With all of the noise about Jackson Hole tomorrow and whether they will be hawkish, dovish, pivot or not, we wanted to take a step back and think about broad themes we are/will be pursuing over the next few years.

1) Emerging Markets

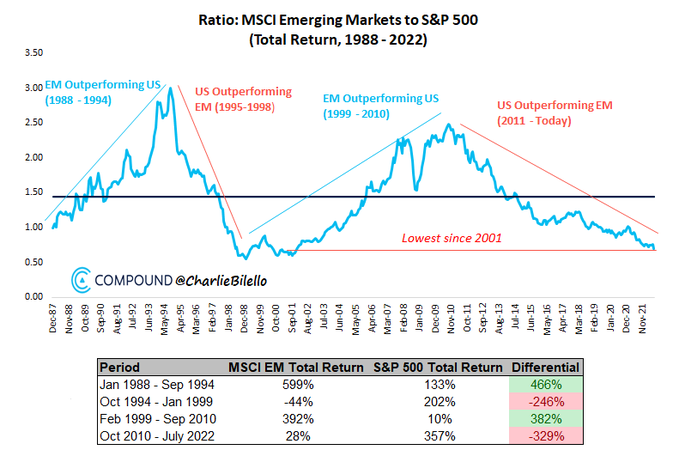

We highlighted the chart above in last week’s note:

“Wrong Side of the Wave” Stock Market (and Sentiment Results)…

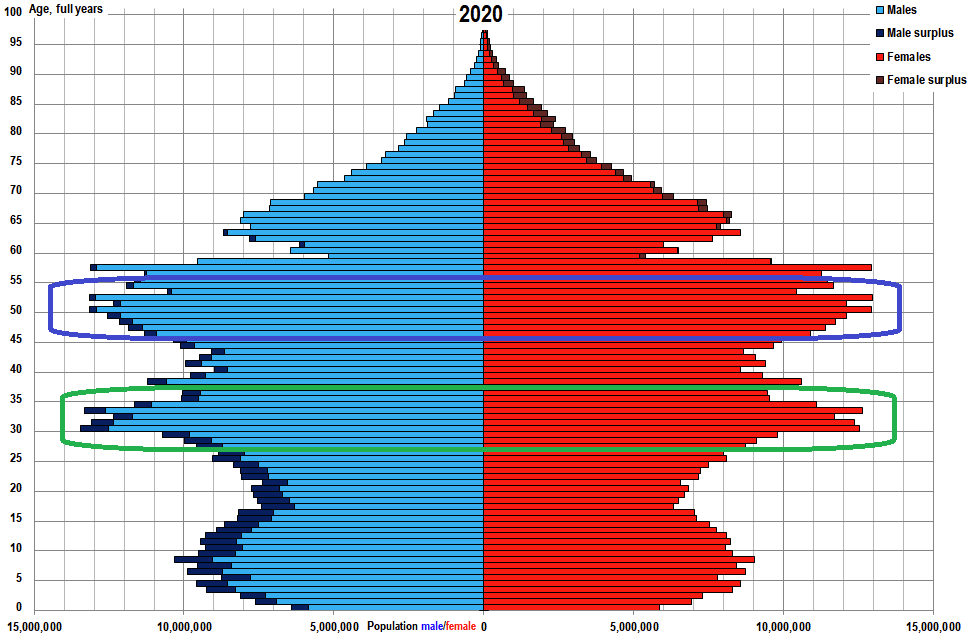

The biggest theme we are pursuing is Emerging Markets. We have initiated this position with Alibaba. Alibaba is the fourth largest weighting in the Emerging Markets index, so as money begins to flow back into the index, Alibaba will be a key beneficiary. While China represents over 33.5% of the weighting in the Emerging Markets index, it has the least favorable LONG-TERM demographics (and best short term).

For those worried that China will overtake the US as the world’s leading economic power, you can rest easy as the one-child policy created an aging population that will look a lot more like Japan following the late 1980’s than a new economic superpower. Recent policy decisions have cemented their fate – and even when reversed aggressively it will not help their outlook in the long term. However, in the short-term (next 3-5yrs) we are very bullish on China. The best investors in the world can hold two conflicting thoughts in their mind at the same time and still execute.

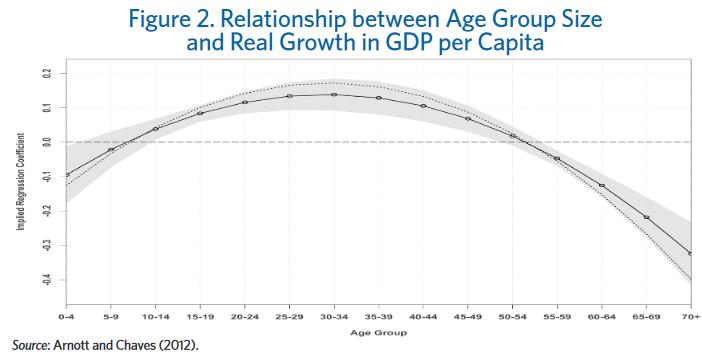

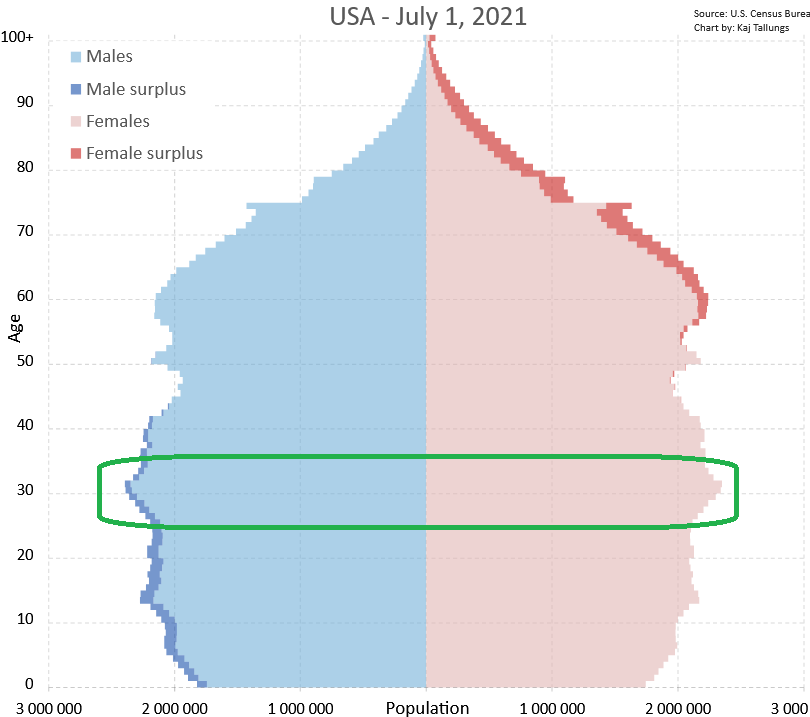

In short, the countries that will achieve the highest growth in coming years are those with the largest populations AT or nearing the 25-35yr old range where housing and family formation is at its highest. Spending and productivity accelerates into the late 30’s and early 40’s. The US has the most favorable profile outside of the Emerging Markets, but you can contrast by country to see where the future is headed:

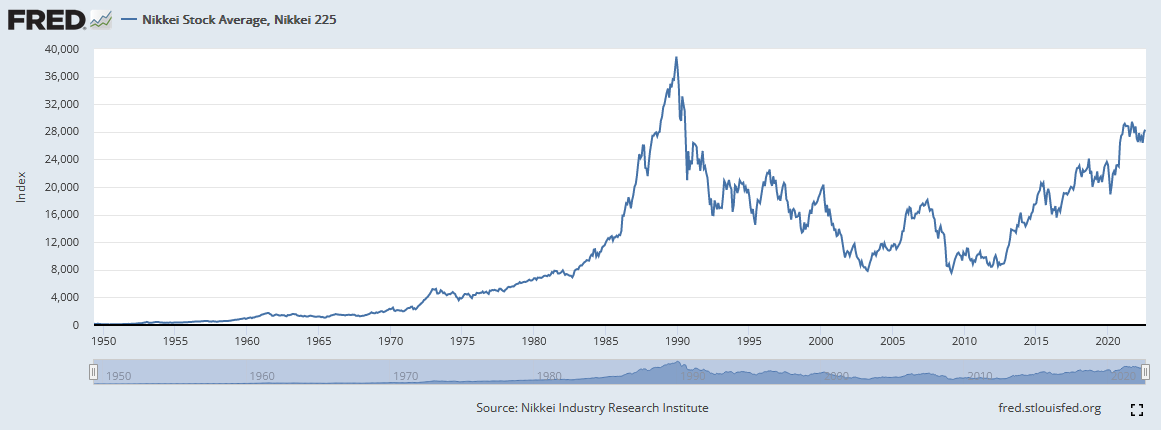

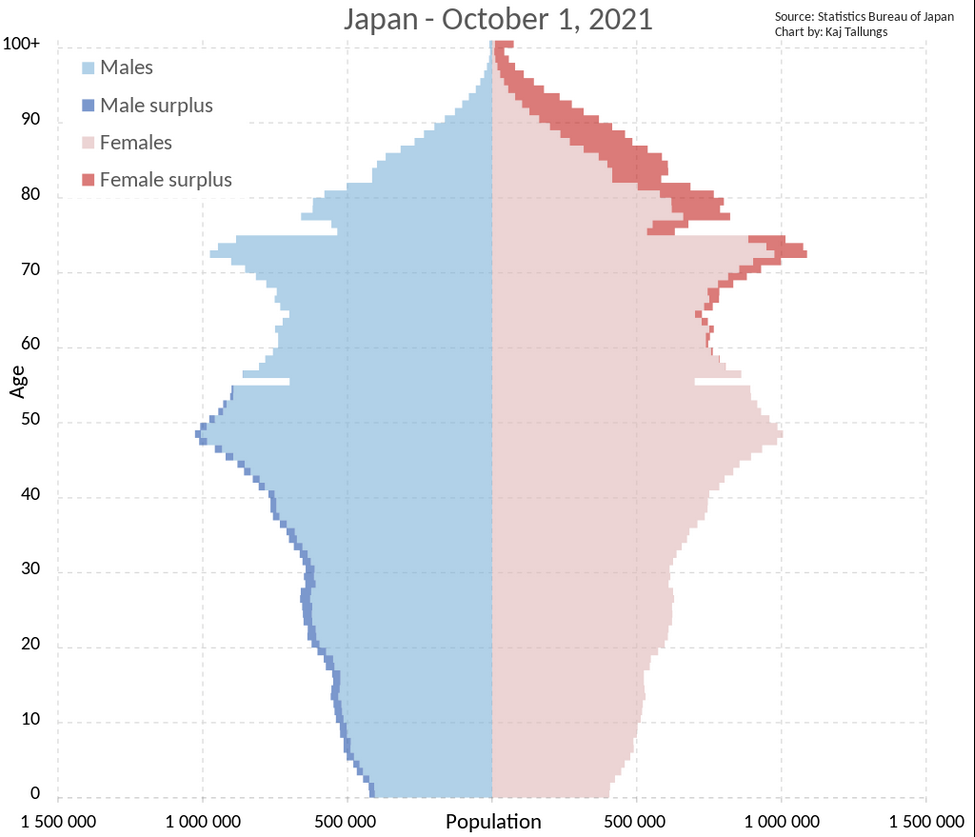

Japan enjoyed a demographic tailwind (younger population) from 1960-1980. The momentum carried their economy and stock market until 1989. Everyone pointed to their purchases of Rockefeller Center in October 1989 and other prized assets in the US to explain why they would become the world’s largest economy. We know what happened next (they have still not recovered 3 decades later):

If you look at the thick lines (around age 73-74 right now), in 1989 that same large segment of the population was ~40 years old. The biggest growth in their economy and stock market occurred when the largest portion of their population was 30-39.

So what countries have a large portion of their population ~30yrs old?

China (above) has an eco-boom with a large portion of their population aged between 32-37 (green circle above). This is in line with our outlook that (like Japan in the late 80’s), China will have one last spurt of parabolic growth and a stock market rally predicated on the idea that it all peaks when this segment ages into their early 40’s. The last parabolic top was in 2007 (15 years ago) when the last large segment of their population (blue circle above) was just hitting ~40 years old. That was the peak [after a ~500% gain (Shanghai Composite) in 2 years off the 2005 lows (300% gain on Hong Kong Hang Seng)}. We are there again (demographically speaking).

In other words, the next 3-5 years will be the best years in China for many decades to come. We expect a long term peak ~5 years from now. In the meantime, get up and dance while the music is playing (like Japan from 1984-1989). We could be seeing new highs before anyone expects it.

In other words, the next 3-5 years will be the best years in China for many decades to come. We expect a long term peak ~5 years from now. In the meantime, get up and dance while the music is playing (like Japan from 1984-1989). We could be seeing new highs before anyone expects it.

This interview from Wednesday 8/24 shows just how hated China is right now (sentiment check). I think it will go down as an historic interview (and turning point) for China equities when people look back just a year from now. It will rival the “China is Uninvestible” note that dropped on the day Chinese equities bottomed in March 2022:

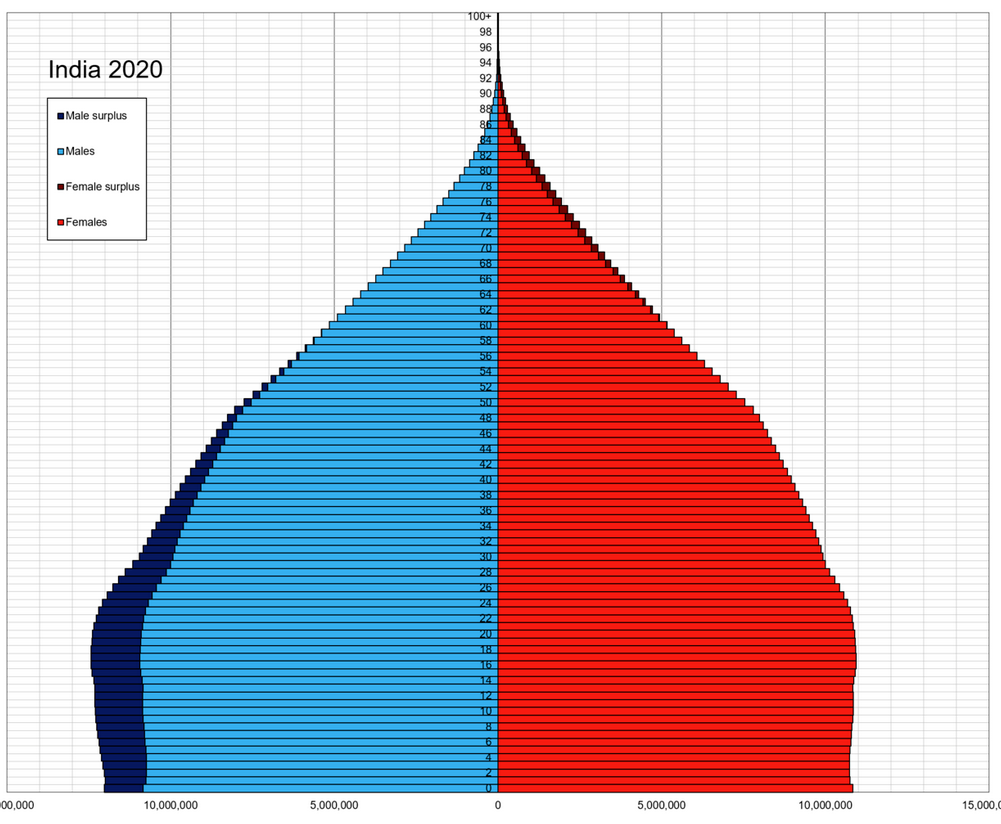

It is a bit early in India, but the future can belong to them in starting in the 2030’s. Their largest population segment is still in their early 20’s:

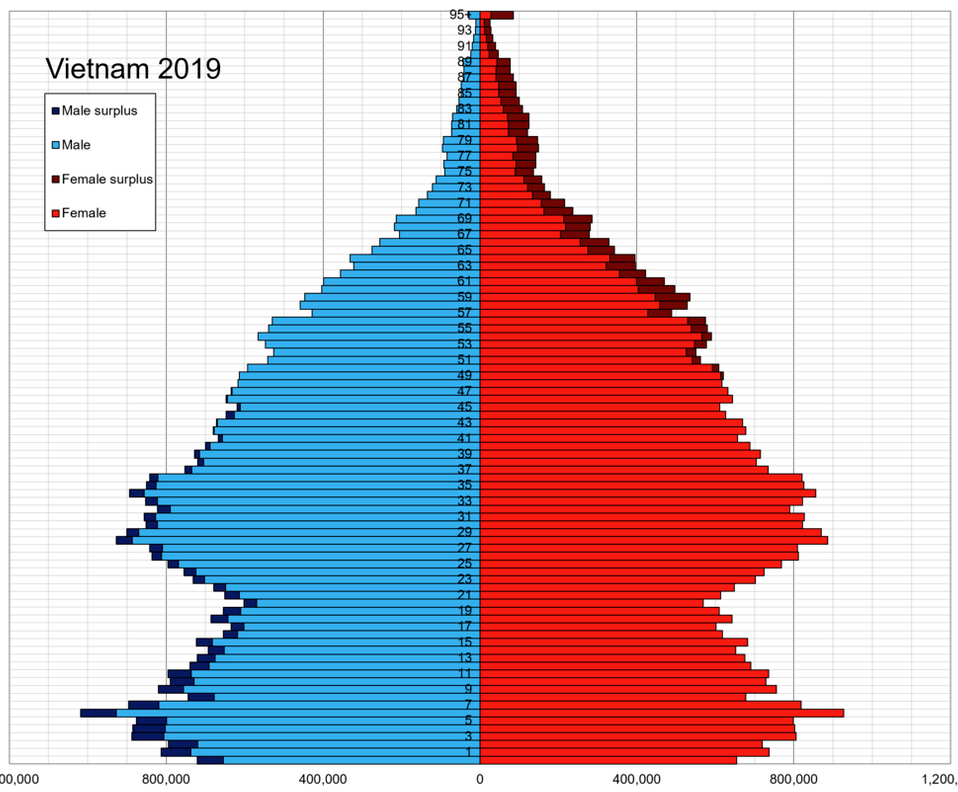

Vietnam is well positioned right now:

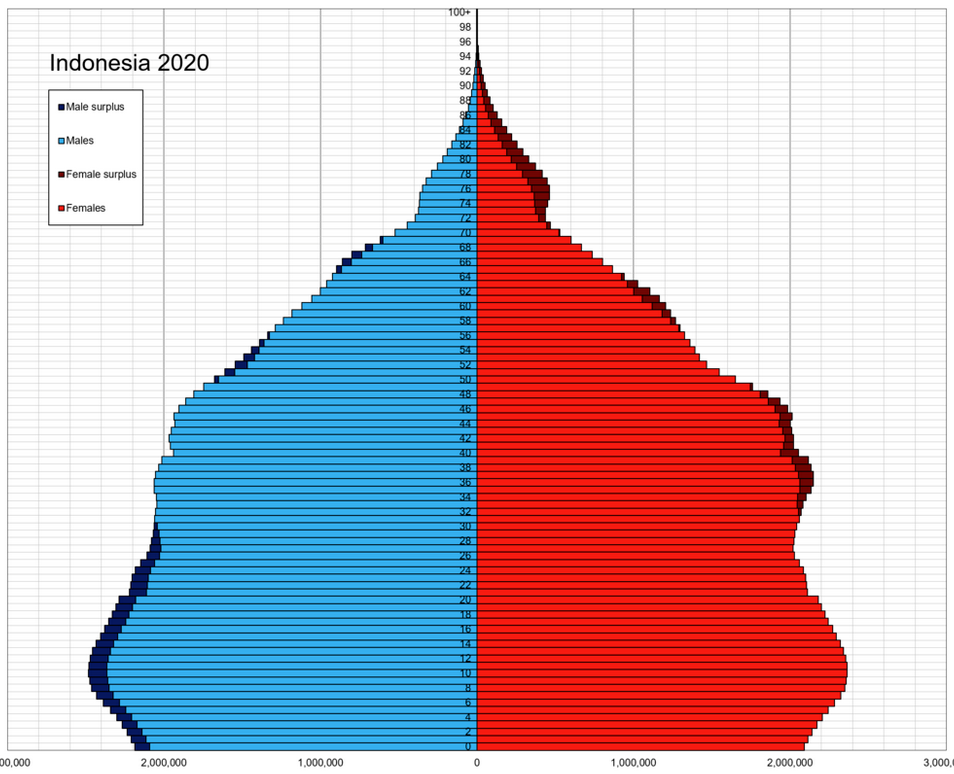

Indonesia has a favorable setup:

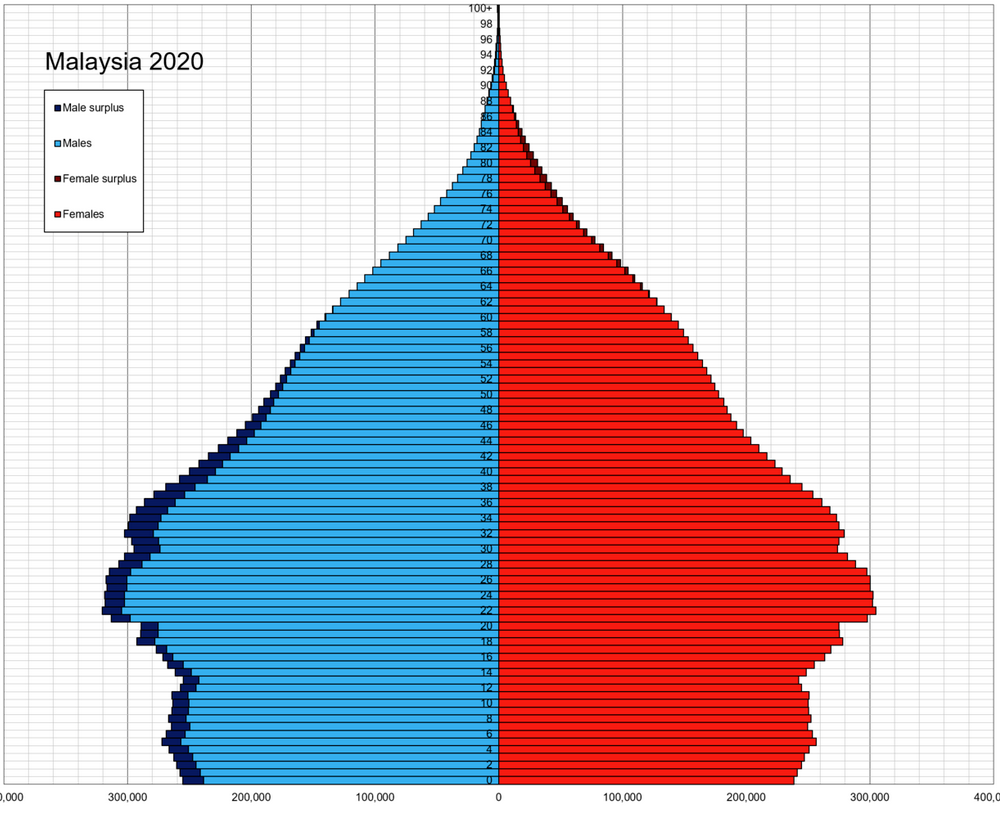

Malaysia is well positioned:

And last but not least, USA is perfectly positioned for the next decade!

Our job for our investors will be to continue to find the best companies in each country – that are expected to grow the fastest – at the right time. We will build up positions when everyone is questioning the validity with despondency, and sell off our positions when consensus has embraced our outlook with exuberance (and much higher prices). That is what we have always done and will always do. It’s in our DNA.

Our core big bet (outside of the US) is China, because the timing dictates it. We believe we own the highest quality asset in the country in Alibaba – and as Marko said in the interview above – nothing has changed in the past year other than working through a once in 100yr event. Tight regulatory policy has now begun transitioning into monetary and fiscal stimulus in recent months. The government can’t screw it up no matter how hard they have tried (even working overtime). There are too many 33-35 year olds starting housing and family formation, and the next five years will boom irrespective of who is in power. Demographics and spending dictate economic destiny. By the time we are out of China we will be buying India hand over fist. In the meantime, we are starting to look closely for high quality companies in Vietnam, Malaysia and Indonesia. USA however, continues to be #1 and will be for the foreseeable future.

2) Biotech

The sector is now up ~50% off its May lows. We believe the trend is just beginning and will persist to move higher in fits and starts over the next 2+ years – similar to 2016-2018 (the last tightening cycle). We have covered this theme many times in the past few months so we will not repeat it, but you can review it in a few previous notes and podcast|videocast‘s here:

“Threading the Needle” Stock Market (and Sentiment Results)…

The “Mystery Liquidator Revealed” Stock Market (and Sentiment Results)…

3) Housing

We have done nothing material on this front at present because despondency has not yet set in (despite higher rates softening demand). People are still hopeful because of the supply demand imbalance. If that sentiment changes during the slower winter selling season and the short term “voting machine” puts quality businesses (home builders) on sale, we will pounce. Until then we watch and wait – fully knowing that the opportunity may not present itself (with a large enough “margin of safety” for our liking). There is a ~3.8M under-supply of starter homes and that is the area we would like to own if the opportunity becomes attractive enough.

Yahoo! Finance

On Friday, I joined Seana Smith and Dave Briggs on Yahoo! Finance (in studio). Thanks to Taylor Clothier, Seana, Dave and Jeff Cohen for having me on. My full/comprehensive current stock market outlook is all here:

Now onto the shorter term view for the General Market:

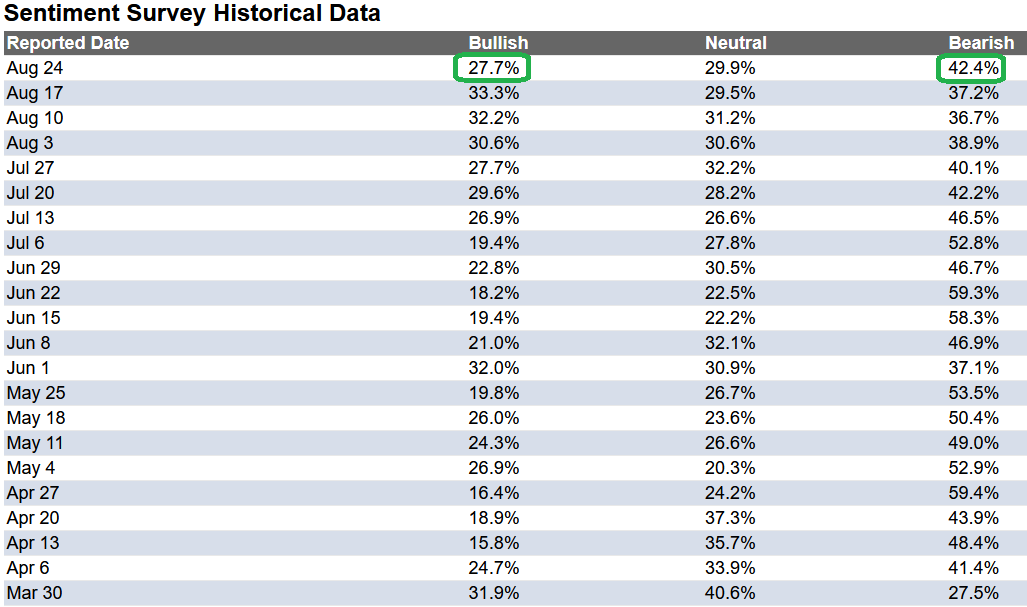

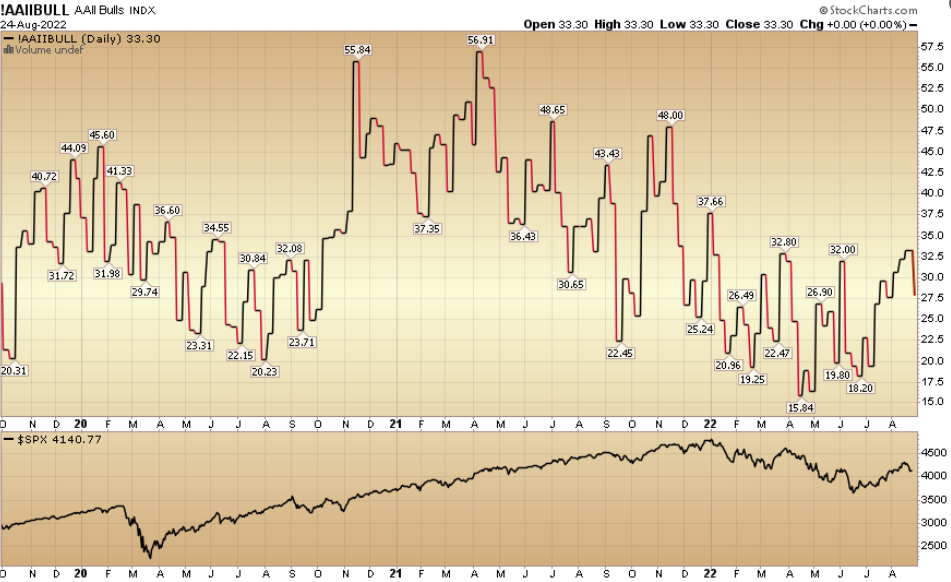

In this last week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 27.7% from 33.3% the previous week. Bearish Percent jumped to 42.4% from 37.2%. Retail investors’ sentiment is still fearful.

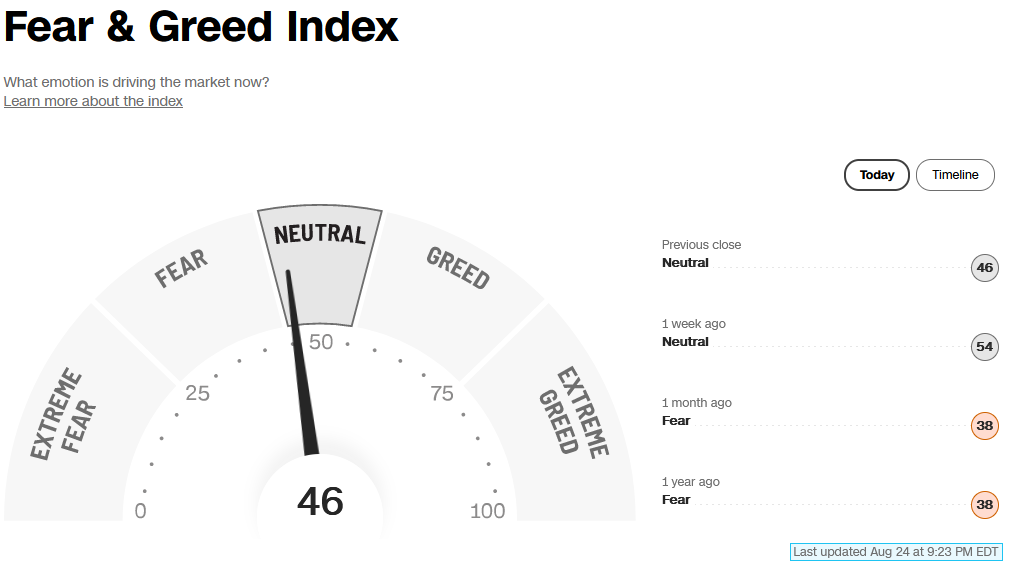

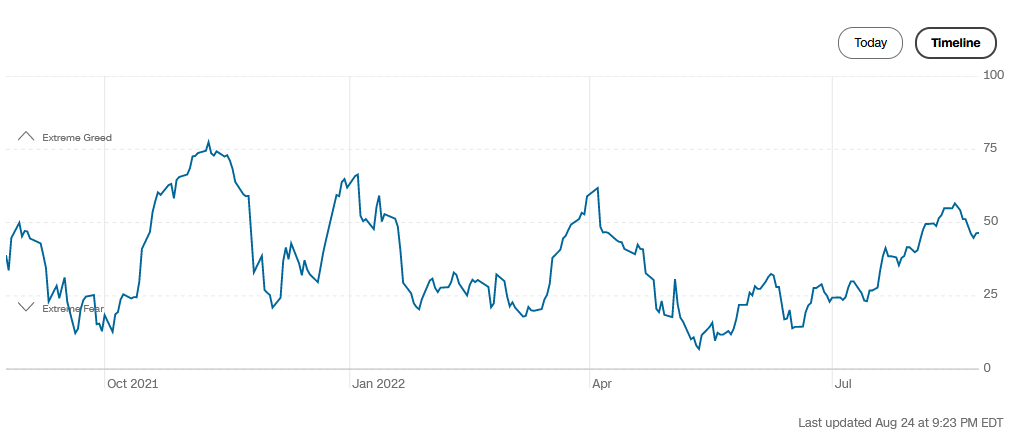

The CNN “Fear and Greed” dropped from 57 last week to 46 this week. Sentiment is in “no man’s land!” You can learn how this indicator is calculated and how it works here: (Video Explanation)

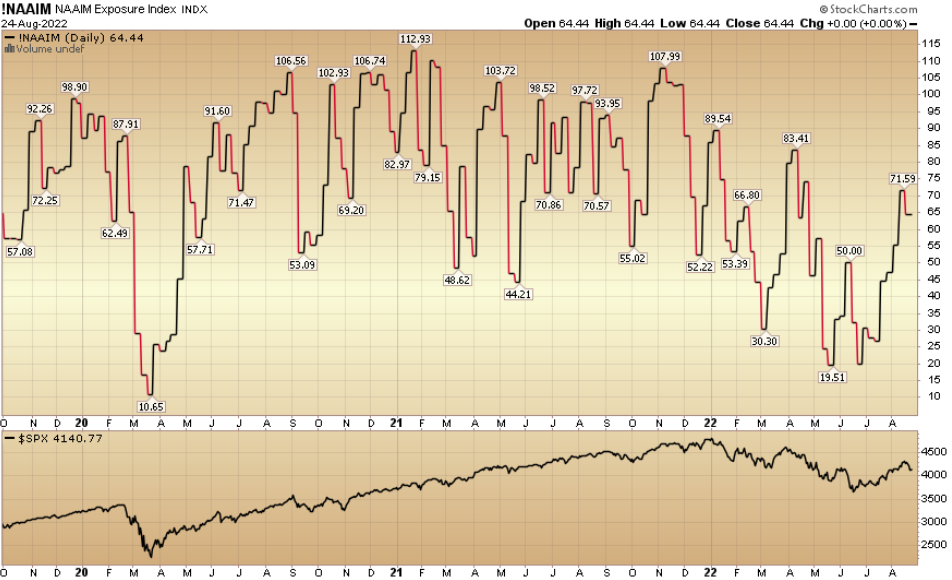

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 64.44% this week from 71.59% equity exposure last week. The late chasers from early this month are getting shaken out.

Our podcast|videocast will be out today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.