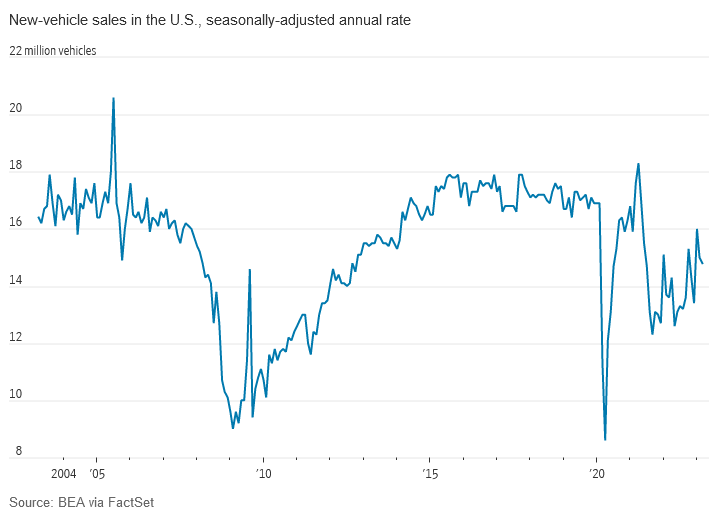

- As Dealerships Get More Stock, Auto Makers’ Sales Rebound. GM, Hyundai and others report a robust start to the year, due in large part to rising inventory levels and easing supply-chain troubles (wsj)

- JPMorgan Chase stock shifts into rally mode after it blasts past earnings and revenue estimates (marketwatch)

- Banking crisis forces ECB policymakers to rethink rate hikes, but focus still firmly on inflation (cnbc)

- Wells Fargo shares rise after bank’s first quarter profit and revenue top the Street (cnbc)

- Can Intel become the chip champion the US needs? (ft)

- Birkin bag maker Hermes sees no U.S. slowdown as sales jump 23% (cnbc)

- For Regional Banks, Surviving Won’t Be the Same as Thriving (wsj)

- JPMorgan Chase posts record revenue that tops expectations on higher interest rates (cnbc)

- Wall Street is wrong: Former Pimco chief economist Paul McCulley predicts rate hikes will end next month (cnbc)

- New-vehicle inventories, discounts rise as the New York Auto Show heralds spring selling season (wsj)

- Hedge Fund 101: You Always Buy Liquidation Events (chinalastnight)

- Big banks kick off earnings season with a bang (yahoo)

- BofA Strategists Prefer Global Stocks to Tech-Heavy US Market (bloomberg)

- PBOC Pledges Stronger Support to Economy (bloomberg)

- Buffett Focus on ‘Quality’ Helps Narrow Hunt for Value in Japan (bloomberg)

- Citigroup profit rises and beats analyst forecasts, shares rise (marketwatch)

- Retail Sales Fell More Than Expected in March (barrons)

- Supplier Prices Fell in March, Adding to Signs of Moderating Inflation (wsj)

- Amazon CEO Andy Jassy Commits to Cost-Cutting, Innovation in Shareholder Letter (wsj)

- The Fed could turn a mild downturn into an ugly recession if it doesn’t stop raising rates soon, market veteran Ed Yardeni says (businessinsider)

Be in the know. 20 key reads for Friday…