- Yes, There Is a Bull Case for Investing in China (wsj)

- “While many indicators lately have disappointed, growth isn’t plummeting, and there’s still a fair chance of meeting the about-5% target for the year” (bloomberg)

- Alibaba Cloud Eyes State Firms for Up to $3 Billion Funding (bloomberg)

- Disney encourages Spectrum customers to move to Hulu + Live TV amid Charter dispute (foxbusiness)

- Arm Prices IPO. It’s Set to Be the Biggest of the Year. (barrons)

- Disney and Charter Are Locked in a Dispute. Why It’s a ‘Tipping Point’ for Legacy TV. (barrons)

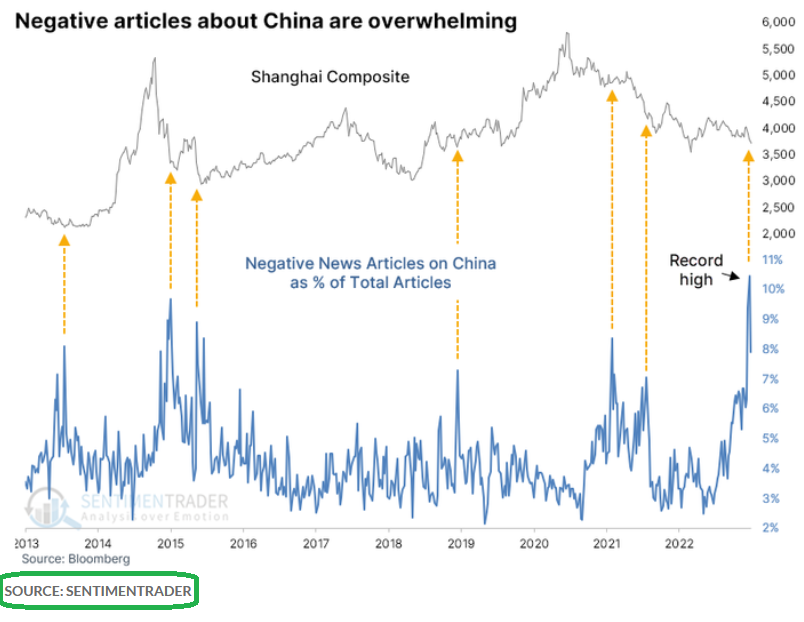

- “When sentiment towards a market is resolutely negative, any positive news can more easily deliver a bounce as traders feel forced to shift positions.” (marketwatch)

- They’ve Been Friends for 60 Years. Lew and Bobby Have Figured Out What Most Men Don’t. (wsj)

- China’s Country Garden Narrowly Avoids Default (wsj)

- Is Now the Time to Invest in Emerging Markets? (wsj)

- Return-to-Office Is a $1.3 Trillion Problem Few Have Figured Out (bloomberg)

- China: “Some bright spots are also emerging. Earnings estimates for tech stocks have been trending upward since a March low, even as those for the broader benchmarks have remained largely unchanged.” (bloomberg)

- China Dials Up a Tech Win (bloomberg)

- The ‘Wizard of Wharton’ says stocks are on solid ground – and house prices are shaking off mortgage pain (businessinsider)

- The greenback is ‘losing some influence’ in the oil markets — and it means a partial de-dollarization is likely, says JPMorgan (businessinsider)

- Exclusive: China to launch $40 billion state fund to boost chip industry (reuters)

- China “The general trend of foreign ownership is still quite high,” Ahern says. “If anything else, it shows that maybe foreign investors are very poor market timers because this outflow is occurring just as Chinese equities are enjoying one of their strongest weeks in quite some time.” (yahoo)

Be in the know. 17 key reads for Tuesday…