With the market looking and feeling extended at these levels, the song we chose to embody current market sentiment for the week is Ryan Hurd and Maren Morris’ 2021 hit, “Chasing After You.” This has effectively been the theme song for managers who have been skeptical of the market rise all year and were repeatedly forced to chase up:

Don’t know why, don’t know why I let you but I do

Guess I love chasing aftеr you…

Wish I could quit you but it feels too good

If I could turn it off, you know I would

But somethin’ ’bout you makes me think we could

Make it after all…

But I know, yeah I know it’s a matter of time

‘Till you walk, ’till you walk back out of my life

Leave me standing here lonely feeling like a fool

Every time, every time you say we’re done

You come back to the love you were running from

Don’t know why, don’t know why I let you but I do

Guess I love chasing after you…

So while the market has looked extended on a macro basis, all year long, when you looked under the surface there was abundant opportunity on a stock-by-stock basis – buying quality stocks/sectors when they went on sale.

These selective opportunities still exist despite the fastest doubling of the S&P 500 off the lows in history, and 53 record highs for the index year-to-date.

On both Friday and Monday I was on Fox Business – The Claman Countdown – with Liz Claman and Lauren Simonetti. Thanks to Ellie Terrett, Liz and Lauren for having me on.

In both of these segments we discussed the opportunity that is setting back up for several energy/re-opening stocks in September/October (as well as next Fed moves). In Monday’s segment we discussed SLB, EOG, ET, PSX:

Click Here to Watch HD Version Directly on Fox Business

Later on Monday I was on Cheddar news with Alicia Nieves and Kristen Scholer. Thanks to Ally Thompson, Courtney McGee, Alicia and Kristin for having me on. In this segment we discussed two other “re-opening trades” we like at these levels: BAX and BA. We also had time to discuss the Fed Taper expectations, Market Outlook, earnings and reasons the market keeps pushing higher:

Click Here to Watch HD Version Directly on Cheddar

The key takeaway you should have after watching these two videos is to stop worrying about the general market because there continues to be opportunity under the surface. In my first segment I made the statement that “strength begets strength.” Ryan Detrick lays out the data here:

S&P 500 up >20% YTD at the end of Aug. What’s next?

Higher 6 out of 7 times, with only 1987 in the red. pic.twitter.com/A0NdDVvUIn

— Ryan Detrick, CMT (@RyanDetrick) September 1, 2021

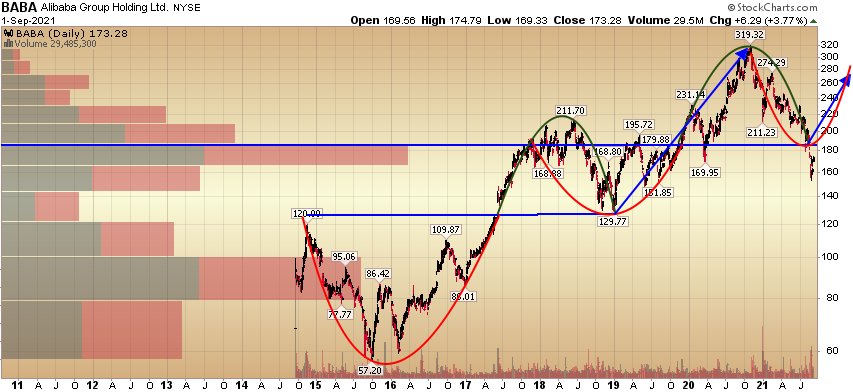

Alibaba Update

As for our favorite “quality on sale” stock – Alibaba, we have spent a lot of ink and commentary on this name in recent weeks. Here’s the best summary I did on Kitco News (August 26).

The key update now is that it’s rallying on bad news and coming in off the “skinny branches” we discussed last week. Here’s what I posted on twitter early this week when more headline bombs were dropping. For those of you who follow my weekly podcast|videocast, you were expecting this to happen ahead of time:

China Stocks up overnight on this news. While stocks rallying on bad news doesn’t always mean a bottom, bottoms generally don’t happen without that type of action. $BABA $KWEB https://t.co/ga2FmL0nwQ

— Thomas J. Hayes (@HedgeFundTips) August 31, 2021

Coming in off the “skinny branches” overshoot:

When fundamentals are thrown out the window, structural deleveraging has created massive dislocation, and sentiment on a group is at an all-time low, here’s what usually happens NEXT:

When fundamentals are thrown out the window, structural deleveraging has created massive dislocation, and sentiment on a group is at an all-time low, here’s what usually happens NEXT:

Initial buying comes from short covering and begins to accelerate. Cautious dip buyers start loading up with call options to try to catch the run – forcing dealers to buy stock in order to hedge. And then the worst part, THEY DON’T LET ANYONE IN ON THE WAY UP.

There will be no interest in this stock until it’s up ~75% off its recent lows. Often that first move is violent, no one believes it, and by the time they do they are “waiting for it to retest the lows.” That retest never comes and once the “coast is clear” and the headlines turn positive (after a 75% move), the trap door is opened once again to take out the late money (weak hands).

We said this would happen in the S&P in March 2020, and Energy and Banks last year when they were being sold off harder than even Chinese stocks last month. Scroll to the bottom of this article to see the model/history.

Could this time be different? Sure, it can always be different otherwise you wouldn’t have to manage your risk (HINT: YOU DO!). But that said, when fundamentals are ignored, technicals are broken and sentiment is beyond despondent – a violent rally that lets no one in on the way up is usually the prescription. Wait until everyone wants the shares again and then help them out by giving them what they want (after you’re up ~75%)…

Always remember, “Opinion Follows Trend…”

Now onto the shorter term view for the General Market:

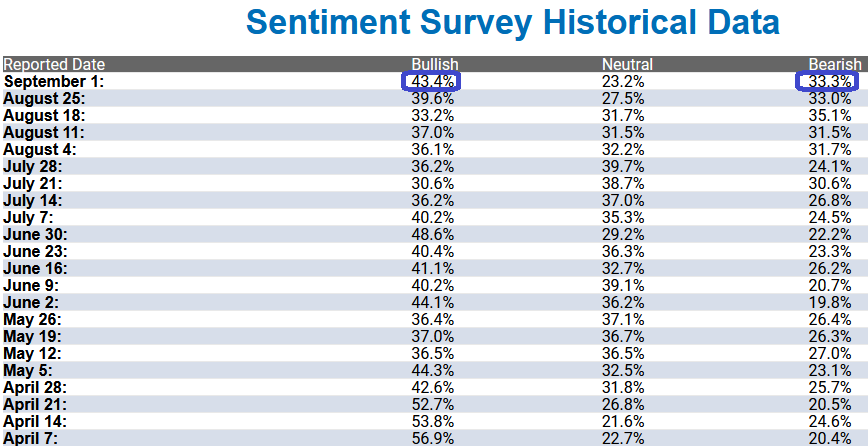

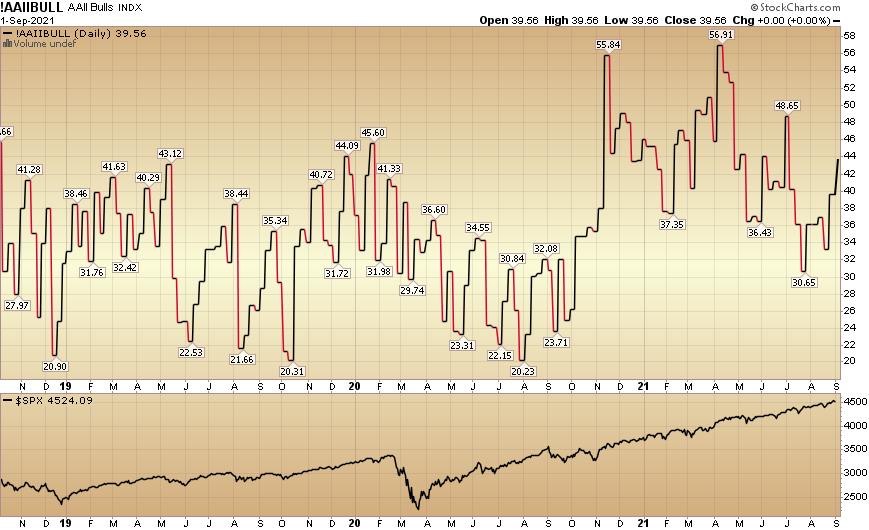

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 43.4% from 39.6% last week. Bearish Percent flat-lined at 33.3% from 33.0% last week.

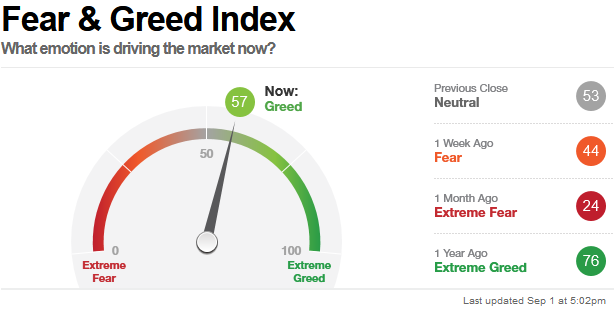

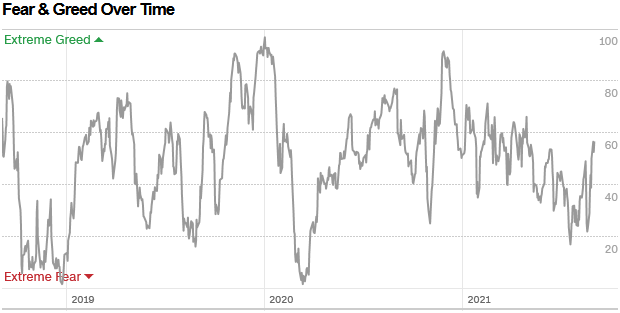

The CNN “Fear and Greed” Index rose from 44 last week to 57 this week. This is a neutral read. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” Index rose from 44 last week to 57 this week. This is a neutral read. You can learn how this indicator is calculated and how it works here: (Video Explanation)

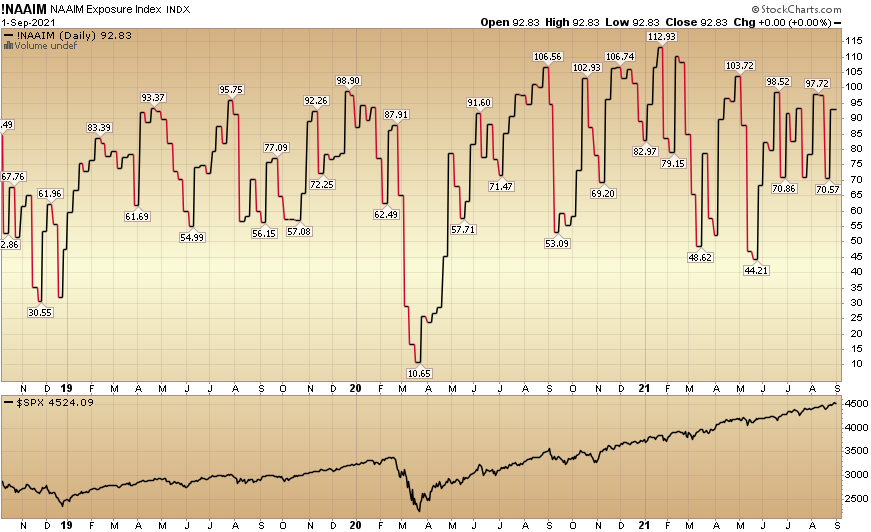

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 92.83% this week from 70.57% equity exposure last week.

So while everyone debates whether we are going to have a “September Swoon” or not, take a step back and look for sectors/stocks that have already had a “Summer Swoon” and buy the quality stocks that are on sale. We’ll go through a few opportunities we like on this week’s podcast|videocast.

While everyone “chases aftеr you” (the Stock Market indices), and worries about the market “leaving me standing here lonely feeling like a fool,” you can ignore the noise and choose to buy quality “under the surface” that is still currently on sale.