- China’s Central Bank Cuts Rates. How It Helps Stocks and the Global Economy. (barrons)

- China Weighs Broad Stimulus With Property Support (bloomberg)

- China Shifts to Stimulus Mode (bloomberg)

- China Opens The Gates To More Easing (zerohedge)

- New study ranks New York as America’s best city of 2023 (nypost)

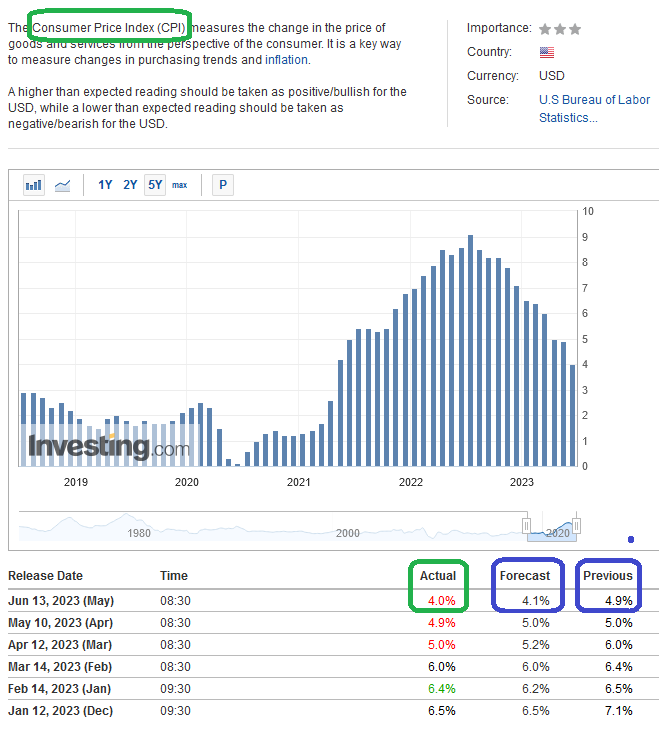

- Inflation rose at a 4% annual rate in May, the lowest in 2 years (cnbc)

- China’s Top Broker Sees Earnings Relief for Hong Kong Stocks (bloomberg)

- Oil prices bounce after China central bank cuts key rate (marketwatch)

- Top 5 China Stocks To Buy And Watch: EV Giant BYD Leads 3 In Buy Zones (investors)

- Intel Could Be Investor in Chip Designer Arm’s Blockbuster IPO (barrons)

- Inflation Slowed Down Again in a Victory for the Fed (barrons)

- Bearish investors are chasing the rally in U.S. stocks. Here’s what that means for the market. (marketwatch)

- Rents Keep Rising, but More Slowly. It’s Good for Inflation. (barrons)

- S. to Allow South Korean, Taiwan Chip Makers to Keep Operations in China (wsj)

- Stock-Market Bulls See Room to Run (wsj)

- Moderating US Inflation Likely to Support Fed Rate Pause (bloomberg)

- Nobel economist Paul Krugman says inflation doesn’t need to get down to 2% and the Fed can back off because people have stopped caring (businessinsider)

- Tech stocks are in a ‘1995 moment’ and poised to boom on the AI revolution, Wedbush says (businessinsider)

- Inflation slows again, CPI shows, and might keep Fed on sidelines (marketwatch)

- China cuts short-term borrowing costs to support recovery (reuters)

Be in the know. 20 key reads for Tuesday…