The May survey covered ~266 managers with $747 Billion in assets under management.

OUTLOOK:

- A net 72% among survey respondents expect global profits to decline over the next month, the most since October 2008 and up from a net 66% in May.

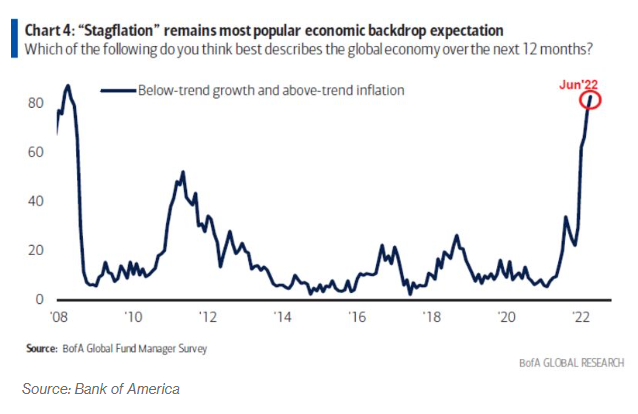

- 83% said they expect stagflation (below-trend growth and above-trend inflation), which was up from 77% in May and represented the highest percentage since June 2008.

SENTIMENT:

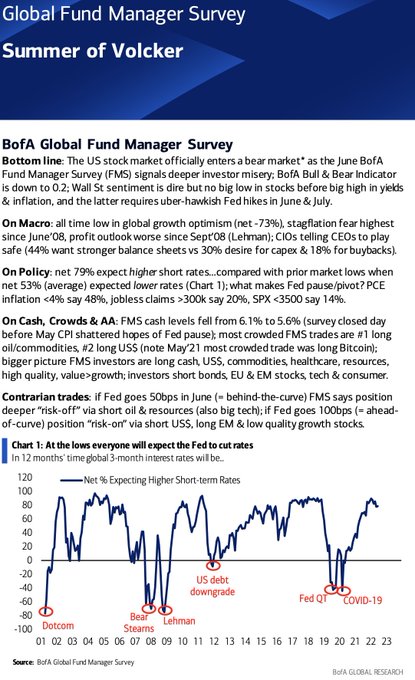

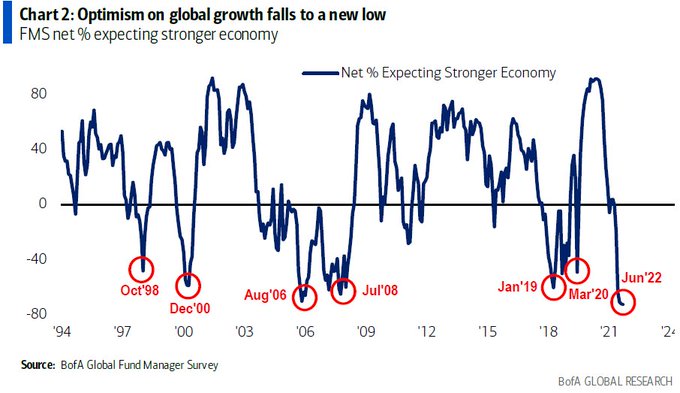

- Optimism on global growth fell to a new low in June, with the net percentage of fund managers expecting a stronger economy — meaning the difference between those expecting a stronger economic minus those expecting a weaker economy — hitting -73% this month, the lowest since 1994.

- Only 12% of fund managers expect a global economic boom (above-trend growth and inflation) over the next 12 months, down from 17% in May.

POSITIONING:

- A net 48% of respondents said they are currently taking lower-than-normal risk levels, up from a net 49% in May.

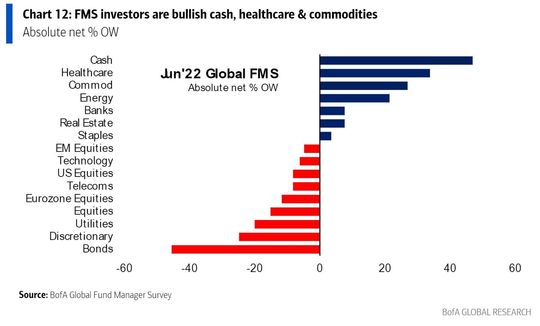

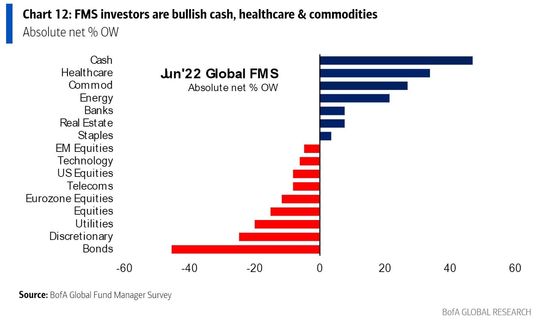

- Investors are long cash, US dollar, commodities, healthcare, resources, high quality and value stocks, while short positioning dominates bonds, European and emerging-market stocks, tech and consumer shares.

MOST CROWDED TRADES

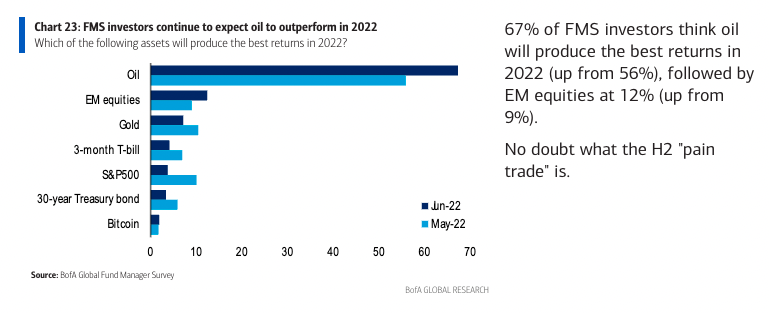

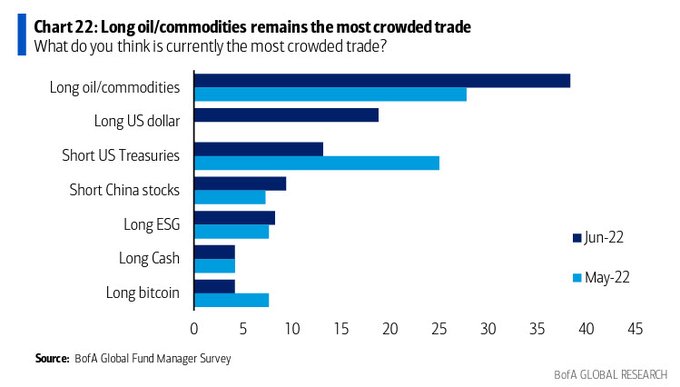

- Long oil and commodities was the most crowded trade.

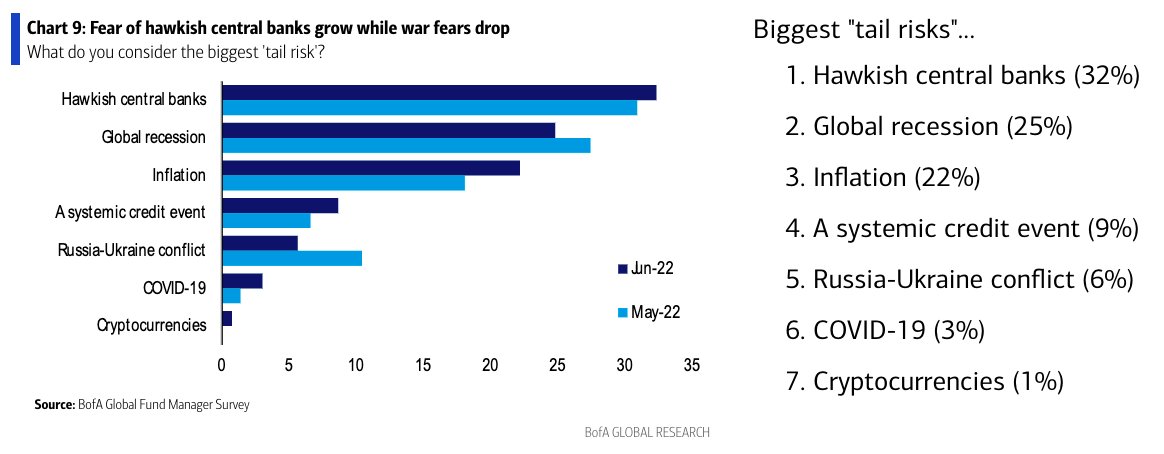

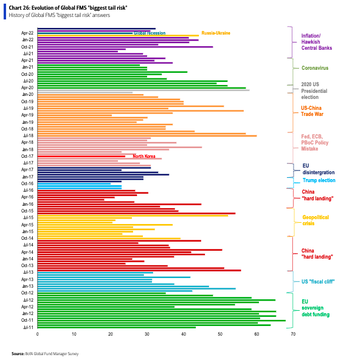

BIGGEST TAIL RISKS:

BANK OF AMERICA COMMENTARY: