- China, IMF bailouts ease bearish sentiment towards emerging markets (scmp)

- The Fed Is About to Go Full Throttle on QT. Fear Not. (bloomberg)

- BofA Says Small Caps Cheaper Than Since the Dot-Com Bubble (bloomberg)

- Nobel-winning economist Paul Krugman points to a slowdown in rents as a sign inflation is starting to flatten (businessinsider)

- Shipping rates plunge as experts say ‘unprecedented’ boom has peaked (yahoo)

- 15 Stocks Billionaire Investors Agree It’s Smart To Buy Now (investors)

- TikTok brings new life to the Old Internet (mashable)

- Ockham’s Razor Is Not So Sharp (slate)

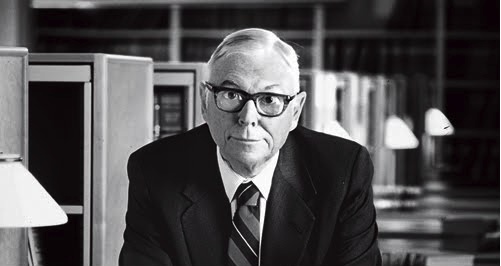

- Charlie Munger and Li Lu on How to Invest (gurufocus)

- US national debt nears $31 trillion and counting (foxbusiness)

- How Student Debt Relief Could Boost the Housing Market (barrons)

- Dan Loeb Withdraws His Call for Disney to Sell ESPN (barrons)

- Carvana Stock Is ‘Grossly Undervalued,’ Analyst Says (barrons)

- Roblox to launch 3D ‘immersive’ advertising in 2023 (nypost)

- Gusher of pandemic aid averted global depression, but left a bad hangover (reuters)

- iPhone 14 pre-orders crash Apple’s services amid high demand in China (scmp)

- Inflation Showed Signs of Easing in Several Industries in August (wsj)

- These Chinese stocks can benefit if the metaverse takes off, JPMorgan says (cnbc)

- Biden to hit China with broader curbs on U.S. chip and tool exports: Reuters, citing sources (cnbc)

- ‘The market has begun to correct itself’: House hunters say they’re ready to buy in the next six months — even in a recession. Here’s why. (marketwatch)

- Europe’s Newest Reactor Hits Output Milestone For First Time (bloomberg)

- PayPal’s (PYPL) Targets Finally Look Achievable Says Deutsche Bank After Raising Price Target (streetinsider)