- Apartment Rents Fall as Crush of Supply Hits Market (wsj)

- An acceleration of digitalisation is crucial to fully promoting China’s ‘great rejuvenation’, says road map released by ruling Communist Party (scmp)

- Opinion: ‘We remain in the soft-landing club’: Strategist Ed Yardeni’s bullish scenario puts S&P 500 up more than 20% by end of 2023 (marketwatch)

- Several tech firms in China, including Alibaba and Tencent, have committed to releasing their own chatbots that can rival OpenAI’s (scmp)

- Star Banker in China Who Vanished Is Said to Be Aiding Government Inquiry (nytimes)

- Pfizer in Talks to Buy Seagen for $30 Billion or More (barrons)

- The Forward Discount Investors Accept or Deny (finomgroup)

- Why Warren Buffett Doesn’t Worry Much When the Market Goes Down (barrons)

- The Dot-Com Bubble Peaked 23 Years Ago. The Nasdaq Has Barely Beaten Inflation Since Then. (barrons)

- Covid-Era Savings Are Crucial to China’s Economic Recovery (wsj)

- ChatGPT Heralds an Intellectual Revolution (wsj)

- This is what Warren Buffett, a self-described ‘so-so investor,’ says is his ‘secret sauce’ (marketwatch)

- Bets on a rise in Wall Street’s fear gauge swell to most since March 2020 (wsj)

- ‘You can learn a lot from dead people.’ Charlie Munger, Warren Buffett’s 99-year-old partner, doles out investing wisdom. (marketwatch)

- Amyloid Gains Converts in Debate Over Alzheimer’s Treatments (wsj)

- Chinese E-Commerce Flourishes on U.S. Soil (wsj)

- Warren Buffett’s Slap at Buyback Illiterates Rings True (wsj)

- Confused about what’s causing inflation? This metric shows what’s driving the price rise. (marketwatch)

- New Salesforce Has to Keep Selling (wsj)

- Goldman Sachs Sets $30 Billion Repurchase Plan as Buyback Pace Climbs (bloomberg)

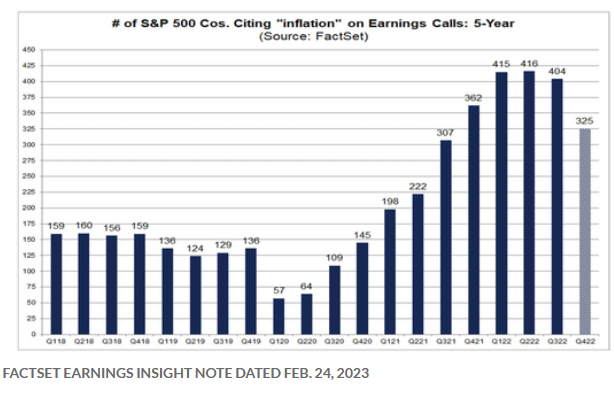

- Fewer S&P 500 companies mention ‘inflation’ during earnings calls despite elevated concern over price pressures (marketwatch)

- JPMorgan Says Prepare to Dump Value Stocks for Growth (bloomberg)

- US companies say it is easier to hire despite low jobless rate (ft)

Be in the know. 23 key reads for Monday…