- Everyone Expects the Stock Market to Tumble. What If It Goes Up Instead? (barrons)

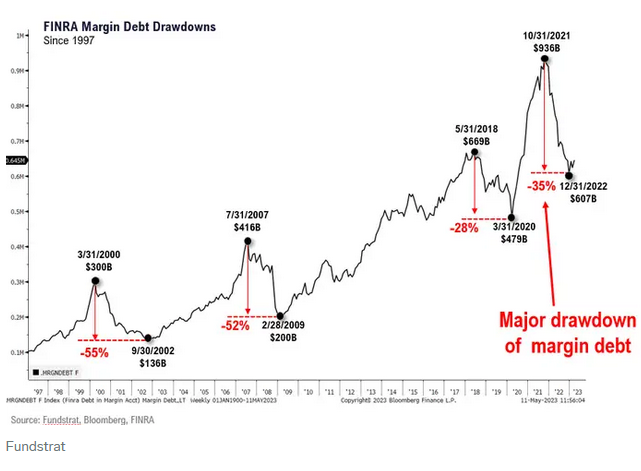

- “Margin debt a percentage [of] market cap now 1.59%, matching ‘dot-com’ 2002 25-year low,” Fundstrat said. (businessinsider)

- Hedge Fund Trade With a History of Blowups Is Back Again (bloomberg)

- S. can avoid default in July if Treasury can make it through June cash crunch, Congressional Budget Office says (cnbc)

- General Dynamics Stock Is Sliding. One Director Scooped Up Shares.

- Rand Hits Record Low as U.S. Says South Africa Supplied Weapons to Russia (barrons)

- Buy Topgolf Callaway Stock. Why the Battered Shares Are Worth a Shot. (barrons)

- It May Be Time to Nibble on Small-Cap Stocks. Just Don’t Gorge. (barrons)

- Healthcare Stocks Are on Sale. Pfizer and Stryker Have Strong Growth Prospects. (barrons)

- The U.S. and China Are Finally Talking Again, but Mistrust Clouds Next Steps (wsj)

- Stop Equating the Latest Bank Failures to the 2008 Crisis (wsj)

- China to send special envoy to seek ‘political settlement’ to Ukraine war (ft)

- Yellen: ‘A growing China that plays by international rules’ is ‘good for the US’ (foxbusiness)

- How Lyft’s new CEO is ‘copying’ his former boss Jeff Bezos to turn around the company (cnn)

- Russell Death Cross Implications for SPX (quantifiableedges)

- 5 Book Recommendations From Warren Buffett (acquirersmultiple)

- 2023 Berkshire Hathaway Annual Meeting Full Video (cnbc)

- If you are going to buy banks, buy a whole basket of them: Ariel Investment’s John Rogers (cnbc)

- What I Learned From the Oracle of Omaha & Charlie Munger (contrarianedge)

- Letter #80: Todd Combs (2023) (substack)

Be in the know. 20 key reads for Saturday…