- China’s Economy Improves in September, Satellite Data Show (bloomberg)

- Alibaba, NIO, XPeng Climb. Chinese Businesses Get a Regulatory Boost. (barrons)

- Automakers grow frustrated over pace of UAW negotiations as new strike deadline looms (cnbc)

- China Looks to Relax Data Rules to Allay Business Fears (bloomberg)

- Intel hails ‘landmark’ as high-volume EUV production begins at Irish plant (yahoofinance)

- 10-year Treasury yield falls from 15-year high after Fed’s preferred inflation gauge eases (cnbc)

- US Core PCE Prices Post Smallest Monthly Rise Since Late 2020 (bloomberg)

- Bank Stocks See Big Insider Buys (barrons)

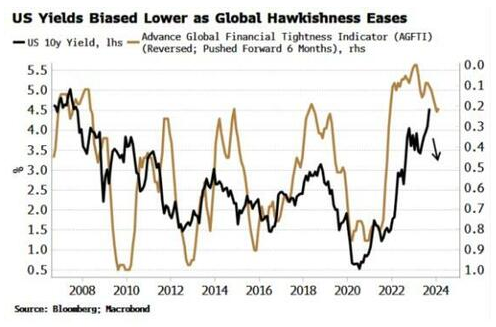

- Bonds Remain Oversold After Fastest Yield Rise On Record (zerohedge)

- ‘I see more fear than anytime in my business career,’ says BlackRock’s Larry Fink (marketwatch)

- House Passes Some Late-Night Bills. Shutdown Still Looking Likely. (barrons)

- Buy This Defense Stock. It’s Cheap, and a Shutdown Won’t Hurt It for Long. (barrons)

- Nike Sees ‘Very Strong’ Demand in Year Ahead. The Stock Rallies.(barrons)

- Nvidia and Other Chip Stocks Had a Terrible September. Wall Street Remains Upbeat. (barrons)

- Where Did All the Dark-Suited Japanese Businessmen Go? (nytimes)

- Europe’s Richest Royal Family Builds $300 Billion Finance Empire (bloomberg)

- Forget the sell-off – Tech stocks have a ‘springboard for growth’ into 2024 that Wall Street has underestimated (businessinsider)

- Here Is What Stops, And What Doesn’t, When The Government Shuts Down This Weekend (zerohedge)

- Eurozone inflation hits two-year low (ft)

- S&P 500 Quarterly Returns (carson)

Be in the know. 20 key reads for Friday…