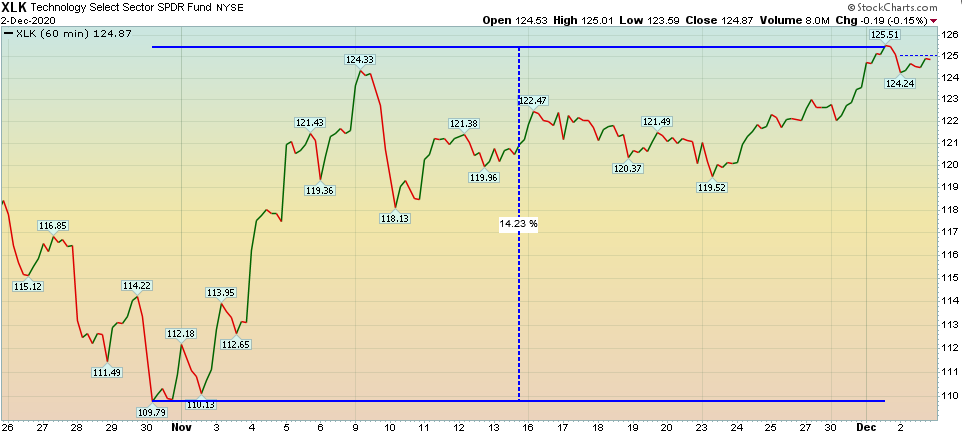

COMPARE THIS TO:

Tech Stocks UP only ~14.23%

With all of the focus on “Dow 30,000” in the past week, what people fail to recognize is we’ve been treading water for almost 3 years.

The DOW has appreciated only 12.49% or ~4.09% per year (ex-dividends) since January 2018. This is well below trend and more consistent with a long term consolidation prior to taking its next multi-year bull move following a multi-year rest.

Where people get confused is with recency bias, “we just rallied over 61% off the lows – we have to crash.” Versus, the market has done nothing for three years after consolidating a decade of gains. It’s ready for a new leg higher after breaking out…

Let’s take a look at a few historic sharp rallies off lows, and what happened next:

Did it make sense to short a 60% rally in a “new business cycle” the last three times?

Taking an even larger step back, we can see that the past two decades are WELL BELOW TREND, compounding at just 4.55% per year (ex-dividends) since 2000. In other words, despite all of the “doom and gloom” you hear about “new normal” and “lost decade” – the real narrative should be “catch up to the long term trend” of 8-10% total annual return (depending on your starting point).

Remember, “OPINION FOLLOWS TREND.” WFC (Wells Fargo) was upgraded again this week (by Morgan Stanley) with a $40 price target. Expect more bearish sell-side analysts and commentators to come out bullish on banks in coming weeks. The floodgates will open AFTER it’s up 50%.

NEVER FORGET, WALL STREET IS THE ONLY MARKET IN THE WORLD THAT WHEN THEY HOLD A “50% OFF” CLEARANCE SALE, NO ONE SHOWS UP!

IT’S ALSO THE ONLY PLACE IN THE WORLD THAT IF YOU HAD THE COURAGE TO BUY WHEN THE MERCHANDISE WAS ON CLEARANCE, PEOPLE WILL BE TRIPPING OVER THEMSELVES TO TAKE IT OFF YOUR HANDS AFTER IT’S UP 100% OFF THE LOWS! BE SURE TO HELP THEM OUT WHEN THE TIME COMES…

Now onto the shorter term view for the General Market:

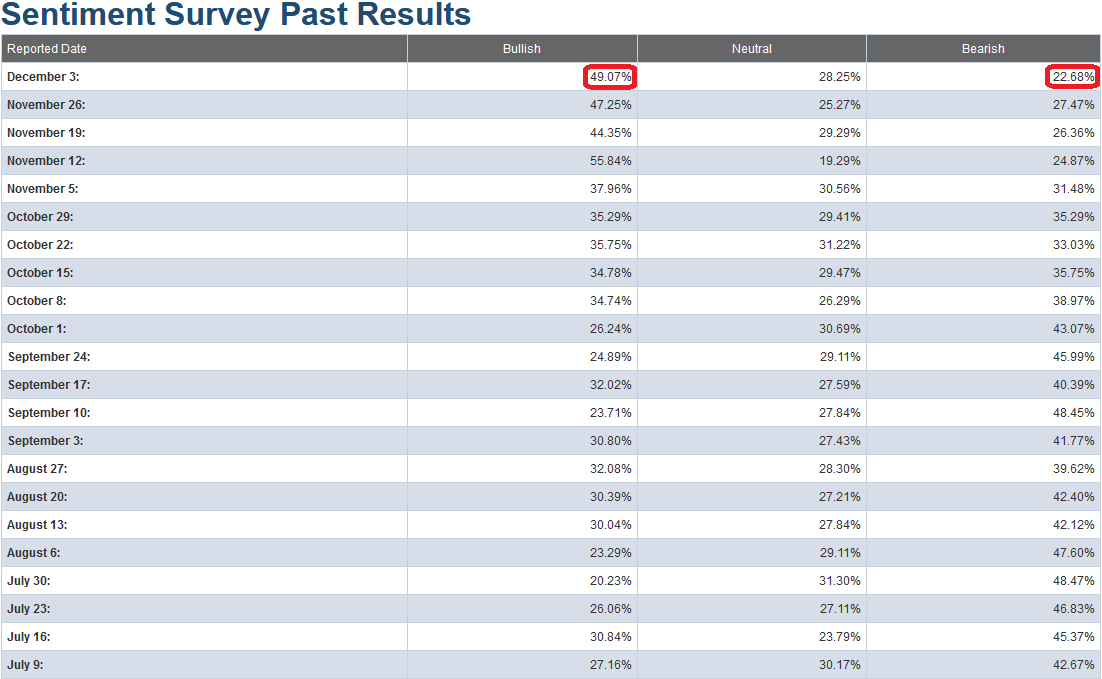

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 49.07% from 47.25% last week. Bearish Percent fell to 22.68% from 27.47% last week. We are still at an extreme in sentiment for retail investors.

Just like last week, while this is still an extreme in short-term sentiment – and should be heeded in the short-term – it is important to note in the chart below, that while similar levels presaged a short term top in early 2018, they occurred near the beginning of a longer term uptrend at the end of 2016-2017 (right after the last Presidential election).

We noted the similarities between the pre-election stock-market in 2016 versus 2020 in our October 29, 2020 note. It has played exactly according to script ever since, which is why I am inclined to give this extreme level in sentiment the same “benefit of the doubt” as late 2016. Just like then – most managers were off-sides and flat-footed going into the election and had to panic into the market to play “catch up.” You can review the October 29 note here:

The “Back to the Future” Stock Market (and Sentiment Results)…

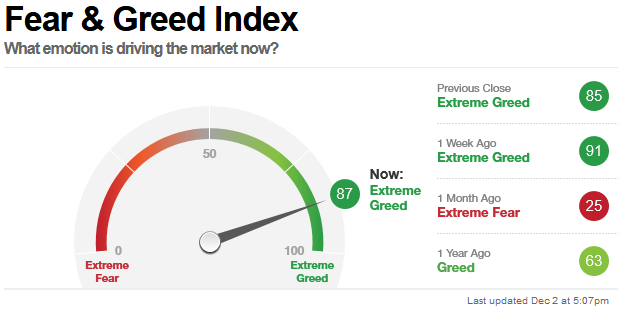

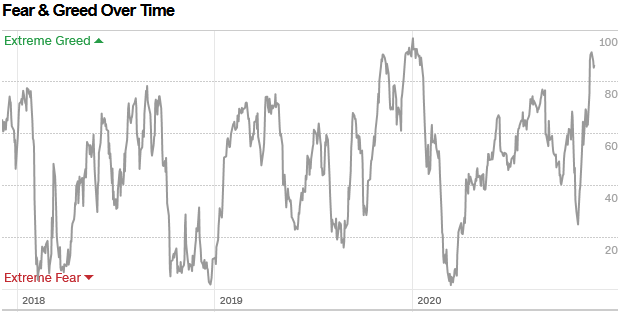

The CNN “Fear and Greed” Index moderated from 91 last week to 87 this week. This is still a euphoric read. This is not where you want to be adding risk to as it relates to the general indices.

It can run hot for a while, but the odds start to stack against you if you are not selective at these levels. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) flat-lined at 106.74 this week from 106.41% equity exposure last week. As we said before the election, managers would have to chase into year end – and they are now doing just that. As you can see over the past five years, this level of extreme warrants caution but is not always indicative of a top.

Our message for this week:

Bad News – Short Term Euphoria

- AAII sentiment is extended at 47.25% bullish.

- CNN Fear and Greed at 87.

- NAAIM (Nat’l Association of Active Investment Managers) equity exposure extended at 106.74.

Good News

- Everyone knows this (euphoric measures) and when everyone is expecting a correction, and there’s $4.4T cash on the sidelines, you might not get it.

- What no one is expecting is a melt-up into year end. I’d place higher odds on that – as managers caught flat-footed into the election and have to play catch up. The “pain trade” may very well be UP, not down (in the short term).

- Leave the pullback/correction expectations for sometime in Q1 2021 (when people stop looking for it).

While the (short-term) “easy money” has been made in the general indices (since the March lows), I think the easy money is just getting started in “left for dead” sectors/stocks. I believe Banks, Defense Stocks and pockets of Energy will be as good – if not “orders of magnitude” better (in coming quarters) – than buying the general market in late March.

In the meantime, you will see a parade of “top callers” praying for a buy-able pullback to catch their benchmarks. Even if they are right in the short term and we get a minor pullback, they will be wrong over the intermediate term as the new business cycle has just begun…