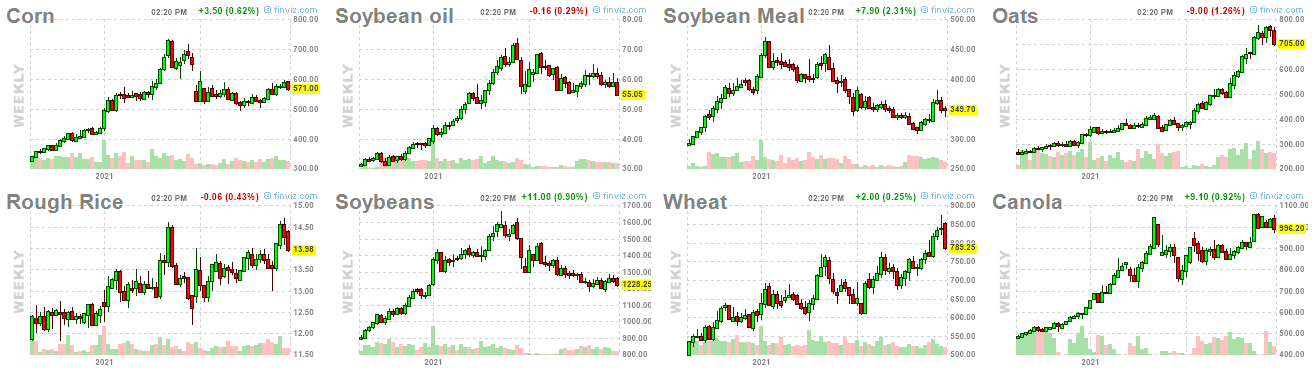

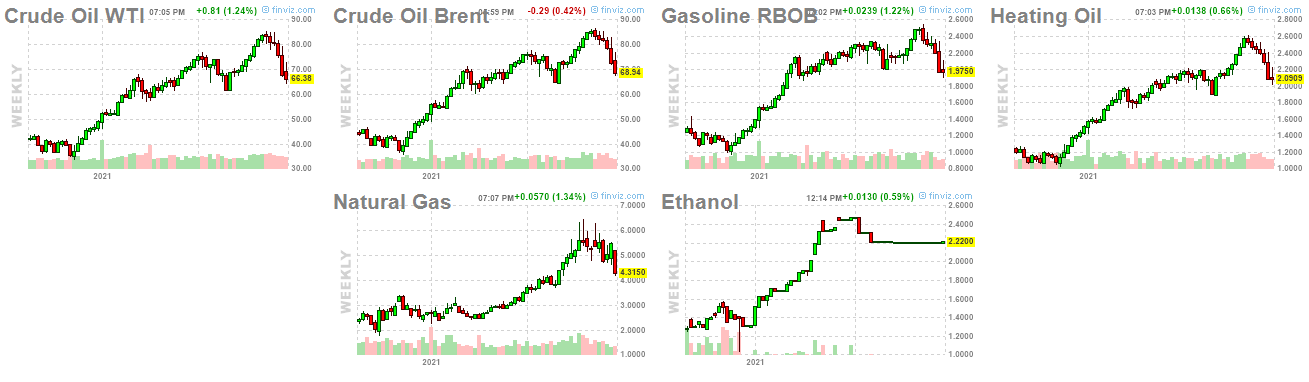

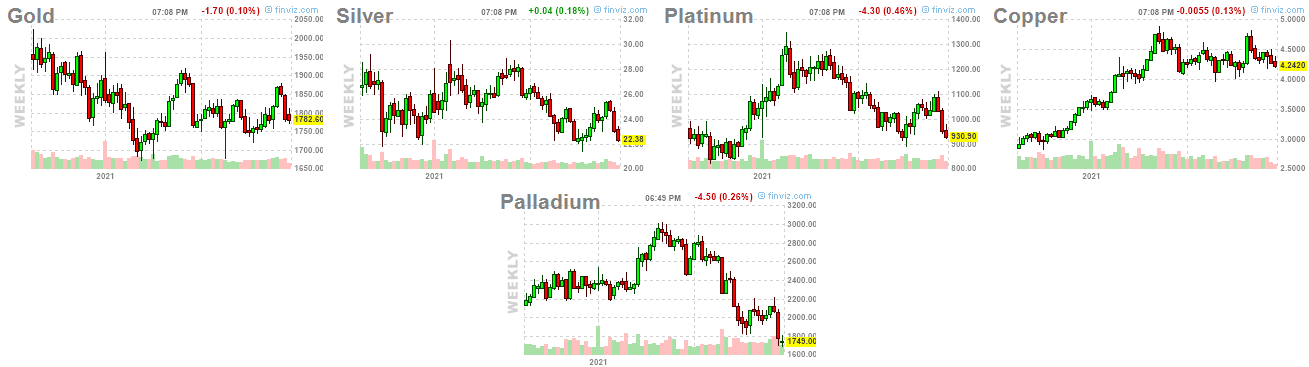

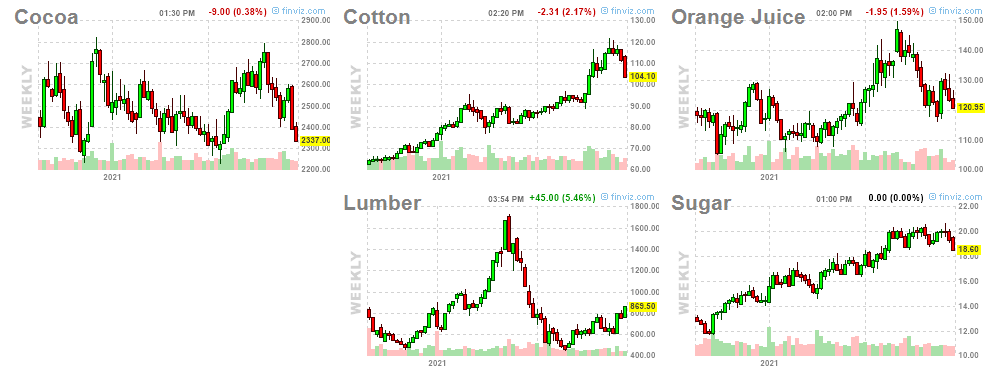

On November 4, we made the case that commodities were starting to roll over and the impact would be felt by consumers on a lagged basis. This weakness persisted in the following four weeks and now all of the the rear view mirror looking officials are in a mad dash to accelerate taper (at the exact wrong time):

If you look at 5-Year inflation break-evens, they have also come down from 3.17% to 2.7% in the past two weeks.

With Chair Powell’s newfound – post re-appointment hawkishness (a complete about face from his 1.5yr “transitory” stance)- we have to be on guard that he does not drive the bus off the cliff like he did by tightening into a slowing economy in December of 2018 (S&P 500 fell ~16% in 24 days). It was the worst December since the Great Depression and 100% avoidable if he had simply paid attention to the data that was staring him in the face at the time. As was the case in December 2018 and February 2020 Secretary Mnuchin stepped in with a plan to save the day. The problem is we no longer have Secretary Mnuchin to save us.

Accelerating the taper in the face of a new variant and falling commodity prices/inflation expectations, may not be the most prudent decision. Stick with the current taper plan and when the variant falls away (like the others) you can always speed up the taper at the next meeting.

In my two media spots this week (on Bloomberg and Yahoo! Finance) I made the case that we are in an “information vacuum” for the next two weeks regarding two subjects: Omicron and Fed’s decision on whether or not to accelerate the bond taper.

Thanks to Alexis Christoforous, Karina Mitchell, Taylor Clothier and Colin Foley for having me on Yahoo! Finance on Tuesday afternoon.

Thanks to Bryan Curtis, Juliette Saly, Yang Yang and Mark Siniscalchi for having me on Bloomberg Radio on Monday night.

In these segments we tried to separate the short term noise and volatility related to Omicron and Chair Powell’s new post-reappointment hawkishness from the underlying economic fundamentals and longer term view.

Here were the show notes. In both cases above you’ll find the hosts asked many great questions in addition to the show notes below:

Bad News:

-CEO of Moderna thinks his vaccine may lose effectiveness against Omicron. Will take ~3 months to make new one.

-Keep in mind in 2020, the market was up ~8% ytd in early November BEFORE we even had any vaccines.

-Early reports from SA imply “more transmissible, symptoms milder” but we will know more in coming weeks.

Good News:

-Pfizer Covid Treatment PAXLOVID is expected to be effective against OMICRON variant according to CEO Albert Bourla and Director Scott Gottlieb (80M dosage production capacity announced this morning – up from 50M). 89% efficacy against COVID + Delta (expected similar against OMICRON). This may prove to be the game changer. Additionally, Pfizer made a vaccine booster for Delta within 95 days but didn’t need it as the original version held up. They expect to do the same for OMICRON, but are not sure it will be needed – once again.

Looking Forward:

-We’ll have more OMICRON data within 2-2.5 weeks. If bad, Fed may be less inclined to accelerate taper – in order to cushion any short-term economic slowdown. More likely, it will be like previous variants and just a blip we’ll power through.

-Plenty of liquidity: M2 +$2.5T above pre-pandemic trend. Another $660B of liquidity to be added during taper period over next 7 months. LESS IF THEY ACCELERATE THE TIMELINE.

-Buybacks: Over $1T have been announced for S&P 500.

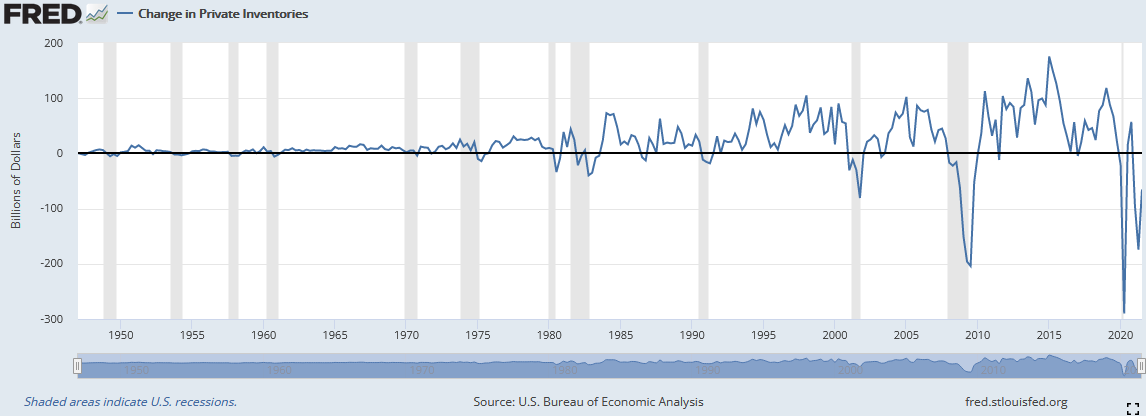

-Inventory Restocking just starting: Inventories back to 2009 levels still.

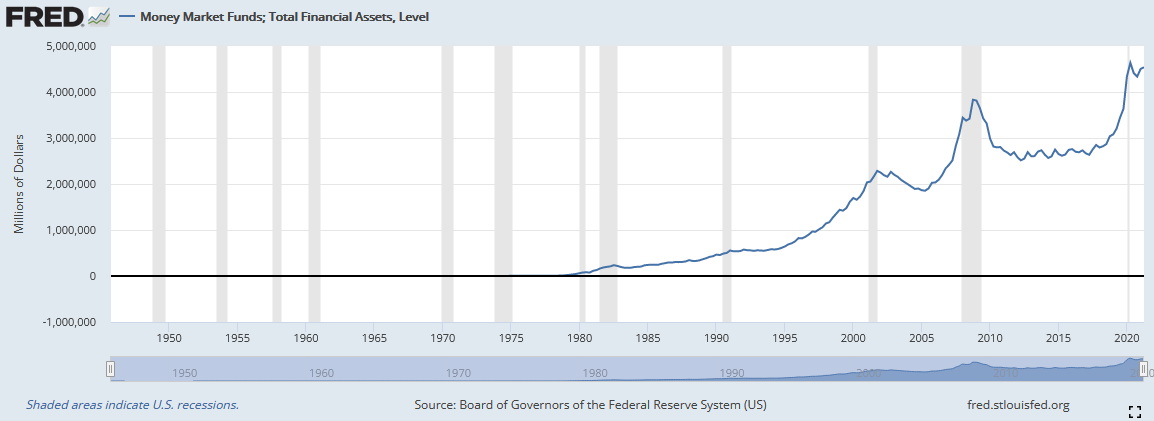

Economic Data still strong: Unemployment rate 4.6%, Retail sales up 16% yoy, Services and Manufacturing PMIs still in expansion mode >50, CAPEX ramping up, and $4.5T still sitting in money markets.

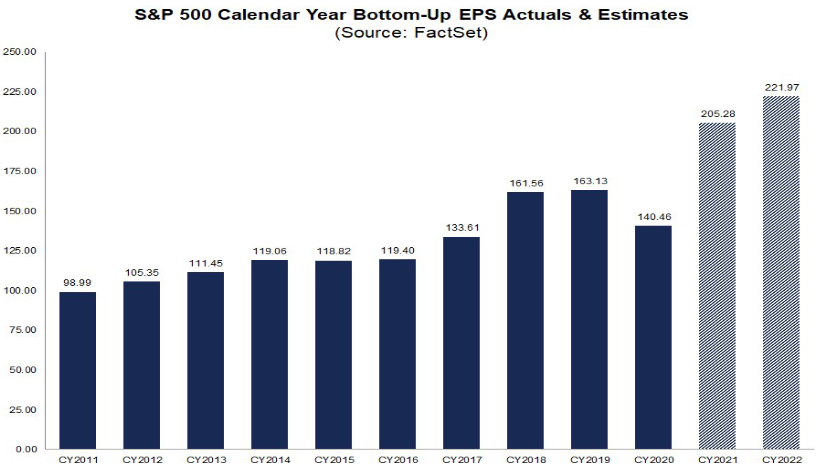

Earnings: Estimates still too low. Q3 was projected to come in +27.5%, it came in ~+40%. 2022 S&P Est ~$222. We could see this work up to ~$230 in coming weeks which would make the multiple look more reasonable moving forward.

2022: With ~9% S&P 500 earnings growth estimated, we expect high single digit to low double digit returns for 2022. However, market will start to anticipate liquidity reduction in 2H, and volatility will be much higher than 2021. The 3-5% pullbacks we saw in 2021 will turn into 5-10%+ pullbacks in 2022, but it will be a solid year nonetheless.

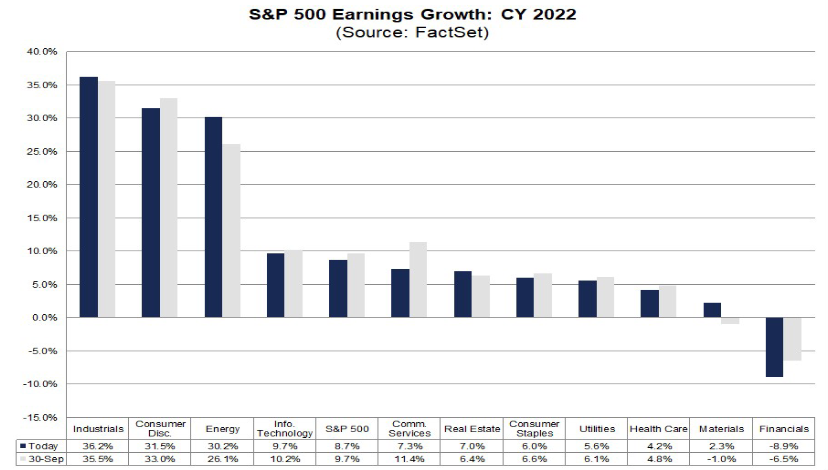

There’s a catchup trade in the works: Since early May, the vast majority of the market has labored sideways – with the exclusion of FAANGM. Looking at next year’s earnings estimates, the biggest growth will come from Industrials at 36.2% earnings growth – relative to the S&P 500 ~9%.

Within industrials, we think Boeing is caught up in the headwinds of short-term travel restrictions at just the time when China is expected to finally recertify the 737Max in coming weeks or months (the CEO expressed confidence on the Q3 earnings call that it would happen before the end of the year – we’ll see if he was right very soon).

Boeing anticipates $1.4T in orders from China over the next 2 decades. Their defense business now 40% of sales and has grown consistently through pandemic. The stock is still >50% off its pre-pandemic high, with global demand for domestic (and international) travel resuming. The TSA passthrough numbers in the US in the past week are getting very close to 2019 same period levels – with 2.45M people flying on Sunday alone.

China Stocks May also be worth a look in 2022:

Source: (Images and note – GS Asia)

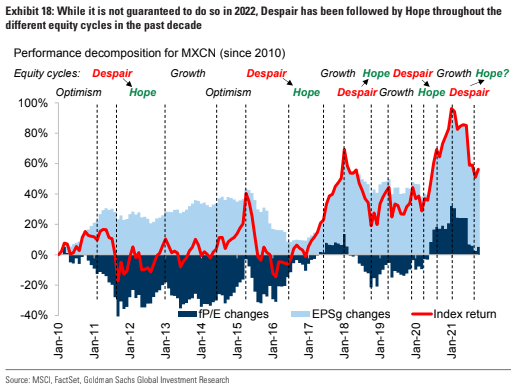

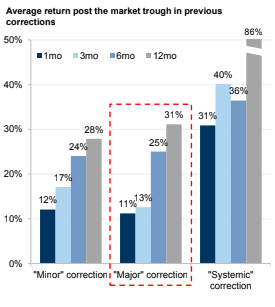

These regulatory crackdowns/crashed happen every 3-4 years and are followed by spectacular returns (average 31% in subsequent 12 months).

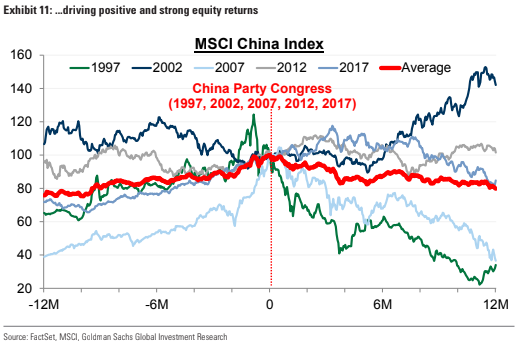

This particular recovery may prove to be more robust than normal due to the fact that the 20th National Party Congress meets in November 2022. As you can see in the table below – MSCI China has tended to perform well on PE expansion, generating roughly 30% 12m returns on average ahead of that event.

The belief that valuations should recover is predicated on:

a) China’s need to ease policy somewhat to rein in systemic risks, making it an outlier globally when most countries in the world will be withdrawing stimulus;

b) the 20th Party Congress will be convened in Nov next year, and equities tend to perform well on valuation expansion ahead of the event as stability takes priority on the policy agenda;

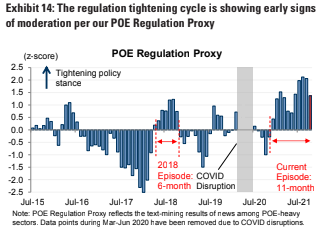

c) the potential for regulation clarity/intensity to improve, which helps compress left-tail valuation risks for Internet companies and boost their fair value; and,

d) prevailing valuations (12.7x) are at the lower bound of the 5-year range, and China’s valuation discounts to global equities are almost at all-time highs. The re-rating upside could be amplified by the close-to-record-low allocation by global mutual funds (470 bps underweight).

What Now?

The S&P is down ~5% in 9 days. As I stated in the Yahoo! Finance clip above, in times like this you can pull out your shopping list and ignore the short term noise that you have no control over (Powell’s about face and Policymakers’ extreme responses to another variant). You have to look out 6-12 months and ask, “will the world need more or less airplanes 12 months from now [Boeing] (remember we just overcame the 2-3 mo. Delta saga a month ago)?” It’s still trading 57% below its pre-pandemic high:

“Will Disney have more park attendees (pent up demand) and more Disney+ subscriptions 12 months from now than it has today?” Disney is trading down ~25% in the past three months:

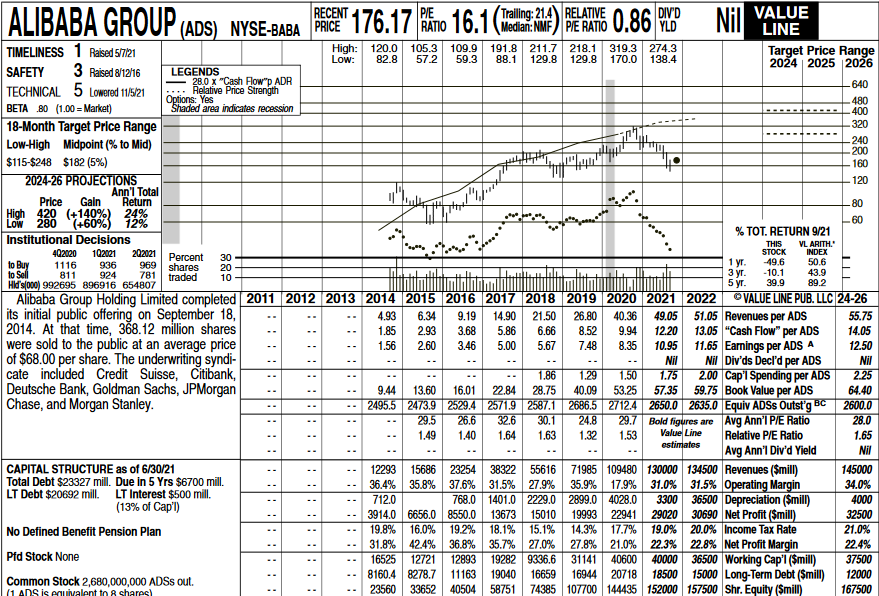

What about Alibaba, the never ending selling pressure is unabated DESPITE the fact that the underlying business continues to grow. Earnings for next year will still grow ~14.9% despite the aggressive and relentless regulatory crackdown of 2021. It’s still growing, but trading at 2017 prices despite the fact that revenues have grown ~350% and profits have doubled. The multiple has compressed from an average of 28x to now ~12.5x forward. They have 1.24B users with a plan to exceed 2B. This is not a franchise that is easily replicated or duplicated – and their cloud business is growing faster than AWS.

Do we know when any of these “bargains” will turn? Nope. But we’re betting soon. If you buy the highest quality franchises in the world when they are on sale, you are amply rewarded – even when it takes a bit longer than you expect due to exogenous events outside of your control. Time is your hedge and when they turn, it comes big and all at once.

Do we know when any of these “bargains” will turn? Nope. But we’re betting soon. If you buy the highest quality franchises in the world when they are on sale, you are amply rewarded – even when it takes a bit longer than you expect due to exogenous events outside of your control. Time is your hedge and when they turn, it comes big and all at once.

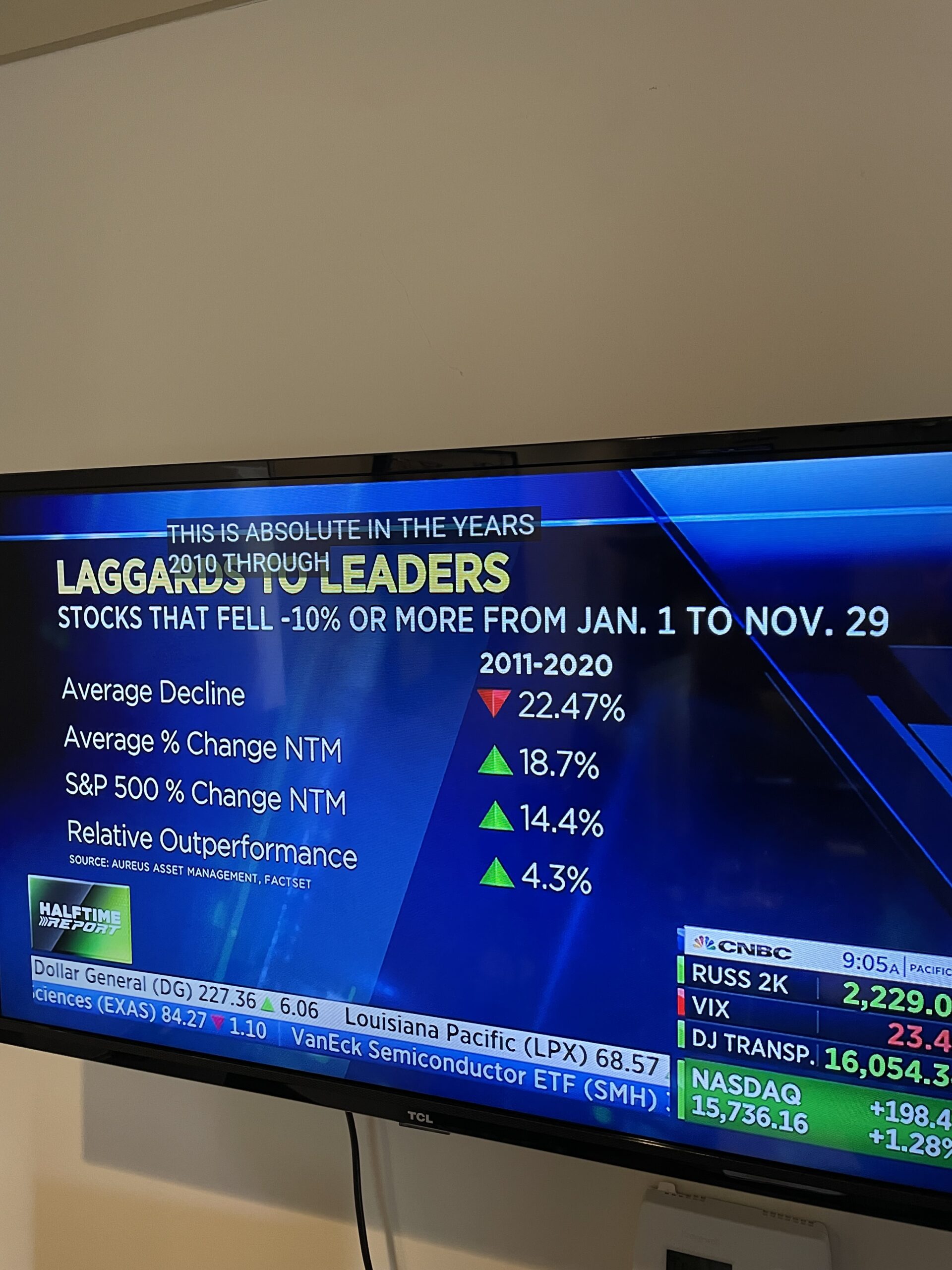

On Wednesday, there was an interesting graphic posted on the CNBC Half Time show: The summary is: BUY LAGGARDS IN DECEMBER AS THEY OUTPERFORM OVER THE NEXT 12 MONTHS.

The summary is: BUY LAGGARDS IN DECEMBER AS THEY OUTPERFORM OVER THE NEXT 12 MONTHS.

They took data from 2011-2020 and measured stocks that had fallen >10% through the end of November. If you bought them on December 1 and held for the next 12 months, the average return was 18.7% (or 4.3% better than the S&P 500).

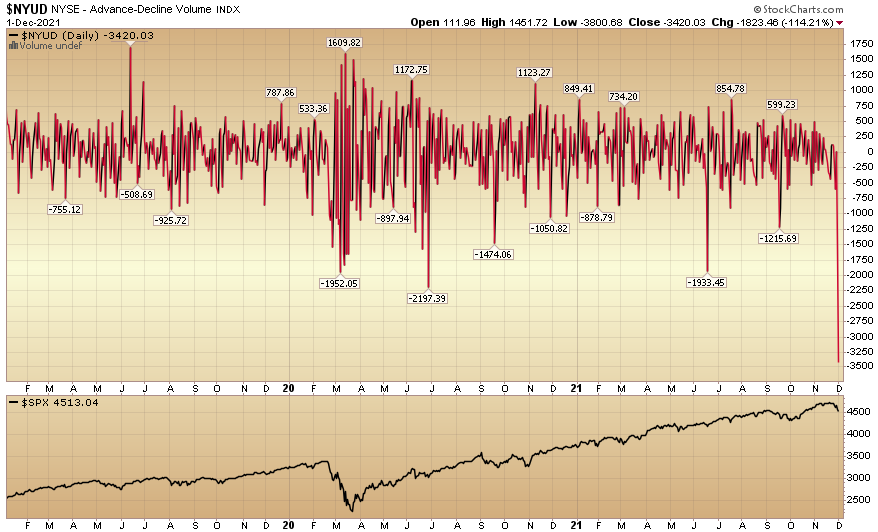

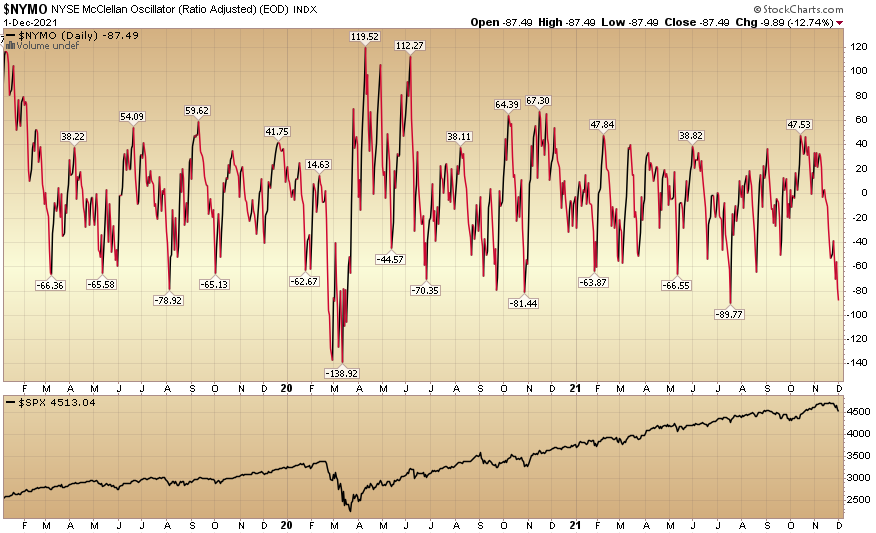

There are a number of short term indicators that point to a near term bounce, but we will need confirmation from the Omicron data and Fed decision before knowing if any new bounces are sustainable (short-term). That is why our focus is to take advantage by buying only the highest quality businesses that we believe will be bigger 6-12 months from now regardless of what Omicron and the Fed do in the short term.

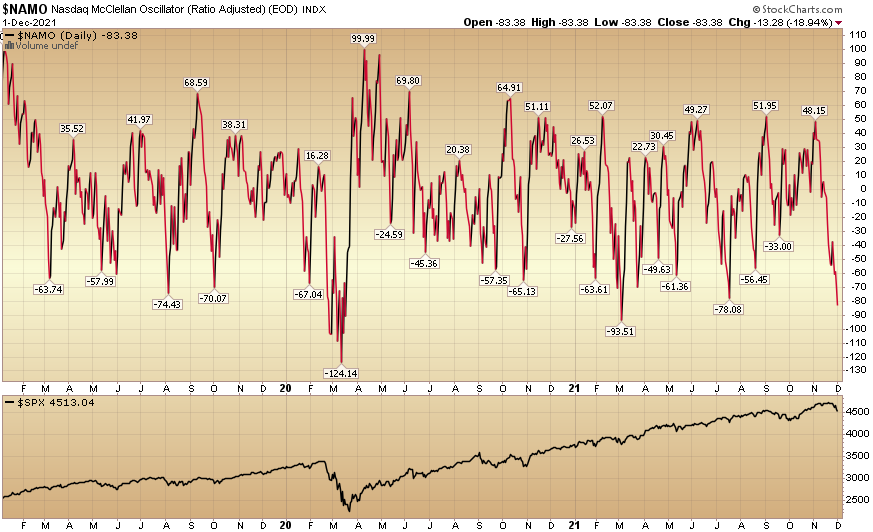

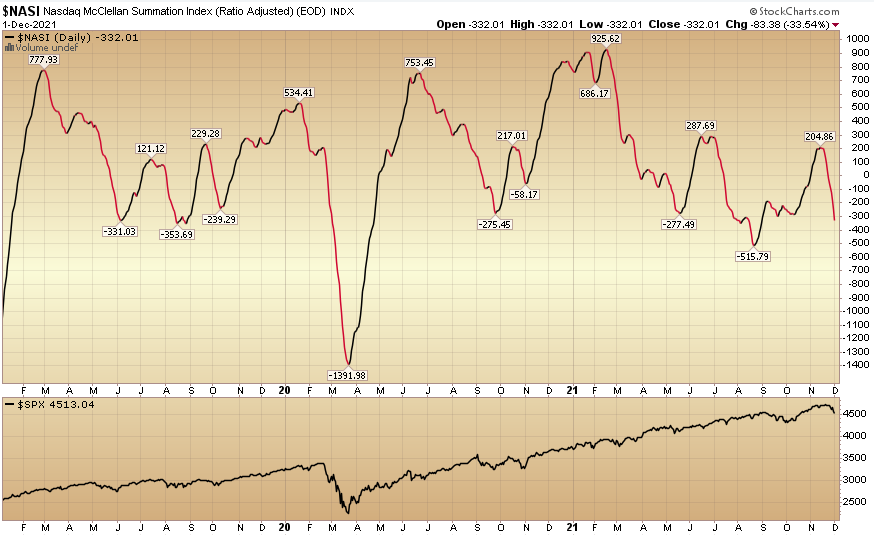

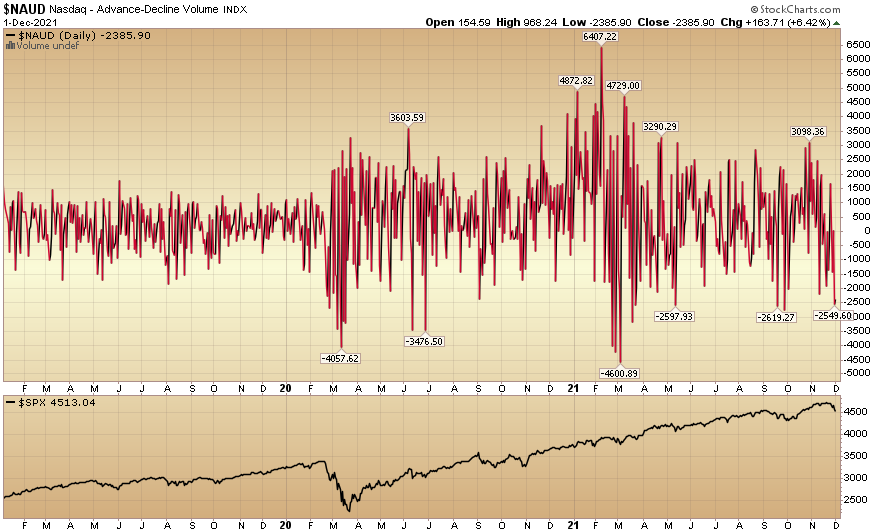

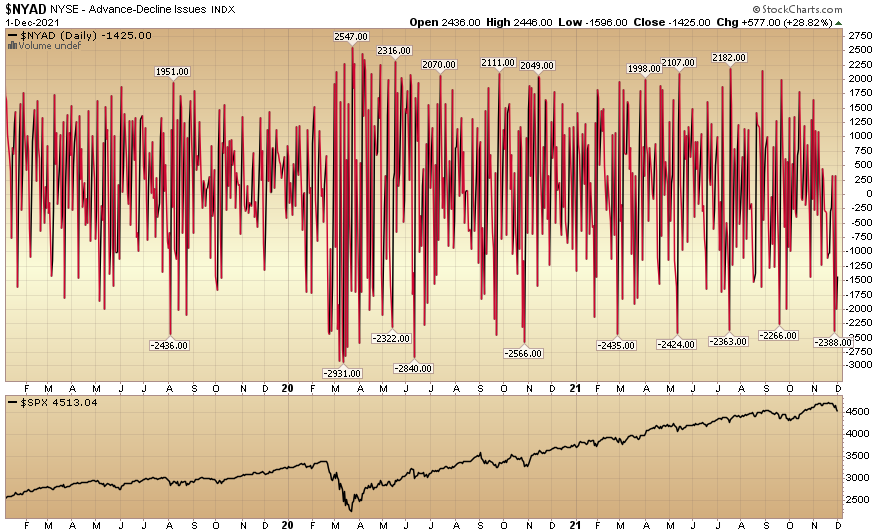

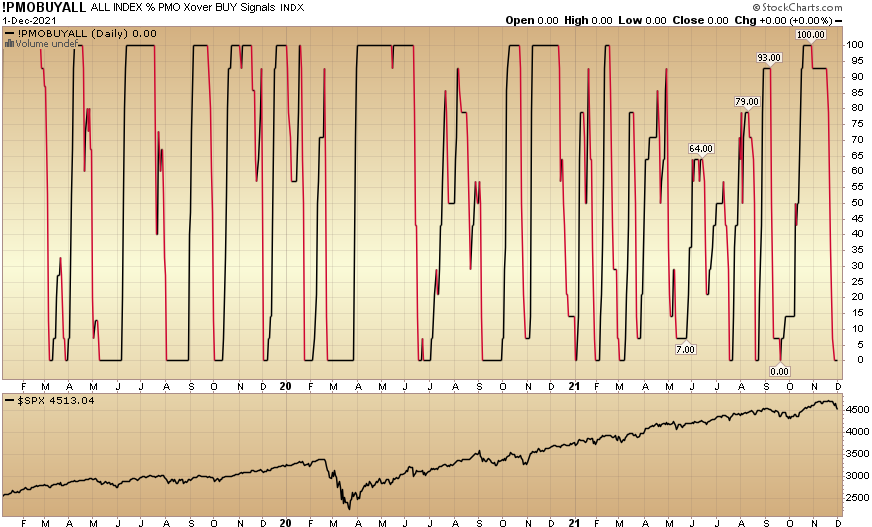

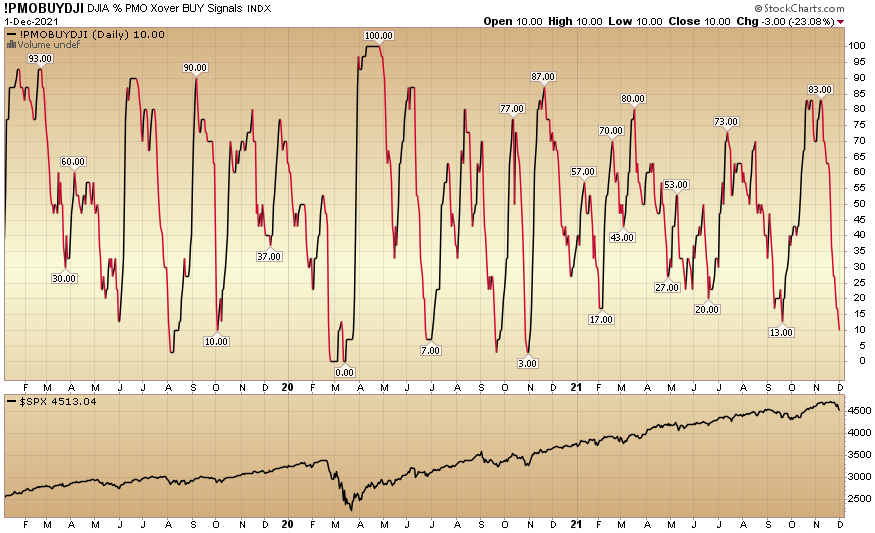

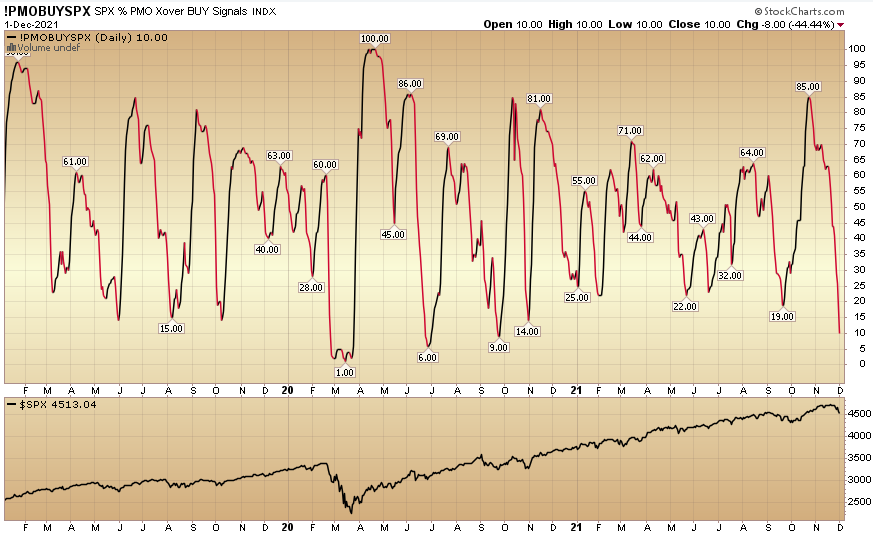

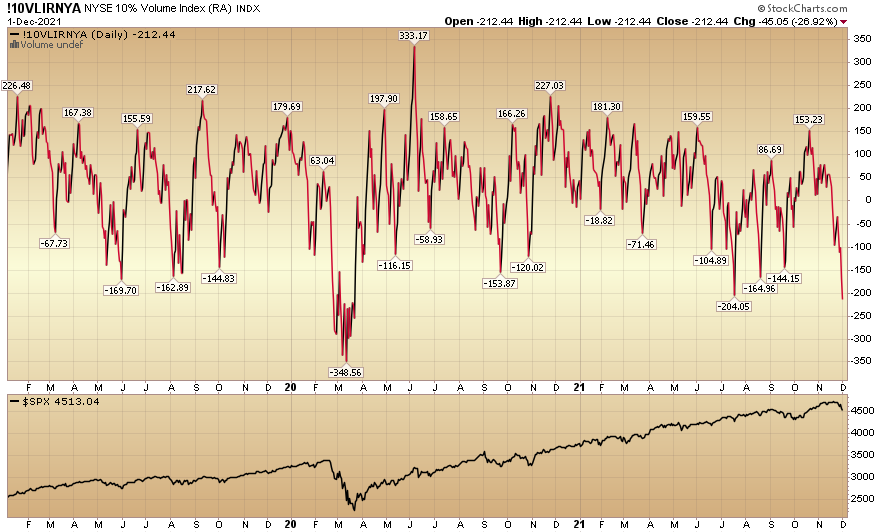

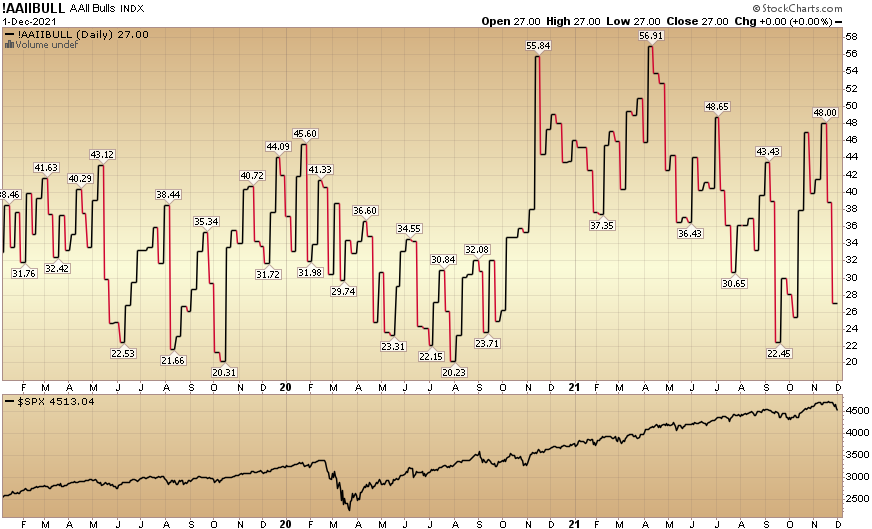

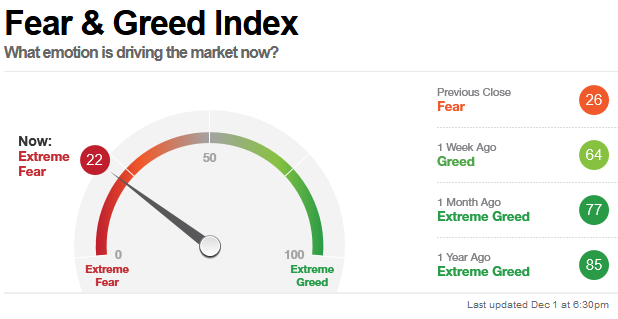

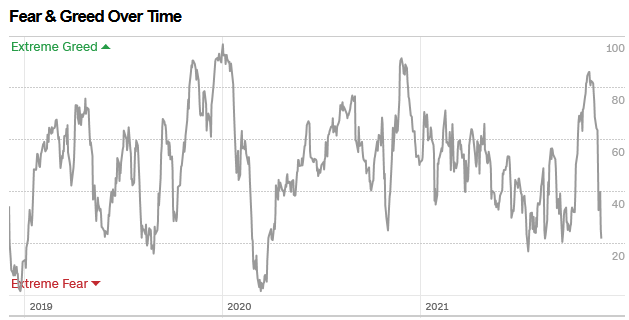

Here are a few of the indicators I’m looking at right now that are saying that odds favor a bounce in coming sessions:

Now onto the shorter term view for the General Market:

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) fell to 27% this week from 33.8% last week. Retail exuberance has rolled over.

The CNN “Fear and Greed” Index dropped from 62 last week to 22 this week. This is an extreme reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

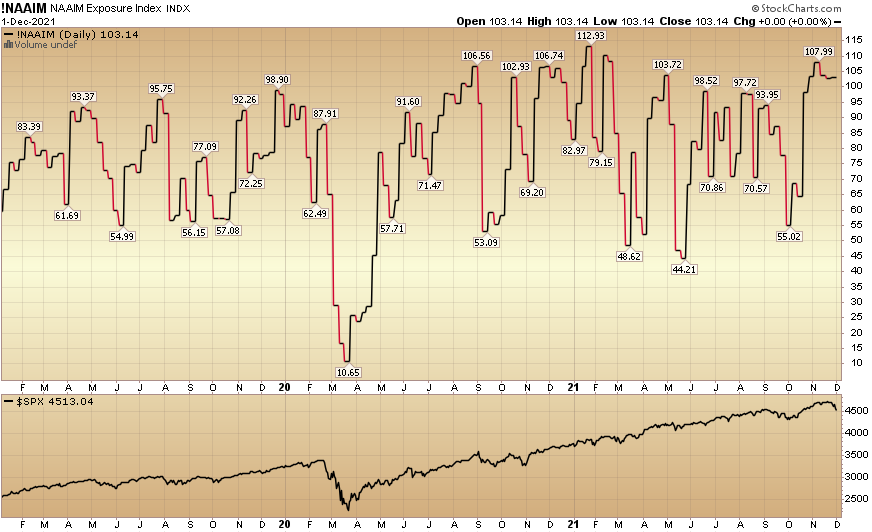

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) flat-lined at 103.14% this week from 103.14% equity exposure last week. This will likely change materially later today when the new data comes in.

We are using this short term volatility to buy/add to high quality franchises that will grow over 6-12 months despite policy and virus surprises along the way. We do it steadily, methodically (on down days) and not all at once…