- China’s Revenge Spenders Are Just Warming Up (bloomberg)

- United Stock Rises After Beating Estimates (barrons)

- China’s Reopening Is a Win for Stocks in Other Markets (barrons)

- Retail Sales Fell 1.1% in December (wsj)

- Moderna Sees Success in RSV Vaccine Trial (barrons)

- China Is Open Again. 13 Ways to Tap Into Its Recovery Right Now. (barrons)

- Should Disney Spin Off ESPN and ABC? It’s Harder Than It Looks. (barrons)

- China Says Economy to Return to Faster Growth as Covid Isolation Ends (wsj)

- K. Inflation Falls for Second Month, Following Global Move (wsj)

- China Returns to Davos With Clear Message: We’re Open for Business (nytimes)

- Microsoft to Lay Off 10,000 Employees (wsj)

- US Producer Prices Plunge Most Since COVID Lockdowns (zerohedge)

- S. Treasury Secretary Yellen and China Vice Premier Liu aim to ease tensions in first face-to-face meeting (marketwatch)

- Summers Is More Upbeat on US Outlook Than He Was a Few Months Ago (bloomberg)

- Amazon Kicks Off Round of Job Cuts Affecting 18,000 People (bloomberg)

- China’s economy will be ‘on fire’ in the second half of 2023, StanChart chairman says (cnbc)

- China’s likely to rebound in 2023, but much depends on the consumer: KraneShares (cnbc)

- China offers olive branch to the West, but some are still skeptical (foxbusiness)

- IMF signals upgrade to forecasts as optimism spreads at Davos (ft)

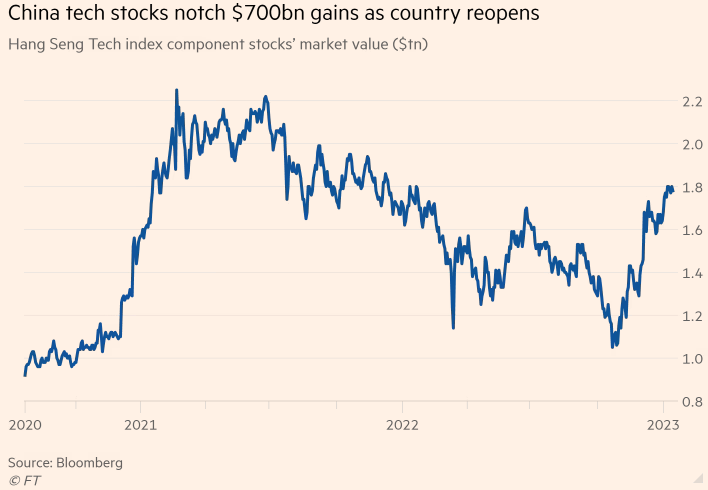

- China tech stocks stage $700bn recovery rally (ft)

- China’s tutoring giant triples sales by selling eggs after crackdown (scmp)

- China set for ‘steady, continuous’ foreign capital inflows as investors return (scmp)

Be in the know. 22 key reads for Wednesday…