This week we chose an unconventional song to embody the theme of our article (and the Stock Market). It comes from a trending song on TikTok with the following lyrics:

Hit It, Hit It, Hit It, Hit It,

Get It, Get It, Get It, Get It…

We are going to talk about these lyrics in the context of sector rotation and rally opportunities “under the surface,” but this innovative Tik Tokker used the song to display his exuberance over the latest JNJ vaccine news:

@washingtonpostA FDA review released Wednesday of the single-shot coronavirus vaccine made by Johnson & Johnson found it was safe and effective.♬ original sound – Johnny Sibilly

On Tuesday, I was on Fox Business – with Liz Claman – on the Claman Countdown. Thanks to Liz and Jacqueline D’Ambrosi Scales for having me on.

In the first part of the segment we discuss the rate of change in 10 year Treasury yields and its impact on the market. At the end of the segment, we discuss three sectors (and six individual names) that the market is “Hitting” and we’re “Getting”:

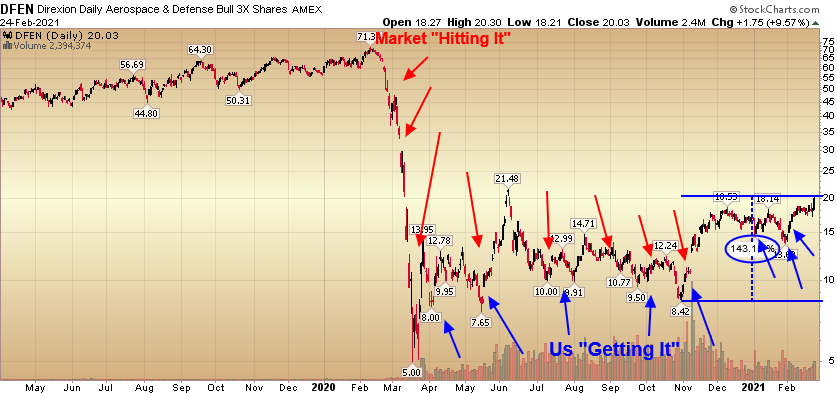

If you’ve followed me for any amount of time, you know by now that I like to buy when a group or company is out of favor and sell it when everyone is clamoring for it. We did it with banks and energy in recent months. While the market was “Hitting It” we were “Getting It!”

Here’s some of what we’ve done in Banks, Energy, Defense & Aerospace (you can review all of our past notes and VideoCasts):

Here’s some of what we’re doing now (Staples, Utilities, Big Pharma):

Here are some thoughts around this new focus:

When capital is free, you get a circus of companies with BIG promises and LITTLE(no) profits. We are seeing pockets of that froth in numerous SPACs and profitless IPO companies trading at nosebleed valuations…

With the 10yr Treasury yield increasing ~50% in in the past 7 weeks (90bps to 135 bps) and ~170% since August (50bps to 135 bps), the market is coming to the realization that capital has a cost.

Once capital has a cost, investors demand profits and the circus must pack up its tent and move on. These type stocks were hit hardest recently (CCIV, NIO, TSLA, SPCE, ABNB). While they may bounce short term, they face more headwinds as rates climb over time (albeit more slowly than the pace we have seen of late).

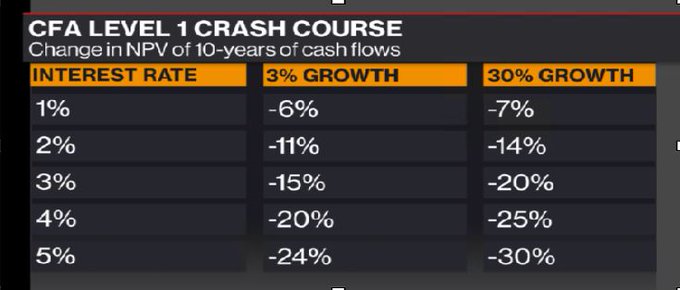

Rising rates is the core reason that money has been coming out of high flying tech stocks, and into the value/cyclicals trade. When you increase the discount rate, the valuations of “growth” stocks are hit disproportionately harder than “value.”

Source: Sarah Ponczek – Bloomberg

Chair Powell calmed markets by trying to make the case this week that inflation spikes will be temporary and that he will keep full throttle ($120B/mo. bond purchases/low short rates) to ensure full employment.

With 2021 GDP projected to be north of 6%, the continued move into cyclicals should persist over the next 18 months – as it does at the beginning of every new business cycle.

While we have emphasized Banks & Energy in recent months, they have now had a huge run. (WFC is up ~90% in the past 3.5 months. XOM is also up ~90% since the Election).

We now expect a bounce in more defensive groups in coming weeks: Consumer Staples (Think Soup “CPB” and Cereal “K”), Big Pharma, Utilities. This is where managers hide when the market gets choppy. These groups are oversold and due for a bounce.

Just like when the market was “hitting” banks and energy for the past six months and people thought we were nuts for buying these “dead” industries (and reducing tech), we will likely see a similar scenario in coming months in our “boring”/”broken down” selective staples, pharma, and utilites.

Source: “The Domino” CNBC

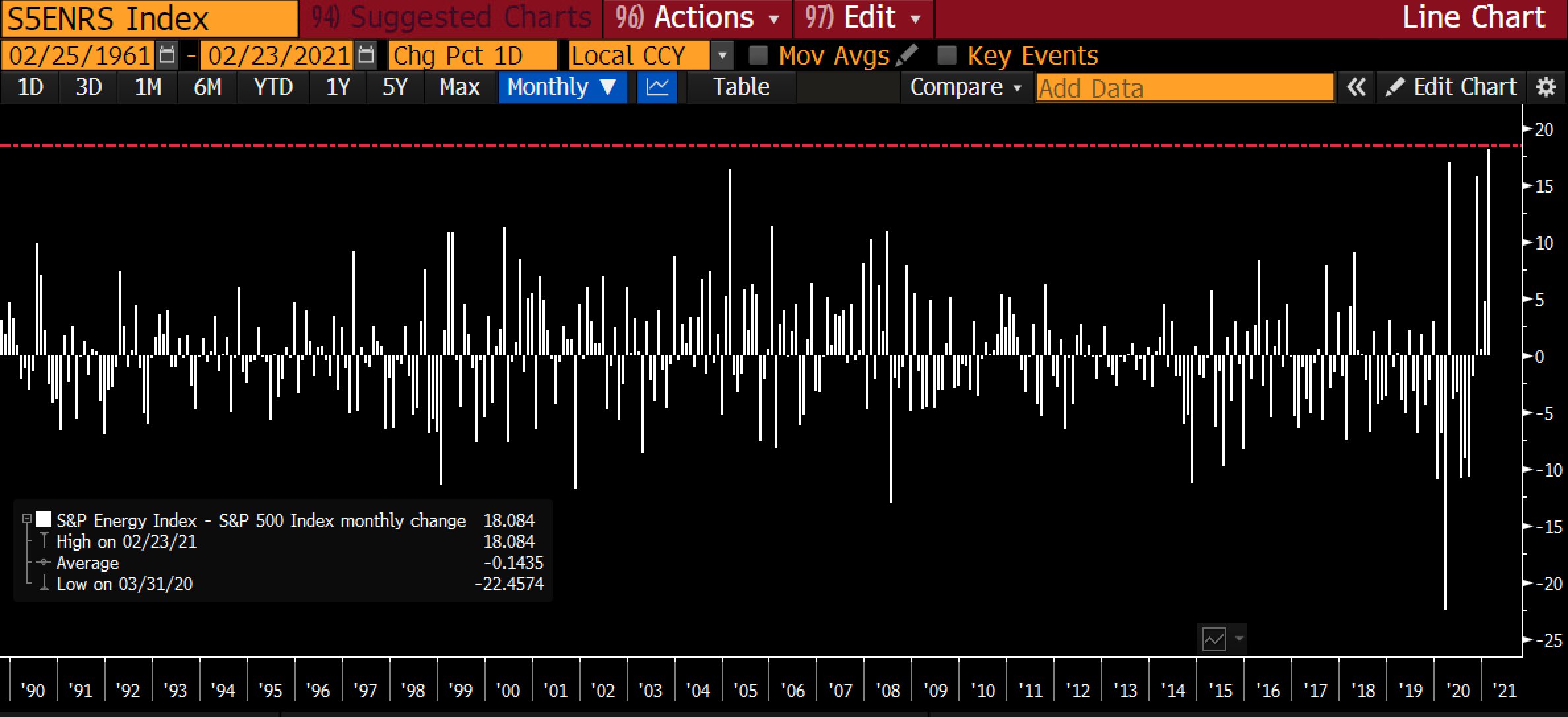

Energy is now up ~32% ytd, while Tech is only up 3%.

The S&P 500 Energy Index is on track for its best month ever relative to the S&P 500. Source: Elena Popina – Bloomberg

The S&P 500 Energy Index is on track for its best month ever relative to the S&P 500. Source: Elena Popina – Bloomberg

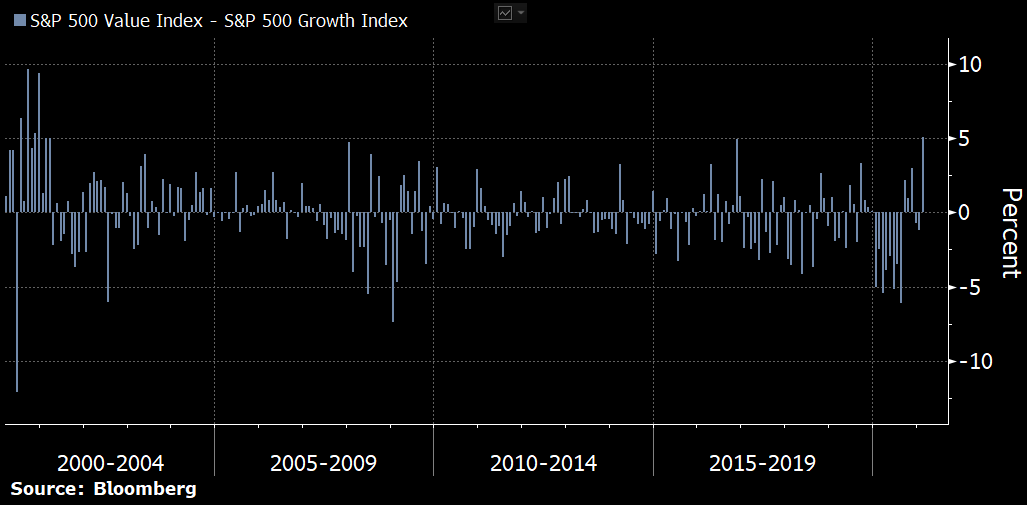

Source: Sarah Ponczek – Bloomberg

S&P value is now on track for best month vs. growth since December 2000.

If you recall, that was the last time that money meaningfully shifted out of growth/tech and into value/cyclicals. We believe this move has legs over the next 18-24 months – even if it takes a breather in the short term.

Now onto the shorter term view for the General Market:

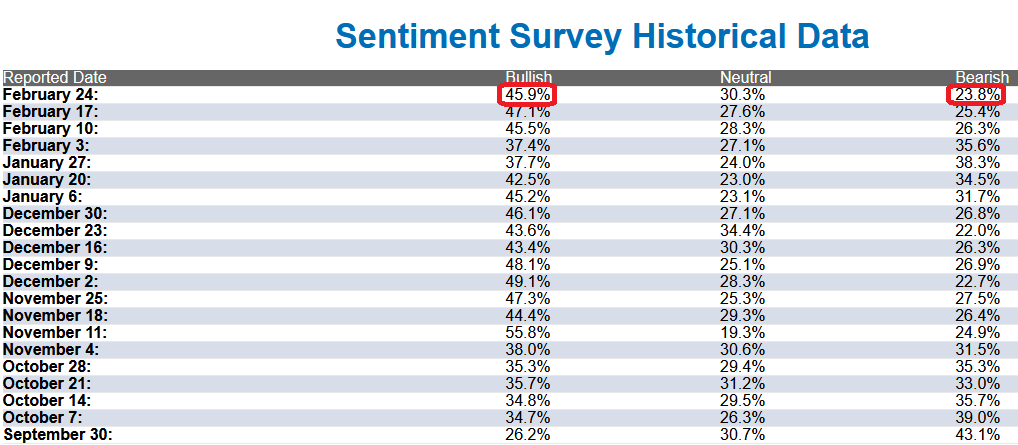

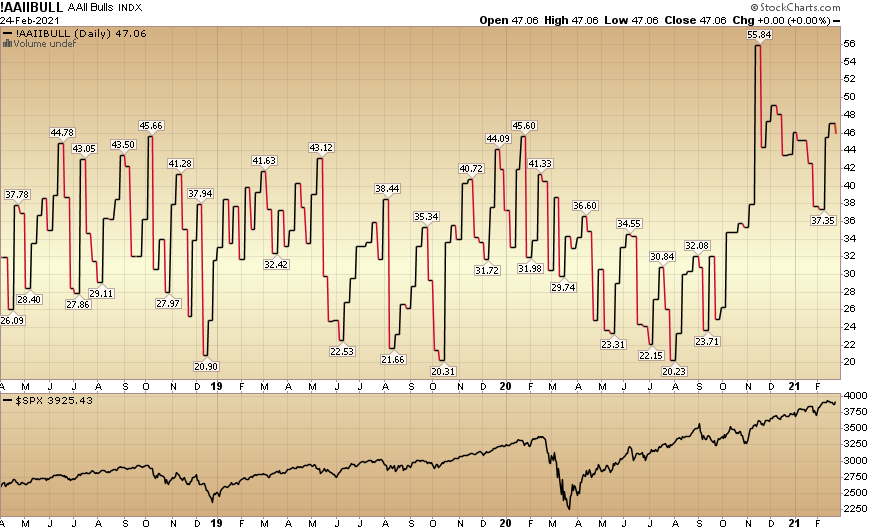

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked down to 45.9% from 47.1% last week. Bearish Percent declined to 23.8% from 25.4% last week. Retail exuberance is persisting.

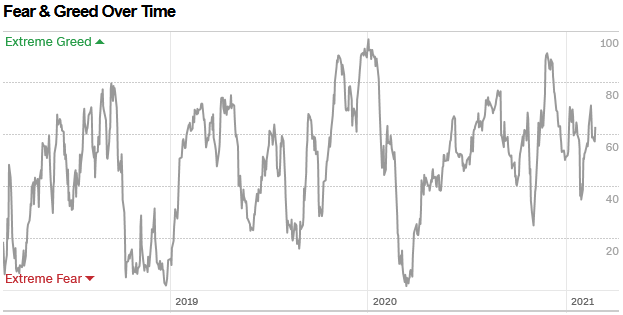

The CNN “Fear and Greed” Index flat-lined from 66 last week to 63 this week. This is a neutral read. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) flat-lined to 108.32% this week from 110.28% equity exposure last week.

Our message for this week:

We will continue to add to Defense & Aerospace on any weakness (on the 2H Commercial Aviation recovery thesis), and hold Banks and Energy – as we have a much lower basis in these groups.

New: We are building up selective positions in Consumer Staples, Utilities and Big Pharma. We will likely add on any weakness.

This would also imply that we could see a possible short-term bounce in bonds in coming weeks.

Remember: Pay less attention to the general indices – as there are many crosswinds at present – and more attention to take advantage of the “rallies under the surface” through sector rotation.