On September 22, Chairman Powell said that while we had met “substantial further progress” on one half of the dual mandate (inflation), we had not yet hit “substantial further progress” as it related to the second half of the mandate (full employment). He specifically said he would need to see a “decent” jobs report prior to moving ahead with taper. That may happen on Friday, but it had not happened at the time of his announcing taper (yesterday).

He bowed to the pressure and blinked before meeting his objective. Whether this will result in his deepest fear of long-term structural unemployment (as we saw in the 8 years following the Great Financial Crisis of 2008-2009) remains to be seen. In the mean time, several factors that led to the high inflation prints of late are rolling over into this new tightening of policy:

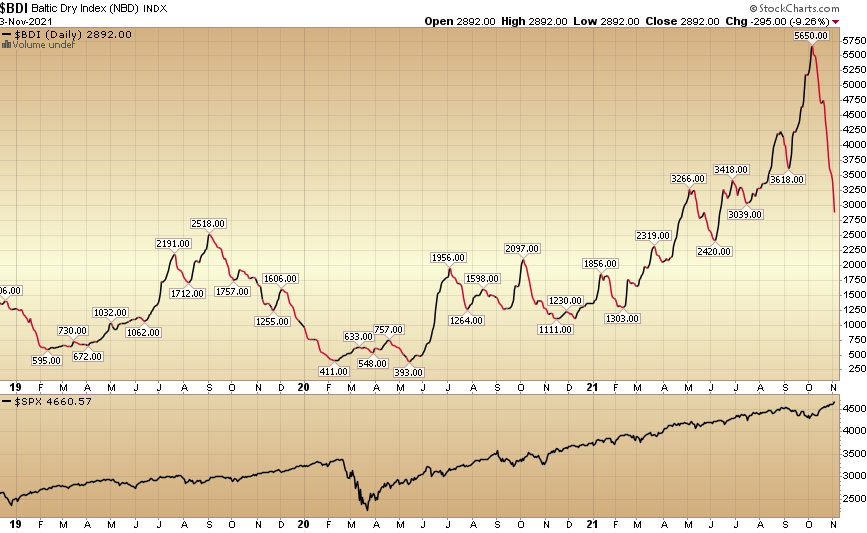

The Baltic Dry Index – which measures the average prices paid for the transport of dry bulk materials across more than 20 routes – has collapsed 48.81% since October 7.

The Baltic Dry Index – which measures the average prices paid for the transport of dry bulk materials across more than 20 routes – has collapsed 48.81% since October 7.

The average sale price of a 40-foot container in China plunged by 22.5% in the first two weeks of October alone.

Malcolm Wilson, CEO of GXO Logistics Inc. – the world’s largest pure-play contract logistics provider – said Tuesday that global supply chain bottlenecks should ease by the end of the second quarter of 2022, and that massive spikes in demand hitting GXO’s U.S. facilities are already starting to level off. He told analysts that the issues that we’re seeing right now he believes are very much temporary.

“We’re anticipating to continue to see them probably into Q1, maybe even into Q2, but definitely it’s a temporary issue, [and] it will abate.”

But Chair Powell couldn’t take the heat, so he got the hell out of the kitchen.

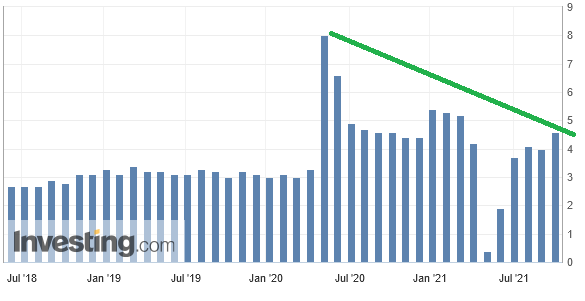

Wages (year on year percent increase below) – which are sticky and have moved up – should start to rise more modestly as more and more people re-enter the workforce due to extended unemployment benefits expiring in September, and vaccination rates (childcare/school resumption) improving:

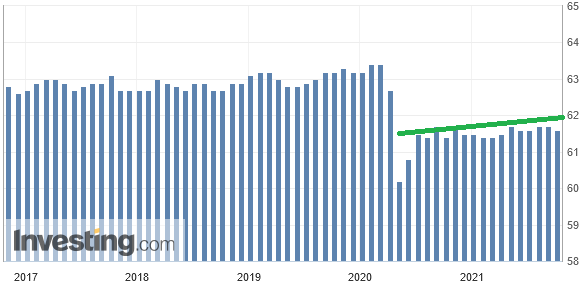

The labor force participation rate recovery will dampen the wage increases over time (it is modestly trending up – with the exclusion of September – due to Delta):

Whether he went in November (bowing to external pressure), or January (as I had anticipated), does not make much of a difference – as it was well telegraphed to the market. At the end of the day, people don’t like paying $12 for a gallon of milk – whether it’s due to short term supply chain issues or not. Couple that with the Fed trading fiasco and they blinked a couple of months earlier than anticipated – but it was inevitable nonetheless.

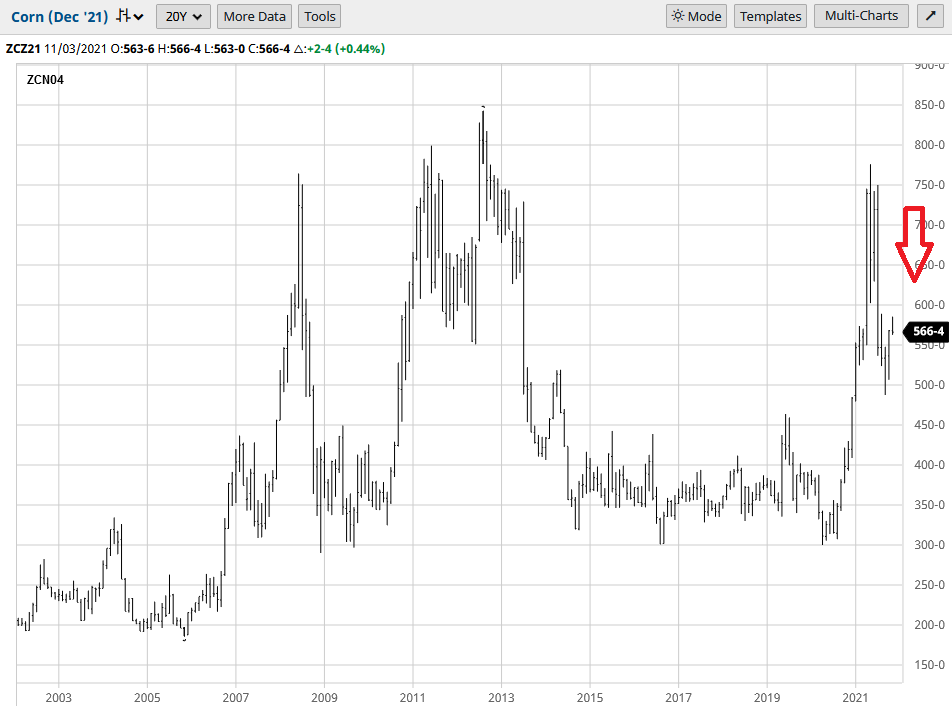

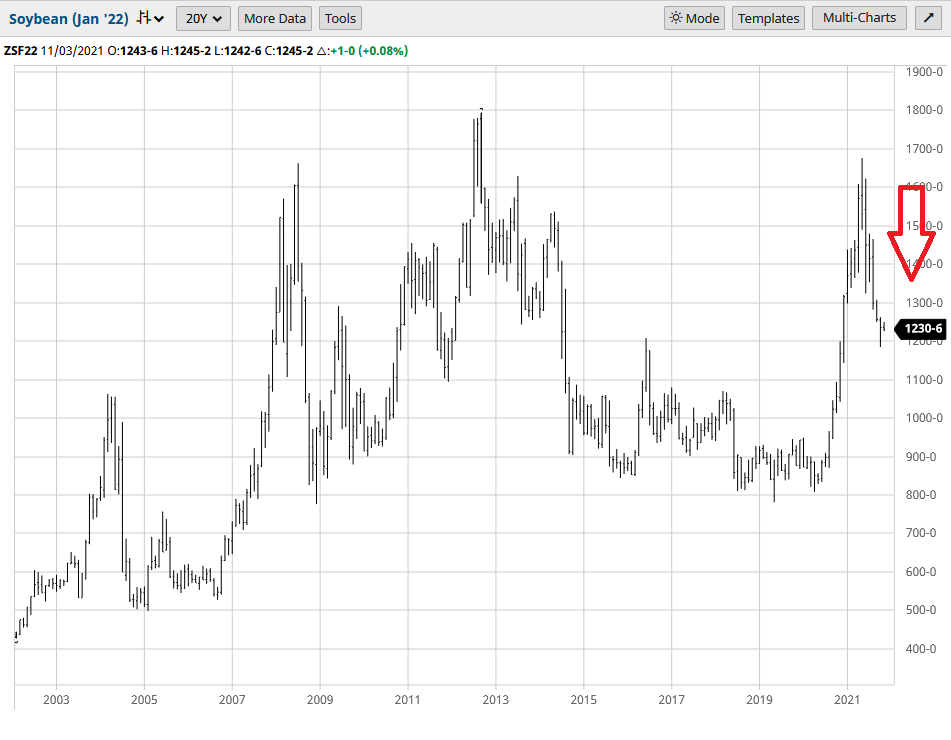

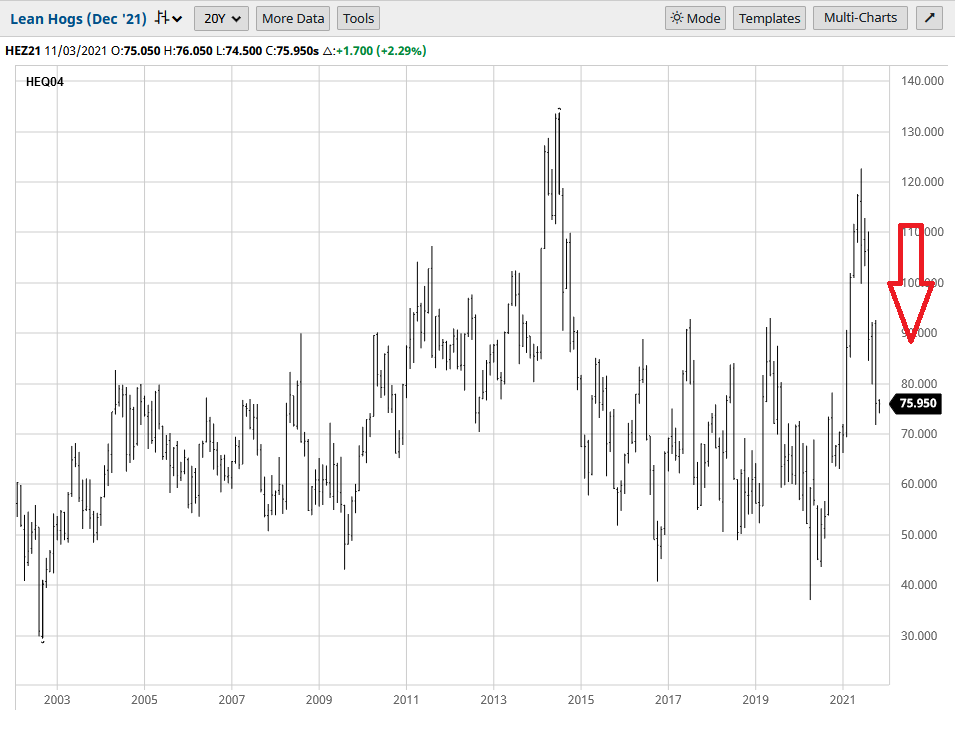

They had more runway than they thought to get the 2M extra unemployed folks back to work, but they are opting to put out a grease fire with water – despite the fact that the sand is just a little further away (and more effective). Here’s what I mean when I suggest that the rollover in some prices are already well underway and will show up on a lagged basis in coming months (irrespective of taper):

(Charts by BarChart, Annotation by Tom Hayes)

Everyone’s complaining about milk prices TODAY but the collapsing prices WILL SHOW UP IN THE SUPERMARKET ON A LAGGED BASIS:

Everyone’s complaining about milk prices TODAY but the collapsing prices WILL SHOW UP IN THE SUPERMARKET ON A LAGGED BASIS:

So could they have waited a few extra months to ensure those 2 million more people unemployed (than pre-pandemic) got back into the labor force? Yes.

Does it matter that they are tightening into falling prices (will show up on lagged basis) and slowing rates of growth?

Yes, but it’s tough to get re-appointed when milk is $12 a gallon and the general public is upset with public officials (legally) trading while in possession of non-public information.

So they bent – despite not having the confirmatory employment data in hand at time of announcement. The net effect is probably 500k unemployed people will be left out in the cold when all is said and done. Rather than having 5.7M unemployed as we did in Feb 2020, we’ll likely wind up with ~6.2M unemployed when we hit “full employment” this time. Enough time will pass that they will stop being counted because we took the foot off the gas a hair too early. Hard to see now, but it will become clear ~18 months from now.

Overbought?

Alan Shaw, the legendary former head of technical analysis at Smith Barney, once said, “The most bullish thing a market can do is get overbought and stay that way.”

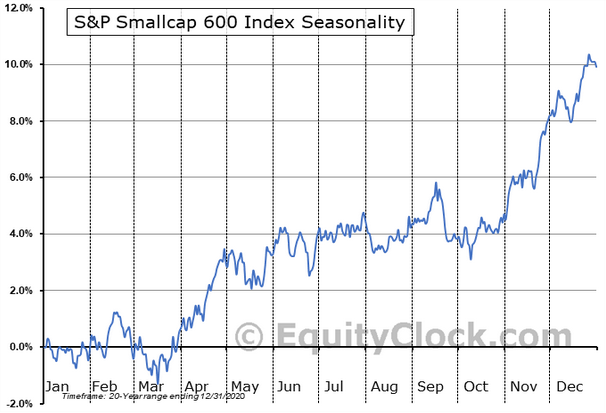

On the one hand, the S&P Small Cap index (similar to Russell 2000) finally broke out to new highs – after consolidating sideways for ~9 months. This is constructive (and consistent with a rising rate environment). We also saw regional banks up nicely after the Fed announcement. ‘Tis the season…

The ValueLine Geometric Index (the original “equal weight” index) also broke out to new highs on the Fed announcement:

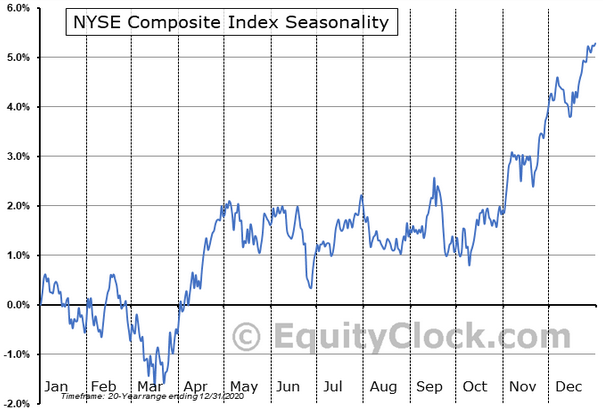

Did I mention the Dow Transportation Index also broke out?

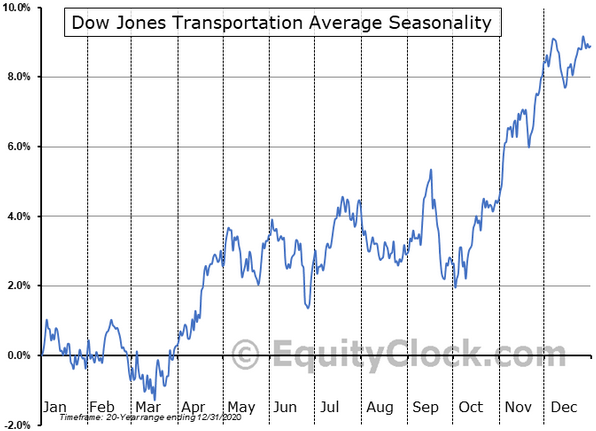

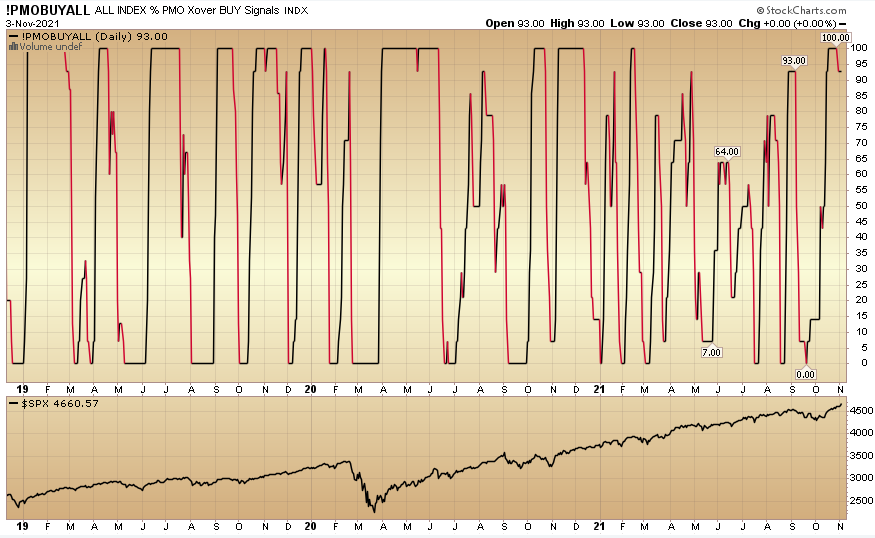

So while there are many indicators pointing to the market being “overbought”, sometimes the most bullish thing it does is stay that way for some time. In other words, these warning signals may not come into play in a material way before year-end (but we will keep a close eye on them):

So while there are many indicators pointing to the market being “overbought”, sometimes the most bullish thing it does is stay that way for some time. In other words, these warning signals may not come into play in a material way before year-end (but we will keep a close eye on them):

Now onto the shorter term view for the General Market:

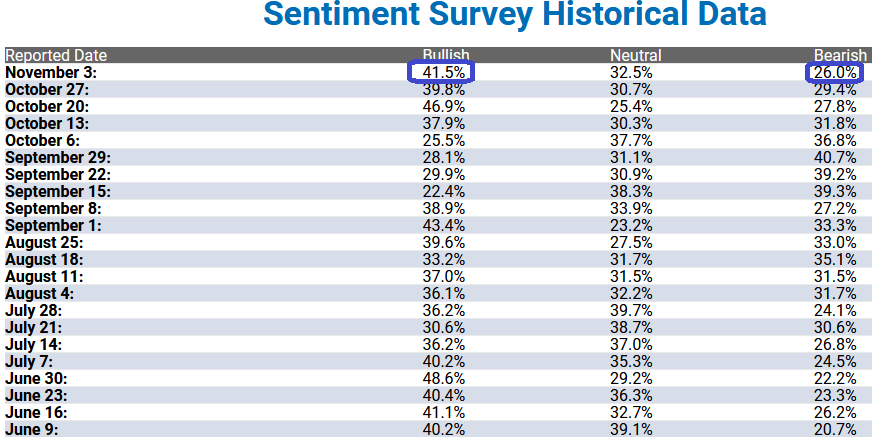

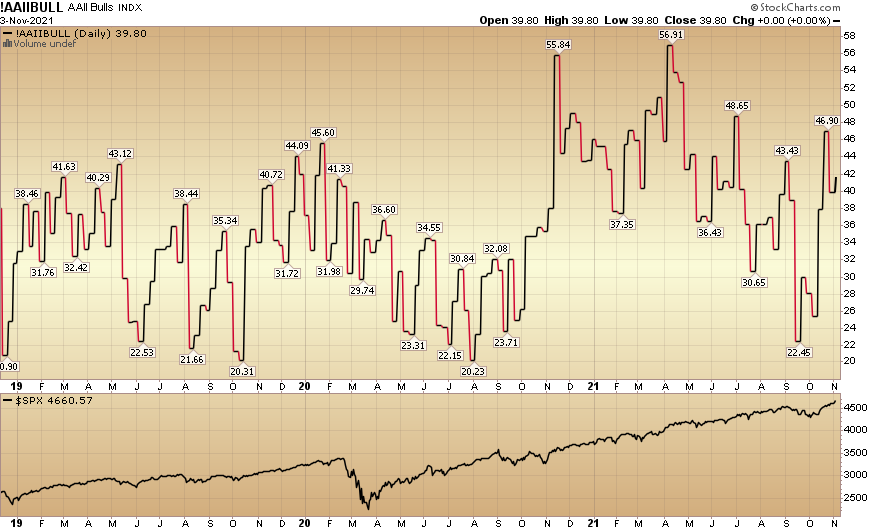

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) bumped up to 41.5% this week from 39.8% last week. Bearish Percent ticked down to 26% from 29.4% last week.

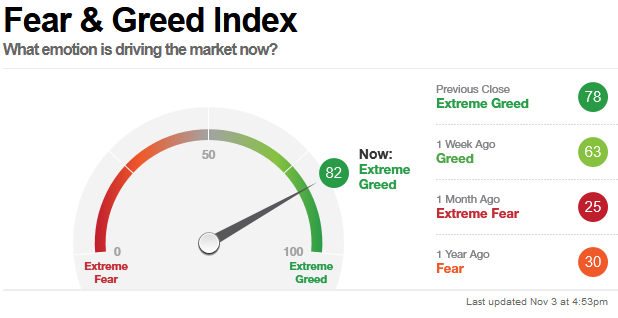

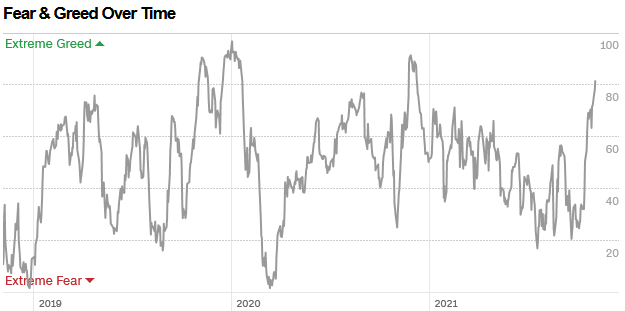

The CNN “Fear and Greed” Index ticked jumped up from 63 last week to 82 this week. Greed is back. You can learn how this indicator is calculated and how it works here: (Video Explanation)

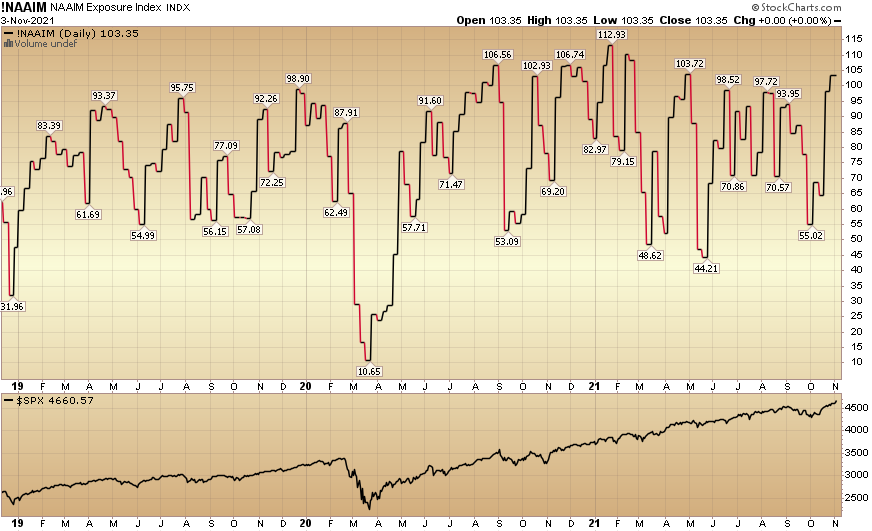

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 103.35% this week from 98.02% equity exposure last week. Managers are chasing into year end – as they were underweight with the market pressing higher through earnings season.

There are times to heed warnings and times to ignore them. The Fed will still add another $660B of liquidity to the market over then next 7 months taper period (through bond purchases and reinvestment). We think that although there are numerous indicators flashing yellow (and will come home to roost in 2022), getting too defensive in front of a year-end performance chase – when many managers came into Q3 earnings season short or defensive and now have to play catch-up to match or exceed their benchmarks – is probably not a good idea…