This week’s theme song to embody current stock market sentiment is, “Rock the Boat” by The Hues Corporation.

According to Wikipedia, “Initially, ‘Rock the Boat appeared as though it would also flop, as months went by without any radio airplay or sales activity. Not until the song became a disco favorite in New York did Top 40 radio finally pick up on the song, leading the record to finally enter the Hot 100 and zip up the chart to number one the week of July 6, 1974, in only its seventh week on the chart (and fourth week in the Top 40).”

The salient lyrics – given where we are in the markets – are as follows:

Said I’d like to know where, you got the notion

(To rock the boat), don’t rock the boat baby,

don’t tip the boat over

(Rock the boat), don’t rock the boat baby

(Rock the boat)

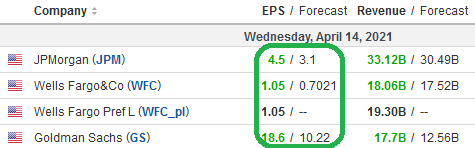

The number one factor that will determine if this market continues to go up is earnings estimate revisions. The market is “priced for perfection” based on current estimates. However, it may be very “fairly valued” by the time earnings season is over and guidance takes those estimates up higher than anyone is anticipating. Here’s an example of how low estimates are based on what we saw with bank earnings last week:

![]()

![]()

source: investing.com

These were not even close. They blew the doors off. Here’s what has happened to Wells Fargo (up >97% in 7 months) since we put out our “Cobra Kai – Sweep the Leg” article on September 24, 2020 (when you couldn’t give away the stock):

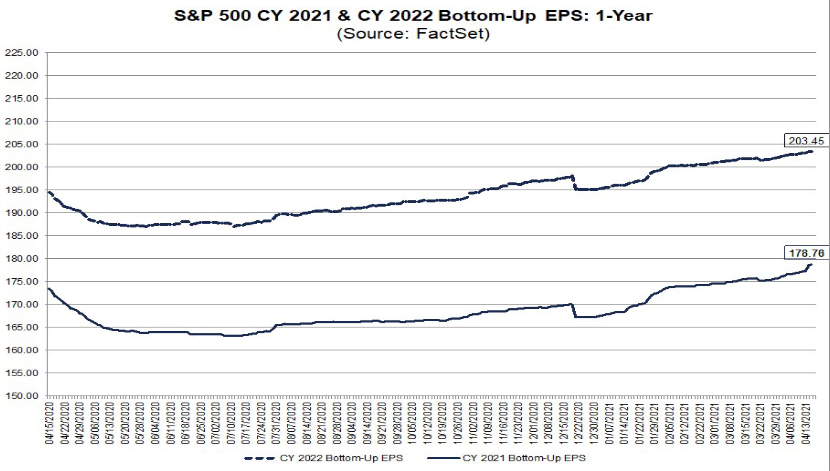

And while 2021 S&P 500 earnings estimates bumped up another ~$3 to $178.78 last week, I still think they are low and could bump up another $10-$15 by mid-year. If we get the same bump on 2022 numbers, with short rates on hold for at least another 12 months, an ~18.5x multiple on 2022 EPS is not excessive. But again, that’s assuming that estimates are still too low – which we will get more color on in coming weeks.

In the mean time, for the market to stay elevated, it’s imperative that we, “don’t rock the boat, don’t tip the boat over.”

On Friday morning, I was invited to do a long-form interview with David Lin from Kitco. Thanks to David and Michelle Makori for inviting me on.

In this segment, we covered: Stimulus, Inflation, Commitments of Traders reports, Banks, Energy, Demographics, Housing, Treasuries, Yield Curve, Defense (and Aerospace), Consumer Staples, Utilities, Big Pharma, Macro Trends our “top picks” and much more…

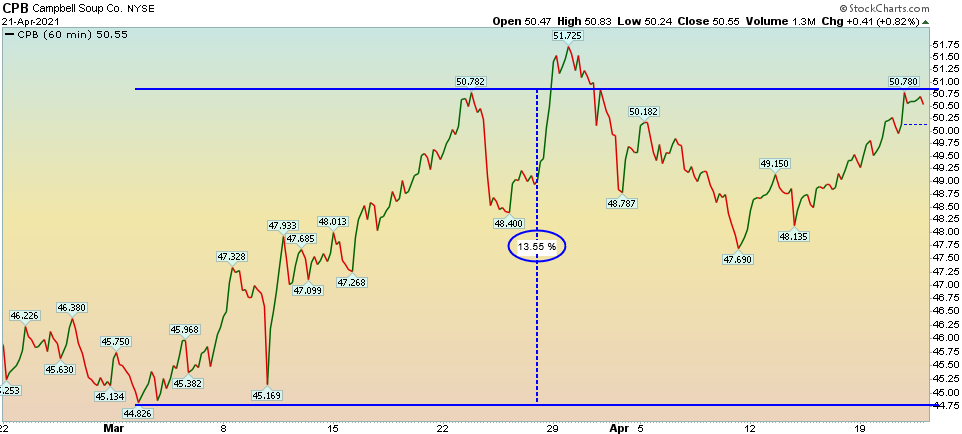

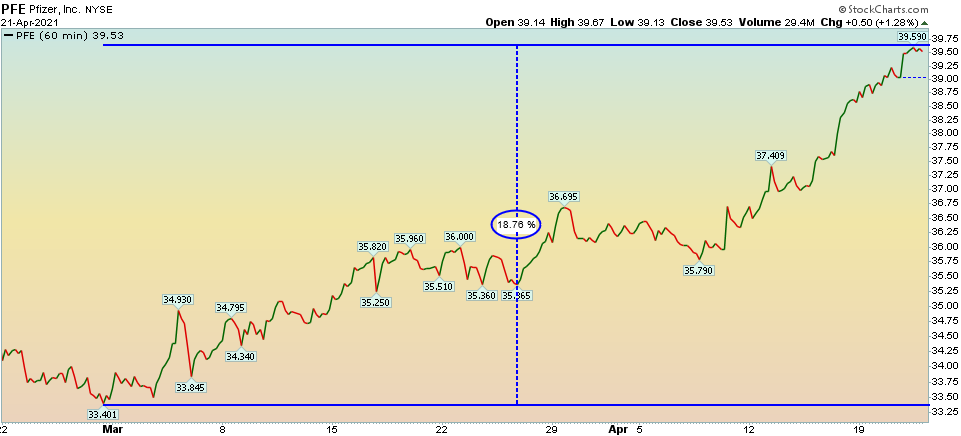

Our top picks in Utilities, Staples and Big Pharma – which we posted in our articles and TV hits (since the last week of February and first week of March) – have continued to move up nicely in the last 7 weeks. Big Pharma (which was the laggard for the first 6 weeks) started to catch up this week:

We think there is more juice in this “defensive trade” and we are “hodlers” for the time being. For new money, we would add to the laggard NVS – as it is a play we discussed in detail on the Kitco segment above.

On Friday evening I was on CGTN America “Global Business” show with Rachelle Akuffo. Thanks to Rachelle and Stephanie Savage for having me on.

In this segment we discussed China’s new GDP numbers, data releases and economic outlook. This is particularly timely as many Chinese stocks have taken a hit in recent weeks and may be a spot we start to explore in coming days and weeks (on a very selective basis):

So last year we pounded the table on Banks, Energy and (Defense & Aerospace). We are still holding and will peel off profits slowly on the way up – as we want to hold the core of many of these positions for the first few years of the new business cycle (which is only one year in at present).

Seven weeks ago we put out out defensive value/yield plays (Utilities, Staples, Big Pharma) when they were left for dead (after the abrupt rate rise in the 10yr yield). We think this trade has more legs in coming weeks.

But moving forward – where the puck is going – we are starting to see some very selective opportunities in broken down (high quality) Chinese Stocks, Clean Energy/”Green New Deal” Stocks, and Busted SPACs. More to come in future podcasts/VideoCasts and articles as the opportunities clarify…

Now onto the shorter term view for the General Market:

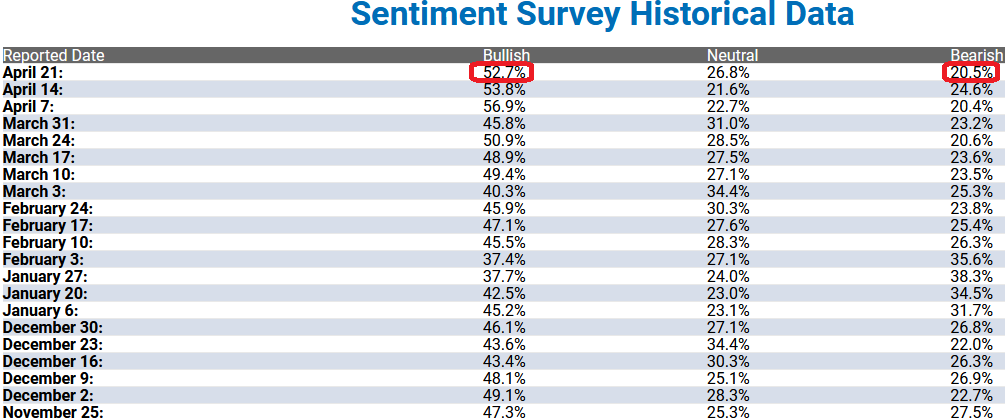

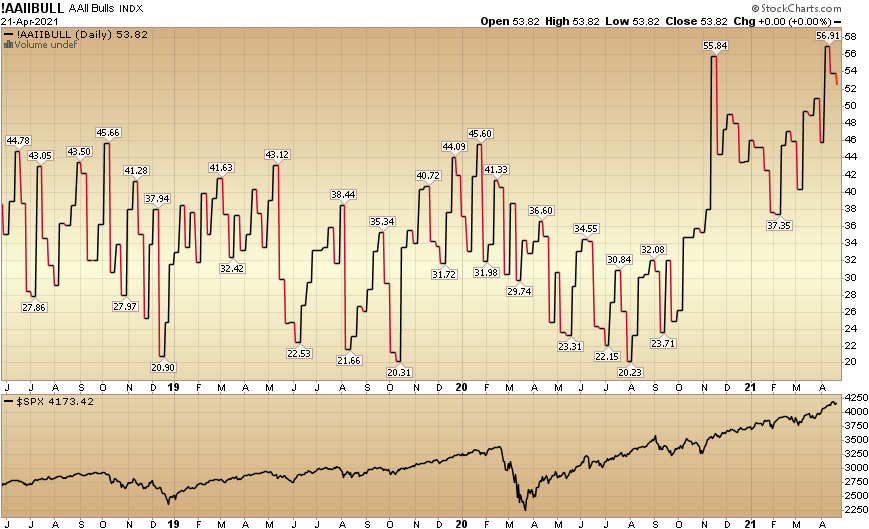

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked down to 52.7% from 53.8% last week. Bearish Percent fell to 20.5% from 24.6% last week. Retail investors are still exuberant.

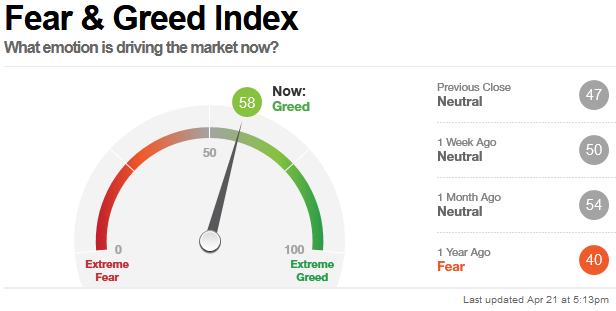

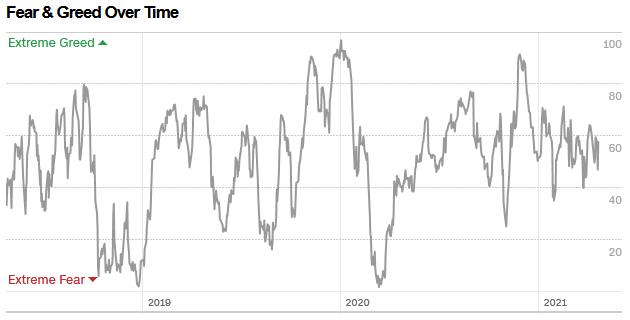

The CNN “Fear and Greed” Index climbed from 50 last week to 58 this week. This is a neutral read. You can learn how this indicator is calculated and how it works here: (Video Explanation)

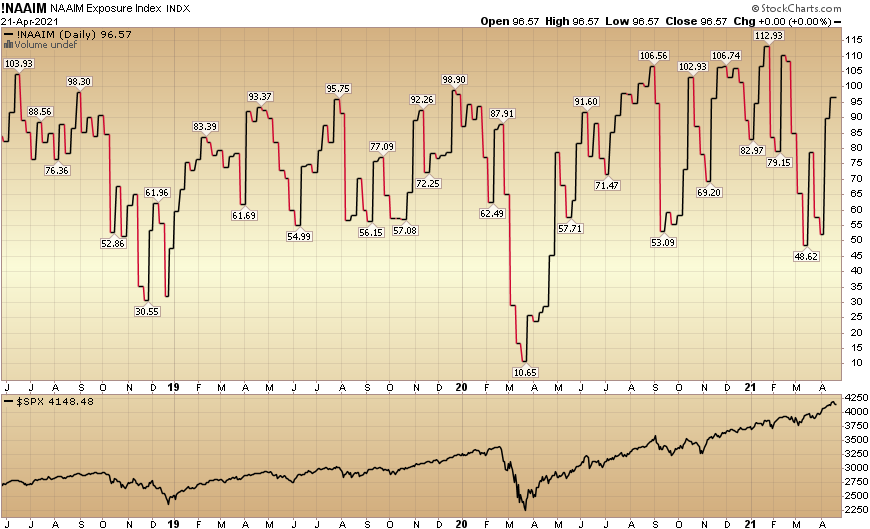

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 96.57% this week from 89.95% equity exposure last week.

Our message for this week:

We built up selective positions in Utilities, Consumer Staples, and Big Pharma since we first mentioned it at the end of February. We think the rebound in this group should continue in coming weeks/months (even after the big move in the past 7 weeks).

We continue to hold our banks, energy and defense/aerospace stocks from much lower levels last year and would not be surprised if they take a breather – before resuming their uptrend/new highs later this year.

With the market up ~85% off the March lows, we are very selective where we put new new money to work. We will look to add to our Big Pharma positions – but only if any weakness presents itself.

In the mean time, we are starting to look for very selective opportunities in Chinese Stocks, Green New Deal/Clean Energy Plays, and Busted SPACs. There are quality names in all three groups that have taken gut shots in recent weeks (some down 30%+ percent) that we will start to pursue in coming days and weeks.

Today, President Biden will host the “Climate Summit” with ~40 leaders from around the world. The call is for net-zero emissions by 2050. With a blank check Congress until mid-terms, you can be sure he will execute on his agenda. This means more spending, more regulation, and more inflation is in the offing.

The key will be how to make money from these initiatives. We are positioned to take advantage, but there will be more new opportunities that unfold in coming days and weeks. Stay tuned…