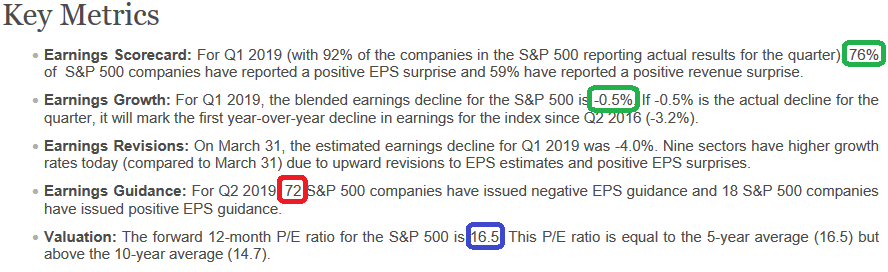

Source Above: Factset

Earnings continue to stay solid. As of today we have had 92% of the S&P 500 report for Q1. 76% of companies have beat, and while earnings still look to be modestly negative year on year, they came in better than recent expectations. Guidance is somewhat light – with 72 companies issuing negative guidance versus 18 issuing positive guidance. This is below average.

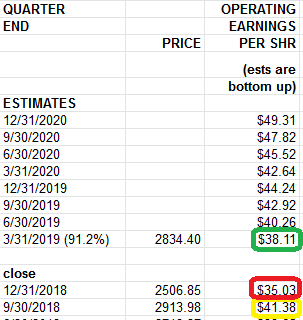

On a more important note, operating earnings look like we will NOT have 2 sequential quarters of declines which is very constructive. In previous notes we have analyzed the last 40 years of earnings history and found that if you have 1 sequential drop in Operating Earnings of ~5% or greater but then you recover, the correction holds.

In this case, since we are estimated to do $38.11 in operating earnings for Q1 (which would be positive against Q4 2018), history would suggest that the worst (December 2018 20% correction) is behind us. This contrasts with 2000 and 2007/08 where we had 2 sequential quarters of operating earnings and the initial correction was just the beginning.

Source Below: Howard Silverblatt – S&P Global

You can read more about it here:

UPDATE (newest data): Bull vs. Bear Death Match: Why Q1 Operating Earnings are “Make or Break”

The earnings multiple is well within a reasonable level at 16.5 – in line with the 5 year average. Now we just have to watch expectations moving forward as all of the earnings growth for 2019 is back-end loaded for Q3 and Q4.