This week we chose Bruno Mars new hit song, “Leave the Door Open” to embody the sentiment of the stock market. The salient lyrics are:

I’ma leave the door open

I’ma leave the door open

I’ma leave the door open, girl

On several segments this week we discussed how the re-opening trade (Banks, Energy, Industrials) – that we were aggressively positioned for since last summer – has had a huge run and is now taking a breather. While we fully anticipated this in recent podcasts/videocasts, we also emphasized that they were “holds” through this pause (that will refresh), and will finish the year higher. In last week’s podcast I emphasized that it is essential they take the stuffing out of the “johnny come latelies” and “weak sisters” who jumped on the trade AFTER it was up 75-100%+.

Hence, we are “leaving the door open” (by holding through the short term pullback) and will resume the romance when they make new highs before year end!

In the mean time, at the end of February and early March we started dancing with a a few new partners/sectors that will benefit in the mean time.

On Tuesday, I was on Fox Business – The Claman Countdown – with Cheryl Casone discussing the re-opening trade and where the puck is headed. Thanks to Cheryl and Ellie Terrett for having me on:

On January 4, I gave my “Top 4 Picks for 2021″: WFC, XOM, WBA, RTX. They were up ~ 32.7%, 37.7%, 35.7% and 12.4% respectively (versus the S&P 500 which was up ~4.8%) – going into the show this week.

While we think these “re-opening” stocks will finish the year even higher – in the short term, they may be due for a rest/pullback.

Instead, we like those stocks that are going to benefit from a slowdown in the rate of change in yields (10yr yield stabilization). With pensions re-balancing into end of quarter (buying bonds) and the fed not wanting to lose control of the long end of the curve, we expect yields so slow their ascent and stabilize (Fed may start to jawbone Operation Twist in coming weeks if yields go up again – just like Spring 2011).

The same stocks that got hit in Feb/March (when the 10 year yield went from 100bps – 175bps) (yield sensitive stocks) will be the key beneficiaries in the next few months. We like high dividend growers like/own Big Pharma (PFE, NVS), Consumer Staples (KMB, CPB), Utilities (AEP, D) (over the next few months). All yield > 2x the 10yr yield.

PFE earnings will be up ~49% in 2021 over 2020. It is trading at 10.75x earnings relative to the S&P 500 ~22x and offers a ~4.33% dividend yield.

NVS is trading at 13.5x earnings relative to the S&P 500 ~22x. It pays ~3.7% dividend yield.

The re-opening trade banks/energy/industrials will resume its uptrend and finish the year higher, but it is due for a near term rest – in our view.

We emphasized this point in more detail on TD Ameritrade Network with Nicole Petallides on Tuesday, and drilled down on the leisure/hospitality sector to make our case. Thanks to Nicole and Declan Murphy for having me on:

On Tuesday evening, we did a segment discussing GameStop earnings results and implications moving forward. Thanks to Roee Ruttenberg and Kamelia Kilawan for having me on CGTN America:

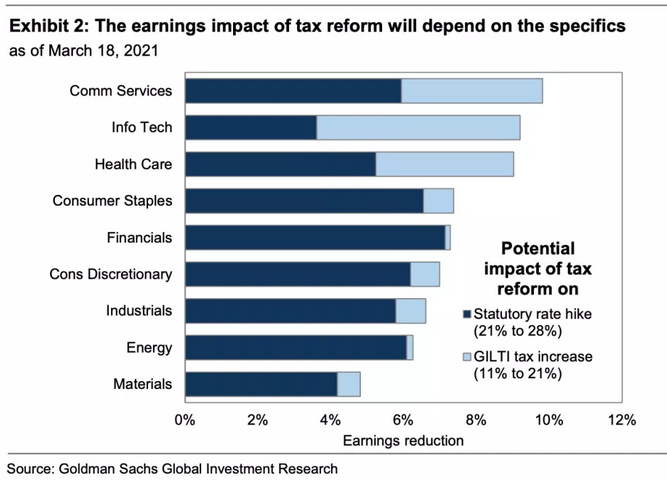

On Wednesday Morning we made the rotation case (in greater detail) on Cheddar TV with Jill Wagner. We also discussed what could potentially derail growth moving forward. An increased corporate tax rate will disproportionately hit Technology stocks:

Thanks to Jill, Ally Thompson, and Taylor Garre for having me on the show:

While we focused on the “rallies under the surface” and the rotation into groups that will benefit from a slowed rate of change for the 10-yr treasury yield, we also laid out the reasons that we expect the market to make new highs by year end. Here are the key points:

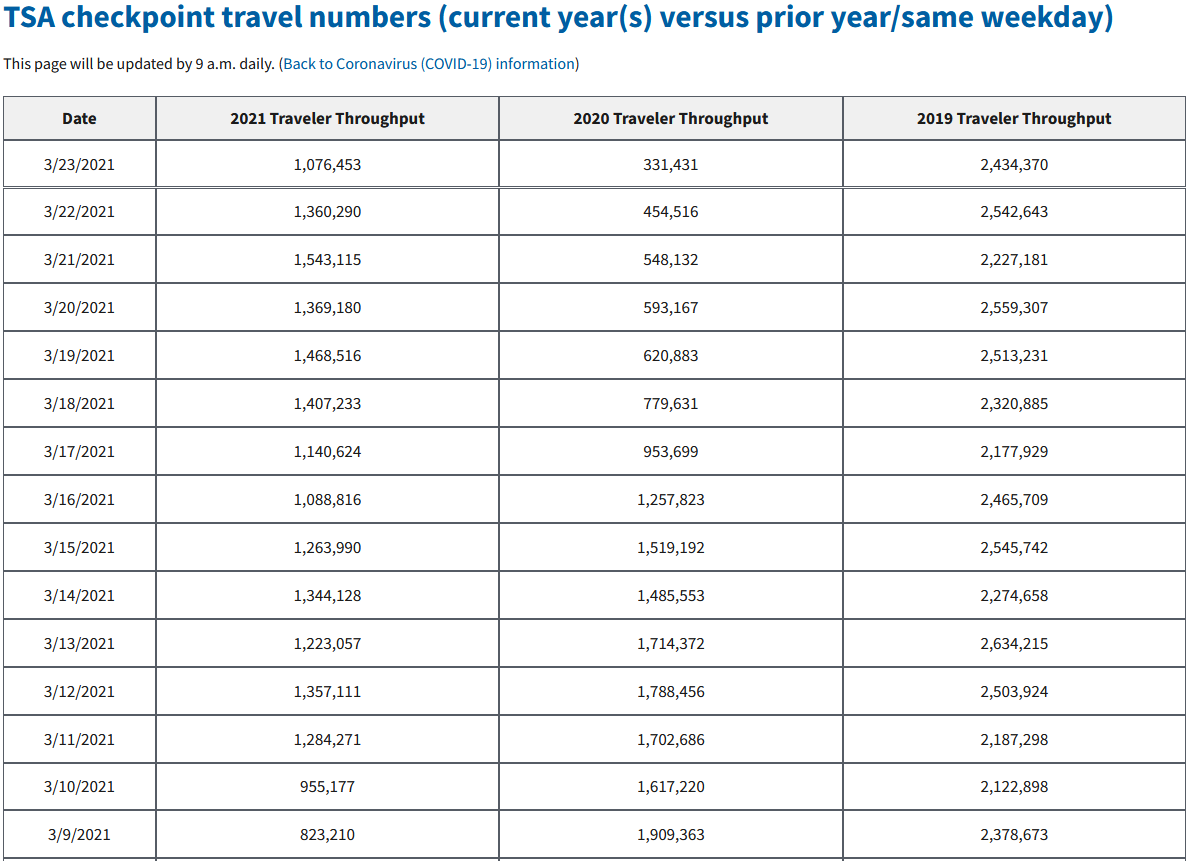

TRAVEL RECOVERING: TSA Numbers – Consistently > 1M daily travelers.

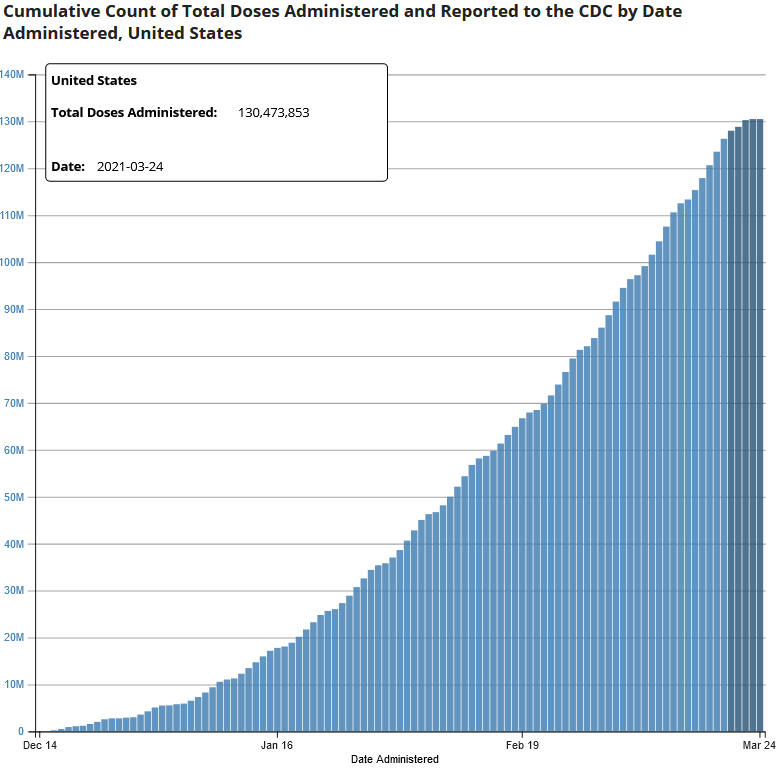

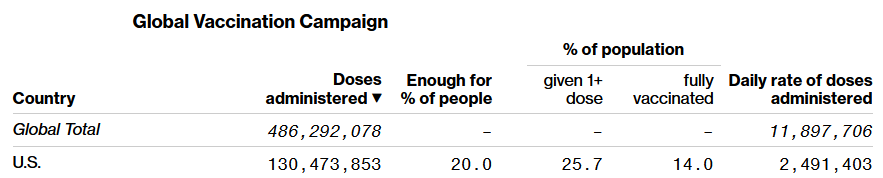

VACCINATIONS > 130M (~2.5M/day US)

Source: Bloomberg

Cases (49.1k 7-DMA) – Deaths (910 7-DMA)

Source: USA Facts

GDP CONTRACTION versus RESPONSE size:

GDP contraction (-3.5%) ~$750B in 2020.

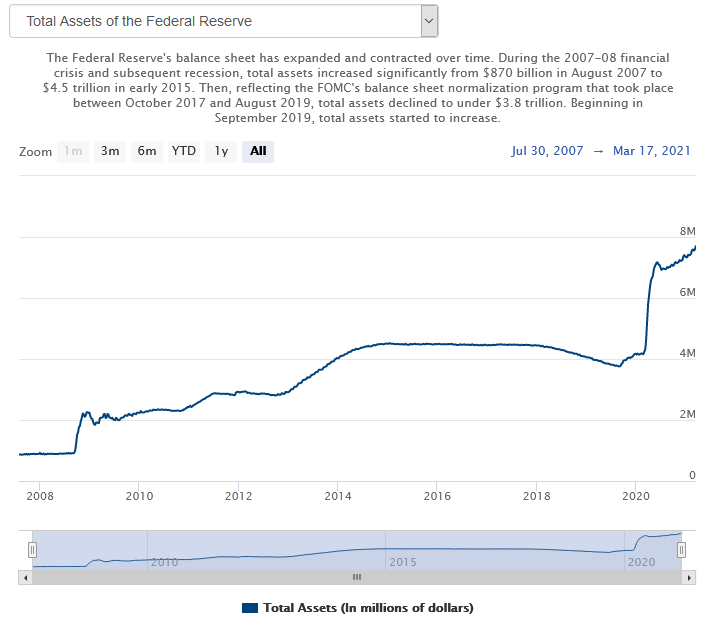

Fed Balance Sheet Expansion ~$4 TRILLION (from ~$3.7T to ~$7.7T)

M2 money supply up >27% since last February

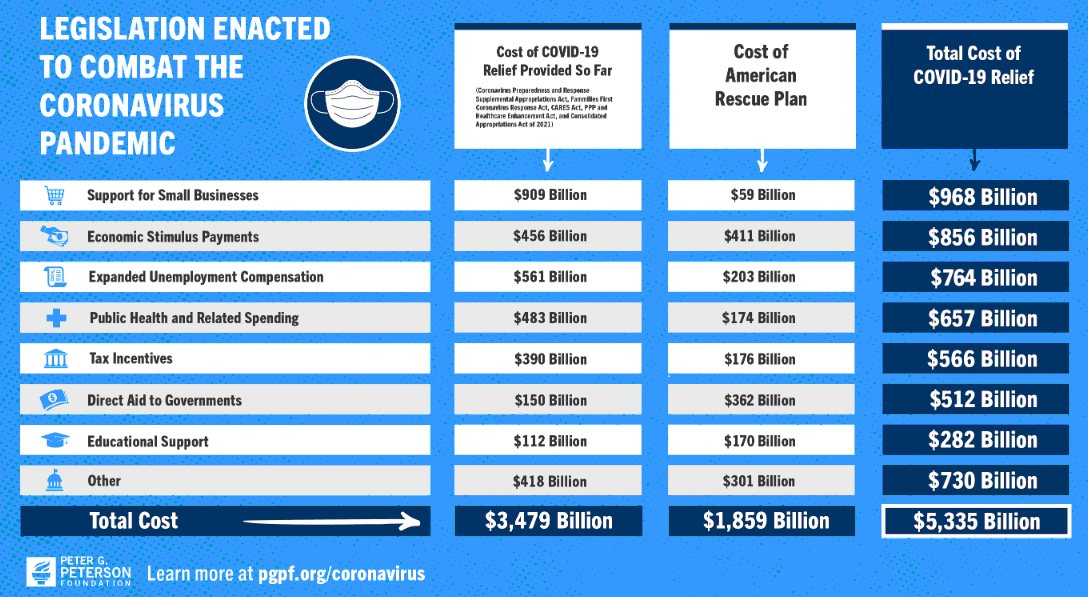

PLUS FISCAL STIMULUS: So far, lawmakers have enacted six major bills, costing about $5.3 trillion, to help manage the pandemic and mitigate the economic burden on families and businesses.

Fiscal and Monetary support related to COVID is approaching 45% of GDP.

As velocity picks up (from spending in 2H), we are going to see growth (and modest inflation) that is unlikely to be transitory.

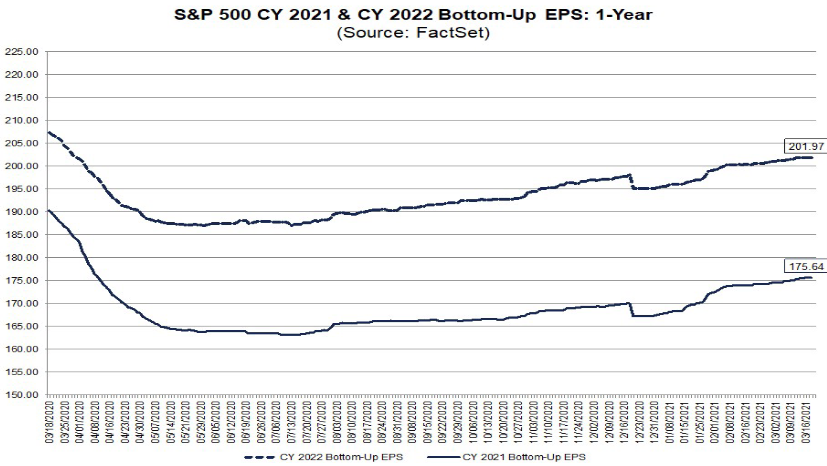

A good amount of the initial recovery and pent up demand is priced into the market. However, earnings expectations continue to improve – which could provide some extra juice before year-end:

As we anticipated last week bonds have caught a bid and the crowded hedge fund short is backing up:

Our notes from last week helped identify this change:

Our notes from last week helped identify this change:

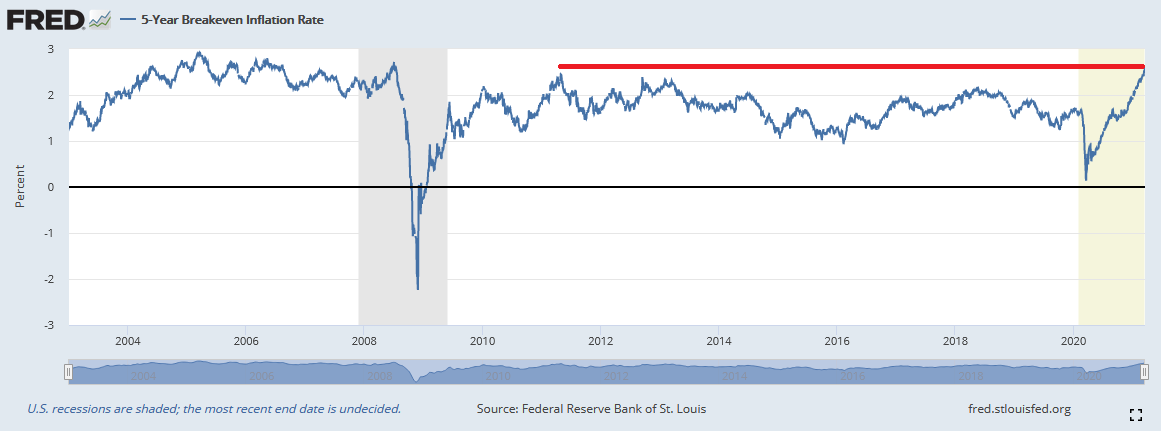

The last five months were dominated by the “re-opening” trade – with banks and energy outperforming (coupled with a steepening yield curve and highest inflation expectations/5yr breakevens – since 2011). We believe this is going to force the Fed to begin jawboning what part of the treasury curve they buy to retain control over the long end of the curve.

This will benefit those sectors which have recently sold off (high-yielding stocks that yield more than the 10yr) like Utilities, Staples and Big Pharma. These are also groups that will benefit from any volatility as they are the go-to for institutions as a defensive play. The re-opening trade certainly has room to run in the intermediate term, but after such a big run in recent months it may be due for a breather before taking the next leg higher.

Hedge Funds have been aggressively short bonds and this trade is too crowded. Commercials have been buying bonds in recent weeks and are usually early and right.

This week started to show that the Commercials were right.

Now onto the shorter term view for the General Market:

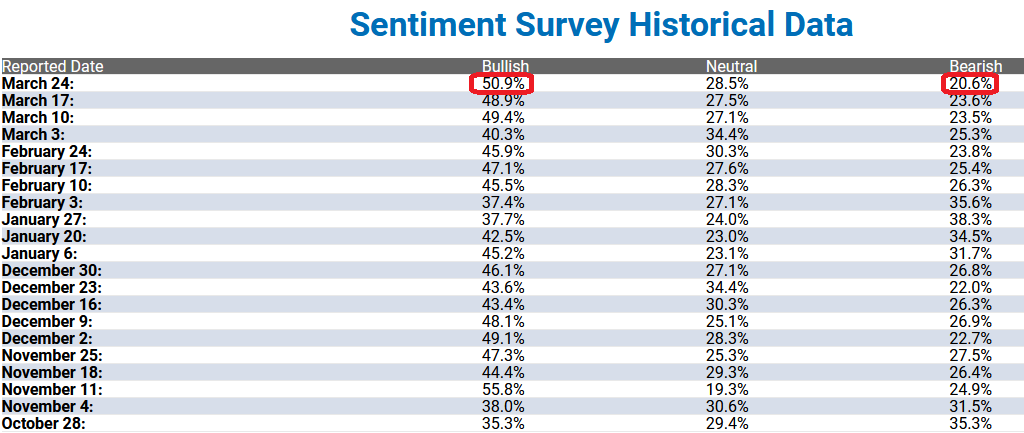

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 50.9% from 48.9% last week. Bearish Percent fell to 20.6% from 23.6% last week. Retail exuberance is persisting and extreme at these levels.

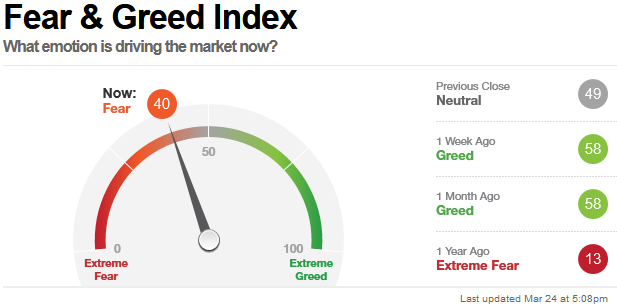

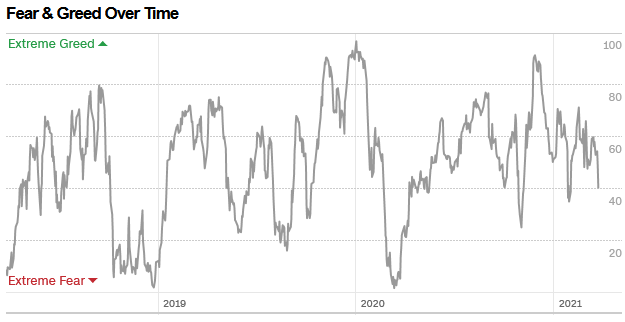

The CNN “Fear and Greed” Index fell from 58 last week to 40 this week. Fear is creeping in. You can learn how this indicator is calculated and how it works here: (Video Explanation)

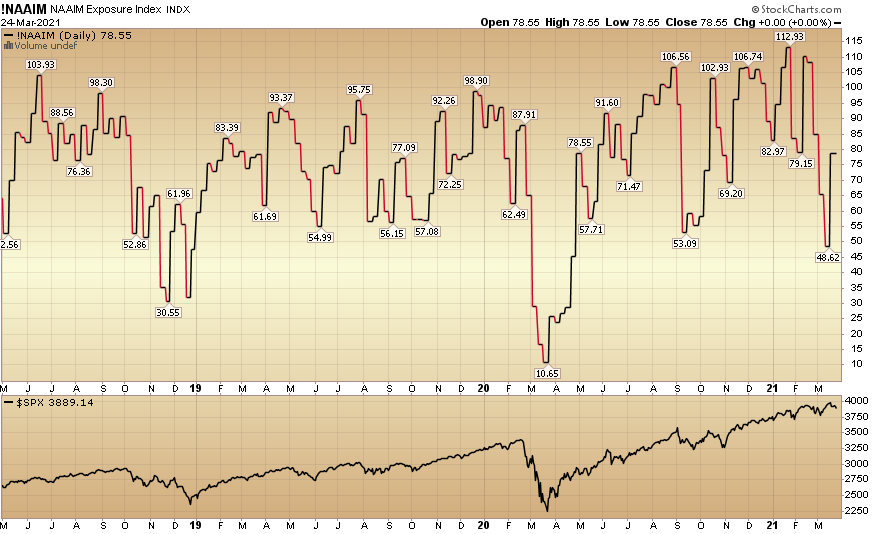

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 78.55% this week from 48.62% equity exposure last week. Active managers jumped back in.

Our message for this week:

We built up selective positions in Utilities, Consumer Staples, and Big Pharma since we fist mentioned it at the end of last month. We think the rebound in this group should continue in coming months (even if we have a few fits and starts – after a very nice jump in the past 3 weeks).

We continue to hold our banks, energy and defense/aerospace stocks from much lower levels last year and would not be surprised if they continue to take a breather – before resuming their uptrend. We will “Leave the Door Open” for them to make new highs before the end of the year.

Reminder: Pay less attention to the general indices – as there are many crosswinds at present – and more attention to take advantage of the “rallies under the surface” through sector rotation.