- China Cuts Policy Interest Rate for First Time Since April 2020 (bloomberg)

- China’s Xi says countries must abandon ‘Cold War mentality,’ warns against confrontation (cnbc)

- A quiet comeback is starting in emerging markets (ft)

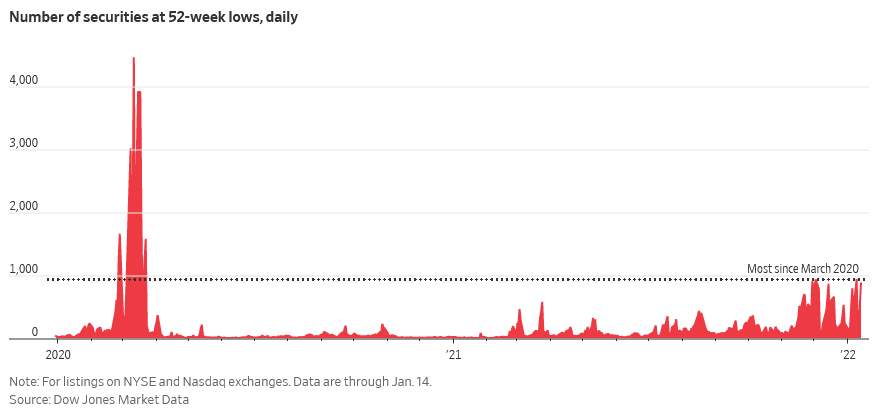

- Hundreds of U.S.-listed companies are off more than 20% from highs. (wsj)

- Tom Brady surprises 10-year-old cancer survivor with Super Bowl tickets (nypost)

- China’s Population Stalls With Births in 2021 the Lowest in Modern History (wsj)

- China’s Population Crisis Is Complicated. What It Means for the Country’s Economy. (barrons)

- Angi Could Be the Next Uber. Its Stock Looks Too Cheap. (barrons)

- Here Are 13 Stocks Whose Pandemic Dividend Suspensions Remain (barrons)

- China Seeks to Cushion Blow of Economic Pain as Momentum Slows (wsj)

- China GDP Grew 8.1% in 2021, but Momentum Slowed in Quarter (wsj)

- Big Tech Braces for a Wave of Regulation (wsj)

- These TikTok Stars Made More Money Than Many of America’s Top CEOs (wsj)

- Why China’s Central Bankers Are Still Worried (wsj)

- Amazon Scraps Plan to Stop Accepting Visa’s U.K. Credit Card (barrons)

- Day Traders as ‘Dumb Money’? The Pros Are Now Paying Attention (wsj)

- How to Use a Free Password Manager—and Make Your Logins Safer (wsj)

- Analysis: China’s ‘zero-COVID’ campaign under strain as Omicron surges (reuters)

- Boom Times for Classic Car Auctions Conducted Online (nytimes)

- Wells Fargo price target raised to $67 from $57 at Keefe Bruyette (thefly)

Be in the know. 20 key reads for Monday…