- Charlie Munger’s Firm Doubles Down on Alibaba Investment. Again. (barrons)

- Boeing Stock Rises on New 737 MAX Order (barrons)

- AT&T Shed Media Assets in 2021. Now It Wants Investors. (wsj)

- Chinese Premier Li Urges Bigger Tax Cuts to Ensure Economic Growth (bloomberg)

- Manchin Deflates Democrats’ Hopes of Changing Filibuster, Passing Election Bills (wsj)

- China’s Stocks Had a Tumultuous Year. Analysts Size Up the Market’s Prospects for 2022. (barrons)

- China Tech Selloff Deepens as Tencent Sale Spooks Traders (bloomberg)

- Long Shadows. The Energy Report 01/05/2022 (Phil Flynn)

- Fed Minutes Eyed for Details on Rate Liftoff, Shrinking Assets (bloomberg)

- S. Companies Add Most Jobs in Seven Months, ADP Data Show (bloomberg)

- Gas Tankers Divert From China to Europe in Price Premium Race (bloomberg)

- AT&T Stock Rises After Posting 1.3 Million Subscriber Adds (barrons)

- Omicron seems to have peaked or plateaued in some regions, experts say (cnbc)

- China says apps that could influence public opinion require a security review (cnbc)

- A Slimmer Build Back Better Bill Is Still Possible (barrons)

- Stocks will rally in 2022 even as US interest rates hit 2%, Wharton professor Jeremy Siegel says (businessinsider)

- General Electric upgraded to Outperform from Neutral at Credit Suisse (thefly)

- Turkish Central Bank Revives Bond-Buying Drive to Rein In Yields (bloomberg)

- BofA Securities Out With 10 Favorite Stock Ideas for Q1 2022 (247wallst)

- Opinion: Why the bull market will stay alive in 2022 — plus 8 cheap stocks for your money now (marketwatch)

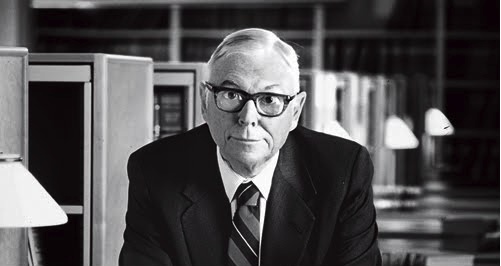

- Opinion: Charlie Munger, Warren Buffett’s right-hand man, just turned 98 and has some choice words about inflation, EBITDA and marriage (marketwatch)

- Federal Reserve could invert Treasury yield curve by third quarter as it delivers rate hikes, economists say (marketwatch)

- Fed’s Kashkari, a leading dove, backs two interest-rate hikes this year (marketwatch)

- JPM Urges Clients To “Stay Bullish” As Positive Catalysts “Are Not Exhausted” (zerohedge)

- China’s internet watchdog posts revised app rules to tighten cybersecurity provisions (scmp)

Be in the know. 25 key reads for Wednesday…