Our article of the week and podcast is going out a day early this week as I will be traveling to Dallas for my eldest daughter’s Olympic Development Program in Water Polo. On Friday afternoon, I will have a window of time open from 11am-4pm, when I am meeting with existing clients and new clients. If you are a prospective investor and would like to meet on Friday afternoon in Dallas, Plano, Frisco or somewhere in-between reach out here.

On Monday, I joined Charles Payne on Fox Business to discuss 2024 market outlook and two stock picks. Thanks to Charles, Kayla Arestivo and Nick Palazzo for having me on:

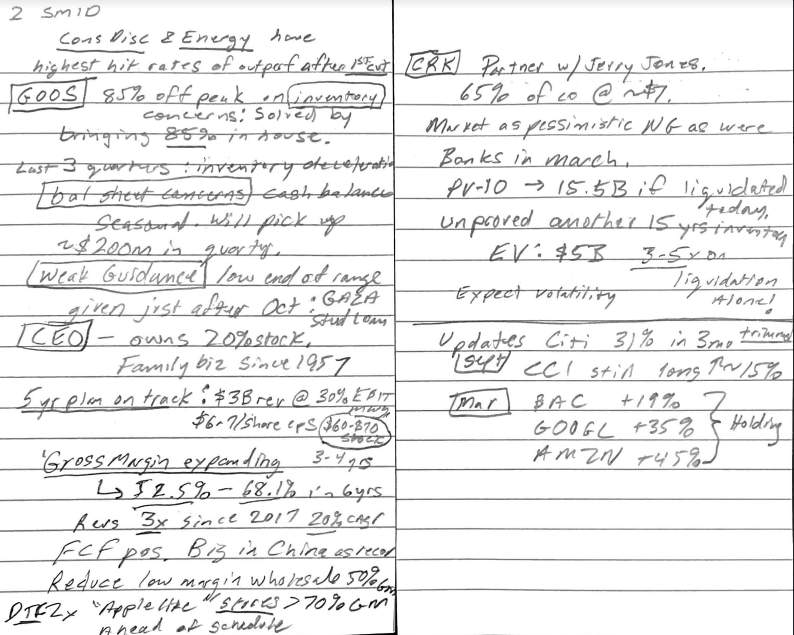

We covered Canada Goose in depth in last week’s article and podcast. We covered Comstock Resources in depth two weeks ago in our article and podcast.

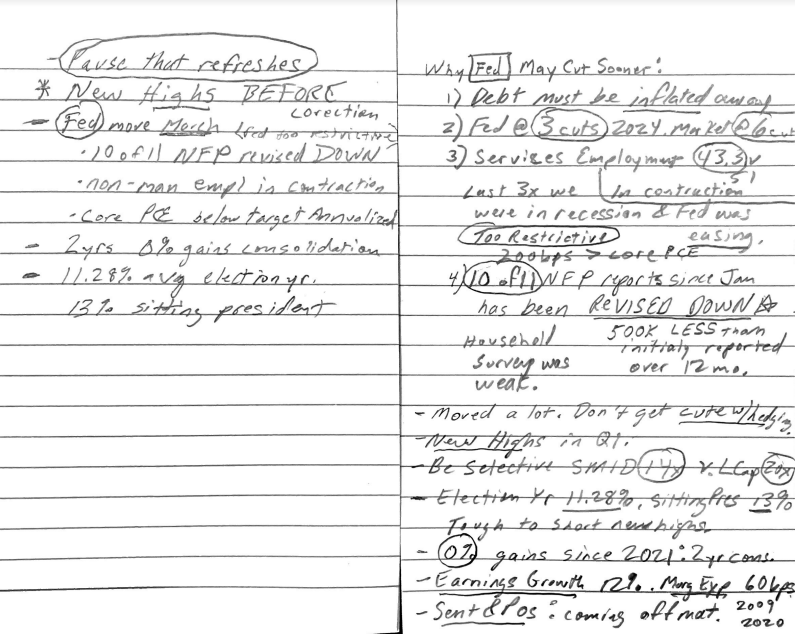

Here were my “show notes” ahead of the segment:

Deja Vu Disney

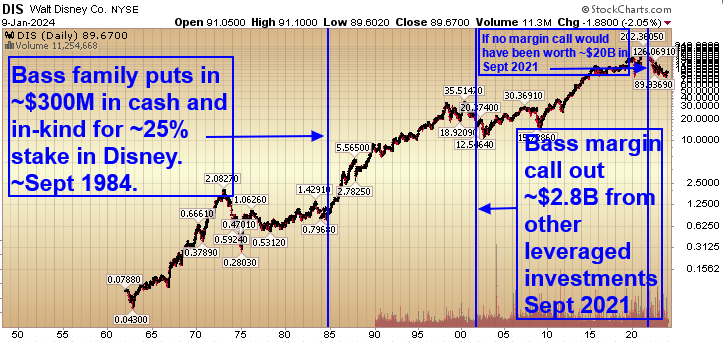

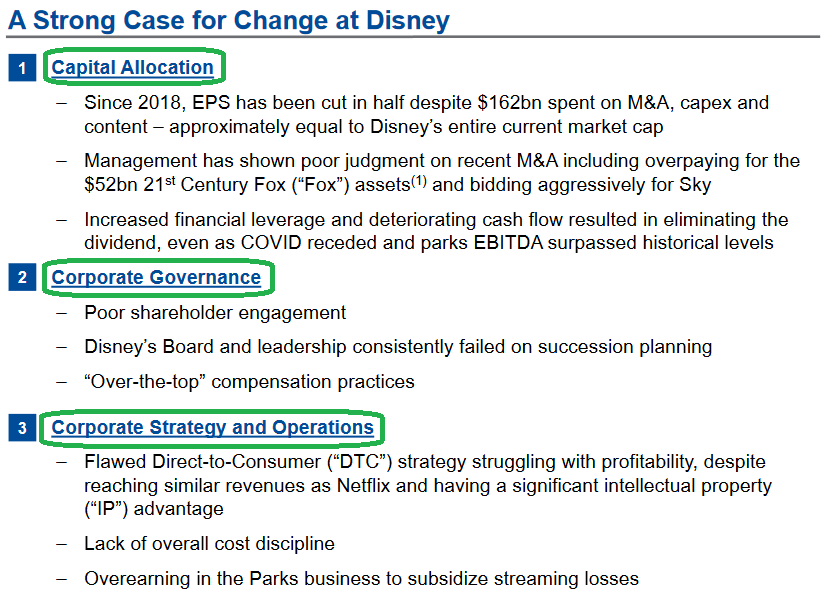

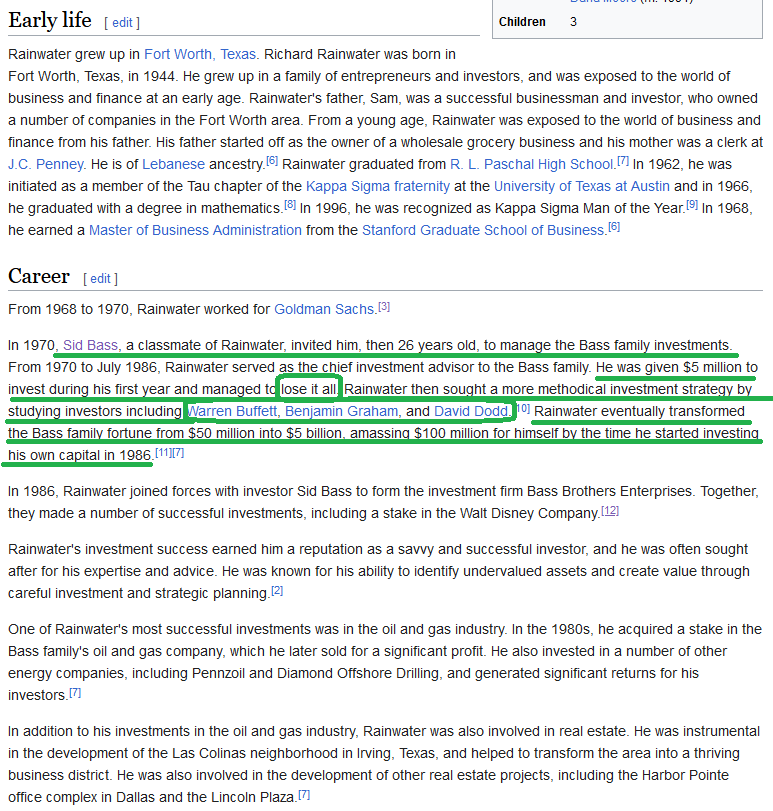

In 1969, Sid Bass had been put in charge of investing ~$50M – from an Oil & Gas fortune built by his father Perry Bass and Uncle Sid Richardson. In 1984, Sid Bass – through/with his hired investment manager Richard Rainwater – built a stake in Disney worth ~$300M (see chart above).

Bass had met Rainwater at Stanford. The first $5M that Bass entrusted Rainwater with – he LOST 100%. Then he discovered Graham and Dodd and became wealthy:

Background of Investment

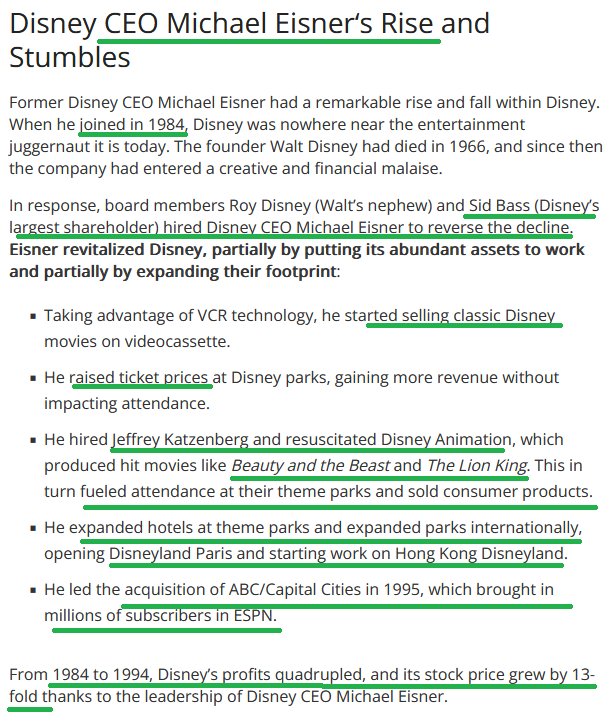

Sid Bass hired Michael Eisner to turn around the company. Here’s what Eisner did:

Why to Avoid Leverage:

As of September 2021: Sid Bass’ $2 billion block of Disney stock sold to fund a margin call in 2001. It would have been worth $20+ billion today.

Echoes of Today

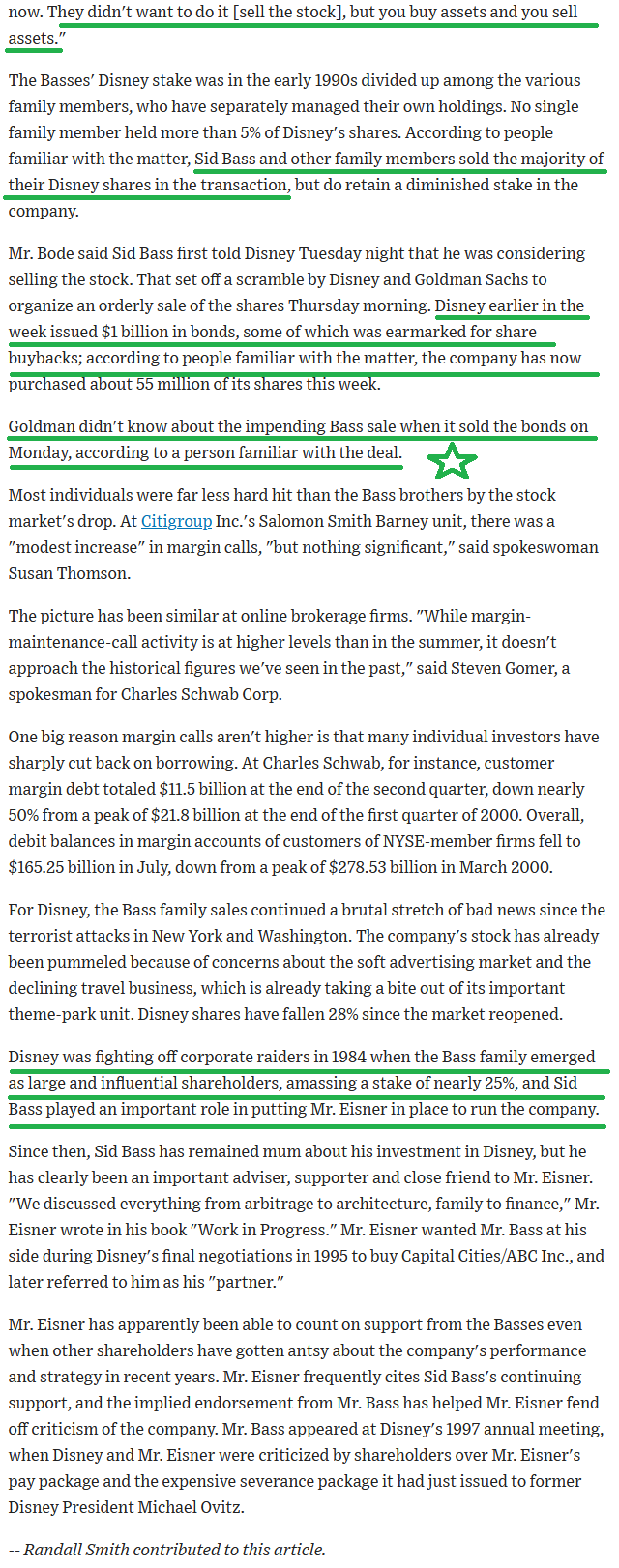

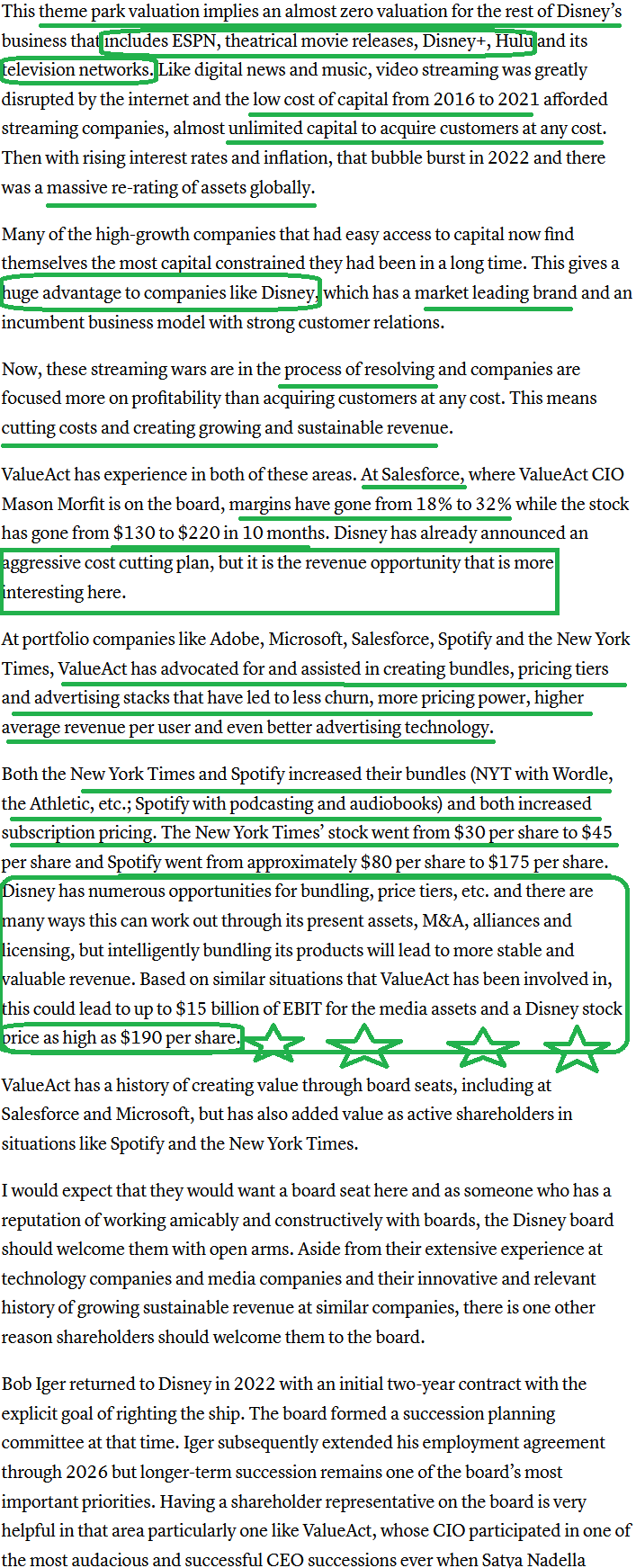

We started talking about Disney publicly on our podcast|videocast last year. Shortly thereafter, Nelson Peltz of Trian took a renewed activist stake in the company, followed by Jeff Ubben’s ValueAct.

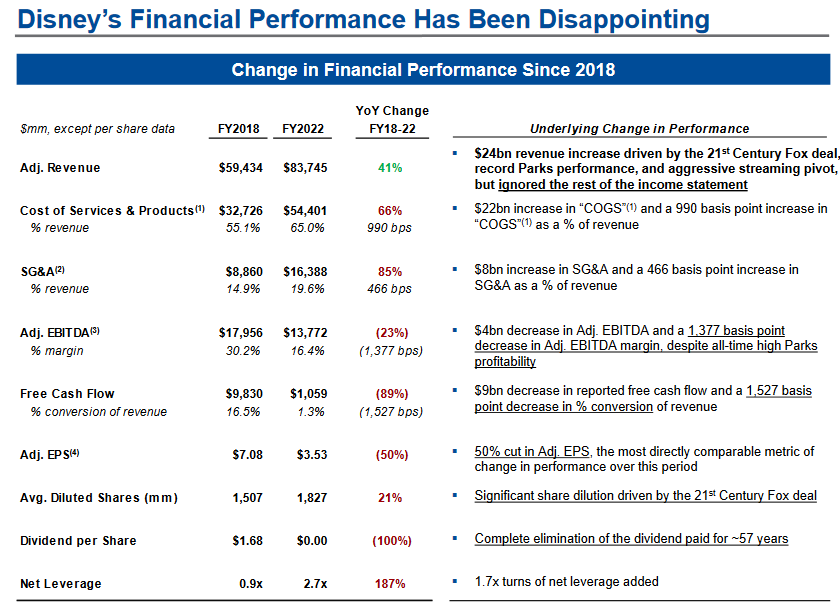

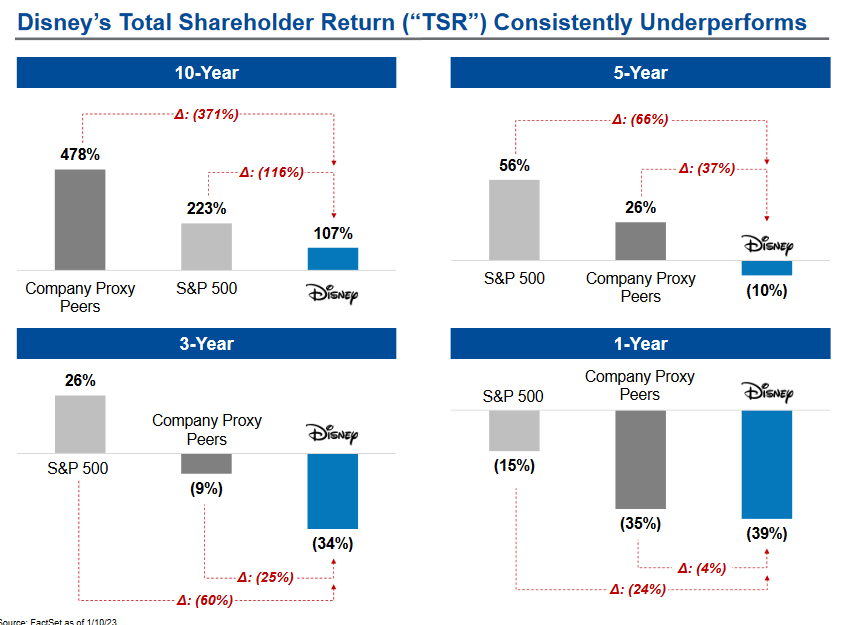

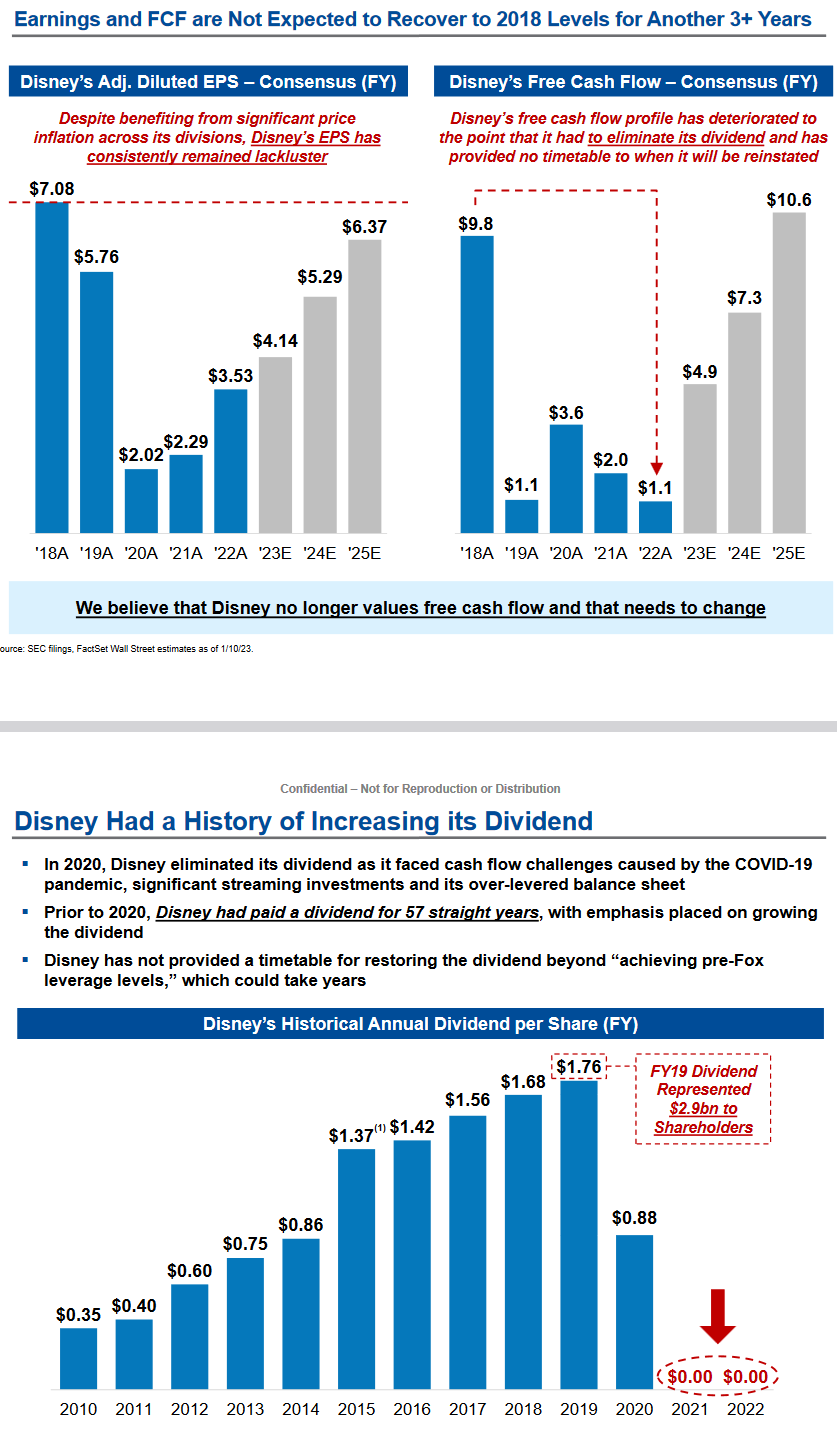

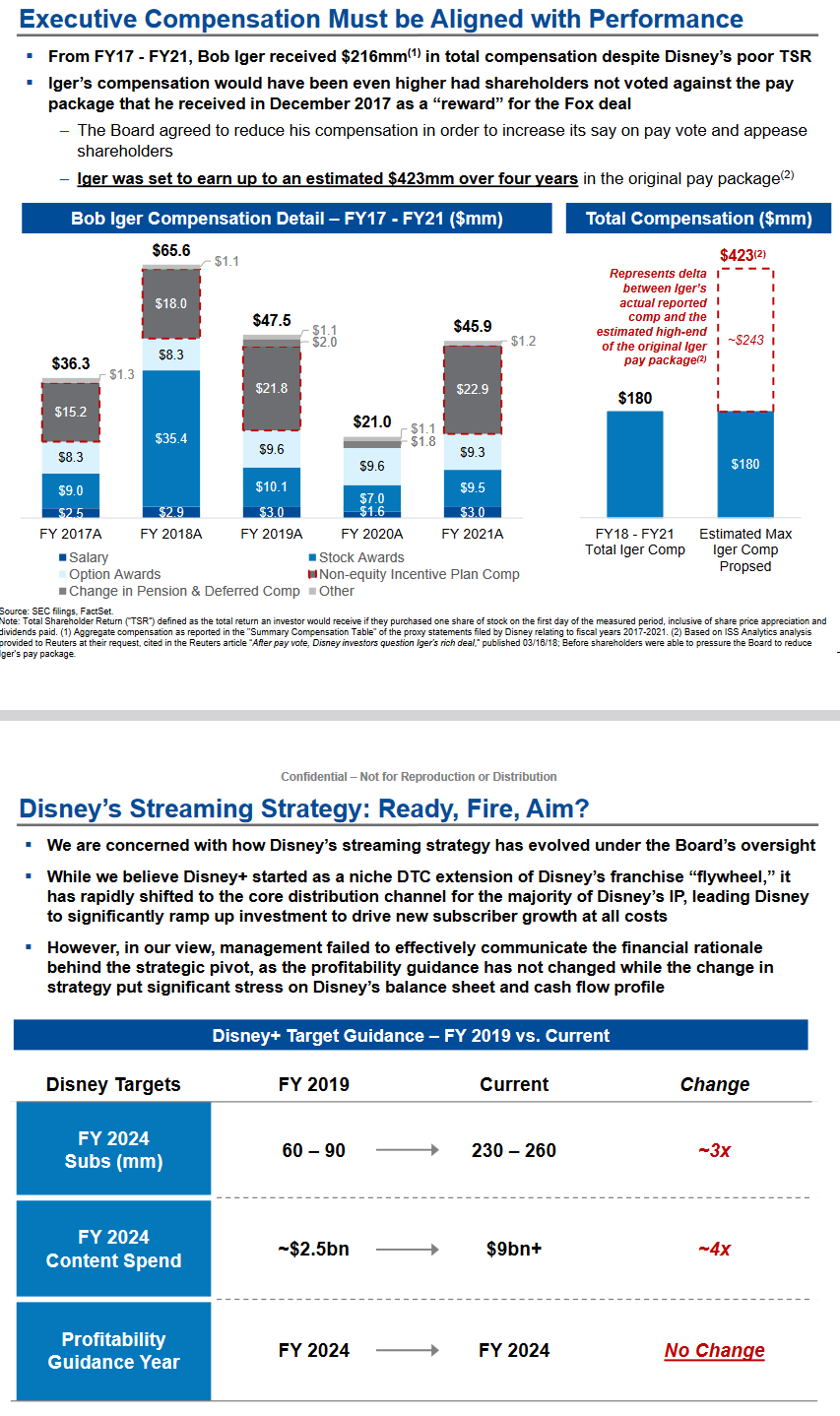

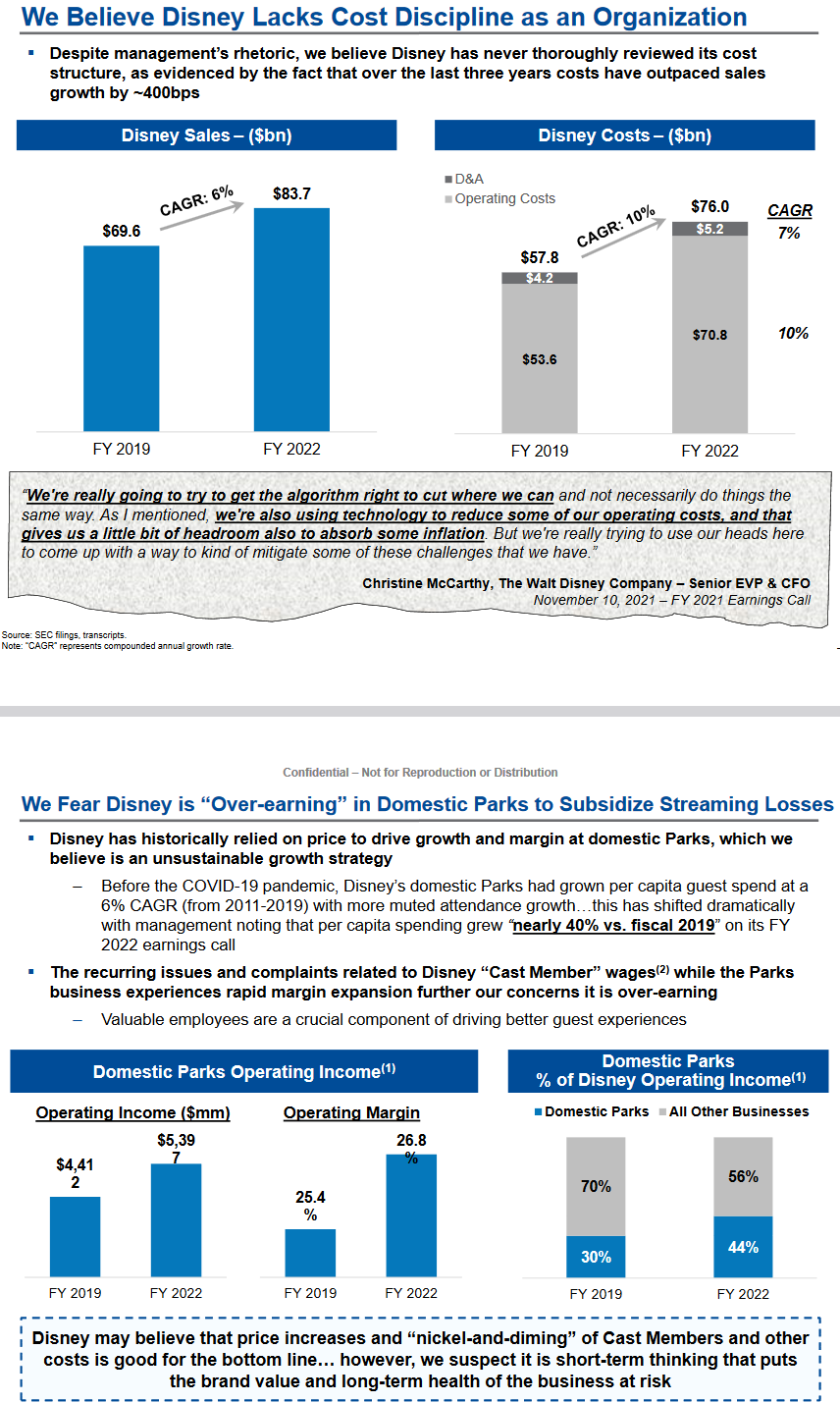

Here is Peltz’s Plan/List of Grievances:

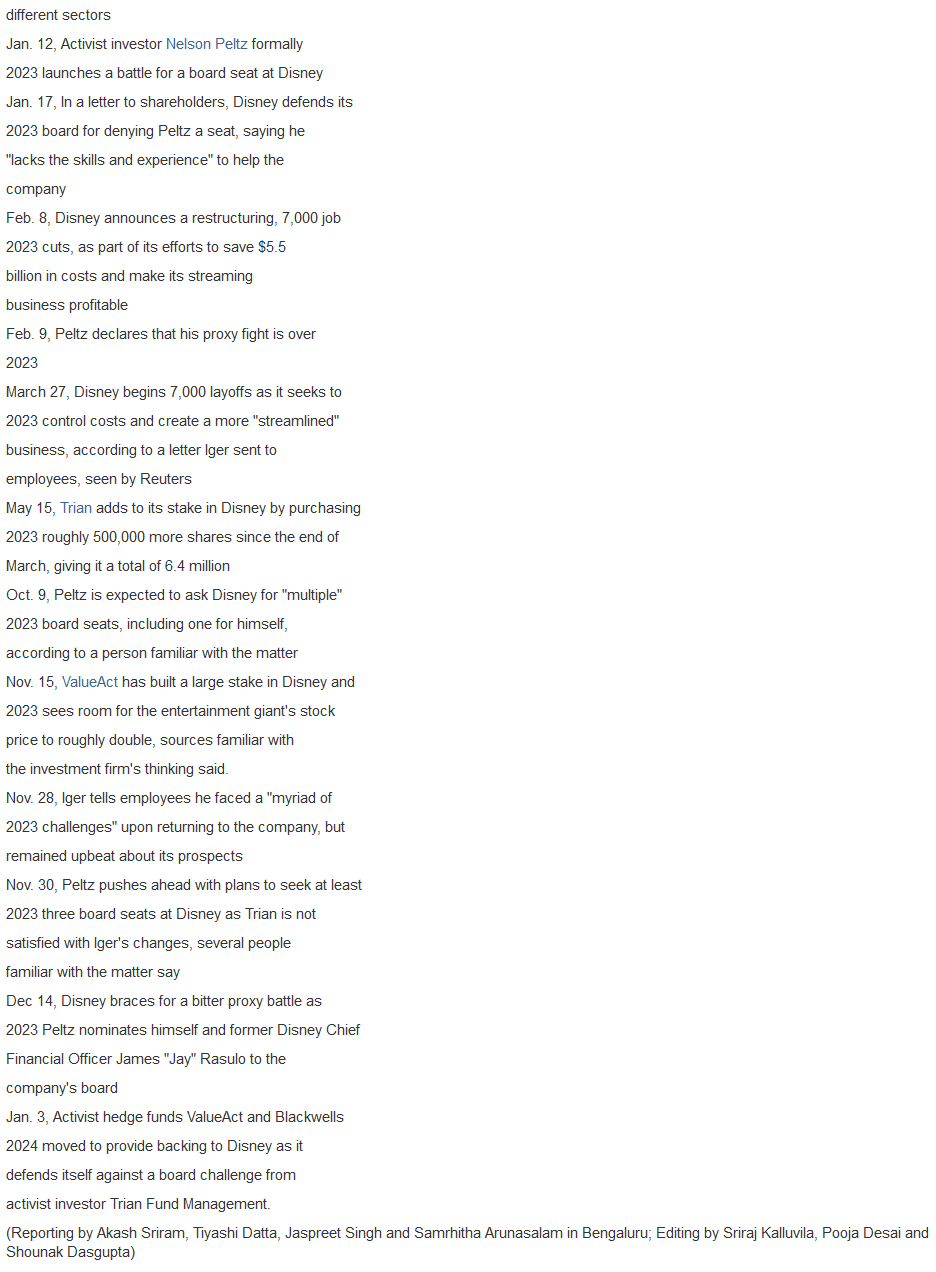

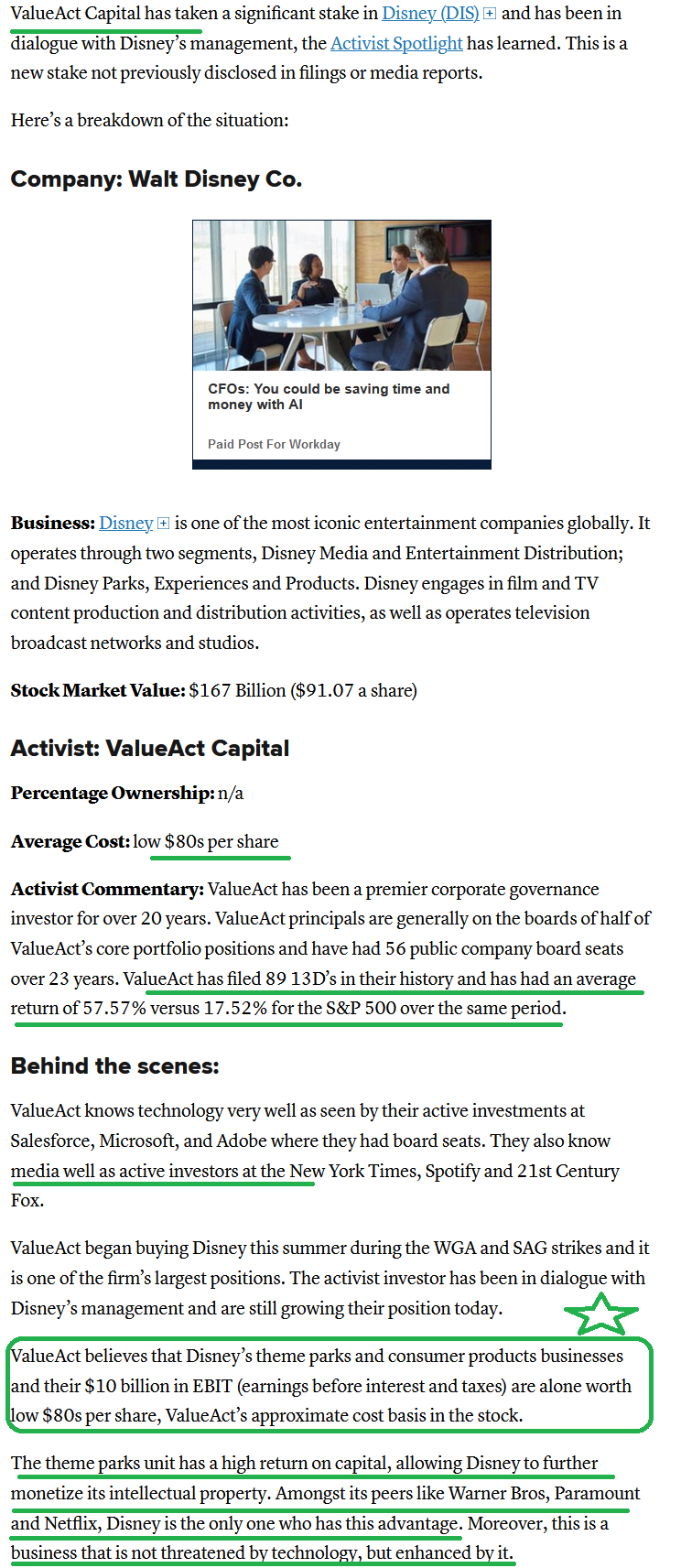

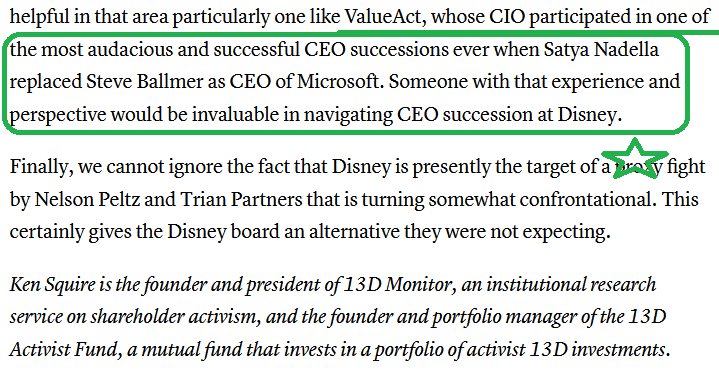

ValueAct throws support behind Disney

*Believes worth $190/share

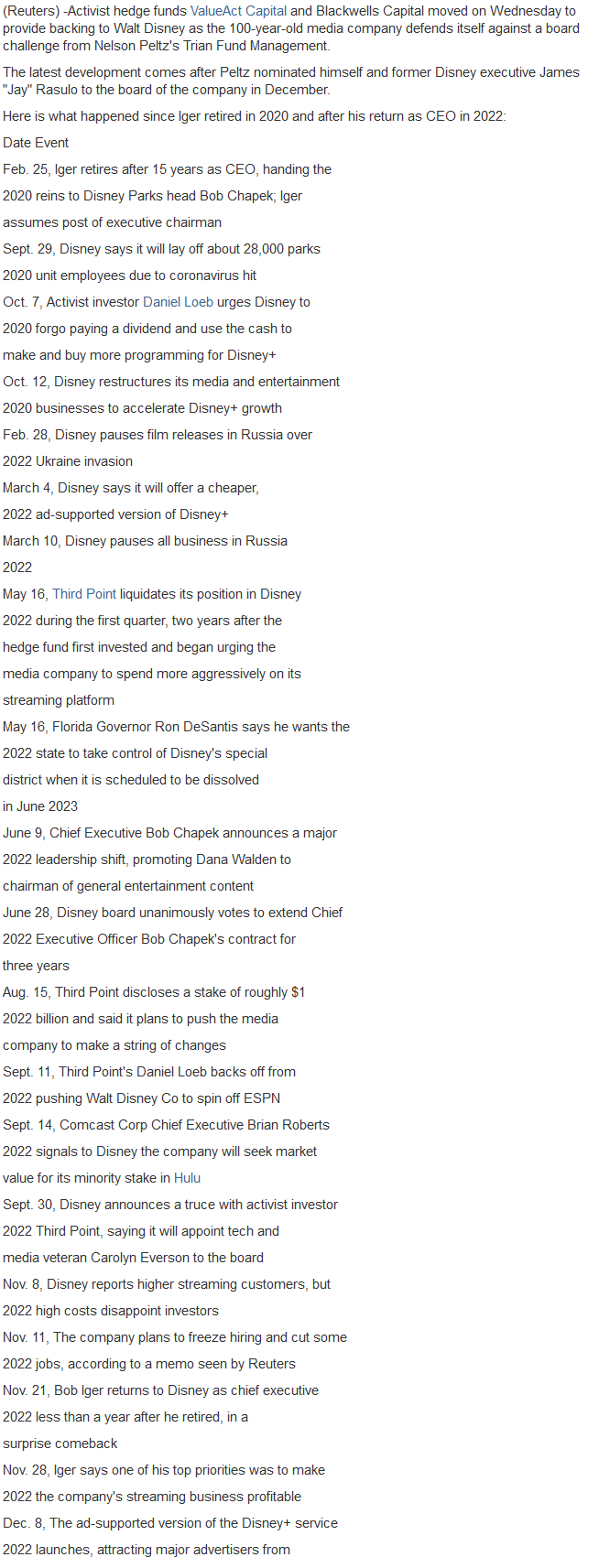

Chronology since return of Iger in 2022:

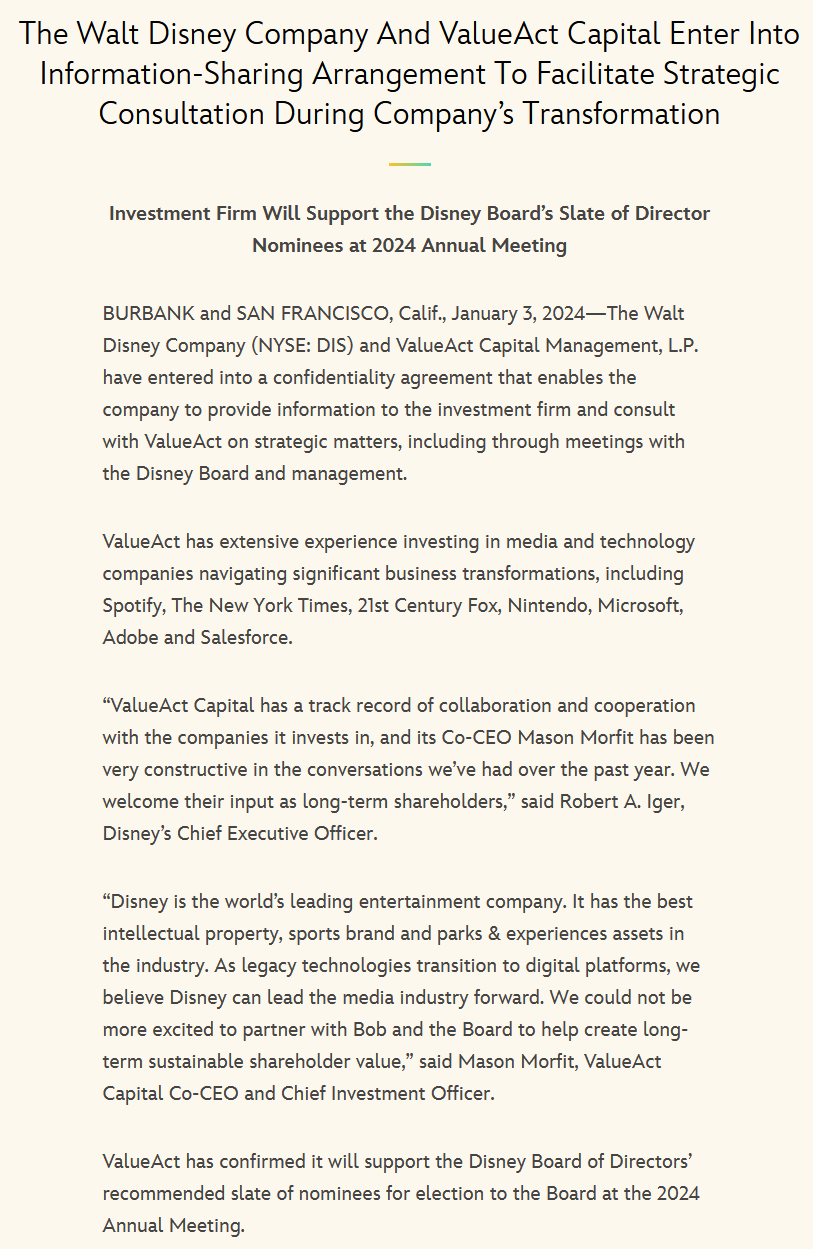

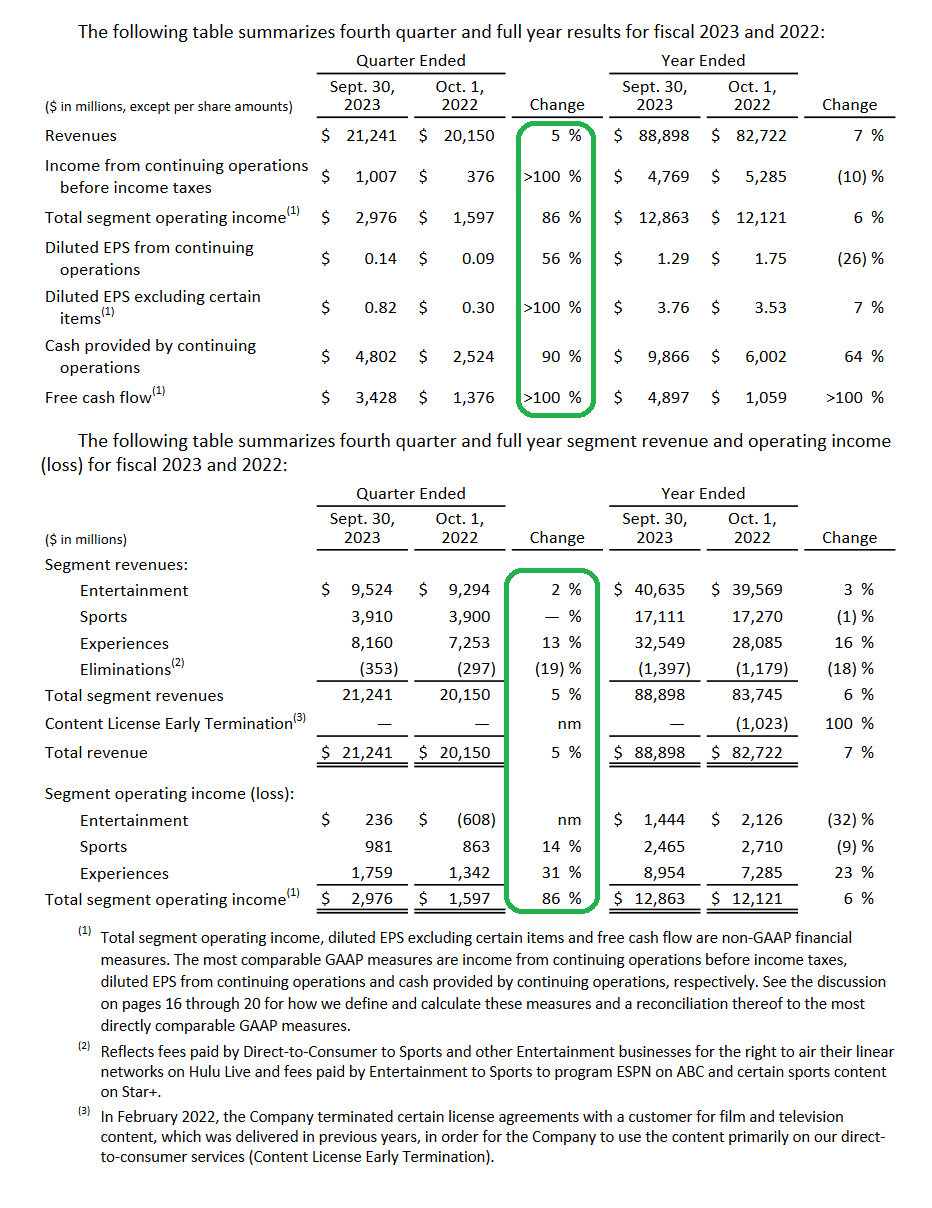

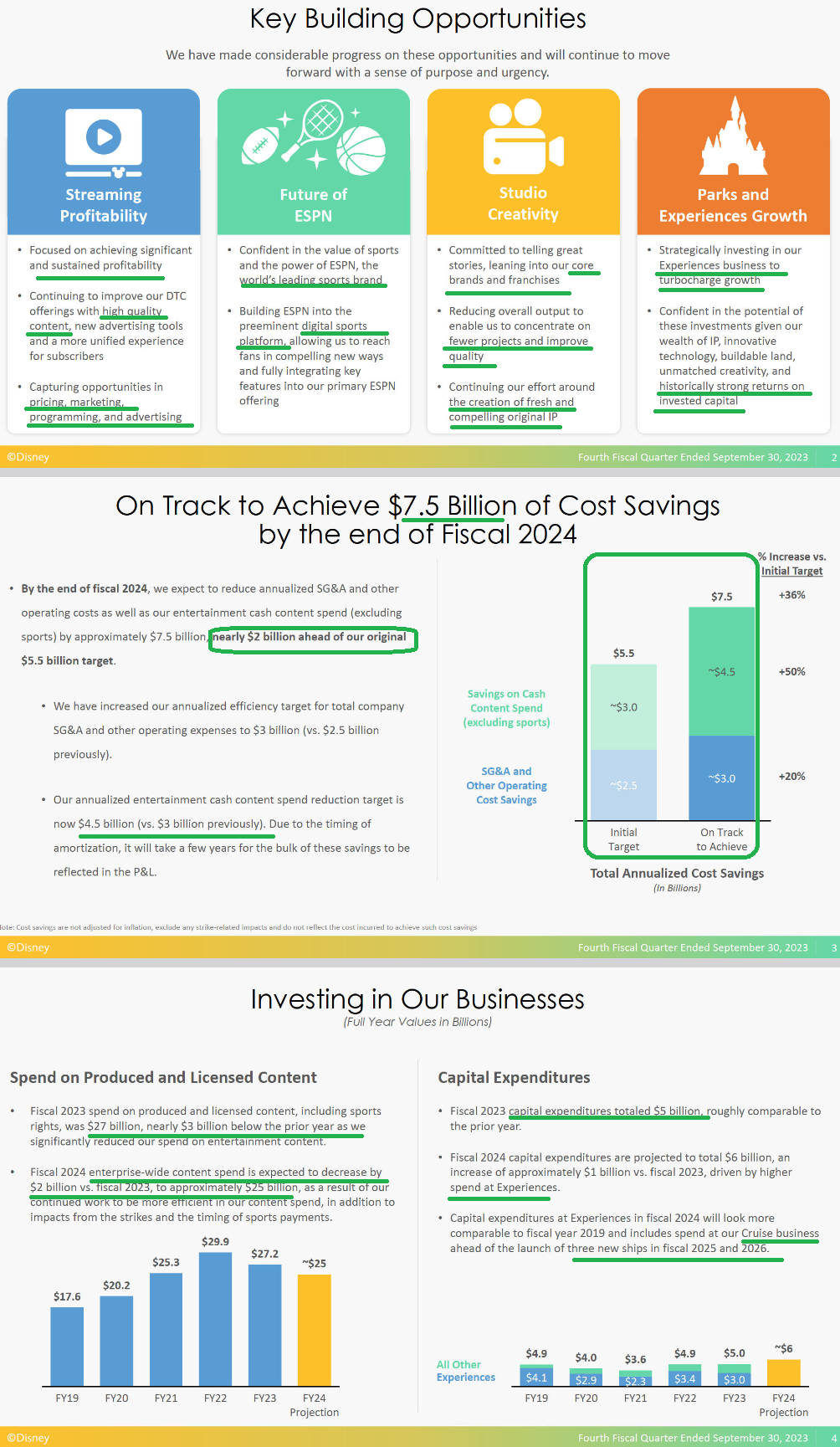

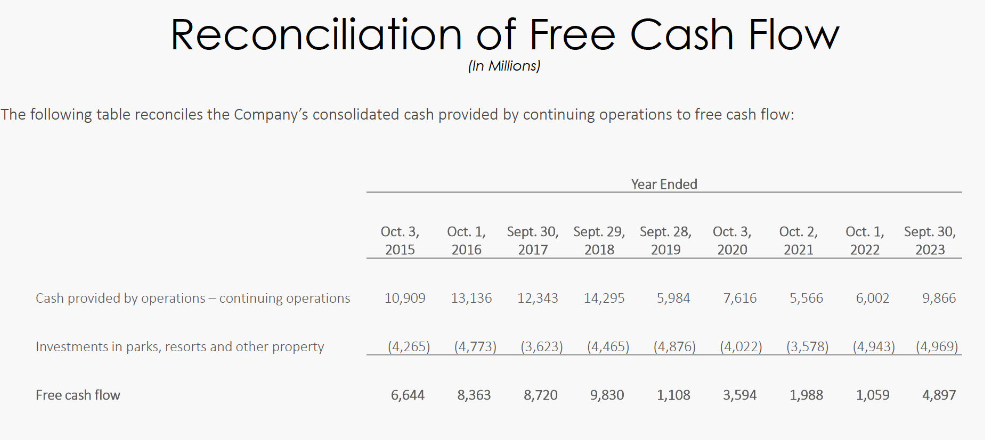

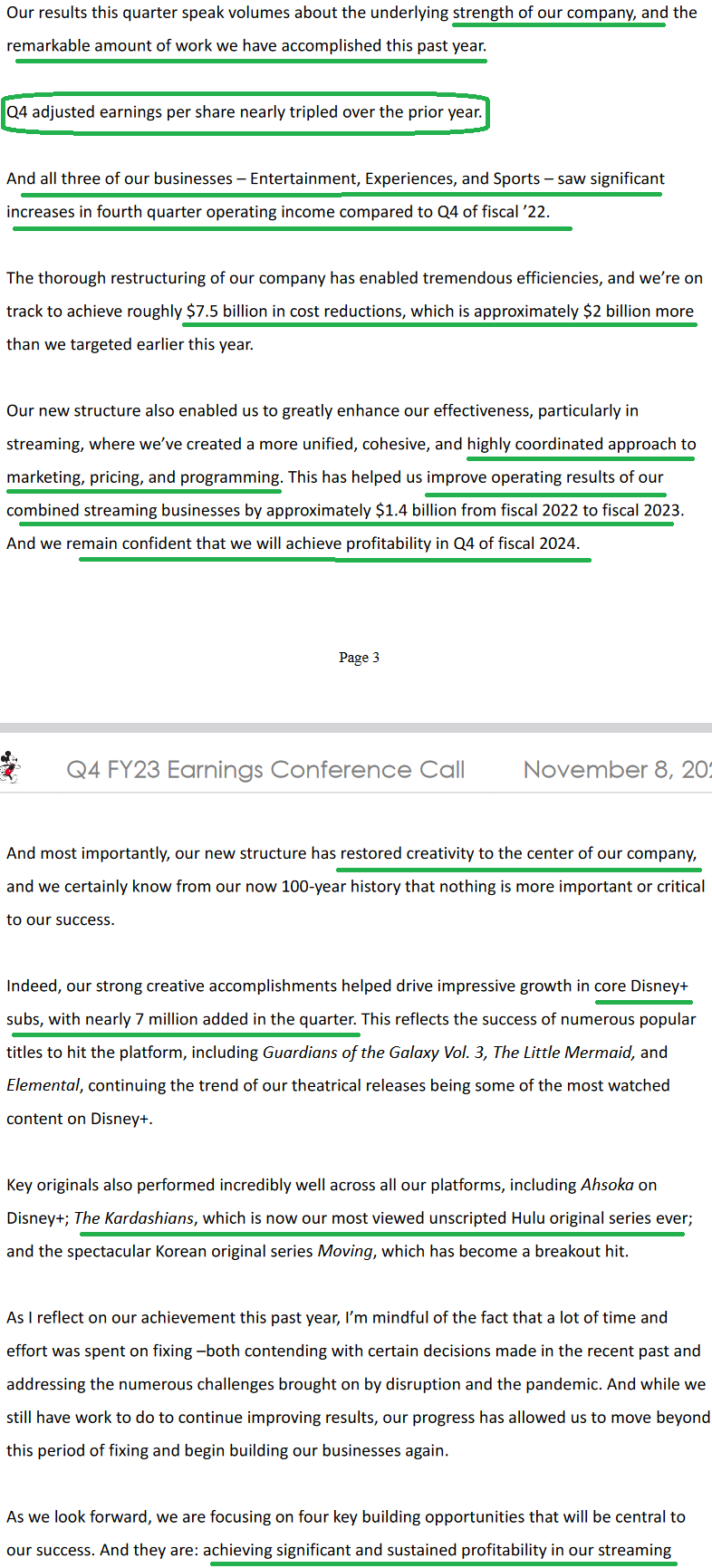

Disney Plan (most recent earnings call)

General Market

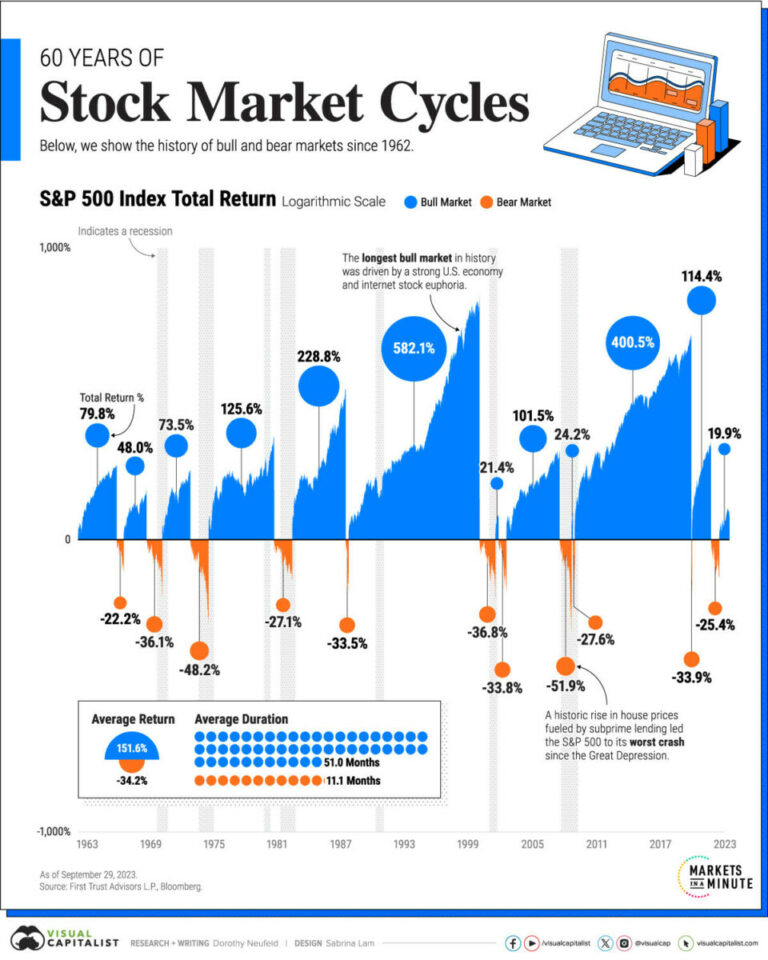

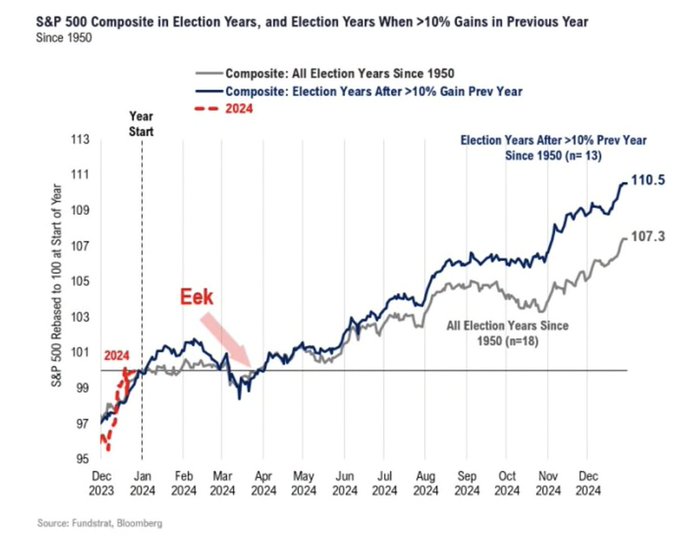

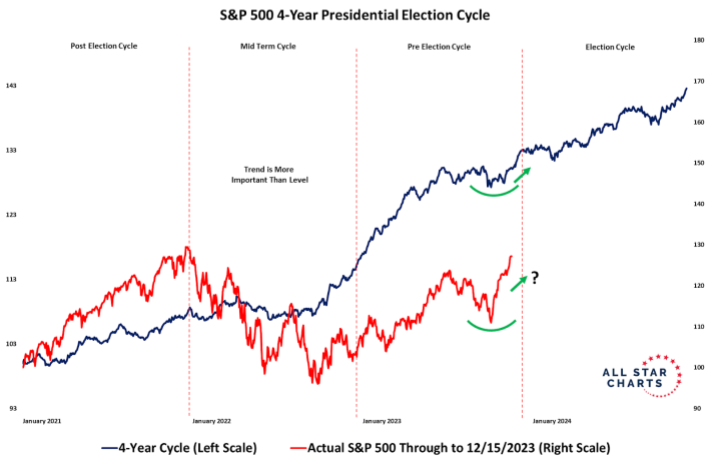

Where we are in the cycle?

Source: Visual Capitalist

Source: Fundstrat

Source: All-Star Charts

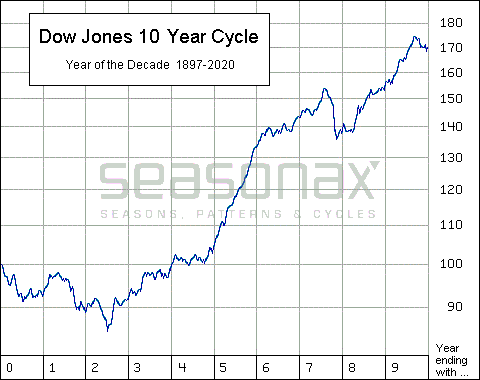

Source: Seasonex

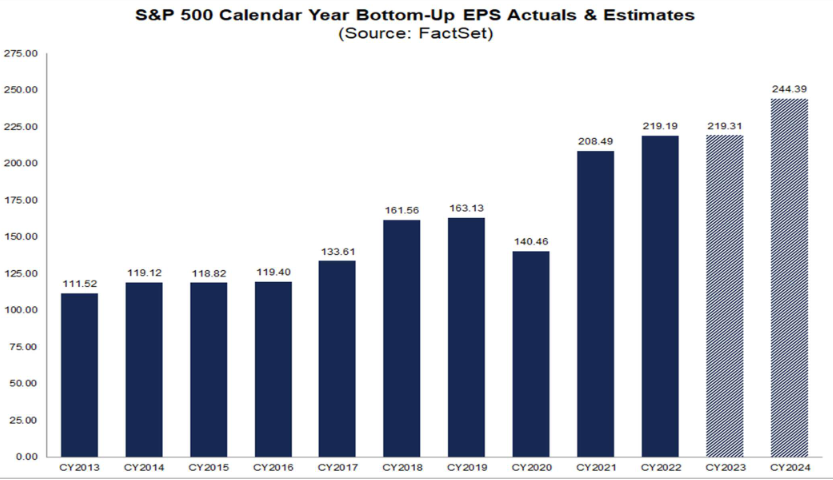

Source: Factset

Source: Factset

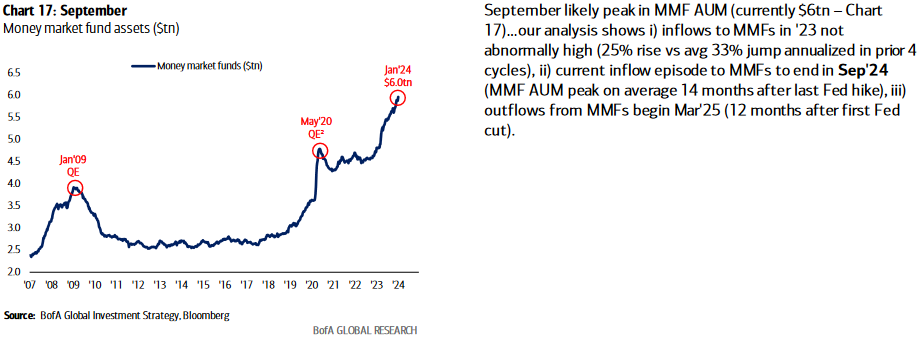

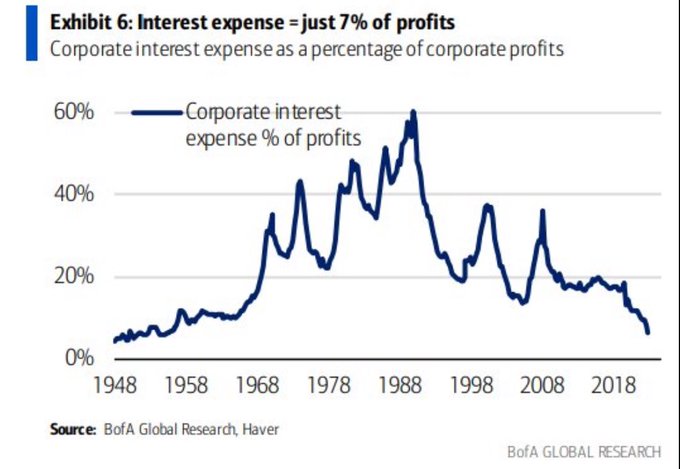

Source: BofA

Source: BofA

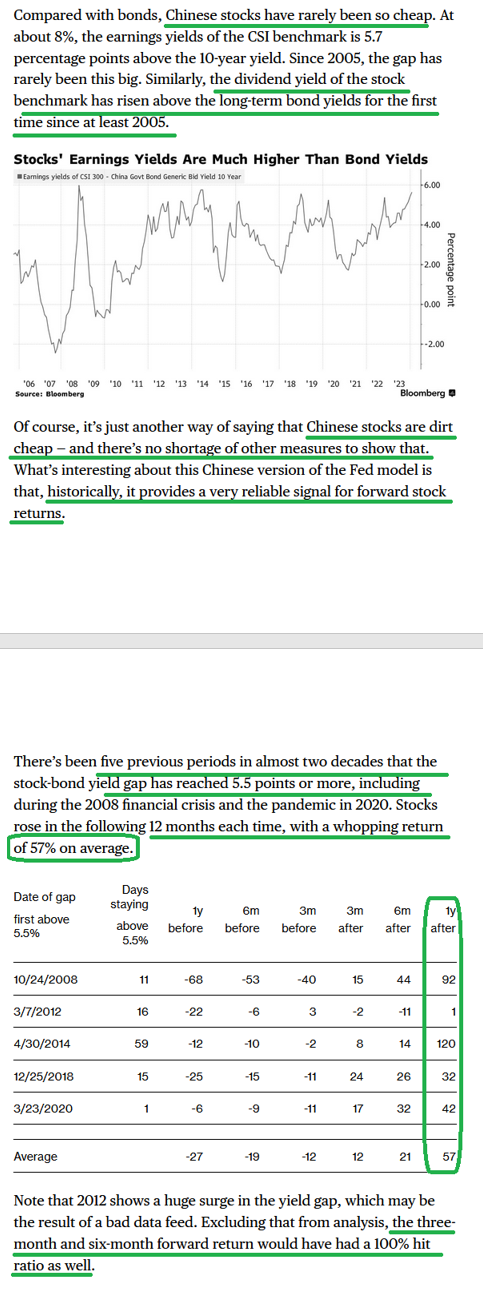

China Update

Now onto the shorter term view for the General Market:

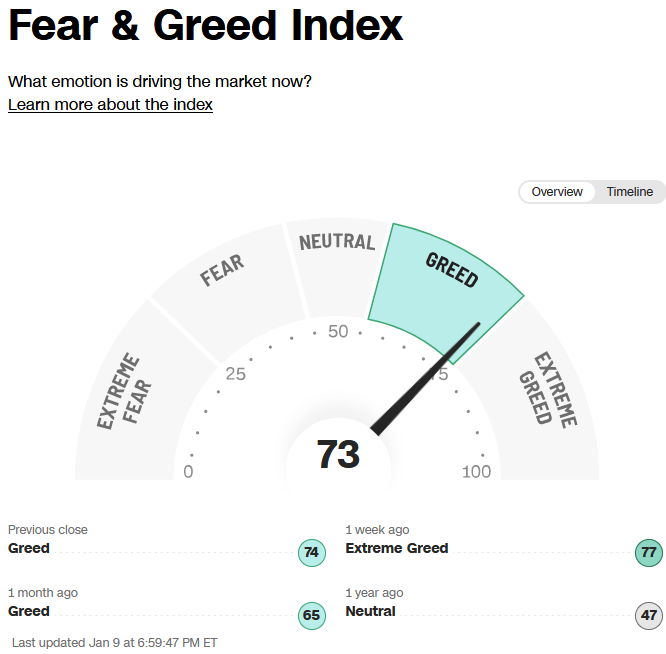

The CNN “Fear and Greed” flat-lined from 72 last week to 73 this week. By this metric, investors are giddy, but not yet fully euphoric. You can learn how this indicator is calculated and how it works here: (Video Explanation)

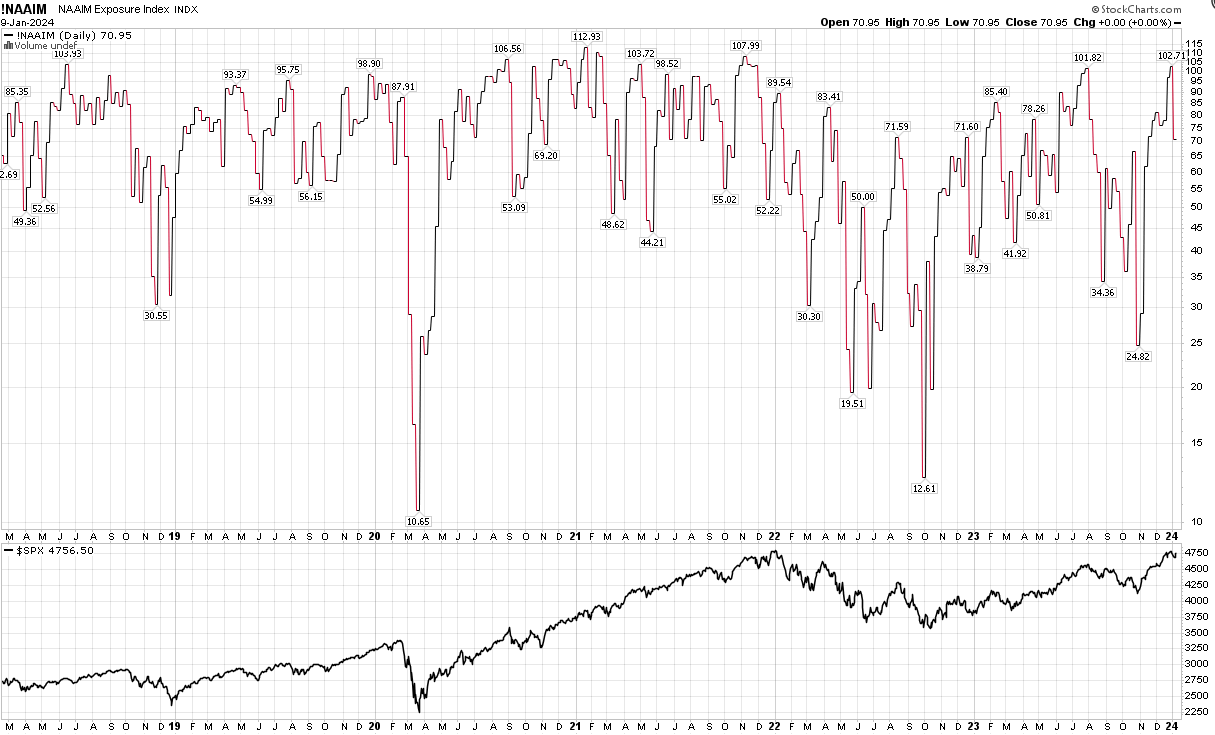

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 70.95% this week from 102.71% equity exposure last week ago. Managers got a little “paper handed” this week!

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 70.95% this week from 102.71% equity exposure last week ago. Managers got a little “paper handed” this week!

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

***After being highly exclusive since 2019 (and closed to new investors prior to that), our business expanded to serve an additional tier of clients in 2023. The response we have received since opening up this past summer has dramatically exceeded our expectations.

If you missed our opening in early Q4, we have decided to do our Q1 opening for smaller accounts ($1M+) this week (as a couple that wanted to come in in Q4 – but missed it – asked to come in over this weekend). We are accepting them and opening equally for everyone else waiting since Q4. For details, and to see if you qualify, go here.

We anticipate keeping the Q1 opening for smaller accounts ($1M-$5M) available for the next week and a half. $5M+ and $10M+ accounts can always reach out directly for bespoke service.

*Opinion, Not Advice. See Terms