- Alibaba, JD.com Stocks Gain. China Is Backing Tech as Economy Splutters. (barrons)

- Traders flock back to China tech stocks after premier acknowledges economic role (scmp)

- Fund Titans Are Betting on Everything Gaining Against the Dollar (bloomberg)

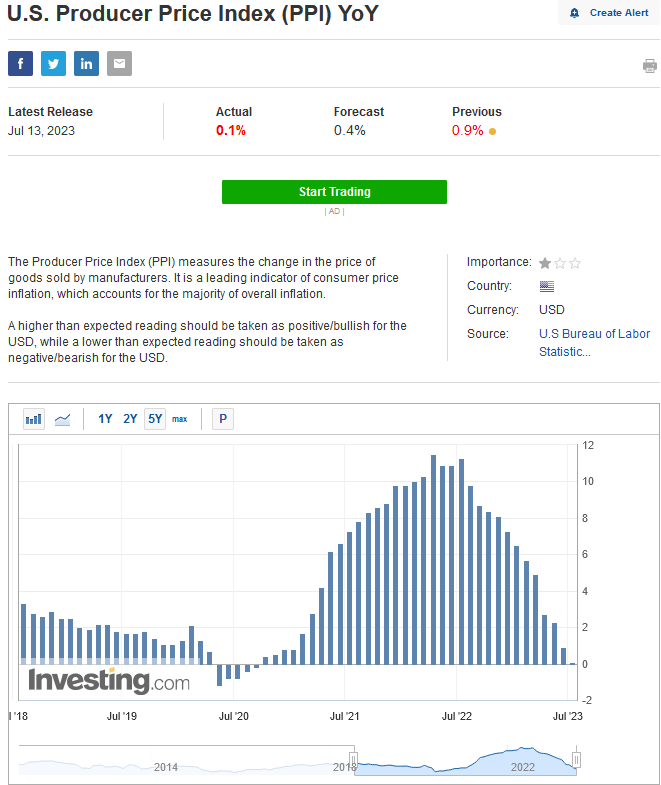

- PPI shows lowest U.S. annual wholesale inflation rate — 0.1% — since September 2020 (marketwatch)

- Alibaba, Tencent and Meituan praised by Beijing for helping China’s tech progress in new sign of attitude change (scmp)

- Premier Li Puts Final Nail In Coffin For Internet Regulation, Praises Platform Economy (chinalastnight)

- Xi Gets Serious About Boosting Private Sector as Economy Slumps (bloomberg)

- China’s state planner praises Tencent, Alibaba as attitude towards tech shifts (yahoo)

- China’s tech giants off leash after years-long crackdown, as Beijing primes them to be the economic engine they once were (scmp)

- Chip wars: How ‘chiplets’ are emerging as a core part of China’s tech strategy (reuters)

- Bill Dudley Says CPI Could Make July Last Fed Rate Hike (bloomberg)

- Delta’s Record Revenue (barrons)

- Pepsi Raises Guidance (barrons)

- It’s a Stockpicker’s Market. What That Means and What to Buy. (barrons)

- Boeing and 17 Other Money-Losing Companies That Are About to Turn a Profit (barrons)

- Disney Stock Climbs After Bob Iger Extends Stay as CEO. (barrons)

- Citigroup Posts Earnings Friday. Here’s What Wall Street Expects. (barrons)

- Inflation Eased to 3% in June, Slowest Pace in More Than Two Years (wsj)

- Inflation Cools Sharply in June, Good News for Consumers and the Fed (nytimes)

- Dollar Falls to Its Lowest Level Since April 2022 (bloomberg)

- Biggest US Banks Are Bracing for Cost Pressures, Rate Struggle (bloomberg)

- China Takes Friendlier Approach to AI in Finalized Guidelines (bloomberg)

- Chinese Tech Stocks Advance as Signs of Official Support Grow (bloomberg)

- China Premier Meets Major Tech Companies, Vows More Support (bloomberg)

- ‘Disinflation Is Here,’ Says Ed Yardeni (bloomberg)

Be in the know. 25 key reads for Thursday…