- Fed Officials Signal Divide Over Whether to Hike Rates Again (bloomberg)

- Tencent, BYD slam Hong Kong stocks in US$26 billion sell-off (scmp)

- Good News for Alibaba and Other Chinese Stocks. UBS Sees 3 Reasons to Be Bullish. (barrons)

- Today’s Fed Minutes Could Hold Clues to Future Moves (barrons)

- Bank Earnings Are a Big Test. Wall Street Is Banking On a Passing Grade. (barrons)

- Warren Buffett says more banks may fail, but he’s willing to bet $1 million that depositors won’t lose money (marketwatch)

- 3M, Danaher, and Kellogg Are Spinoff Stock Plays (barrons)

- Warren Buffett Is Bullish on Japan. Why Other Investors Should Be Too. (barrons)

- Top US Banks to Reveal Biggest Deposit Drop in a Decade (bloomberg)

- JPMorgan Calls Managing Directors Into Office Five Days a Week (bloomberg)

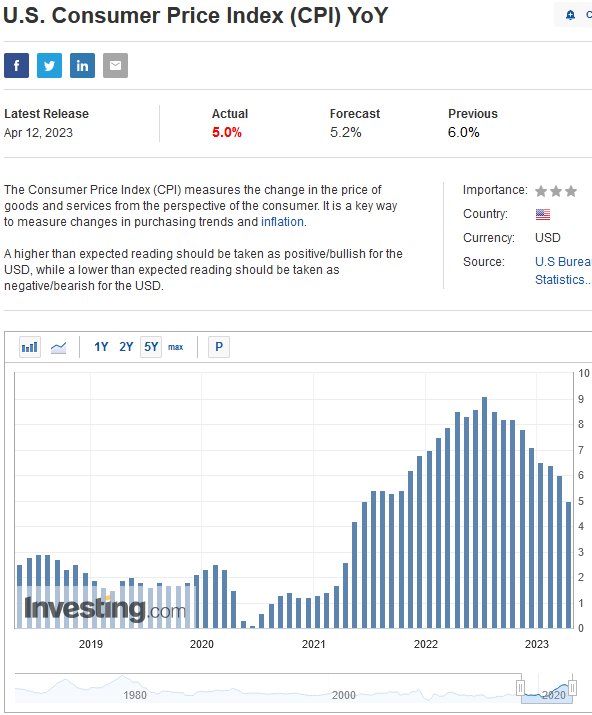

- Traders Boost Bets on Fed Rate Cuts by Year End After CPI (bloomberg)

- Wall Street is wrong: Former Pimco chief economist Paul McCulley sees rate hikes ending next month (cnbc)

- Wharton professor Jeremy Siegel reveals his investment plan if a recession hits and reiterates his view that the stock market bottom is in (businessinsider)

- “Probably Means The Fed Is Done Hiking”: Wall Street Reacts To “Cooler” CPI Report (zerohedge)

- US inflation eased to lowest level in nearly two years in March (ft)

- Top Fed officials debate need for further rate rise amid bank stress (ft)

- China still a key market for Intel, CEO says in Beijing trip (scmp)

- Spring Refining Capacity Fever. The Energy Report 04/12/2023 (Phil Flynn)

- Fed Official: ‘We Need to Be Cautious’ on Raising Rates After Bank Failures (wsj)

- AI Can Write a Song, but It Can’t Beat the Market (wsj)

Be in the know. 20 key reads for Wednesday…