- Tumbling US dollar a boon to risk assets across the globe (reuters)

- Intel CEO wraps up low-key China trip amid ongoing tech war (scmp)

- Chinese mutual funds buy US$351 million of own products in show of confidence (scmp)

- Exclusive: China invites global investors for rare meeting (reuters)

- Goldman Sachs: These 17 stocks could earn much more than the rest of Wall Street expects following a strong second half for markets (businessinsider)

- Americans Are Borrowing Again, Which Is Great News for Big Lenders (wsj)

- CEO fires 90% of customer support staff because AI chatbot outperformed them (nypost)

- Insurer’s Retreat in Florida Signals Crisis With No Easy Fix (nytimes)

- JPMorgan Earnings Get a Boost From Higher Rates, First Republic Deal (barrons)

- SpaceX Is Now Worth More Than Boeing and Raytheon (barrons)

- Deutsche Bank currency guru says it’s ‘time to sell the dollar’ as greenback sees longest losing streak since 2021 (marketwatch)

- The Stock Market Rally Seems Unstoppable. Here’s When the Naysayers Will Give In. (barrons)

- The AI Bubble Isn’t Big Enough. Why There’s More Upside Ahead for Big Tech. (barrons)

- The Yen, the Yuan, and the Dollar: How China and Japan Could Shore Up Their Economies (barrons)

- As Inflation Goes Down, Soft Landing Odds Improve (wsj)

- Emerging-Market Growth Bets Return, Helping Stocks Beat US Peers (bloomberg)

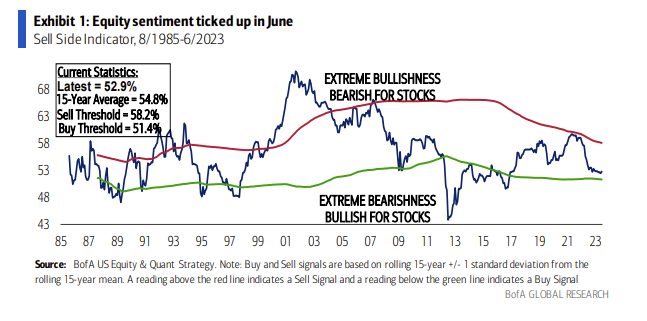

- BofA Stocks Indicator Sees S&P 500 Surging 16% in Next 12 Months (bloomberg)

- ‘I don’t see why people are going to sell their stocks.’ ‘Big Short’ investor Steve Eisman says stocks will keep rallying as long as the economy stays healthy (businessinsider)

- U.S. consumer sentiment soars in July to highest level since September 2021 (marketwatch)

- US Federal Debt Interest Payments About To Hit $1 Trillion (zerohedge)

Be in the know. 20 key reads for Friday…