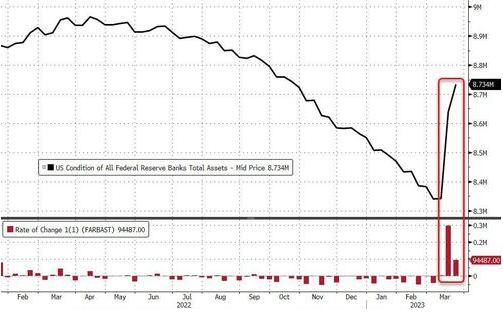

- Fed Balance Sheet Surges By Another $100BN Amid Bank Runs As Foreign Repos Soar By Record And Cash Floods Into Reverse Repo, Money Markets (zerohedge)

- The US banking system may not be as strong as Powell and Yellen are saying, market veteran Ed Yardeni says (businessinsider)

- Volcker Slayed Inflation. Bernanke Saved the Banks. Can Powell Do Both? (bloomberg)

- Banks Are Still Drawing on the Fed for $164 Billion of Emergency Cash (bloomberg)

- Yellen says Treasury is ready to take ‘additional actions if warranted’ to stabilize banks (cnbc)

- Why Vietnam’s Markets Trail Its Sizzling Economy (barrons)

- Deutsche Bank Stock Tumbles. Banking Panic Isn’t Over Yet. (barrons)

- Banks Are Borrowing at Financial Crisis Levels. What It Means. (barrons)

- Cathie Wood’s ARK funds snap up Block after short-seller report (marketwatch)

- Bill Ackman warns of acceleration in deposit outflows from banks despite Fed’s assurances (marketwatch)

- The Personalized Stem Cells That Could One Day Treat Parkinson’s and Heart Failure (wsj)

- Tencent, NetEase win new Chinese video game licences in March (scmp)

- Wedbush says it’s ‘not seeing anything illegal’ with Block even as short-seller Hindenburg alleges the payment firm misled investors (businessinsider)

- Steve Forbes says the Fed’s stubborn rate hikes are trashing the US economy (businessinsider)

- Barry Sternlicht warns the economy is facing a sharp slump as the Fed uses ‘a steamroller to get the price of milk down 2 cents’ (businessinsider)

- Investor Rush to Cash Is Fastest Since Covid Hit, BofA Says (bloomberg)

- Fed’s Bostic Says Rate Decision Came After ‘a Lot of Debate’ (bloomberg)

Be in the know. 17 key reads for Friday…