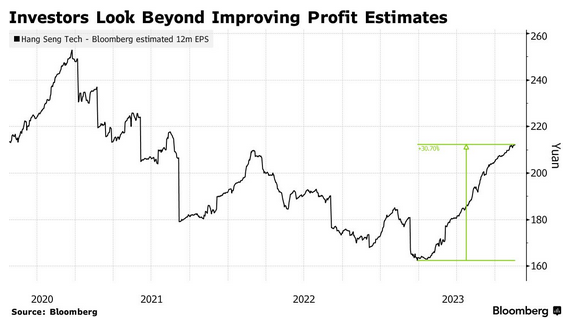

- A Case Is Building for Battered China Stocks to Beat India Peers (bloomberg)

- The Fed Isn’t the Only Thing Sending the Stock Market Higher (barrons)

- Real Estate Euphoria Highlights Trader Angst for End to Hikes (bloomberg)

- Tesla’s $55 ‘OMFG’ Shattered Cybertruck Decal Sells Out in Hours (bloomberg)

- Cell-Tower REITs Are Beckoning Investors. Pick Up the Call. (barrons)

- Suicide Risk From Weight-Loss Drugs Prompts More EU Questions (bloomberg)

- No April rate cuts will be ‘the best thing for the market’, says Bespoke Investment’s Paul Hickey (cnbc)

- Alibaba Int’l Digital Commerce Releases 3 AI Design Ecological Tools, Covering 500K Designers Now (aastocks)

- Fed starting gun for $6 trillion dash from cash (reuters)

- Construction spending climbs again, fueled by commercial investment and public works (marketwatch)

- Here’s what it would take for the Fed to start slashing interest rates in 2024 (cnbc)

- Fed’s Goolsbee says worries that inflation would get stuck above 3% have been proven wrong (marketwatch)

- Bullish investors take heart in Powell’s ‘balanced’ outlook (reuters)

- (foxbusiness)

- Xi Takes Flurry of Small Steps to Open China After US Trip (bloomberg)

- There’s no recession coming and the Fed is likely done, says Carson Group’s Ryan Detrick (cnbc)

- Rate Hikes Are Probably Over, but Fed Officials Are Reluctant to Say (wsj)

- Weight-Loss Stocks Are Getting Pricey. Time to Worry About a Bubble? (barrons)

- Almost $6 trillion cash pile in money markets may need to start being redeployed soon, Janus Henderson says (marketwatch)

- Citi CEO: How We’re Turning the Bank Around (barrons)

- These 11 Stocks Have Been Left Out of the Tech Rally. Maybe Not for Long. (barrons)

Be in the know. 21 key reads for Saturday…