This week I chose Chris Stapleton’s hit song, “Starting Over” as the theme song for our article. The salient lyrics are as follows:

But nobody wins afraid of losin‘

And the hard roads are the ones worth choosin‘

Someday we’ll look back and smile

And know it was worth every mile…

For those of you who have been following me for some time, you know that over the past handful of weeks we had built up a large position in Alibaba – at just over $209 basis. Since most of you don’t have a ~10%+ position in this name, I’m not going to spend a ton of time on this as you can simply read our past articles or listen to last week’s videocast|podcast where we lay out our thesis.

Unlike many commentators who hide or go silent when a public position goes against them – we take responsibility and address it head on…

The Right Question

A few weeks ago I bumped into Tony Robbins at the Stanley Cup in Tampa Bay.

(I do not know who the photo-bomber is)

It reminded me of some of his teachings I learned when I was 17 years old (and working as a Golf Caddie at the time). One of his teachings was that, “the quality of your life is determined by the quality of the questions you ask.”

On Tuesday morning, when we saw the Shanghai Composite down another 8% before the open, rather than ask why the Chinese government is doing this, I asked how can I take advantage of this situation? After all, I made my name in this business profiting from periods of dislocation (sector, stock and index)…

So as Alibaba moved down to the low $180s that morning, put premium (Implied Volatility) EXPLODED higher. Everyone wanted to buy insurance (puts) when it was too late and no one wanted to buy upside (calls) when the opportunity was at its best. The time to buy an umbrella is before it’s raining.

Sell Umbrellas and Buy Rainbows

We decided to use this period of panic to sell umbrellas (puts) and buy rainbows (calls). What we did was we sold put premium below the market at a price that we would love to own more stock ~$170. At the same time, we used those proceeds (collected premium) to buy more upside call premium – which enabled us to take off stock and still have ~33% more upside stock exposure than before Tuesday with no new cash out-of-pocket. We also added some additional call premium which increased our notional exposure and lowered our effective basis. The net effect is that when the stock ultimately returns to our original (pre-Tuesday) basis, we will be nicely profitable versus at breakeven. When it moves through that original basis, we will be significantly more profitable on the upside than we would have been with our positioning prior to Tuesday’s dislocation.

What’s even better is that as we get the next bounce in BABA we’ll be able to buy in the short puts for a profit and use all of the cash that would have been tied up in stock to put on new positions in other stocks – so that we not only benefit from increased exposure to Alibaba upside with less risk, but we get to use all of that cash in new positions to duly increase our portfolio returns. This calm, surgical execution – in the face of unusual exogenous events – is no more than a benefit of years of experience and trading through many dislocations.

As famed trader Jesse Livermore once said, “only the game can teach you the game.”

Whether the bottom is in for BABA or not, we don’t know, but we do know we have dramatically more upside with less risk than we did prior to Tuesday. When life gives you lemons…have a lemonade party.

“Buy the Rumor?”

On Tuesday Morning I was on TD Ameritrade Network with Oliver Renick discussing Tech earnings. Thanks to Oliver and Alexandra Hincks for having me on:

Watch HD Version Directly on TD Ameritrade Network

Indicator of the Week

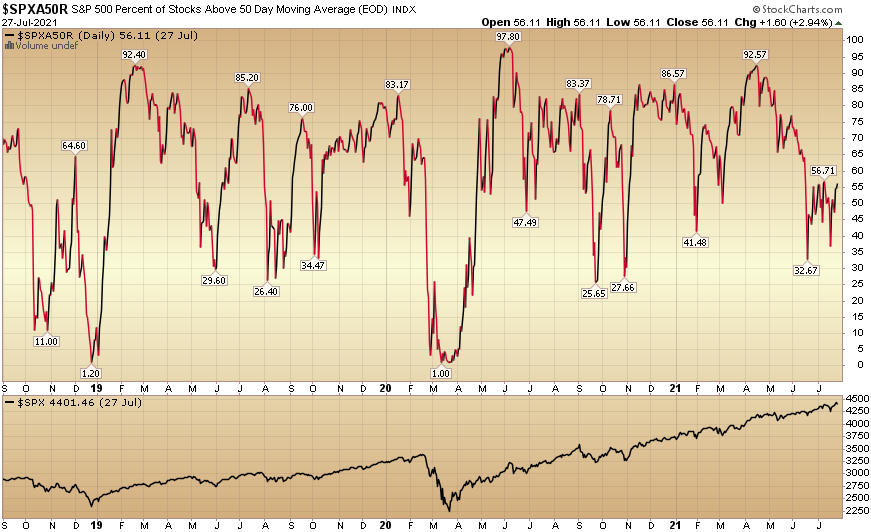

On last week’s videocast I covered the “PMO Buy All” indicator and talked about why there was a bit more gas in the tank. Yesterday we were updating our “indicator of the day” and came across the percent of stocks in the S&P 500 above their 50-day moving average.

While the market feels like it has been climbing, many stocks under the surface have corrected 15-30% or more in the past couple of months. This has created opportunity – even when it feels like the indices have froth.

Couple this with a Fed Chair who re-affirmed his commitment to full employment (and pedal to the metal) on Wednesday (WSJ), and there is still ample opportunity to make big money into year-end. You just have to know where to look…

Now onto the shorter term view for the General Market:

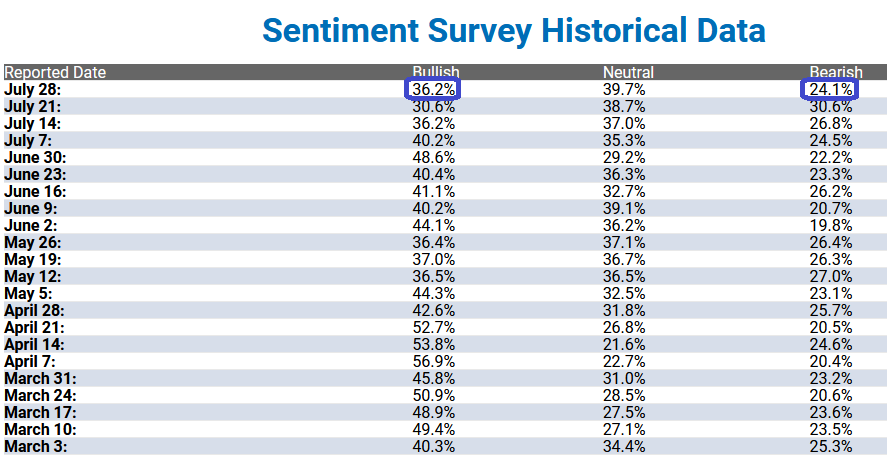

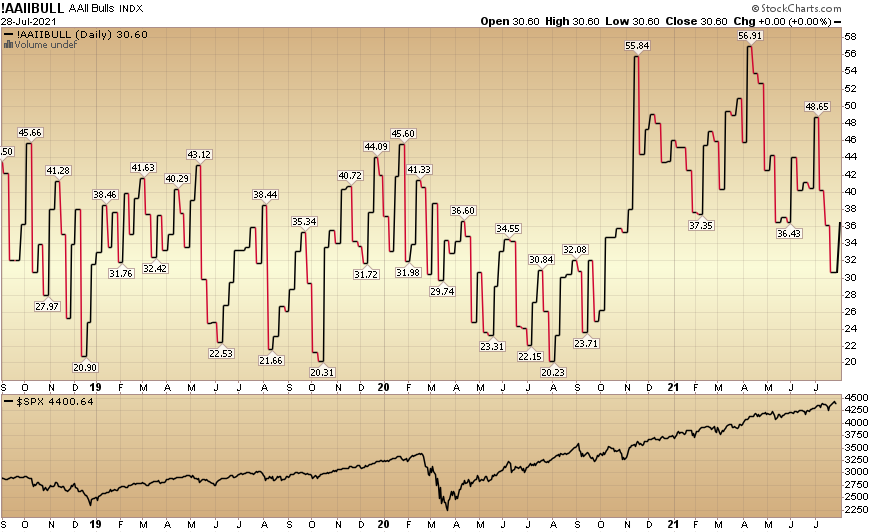

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 36.2% from 30.6% last week. Bearish Percent dropped to 24.1% from 30.6% last week.

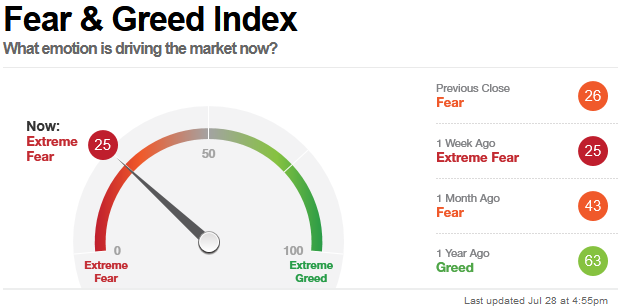

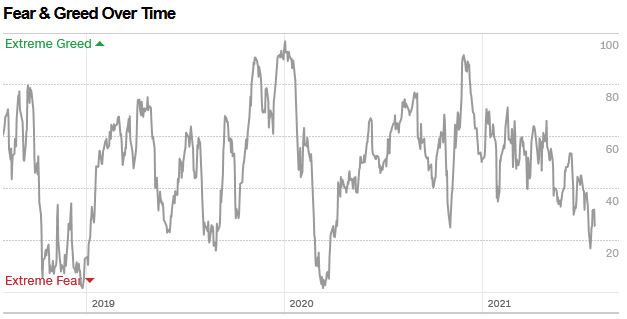

The CNN “Fear and Greed” Index flat-lined from 25 last week to 25 this week. Fear is still present in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” Index flat-lined from 25 last week to 25 this week. Fear is still present in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

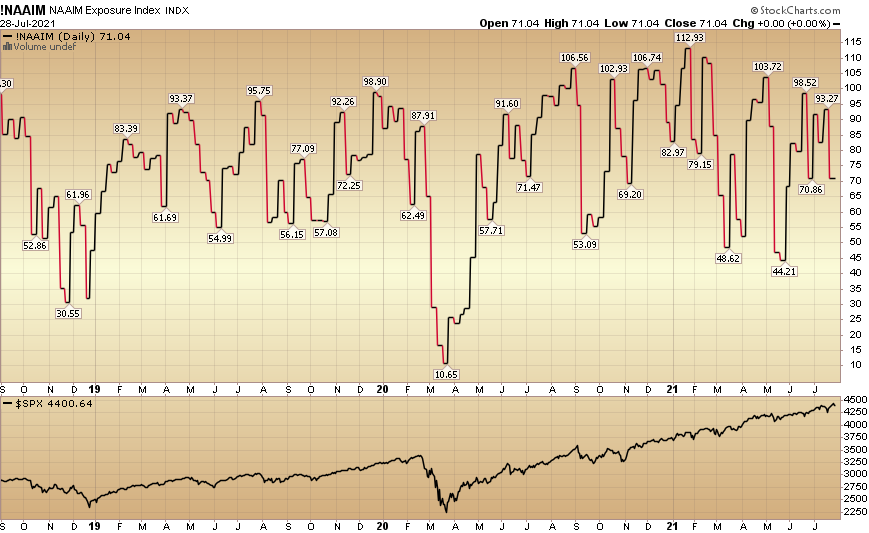

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 71.04% this week from 93.27% equity exposure last week.

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 71.04% this week from 93.27% equity exposure last week.

Our message for this week

Nobody wins afraid of losin’…