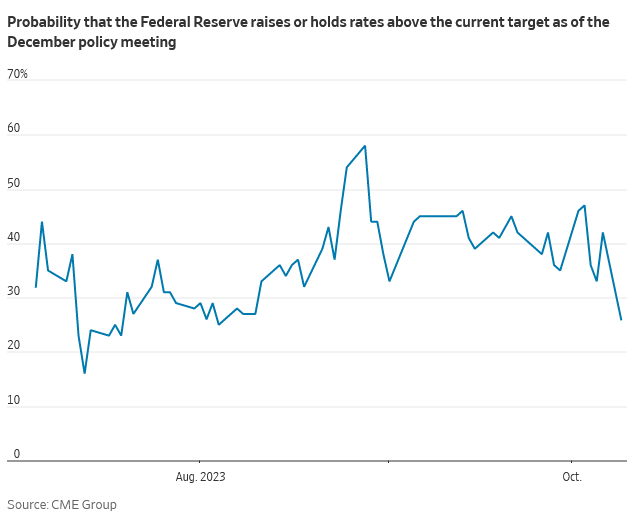

- Higher Bond Yields Likely to Extend Fed Rate Pause. Officials are signaling that a run-up in long-term interest rates might substitute for a further central bank rate hike (wsj)

- General Motors reaches deal with Canadian autoworkers hours after union initiates strikes (cnbc)

- Why the Weight-Loss Drug Hype Looks Overdone (barrons)

- GLP-1 drugs are still in demand. Insurers are cutting back coverage in response, Found study shows (fiercehealthcare)

- Ozempic Won’t Kill Americans’ Taste for Sugary Snacks (barrons)

- Janet Yellen Suggests Much Lower For Much Longer (zerohedge)

- Wholesale inflation accelerates more than expected in September (foxbusiness)

- Emerging-market stocks are looking cheap, especially relative to the U.S. Does that mean it is time to buy? (marketwatch)

- Dividend stocks are dirt cheap. It may be time to back up the truck. (marketwatch)

- Samsung Reports 78% Drop in Profit. Why It Could Be Good News for Micron and Intel. (barrons)

- Age-old excellence NYC’s best new restaurant is a 186-year-old steakhouse (com)

- 104-year-old woman dies after breaking world record for oldest skydiver (nypost)

- The Fed tool that is having a powerful impact (ft)

- Ozempic Shows Promise Treating Kidney Failure in Blow to Dialysis Firms (bloomberg)

- What You Need to Know About Drugs Like Wegovy Being Used for Weight Loss (bloomberg)

- Ten-year Treasury yield hits two-week low ahead of Fed minutes (marketwatch)

- Boeing’s deliveries and production of the company’s bestselling jet slowed in September amid snafus at one of its key suppliers (wsj)

- Lotus Inks Deal With Santander to Finance Sports Car Loans in US (bloomberg)

- CHART OF THE DAY: A bullish formula for the stock market is brewing as the Nasdaq follows 1999 playbook (businessinsider)

- Dialysis-company stocks slide after Ozempic trial’s success in treating kidney disease (marketwatch)

Be in the know. 20 key reads for Wednesday…