Today we released the interview I completed with Philip Vassiliou – Partner and Chief Investment Officer of Billionaire Christopher Chandler’s Legatum. Philip is in charge of all investment activities for the firm.

Before joining Christopher Chandler at Legatum in 2006, Philip worked with both Christopher and his brother Richard Chandler at Sovereign Global Holdings. For those of you who don’t know the story – as the last time they did any press was an Institutional Investor article in 2006 – here’s the punchline:

“In two decades Richard and Christopher Chandler’s bold bets transformed a $10 million family fortune into a cool $5 billion.”

To put this in context:

Chandler Brothers (Richard and Christopher) turned $10M into $5B in 20 years (36% CAGR). This compares with Warren Buffett (19% over 50yrs), Seth Klarman (20% over 34yrs), Peter Lynch (29% over 13yrs), George Soros and Stan Druckenmiller both around (30% over 30yrs). Read the full detail of their Sovereign investments here: (macro ops)

Investment Highlights:

-Mosenergo – 383% in 4 years

-Unified Energy Systems – 430% in 4 years

-UFJ Holdings – 156% in 2 years

-SK Corp. – 433% in 2 years

-Mizuho Financial Group – 353% first 3 years.

If you cannot relate to starting with $10M, these returns are also equivalent to starting with $100K and turning it into $50M over 2 decades – 500x. This is also equivalent to turning $1M into $500M.

To fully understand their investment philosophy, process and what they are focused on today, you will want to tune in to this first ever look “under the hood” in over 16 years…

The interview is now live here:

______________________________

Fox Business

On Tuesday, I joined Lauren Simonetti on Fox Business – The Claman Countdown. Thanks to Ellie Terrett, Liz Claman and Lauren for having me on:

Watch in HD directly on Fox Business

Here were my “show notes” ahead of the segment:

–2/10 spread already inverted in March – which is solid indicator of Recession. Atlanta GDP Now is at -2.1% for Q2.

-If 2 consecutive neg GDP qtrs., we are likely already in a mild recession AND this may be the BEST THING that could happen for finding a bottom in the Stock Market.

-Market is a discounting mechanism and a lot of pain is already priced in (down ~21% S&P ~31% on Nasdaq).

-I wouldn’t be “shorting in the hole.” Expectations are very low and any unexpected positive news (on Inflation, Earnings, Geopolitical, etc) could spark a Summer Rally.

The time to get bearish is when everyone is calm. Right now people are hidden under bunkers. By the time they announce an “official recession” the stock market will have bottomed well beforehand.

People are worried about earnings, and while they have ticked down modestly in the past two weeks, we’re still at ~$250 for 2022 which implies 15x next years earnings (below 18.6x 5yr avg).

Bonds are starting to get bid/yields coming down as Fed may have to make “dovish pivot” (slow/stop hikes) sooner than anticipated.

Key will be NFP jobs report later this week. If unemployment is ticking up, Fed can ease off hikes or go more slowly. If jobs growth is better than expected, Fed goes 75bps at end of month.

Keeping our focus on our top two positions: 1) Alibaba – now up over ~60% from the March “uninvestable” lows. China is easing/stimulating while rest of world is tightening. 2) Biotech – M&A “animal spirits” back ~6 $1-11B deals last 6 weeks. Phase 3 date on multiple drugs this summer could also catalyze industry. XBI is now up over ~30% off its May lows…

Watch What They DO, Not What They SAY

While the Fed has talked a tough game, the actions they have taken around tightening have been more measured – in an attempt to orchestrate a “softish landing.”

Quantitative Tightening started on June 1 with a goal of removing $1T of liquidity from financial markets over a year. They SAID they planned to sell $17.5B in Mortgage Backed Securities and $30B of Treasuries in June.

What did they actually DO? They sold under $10B in MBS and BOUGHT $3B in Treasuries.

In other words their stated plan of removing $47.5B of liquidity in June actually came in at ~$7.5B.

The Fed has also SAID they were going to “expeditiously” raise rates to aggressively attack inflation. While inflation hovered at 8.6% they raised the Fed Funds rate to just 1.5%.

The Fed is TALKING tough, but remaining relatively accomodative. AND, they are SUCCEEDING. They may in fact “thread the needle” as most inflation measures peaked in April, people feel “less rich” with stocks achieving a bear market correction, housing is cooling, demand is declining, and commodities have rolled over across the Board.

With Altanta GDP now at -2.1% for Q2 there is a good chance we already had two consecutive quarters of negative GDP growth (a “technical” recession). Markets typically bottom BEFORE the “official” retroactive announcement that we are in a recession – which could come as early as the end of July when Q2 GDP numbers are printed. With the yield curve having inverted in March, this would be a relief to get the “recession” in the rear-view mirror versus having to wait for 2023 to book it so we can move back to a growth environment.

Like 1994, when they raised 75bps in December and began cutting rates again – just 8 months later – leading to an historic multi-year run in equities, the Fed is setting the stage for a similar outcome.

Will they be able to pull it off? Tough talk with relatively accomodative action may be just what the doctor ordered. They are in a tricky spot and due to calculated patience and data dependence, they may get us to the other side with a few bruises (already achieved and in the process of healing), but nothing broken. Inflation may take some time to come down, but so long as it continues to move in the the right direction DOWN, the Fed can continue to jawbone aggrssively while keeping relatively easy policy in place and most people in their jobs.

Now onto the shorter term view for the General Market:

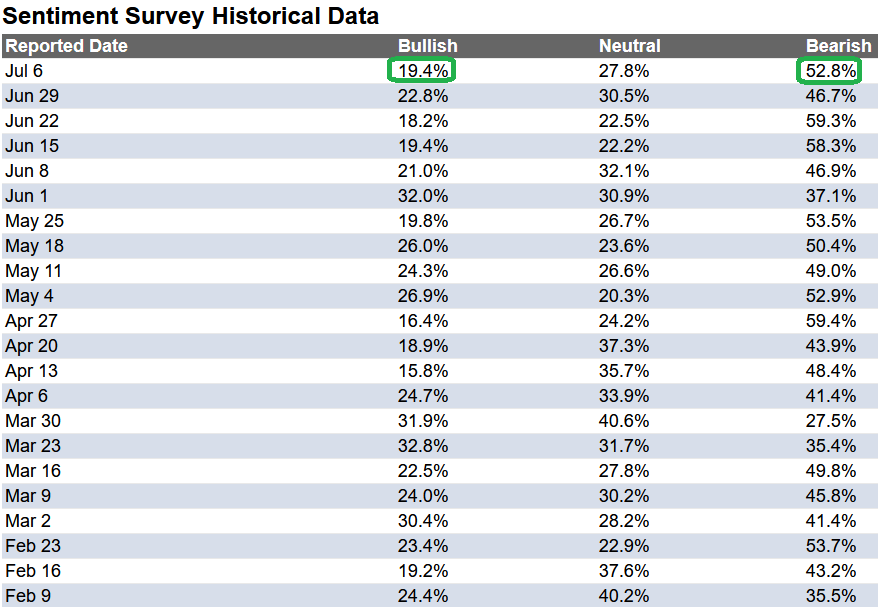

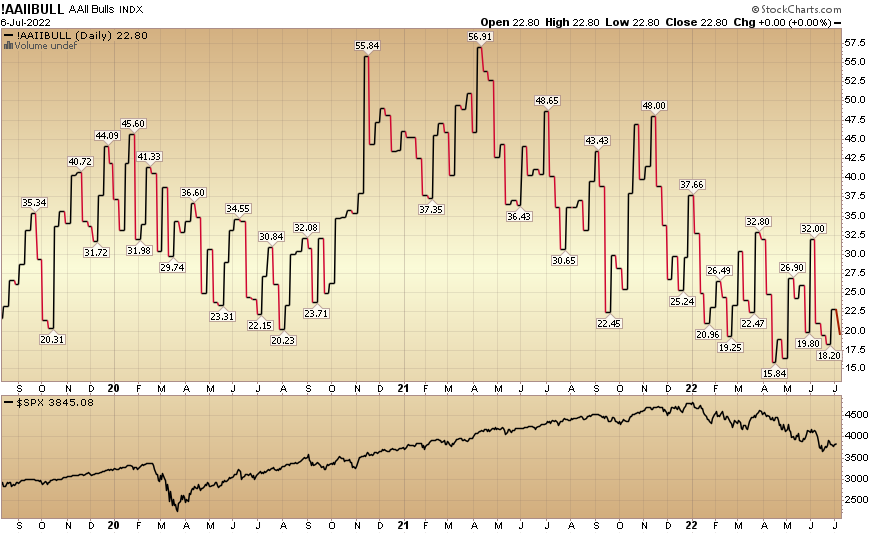

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 19.4% this week from 22.8% last week. Bearish Percent jumped up to 52.8% from 46.7%. Retail investors are still extremely fearful.

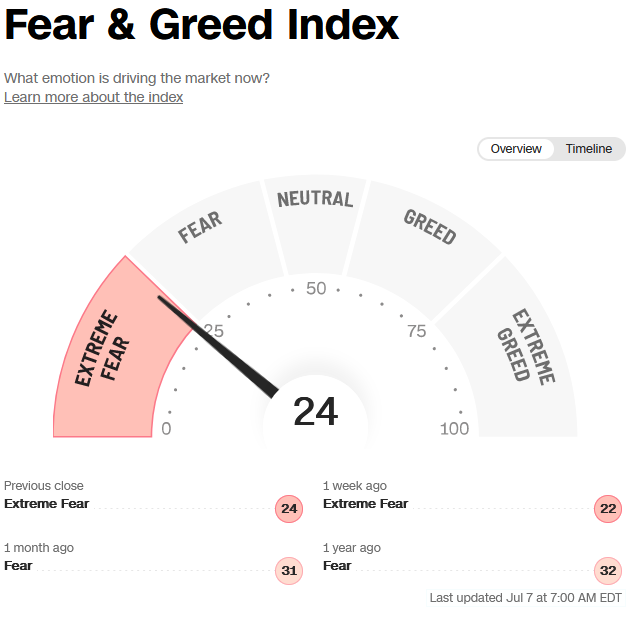

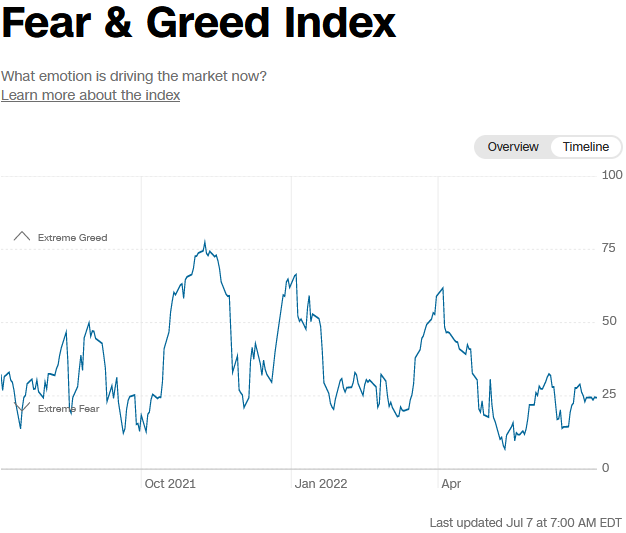

The CNN “Fear and Greed” ticked down from 25 last week to 24 this week. This still shows extreme fear. You can learn how this indicator is calculated and how it works here: (Video Explanation)

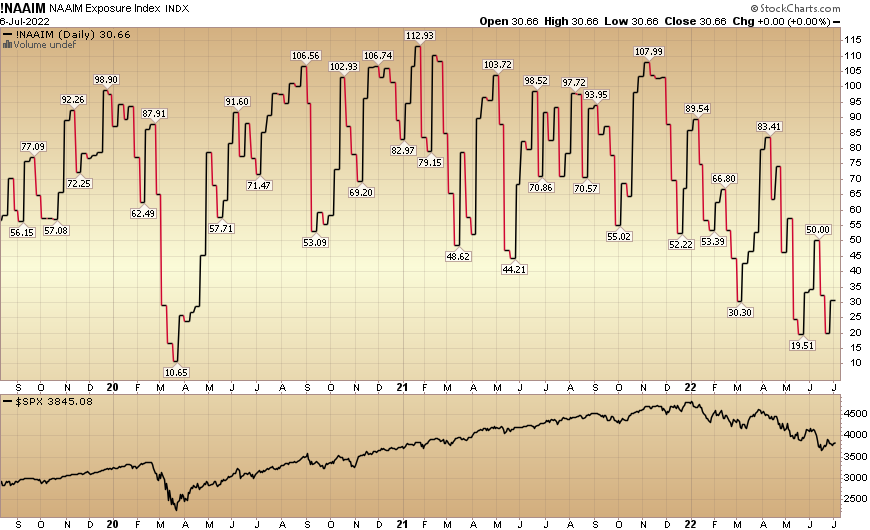

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 30.66% this week from 19.86% equity exposure last week. Based on positioning, we expect to see “panic buying” come in aggressively if Q2 earnings/guidance is not as bad as feared.