- UAW Chief Will Speak (barrons) and, the decision to forgo the all-in strike that many industry observers had expected has so far considerably softened the disruption to the companies’ factory footprints and bottom lines. (wsj)

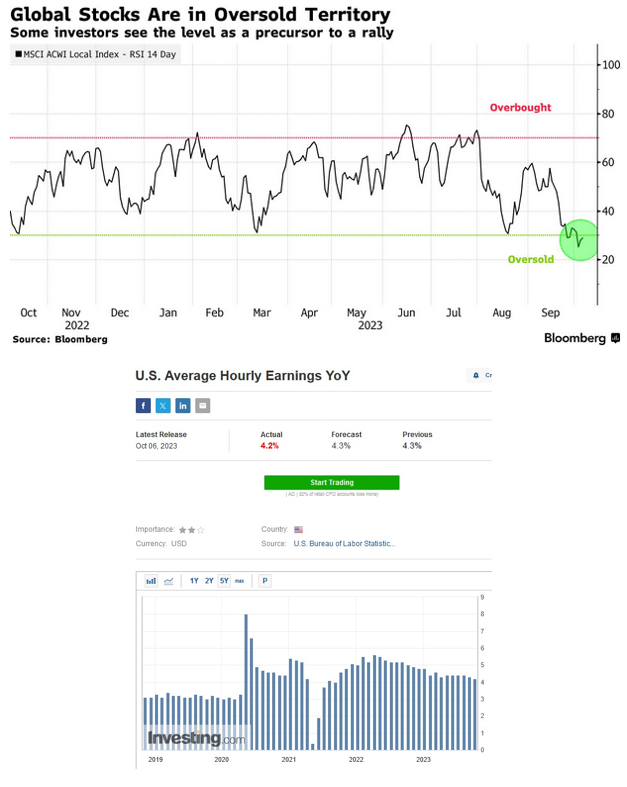

- Buy the Dip in Global Stocks as Rates Peak, Citi Strategists Say (bloomberg)

- The stock market is building up to a major ‘buy’ signal (marketwatch)

- Pepsi Stock Gets Rocked by Weight-Loss Drug Fears. Earnings Could Make Shares a Buy. (barrons)

- Why High Interest Rates Hurt Clean Energy Stocks More Than Oil Stocks (barrons)

- TSMC Stock Rises. There’s Life in Chips After All. (barrons)

- Reports that China has been dumping Treasury bonds have been greatly exaggerated (marketwatch)

- Jobs report shows big 336,000 gain in hiring in September. Labor market is still hot. (marketwatch)

- Here’s what to expect when banks report earnings, and how cheap their stocks are now (marketwatch)

- The Long Dry Spell at One of America’s Most Innovative Companies (wsj)

- Are the Bulls About to Return to Britain? (bloomberg)

- Doing Business in China? You Should Stay the Course (bloomberg)

- Hong Kong stocks rally on property easing speculation, China recovery bets (scmp)

- Is the US strategy of engaging China working? (reuters)

- Alibaba’s Lazada is courting sellers affected by Indonesia’s e-commerce ban on social media (cnbc)

- China plans to ease one of the biggest hurdles for foreign business (cnbc)

Be in the know. 16 key reads for Friday…