- “Forceful” Stimulus: China’s Politburo Shifts Focus to Boosting Economic Recovery (bloomberg)

- China Makes Big Stride in Easing Covid Rules (barrons)

- China Scraps Most Covid Testing, Quarantine Rules (wsj)

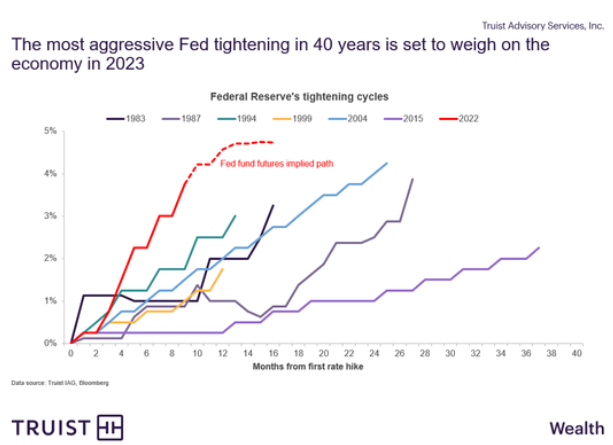

- Jeff Gundlach says the Fed is digging a hole with its rate hikes only to fill it back in: ‘Makes you wonder why they bother’ (businessinsider)

- Chinese Exports Fall at Steep Pace (wsj)

- 30-year Treasury yield hits lowest since September amid fears that Fed hikes will trigger U.S. slowdown (marketwatch)

- GSK and Sanofi shares surge after Florida ruling dismisses Zantac lawsuits in what one analyst describes as ‘best-case scenario’ (marketwatch)

- Alphabet CFO Porat Buys $1.7 Million of Blackstone Stock After Dip (barrons)

- China announces U-turn on strict zero-COVID measures (marketwatch)

- In a bright spot, Hatzius pointed to Fed Chairman Jerome Powell’s recent reference to alternative rent indicators for tracking inflation as signaling he “will not be held hostage” to lagging economic indicators typically used by the Federal Open Market Committee to track inflation. (marketwatch)

- Meta’s Targeted Ad Model Faces Restrictions in Europe (wsj)

- Alzheimer’s Treatment Thrills Investors as Doctors Debate Effect (wsj)

- US Mortgage Rates Fall a Fourth Week, Longest Stretch Since 2019 (bloomberg)

- Southwest Airlines Reinstates Dividend After Coronavirus Suspension (bloomberg)

- Activist investor calls for BlackRock CEO Fink to step down over ESG ‘hypocrisy’ (cnbc)

- Wharton professor Jeremy Siegel says stocks are set for a big rally in 2023 as productivity rises and interest rates fall (businessinsider)

- Here’s one reason to doubt the reliability of data used by the Fed to determine how aggressive it needs to be to tame inflation, according to Fundstrat (businessinsider)

- China boosts gold reserves for the first time in over 3 years in possible attempt to diversify away from dollar (businessinsider)

- China retreats from sweeping zero-Covid policies as economic toll mounts (ft)

- China’s chip imports post steepest drop in 2022 on factory disruptions, tech war scmp)

Be in the know. 20 key reads for Wednesday…