- The coming commercial real estate crash that may never happen (cnbc)

- Micron Stock Jumps as Samsung Cuts Chip Output. Why the Sector Is Poised to Rebound. (barrons)

- Ford and GM Stock Are ‘Exceptionally Undervalued,’ Says Value-Investing Star (barrons)

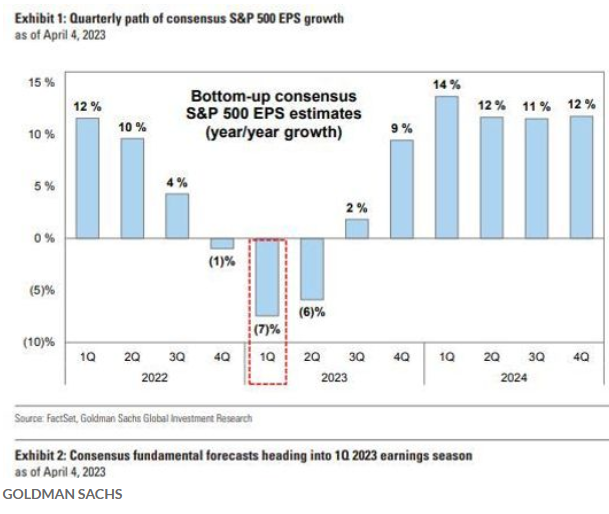

- Here are Goldman’s 4 things to watch for as gloomiest earnings season since pandemic begins (marketwatch)

- Investors looking for further proof of a ‘credit crunch’ just got it, says this strategist. (marketwatch)

- Investors View Corporate Earnings Season as Next Test for Stocks (wsj)

- Argus adds Intel (INTC) stock to its Focus List, sees it as a ‘deep-value opportunity’ (streetinsider)

- The Video Streaming Numbers Game Is Shifting (wsj)

- China’s first batch of shares under new IPO system surge in debut (reuters)

- Occidental Plans to Suck Carbon From the Air—So It Can Keep Pumping Oil (wsj)

- Bond Market Is Overplaying the Risk of a Deep Recession (bloomberg)

- Most of Wall Street is panicking about commercial real estate – but Goldman Sachs says there’s little chance it triggers a financial crisis (businessinsider)

- A $1.5 Trillion Wall of Debt Is Looming for US Commercial Properties (bloomberg)

- What Commercial Real Estate Stress Means for Banks and Bond Funds (bloomberg)

- Apple’s 40% Plunge in PC Shipments Is Steepest Among Major Computer Makers (bloomberg)

- Taiwan Says China Military Drills Similar to Pelosi Response (bloomberg)

- Jon Rahm Comes Back From Behind to Win Masters at Augusta (bloomberg)

- An under-the-radar stock market indicator is pointing to more gains ahead (businessinsider)

Be in the know. 18 key reads for Monday…