- Hopes of China easing Covid restrictions further take hold as market observers detect a delicate shift in tone (scmp)

- Big hedge funds shop for bargains in corporate debt markets (ft)

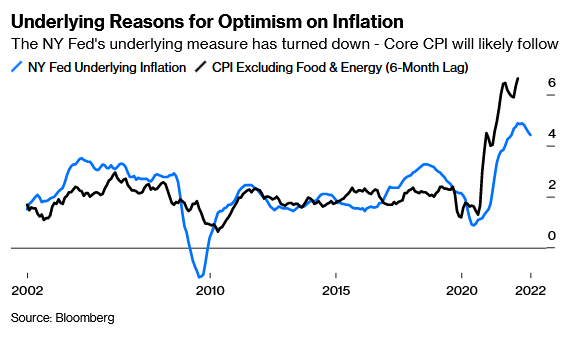

- Reasons Are Adding Up for Optimism on Inflation (bloomberg)

- Xi Jinping Needs to Bring Jack Ma Back Into the Fold (bloomberg)

- China Weighs Gradual Zero-Covid Exit but Proceeds With Caution, Without Timeline (wsj)

- Meta Is Spending Like an Oil Company. It Needs to Stop. (barrons)

- Nvidia Plans New Chip for China to Meet U.S. Rules (barrons)

- Where to Find Stocks That Will Rise 10 Times (barrons)

- Xi’s New No. 2 Faces Challenge to Make China’s Economy Hum Again (bloomberg)

- Why Central Banks Got Serious About Digital Money (bloomberg)

- China Expands Financing Tool That Can Support Ailing Developers (bloomberg)

- Semiconductor stocks have bounced from 2022 lows — and analysts expect upside of at least 28% in the next year (marketwatch)

- What midterm election results mean for the stock-market bounce, according to Morgan Stanley’s Wilson (marketwatch)

- Norwegian Cruise Line Beats Earnings Estimates and Signals Record 2023. The Stock Is Rising. (barrons)

- Jokowi Says Joe Biden, Xi Jinping to Attend G-20 Summit in Bali (bloomberg)

- China’s Lockdowns Fail to Contain Covid as People’s Anger Grows (bloomberg)

- Hedge-Fund Manager Who Helped Expose Luckin Coffee’s Fraud Bets on Chinese Chain’s Comeback (wsj)

- JPMorgan breaks down 4 reasons why it’s time to buy into small and mid-cap stocks amid aggressive monetary tightening (businessinsider)

- There’s only a 35% chance that the US suffers a recession in the next year, top Goldman Sachs economist says (businessinsider)

- Jeremy Siegel says the housing crash will force Fed chief Powell to ‘flip sometime’ on inflation and pivot (businessinsider)

- There are 2 big catalysts that could be a ‘game changer’ for the stock market this week, according to Fundstrat’s Tom Lee (businessinsider)

- Nobel laureate Paul Krugman says ‘true’ US inflation may have cooled to below 4% – and points to falling rental prices and slowing wage growth as proof (businessinsider)

- Alibaba’s international arm is spending millions to expand into South Korea (cnbc)

- Berkshire Sold $5 Billion of Financial Stocks, Possibly Citigroup and Bank of NY (barrons)

- This year’s World Internet Conference to have less glitz and more policy (scmp)

Be in the know. 25 key reads for Tuesday…